Welcome to the spring issue of The Serious Investor. In this issue we discuss how Fed policies and pronouncements drove both a rally in the first quarter and the downturn that preceded it. We also explain why we continue to favor international diversification—and why we’re not expecting an imminent recession, despite the recent inversion of the yield curve.

Quick take:

- The U.S. market surged largely because of the Fed’s more dovish stance – “The Fed Pivot”.

- Fundamentals decelerated but may improve later this year.

- Valuations are relatively attractive in international developed and emerging markets.

- We do not expect recession in the next 12 to 18 months.

- We favor equities over fixed income but remain cautious.

MARKET REVIEW & OUTLOOK

Professional baseball is celebrating its 150th anniversary. America’s pastime has changed over the years, especially in the way teams evaluate a ballplayer’s value. Across Major League Baseball, Ivy League MBAs and advanced statistics have replaced old-school methods for building a winning franchise.

Dayton Moore has been the general manager of the Kansas City Royals since 2006. On a modest, small-market budget, Moore built an organization that played in back-to-back World Series in 2014-2015, winning the championship in 2015. Like every GM, Moore spent the last days of Spring Training finalizing his active roster for the regular season. “You set your rosters on opening day and then after that you’re making battlefield decisions the next 162 [games],” Moore told the Kansas City Star. “This time of year, we spend a lot of energy discussing who is going to be the extra this, who is going to be the extra that, and we debate it like we’re trying to figure out the Federal Reserve.”

What was that? Moore and his staff debate the final roster like investment advisors trying to figure out the Fed? Baseball may be the national pastime, but when a lifetime baseball guy name-checks the Fed, we know Fed policy has become the national obsession.

First Quarter Summary

The global markets certainly have been obsessed with the words and actions of the U.S. Federal Reserve. The S&P 500 gained 13.5% in the first quarter of 2019 and as of the end of March was up 21% from its Christmas Eve low point. All major asset classes—stocks, bonds and commodities—gained between January and March, a stunning reversal from 2018 when almost all asset classes declined in value.

Source: Bloomberg

The key factors driving performance in the first quarter were the mirror image of the factors driving performance for the three prior months: The Fed and global central banks. In October, the Fed was still hiking interest rates and Fed Chair Jerome Powell pronounced that policy rates were “a long way from neutral.” Markets understood that to mean further hikes were coming. Expectations for more restrictive financial conditions led to a sharp sell-off.

The S&P 500’s move lower made sense based on growth concerns and fear of a Fed policy error. But the magnitude of the sell-off was amplified by quantitative, algorithmic trading, including deleveraging by institutional fund managers. The S&P 500 dropped almost -20% from early October through December 24, and asset values reached levels normally associated with recession.

The S&P 500 snapped back after the turn of the calendar largely because the Fed pivoted its policies. Rather than hiking rates further and threatening economic growth, Powell assured the markets that the Fed’s monetary policy was approaching neutral—that is, that it would halt its effort to tighten financial conditions.

The policy shift culminated on March 20. On that day, the Fed announced that it planned not to hike interest rates in 2019 (two increases had been planned). Policymakers also said they would stop “normalizing” the Fed’s balance sheet later this year, suggesting that the banking system would have greater cash reserves than had been expected, meaning more credit would be available. Essentially, the Fed caught up with the markets, and equities rallied due to relief that the Fed would avoid a policy error for the time being.

U.S.-China trade policy. The reported progress in U.S.-China trade negotiations also contributed to positive returns in the first quarter. Although global trade activity was subpar to begin the year, markets were encouraged by more-constructive rhetoric from the Trump administration and signals that a trade deal could emerge soon. The size and influence of the U.S. and China markets mean that trade policies between the two have repercussions throughout trade-sensitive markets like Europe and Japan.

Economic and corporate fundamentals. As the markets rallied, fundamentals deteriorated. U.S. economic growth is estimated to have slowed in the first quarter after GDP expanded 2.9% in 2018. Earnings for companies in the S&P 500 got a boost from the new tax law throughout 2018. They grew roughly 13% in the fourth quarter, a slowdown compared to the approximately 26% increase during the first three quarters of 2018. S&P 500 profits are currently estimated to rise about 4% in 2019.¹

If fundamentals deteriorated, then why did risk assets gain in the first quarter? Because fundamentals weren’t as bad as feared. Throughout the corporate earnings season, corporate management teams sent the reassuring message that business conditions were not as bad as depressed December prices implied.

VALUATIONS & GROWTH OUTLOOK: NEAR-TERM SLOWDOWN & POSSIBLE UPSIDE

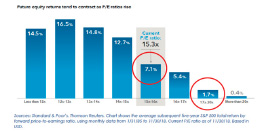

The December sell-off pushed U.S. equity valuations to near recession levels, from a high of almost 19 times forward earnings that was recorded in January 2018. As we have written about in previous editions, long-term equity returns have a high sensitivity to the starting valuation. Said another way, entry points matter. With forward U.S. equity valuations at average levels, long-term returns could be more promising. Subsequent returns for U.S. large cap equities have averaged 7% at today’s valuation levels.

U.S. and global growth data slowed in the first quarter, and the International Monetary Fund, Organisation for Economic Cooperation and Development and other groups have reduced their forecasts for growth this year.² But supportive central banks and an expected U.S.-China trade deal could help global activity stabilize and improve as the year unfolds.

That said, monetary policy has mostly run its course. Structural reforms such as reduced tax and regulatory burdens may be necessary to improve long-term growth in Europe, Japan and China, while fiscal stimulus might be needed to boost short-term growth. In this sense, bad news may be good news. Policymakers tend to enact reform only during periods of acute economic pain. Amid slumping growth in China, officials have cut taxes, promoted credit by reducing reserve requirements for banks, and selectively implemented fiscal spending programs. These actions are having an impact, and there is room for further policy action. In Europe, upcoming EU parliamentary elections might pave the way for less austerity and more fiscal spending, especially with Angela Merkel stepping aside. France has enacted modest reforms, but there is room for more. In the UK, we wonder if a painful Brexit might force a bold pro-growth agenda to recover from multiyear weakness. Such developments could serve as catalysts for outperformance for international securities.

Portfolio Considerations

BCA Research is a trusted resource for us, among many. We agree with the following thoughts from a recent report by BCA Research:

One of the most remarkable features of the past decade’s economic environment has been the impressive performance of U.S. corporate earnings. Despite the weakest economic recovery on record, profit margins have soared to an all-time peak…Looking ahead, the environment will be very different. Inflation and interest rates are more likely to rise than fall, profit margins will be under pressure, it would be imprudent to expect sustained gains in multiples, and broad credit growth will not return to its earlier rapid pace. Thus, future returns will be a pale shadow of the past performance…When returns are low, it takes longer to recover from market losses. This means one should maintain a conservative portfolio bias with higher-than-normal levels of cash.³

Although global growth has slowed in recent months, a widespread economic recession does not appear likely in the next 12 to 18 months given the Federal Reserve policies and other considerations listed above. We offer the following near-term views, with the disclaimer that no one can have perfect visibility into the capital markets and global events:

- The U.S. economy may have entered a so-called “earnings recession,”

- in which profit gains will be muted over the balance of 2019. Now that U.S. equity valuations have rebounded from the depressed levels of last December, we are bracing ourselves for lower returns going forward.

- Lower growth expectations for 2019 are a good thing, because positive surprises could unfold and send equities higher. Nevertheless, our base case assumes a lower return environment over the balance of the year.

- Market behavior across the global economy could vary based on regions and sectors, which justifies international diversification. Europe, Japan, China and most emerging markets are more sensitive to global trade activity than the United States, so these markets would be expected to show a more positive response to a U.S.-China trade deal.

- U.S. interest rates have been dragged lower by weakness in Europe and Japan, technical factors, foreign fund flows, hedging strategies and speculator positioning (hedge funds). So while the yield curve inverted in the first quarter, the U.S. curve probably tells us at least as much about foreign economies as it does about the U.S. economy.

- High-yield corporate credit spreads have rallied this year and now are trading in line with non-recessionary periods.⁴ Fed policy actions may extend the credit cycle, but to us, high-yield bonds and loans look crowded, with underappreciated liquidity risk.

The following considerations are informing our investment decisions:

- Value and quality fundamentals. Our cautious view on global growth -mostly positive but at a moderate late-cycle pace–leads us to favor managers who seek out secular and dividend growth in the companies they own. The return of capital via dividends or other means provides a consistent source of return and helps to mitigate risk. With this focus we believe we can reduce equity risk relative to the broad market.

- International diversification. U.S. equity valuations are in line with historical averages. Valuations for European and Japanese equities look attractive by comparison. For emerging markets, especially China, valuations have rebounded from the depressed levels of the fourth quarter. Global manufacturing could be bottoming, and a U.S.-China trade deal could boost global activity. Developed and emerging markets are more sensitive to global trade than the United States, so could respond more if global economic activity improves as expected. All of these factors give us conviction regarding international markets. Read more about emerging markets, including commentary by Lori Van Dusen, in Barron’s.

- Fixed income for income and defense. With interest rates dropping to begin the year, defensive high-quality bonds have delivered a boost to total return. Although lower rates now reduce their expected returns going forward, high-quality bonds play an important role in providing stability and capital protection during downturns like the one in the fourth quarter. We currently favor short-to-intermediate-term U.S. Treasuries and tax-exempt municipal bonds. We believe these areas offer favorable risk/reward characteristics with limited exposure to credit or interest rate risks.

- Active skill-based strategies. Where suitable, we continue to consider what we call “active skill-based strategies” as a complement to conventional equities and fixed income. Portfolios with long/short equity positions benefited last year amid the market’s turbulence. We also favor alternative credit strategies focused on relative value or event-driven situations—areas that offer returns based on structural complexities, market inefficiencies and illiquidity premiums.

- Opportunistic rebalancing. Behind-the-scenes market dynamics can cause asset prices to drop abruptly and painfully. When such events occur, we search diligently for situations where short-term prices are irrationally distorted from underlying economic fundamentals. Keeping dry powder in the form of cash or other low-risk, liquid assets helps weather such crises, while giving the ability to invest opportunistically where determined appropriate.

Fed policy may not drive the markets in the coming months to the degree it did in the last two quarters. But a potential U.S.-China trade deal could boost global economic activity and asset prices, depending on how exactly the deal plays out. We cautiously favor risk assets (equities) over defensive (high-quality bonds) on a relative basis for the balance of the year, but the bulk of the returns for 2019 are most likely behind us. At present, we appreciate the relative value provided by global diversification. Specifically, we see a potential performance advantage from non-U.S. equities, assuming a trade deal materializes and global activity delivers a positive surprise. And we continue to embrace active strategies in seeking to achieve skill-based returns in a challenging environment.

For more detailed insights into our near-term observations and extended themes, please contact us.

INVESTOR EDUCATION: THE INVERTED YIELD CURVE AND RECESSION RISK

Clients are asking us about recession. We’d like to point them to some words from Bespoke Investment Group: “Recessions are relatively rare, so constantly forecasting them and positioning portfolios in preparation for them is a very expensive proposition in terms of opportunity cost.⁵ At the same time, we need to consider economic trends and risk/reward expectations as we structure investment solutions for clients.

As the U.S. Treasury yield curve has flattened, its reliability as a recession indicator has received a great deal of attention. Each of the last seven U.S. recessions was preceded by an inverted yield curve⁶—a condition in which short-term interest rates are higher than long-term interest rates. On March 22, the 3-month Treasury bill paid a higher interest rate than the 10-year note.

Market observers have raised concerns that this inversion suggests a recession could be just around the corner. We appreciate that concern, but don’t share it.

We recently have studied the history of the U.S. yield curve more than we care to admit. A few observations:

- The seven U.S. recessions since 1960 provide a relatively small sample set, tempering our degree of confidence in any conclusions drawn from this history.

- Past recessions have tended to begin between 12 and 24 months after the yield curve first inverted.

- Real (inflation-adjusted) interest rates matter. We look at real rates to gauge how restrictive financial conditions might be. Real rates were low at the end of the first quarter, at roughly 0.15%.⁷ Financial conditions were more restrictive leading up to the recessions of 2001 and 2008-09, when real rates were roughly 4.00% and 2.20%, respectively.⁸

- The global economy has become much more integrated over the last 59 years. U.S. interest rates today are influenced by global trade partners and foreign investment flows. In 1960, foreign investors held about 4%of the $286 billion U.S. national debt. Today, foreign investors (including central banks and currency-reserve funds) hold about 29% of the $22 trillion U.S. national debt. With U.S. Treasuries paying higher yields than German and Japanese bonds, global investors are motivated to purchase Treasuries.⁹ This dynamic puts a lid on long-term U.S. rates.

- New issuance of U.S. Treasuries influences rate levels and the curve, as do supply and demand. Most new issuances over the last 26 months have had maturities of less than one year. Meanwhile, the mix of issues between 2-year and 10-year notes has tilted toward shorter-duration issues.¹⁰ These factors lift yields on the short end of the U.S. curve.

We respect the history of the yield curve as a barometer of the U.S. economy. That said, today it might say more about economic conditions outside of the United States. Moreover, the yield curve is just one of several recession signals we follow.

- U.S. employment trends remain relatively strong, with a jobless rate below 4%.

- U.S. housing has been stumbling along, but mortgage applications are surging thanks to recent drops in interest rates, so activity could improve going forward.

- U.S. manufacturing growth has been trending lower in connection with the global trade slump, but the ISM Manufacturing Index continues to signal expansion, whereas readings in the Eurozone and Japan point to contraction.

- The Conference Board’s Leading Economic Indicators look fine, though nuanced relationships between subindices are flashing slowdown, according to analysis from Bespoke.

If there is a recession, what is the downside risk? Severe recessions result from major imbalances, but slowdowns or isolated industry-specific recessions happen more frequently. Recent JP Morgan research examined the last 11 U.S. recessions and found that the average decline of the S&P 500 was -26%. During “deep” recessions, the decline averaged -33% and during “mil” recessions, the decline averaged -18%.”¹¹ The past may or may not be prologue. Taken as a whole, this information suggests to us that our best course of action is to keep our portfolios close to their strategic long-term allocations, embrace diversification and position with portfolios with a quality bias while monitoring new developments as they occur.

LVW NEWS: Awards & Accolades

Barron’s article, published in February 2019, on Contrarians Argue That Foreign Stocks Are Attractive Now features commentary from Lori Van Dusen, CIMA, Founder and CEO, on emerging markets yield and strategy.

Lori Van Dusen, CIMA, Founder and CEO, has been ranked third in New York State’s Best-in-State-Wealth Advisors list for 2019 by Forbes Magazine.

Lori Van Dusen, CIMA, Founder and CEO, participated in a panel on Building Your Practice Through Acquisitions at the 2019 Forbes | SHOOK Top Advisor summit in Las Vegas, NV.

“The future of finance will be female” article in 13D Global Strategy & Research spotlighted Lori Van Dusen, CIMA, Founder and CEO, and her ability to relate to female investors while using behavioral economics and indexing.

Employee News

Kim Pugliese has rejoined LVW Advisors as Chief Operating Officer. Kim brings over 30 years of experience holding senior positions in Fortune 500 companies. A native of Rochester, N.Y., Kim holds an MBA from the University of Rochester’s William E. Simon Graduate School of Business Administration. She also holds a Bachelor of Arts in Mathematical Economics from Colgate University.

Kim lives in Penfield, N.Y. and enjoys biking and hiking anywhere an adventure can be sought. She and her husband travel frequently to visit their son, Nick, and daughter, Shauna. Nick resides in Philadelphia and Shauna travels around the world as a trip leader with Backroads. Kim, along with her husband, enjoys catching up with them in a variety of locations.

Welcome back to the team, Kim!

LVW: Staying Current

Paul Salvetti, Manager of Research, recently attended the Context Summit in Miami, which provided an opportunity to meet directly with many of our current fund managers, meet with new managers, and to hear about trends in new offerings.

Danielle DiPaola, Compliance Analyst, attended the annual IAA Investment Adviser Compliance Conference this quarter in Washington, D.C. The conference provided investment advisors with the most current information available on the changing regulatory landscape, and offered an opportunity to hear a distinguished roster of speakers that included SEC staff, investment advisor industry professionals and legal experts.

Abigail Adams, Director of Operations, attended a Tamarac User Group session in New York City. This small-group open format of top operational directors provided a great forum to share best practices across our key technology platform.

Newsletter Citations:

1 According to analyst data compiled by FactSet as of 3/29/19.

2 International Monetary Fund and the Organization for Economic Cooperation & Development.

3 BCA Research, Special Report, 1/28/19.

4 Based on the ICE BofAML High Yield Master II Index as of 3/28/19.

5 Bespoke Investment Group, Chart of the Day, 3/26/19.

6 For U.S. recessions in 1960, 1970, 1973-75, 1980-82, 1990-91, 2001, 2008-09 according to the Federal Reserve Bank of St. Louis.

7 Core CPI reflects consumer price inflation excluding food and energy costs, a price index monitored by policymakers.

8 Referenced real rates as of initial yield-curve inversion. Data from the U.S. Department of the Treasury and the Federal Reserve Bank of St. Louis.

9 Global yields as of 3/29/19: UST 10-Year at 2.41%, German 10-Year at -0.07%, Japanese 10-Year at -0.10%.

10 Based on data compiled by SIFMA (Securities Industry and Financial Markets Association).

11 JP Morgan, Global Markets Strategy, Flows & Liquidity, 3/29/19.

Disclaimer: This report is provided for informational purposes only. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.

The Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years’ experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes or SHOOK receive a fee in exchange for rankings.