Table of Contents

SECOND QUARTER MARKET SUMMARY

IS THIS TIME DIFFERENT?

LVW NEWS

Welcome to the summer issue of The Serious Investor. In this issue we discuss the strong second quarter performance across almost all asset classes, as well as the role of the Federal Reserve and its influence in driving those gains. We also explore a question many people are asking: “Is this time different?”

Quick take:

- Once again, the U.S. market gained largely because of the Federal Reserve’s more dovish stance.

- Economic data weakened in the U.S. and abroad.

- Unprecedented monetary policy demands focused attention on managing risk through the late part of the business cycle.

- We are taking a more selective and defensive investment approach.

- We remain invested in equities, but with caution and an emphasis on quality.

SECOND QUARTER MARKET SUMMARY

Almost all asset classes posted strong gains in the second quarter and first half of 2019, even as the U.S. and global economies showed signs of weakening. The U.S. stock market had its best first half since 1997 as measured by the 18.5% return on the S&P 500. A nearly 7% gain in June— the index’s best June since 1955¹—overcame an equivalent loss in May. Developed and emerging market equities also posted substantial gains. At the other end of the asset-class spectrum, long-dated U.S. government bonds generated double-digit returns, and investment-grade, high yield and municipal bonds all posted solid returns.

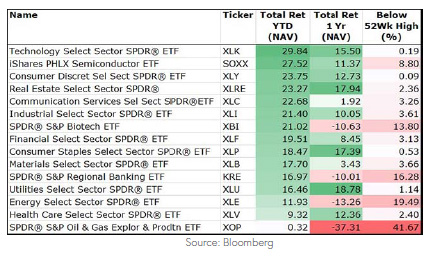

A closer look at sector performance within the U.S. shows strong performance among more defensive sectors like staples, utilities and Real Estate Investment Trusts, but once again technology and consumer discretionary led the way.

The force behind this near-universal rally was what must be the largest, fastest pivot from tightening to easing of monetary policy in Federal Reserve history, joined by similar moves by central banks in Japan, Europe and China. Last fall, Fed Chair Jerome Powell announced an interest rate increase, while calling it a “particularly bright moment” in the American economy.² As recently as December, the Fed was expected to hike rates twice in 2019. By the time of the June Fed meeting, however, Powell’s language had shifted 180 degrees, noting that uncertainties about the outlook have increased. “[We will] act as appropriate to sustain the expansion,” he said.³ “The case for somewhat more accommodative policy has strengthened.”⁴

The Fed and its overseas peers were responding to a raft of weakening economic data, including:

- April and May jobs reports that fell short of expectations, including downward revisions in April⁵

- Soft U.S. industrial production⁶

- GDP growth projected to fall from 3.1% in the first quarter⁷ to just 1.0% in the second quarter⁸

- Inflation staying stubbornly below the Fed’s 2.0% target⁹

- A rise in the New York Fed’s probability of recession indicator to more than 30%, its highest level since 2008¹⁰

- Earnings growth for S&P 500 companies forecast at just 3.0% in 2019¹¹

- A drop in the Organization of Economic Co-operation and Development’s global leading indicators index¹²

- A decline in long-term Treasury bond yields¹³

- The global Purchasing Managers Index (PMI) falling below the range that signals expansion¹⁴

The market moved ahead of the Federal Reserve—potentially forcing its hand.

It is important to note that not all of the economic news in the second quarter was negative. The unemployment rate fell to just 3.6%, a 50-year low.¹⁵ Wages climbed 3.1% in the 12 months through June, helping consumer sentiment and retail sales remain high.¹⁶ What’s more, job growth rebounded sharply in June and beat expectations, driven in part by manufacturers adding

jobs at the fastest pace since January.¹⁷

The markets read Powell’s statements to imply that two rate cuts totaling 50 basis points were all but certain this year, with the first coming in July. Following the Fed’s June meeting, Powell noted that an ounce of prevention is worth a pound of cure. With the federal funds rate at just 2.5% as of this writing, the Fed has little ammunition to fight a recession should the need arise; its members may therefore feel the need to cut rates before weakness takes hold.

Growth stocks continued to power the equity markets, as they have for the last several years (see chart below).

Is the growth-versus-value divergence justified? Is this time different? Those are fair questions, considering that the economy is driven more by technology companies and less by traditional value stocks such as transportation, materials and financials. The underperformance of the traditional value index has occurred as technology has become a major driver of productivity and profit margin expansion.

Investors’ hunger for growth has helped fuel an IPO market reminiscent of the dot-com boom, headlined by high-profile companies like Uber, Lyft, Beyond Meat, Pinterest and Zoom Video. The Wall Street Journal reports that May was the biggest month for IPOs since September of 2014, with more than $15 billion raised.¹⁸ As in the dot-com days, about 80% of the new firms coming

to market are losing money.¹⁹ That said, investors haven’t shown the kind of euphoria they exhibited in the late ‘90s: Uber and Lyft stock prices fell in their first days of trading, and first-day returns have been only slightly higher than historical averages—a far cry from the exorbitant first-day gains during the dot-com days.

IS THIS TIME DIFFERENT?

“The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.” — Sir John Templeton

Pioneering global investor and spiritual seeker Sir John Templeton was a wise man. His observation drives at a basic investing challenge: deciding when changes in the markets warrant new investment approaches and when they do not.

The markets have changed in some major ways in recent decades; nevertheless, our investment discipline, based on value, growth and liquidity, remains as important as ever. In some ways, changes in the markets have made that discipline even more important. But the shifts described below have led us to evolve the ways we implement and execute it.

Unprecedented monetary policy. Central banks around the world have made money extremely cheap for more than 10 years, but these easy-money policies have had mixed results so far. The U.S. economy has expanded for 10 straight years, marking the longest expansion in history and driving the unemployment rate to a 50-year low. But U.S. growth has averaged just 2.2% per year, and the global recovery has been lackluster. Structural issues related to demographics and maturing economies are likely leading to slower growth, higher savings rates and, ultimately, lower economic output.

Stupid things happen when money is cheap for extended periods, and this time is no exception. Corporate America has binged on borrowing: Nonfinancial corporate borrowing reached almost half of GDP by the end of 2018, a record, as companies sunk money into stock buybacks, dividends and mergers and acquisitions. Dividends and stock buybacks have generally exceeded free cash flow since 2013, and debt has made up the difference. Money-losing companies in the Russell 1000 index returned 31.5% during the first five months of 2019.²⁰

Perhaps nowhere is the madness worse than in the world of shadow banking–credit creation/lending facilitated by non-bank lenders. The demand is being driven in part by private equity investors, with leverage playing a large role in propping up investor returns. The fourth quarter of 2018 marked a record high issuance of non-bank debt, totaling US$28.7 billion. Easy money has created a more competitive market; leverage levels have increased, and investor protections/covenants have decreased. Caution is warranted, particularly in cyclical industries where covenants are loose.

The borrowing and spending cannot continue indefinitely. Companies at some point will have to go on a debt diet, which could affect dividends, buybacks and/or mergers and acquisitions. These developments would weigh on the economy and the stock market. Higher rates also could make it harder for large private equity to produce returns greater than the public equity

markets.

Another concern, which we mentioned earlier: With short-term rates at just 2.5%, what does the Fed do in the event of a crisis? To our recollection, the Fed has never begun an easing cycle with unemployment at multi-decade lows and stock markets at all-time highs. Nor has our federal budget deficit, as a percentage of GDP, been this large during an economic expansion. This

confluence of factors makes predicting interest rates nearly impossible.

We are in uncharted territory. There is no guarantee that lowering interest rates from 2.5% to 1.5%, for example, would have the same impact that a one point cut would have had previously or if originating from a higher level. The relationship between interest rates, inflation and economic growth may not

be linear. In a recent post on the Epsilon Theory blog, Ben Hunt uses water as a metaphor. He notes that water gets heavier as its temperature falls until it drops to four degrees Celsius. But as its temperature drops from four degrees to zero, water gets lighter, defying all logic.²¹

Interest rates may act in similarly surprising ways: Reducing rates from historically normal levels tends to boost growth and inflation—but the impact might be entirely different when rates start near zero. The experience of the last 10 years suggests this might be the case, as low rates consistently failed to deliver the results policymakers expected.

Funds flow globally, so one country’s central bank has limited influence on how money moves through its own economy. Meanwhile, an unregulated shadow banking system is responsible for more than half of all new credit creation, and there is nothing the Fed can do to guarantee liquidity in this part of the financial system. Investors who are counting on the Fed to guarantee liquidity when things go wrong may be in for a rude awakening.

The upshot: When it comes to monetary policy, this time really is different. Recognizing that fact is central to managing risk as we progress through the late part of the business cycle.

The herd holds sway. As we have mentioned in previous issues, the growing dominance of passive investments, algorithmic trading and other rules-based strategies means that most of the market is simply trying to mimic everyone else. And the market moves faster than ever, thanks to the ubiquity of information and advances in trading technology.

One result is that herd behavior drives short-term performance more than it ever has before. As long as relatively benign conditions prevail, the stock market tends to march along steadily upward. But when red flags in the global economy or financial system trigger outflows, assets flood out, squeezing liquidity and perpetuating further losses. Imagine a herd of bison:

Most of the time, it makes its way gradually and peacefully over the plains, munching grass. But every now and then it gets spooked and stampedes.

Liquidity can dry up fast in an investor stampede, especially now that there are fewer fundamentals-based value investors to provide price support for securities being sold off unfairly. This dynamic is bad news for sellers but can present sterling long-term opportunities to investors who have the cash, discipline and process to act quickly and decisively when assets sell off for non-fundamental reasons.

Ubiquitous information has produced another important difference in the markets. The parts of the market that receive the most attention—namely large-cap stocks—are extremely efficient in aggregate. Less than 25% of U.S. equity funds have outperformed their benchmarks on a rolling 10-year basis, according to Morningstar data. We think the lack of outperformance is easy

to explain. Active managers typically are incentivized to match benchmark returns, encouraging closet indexing, so very few beat their benchmarks by enough to offset their fees. An exception to this generalization can be found with funds in which fund management owns a high percentage of the fund. A recent study by Capital Group concluded that more than 70% of funds with

high portfolio manager ownership and low management fees outperformed their benchmarks over rolling 10-year periods.²²

Long bull markets lead to complacency by participants and professionals. This cycle is no different. It is impossible to predict when the current cycle will break. But when it does, it is our view that the managers who dare to look differently at the market rather than just the benchmarks they track should outperform significantly. As investors continue to pay up for growth,

the valuation discrepancies become larger, leaving opportunities, we believe, for skilled managers to exploit these dislocations. Seeking to identify such managers is a current area of focus for our research team.

Valuation and fundamentals still drive long-term returns. But our investment process needs to account for the herd’s increasing sway over short-term market performance.

So much has changed; so much remains the same

Although much in the market has changed, certain tenets of investing have not. The best investments are those that are mispriced relative to their risks. We believe that there are always opportunities to find such investments, especially in underfollowed, inefficient parts of the market where specialists’ expertise and access provide the opportunity to ferret out value. And we see no reason to abandon our investment discipline and its emphasis on value, growth and liquidity. To the contrary, it is our view that our focus on the factors that drive long-term returns enable us to capitalize on opportunities the herd leaves in its wake.

In addition, we have worked to fine-tune how we execute our approach. For example, we are able to inform our investment process with far more data than ever before, more quickly than ever before. Likewise, we use robust technology to rebalance portfolios with the speed today’s market moves demand, and to perform stress testing we believe is important to prepare

portfolios for the market’s myriad of potential scenarios.

Our positioning

It is our view that the economy is clearly in the late part of the cycle and several indicators have turned down. The fundamental drivers of U.S. consumption remain in place, with low unemployment, healthy wage gains, high savings rates and strong consumer sentiment, not to mention a newly accommodative Fed.

The global economic backdrop is somewhat less clear. China, the world’s second-largest economy, has been ramping up its stimulus efforts. Stronger demand out of China would boost economic activity worldwide, as would a trade truce. At the same time, the slowdown in economic activity is a global phenomenon.

The Fed’s sudden accommodative pivot could support further gains for U.S. and foreign stocks, despite the mounting risks that led to that pivot. While prices for U.S. equities are relatively high, at about 16.5 times earnings, earnings expectations are relatively low, leaving room for upside surprises. Meanwhile, real yields on cash investments have turned negative, potentially driving flows into equities. International stocks look relatively attractive, trading at a 20% discount to the U.S. market, compared to a historical average of 11%.

In a recent opinion piece for Bloomberg, Allianz Chief Economic Adviser and former PIMCO CEO Mohamed El-Erian writes that this environment “calls for a more selective and defensive investment approach…increasing low cash holdings to take advantage of future possible dislocations and pockets of illiquidity, and using the first half’s rally in higher-risk assets to increase the quality of investment holdings in favor of companies and countries with more resilient balance sheets.”²³

We agree. We look to ensure that we have the liquidity to act quickly when herd moves present opportunities to improve the quality of our portfolios, whether in industries exhibiting secular growth such as enterprise software, or among quality companies with appealing characteristics such as the ability to generate significant free cash flow, strong balance sheets and a history of shareholder-friendly practices such as dividend growth. And we retain the ability to play defense with high-quality bonds and specific alternative strategies that we believe exhibit low sensitivity to equity and interest rate movements to generate returns.

In more efficient parts of the capital markets we may seek to capture exposure through low-cost, tax-efficient passive vehicles, dialed up or down based on valuations. In addition, we may pair this strategy with exposure to specialists who select investments in less-efficient parts of the public markets. With fewer true experts in these less-explored corners of the market, we believe the investment managers who specialize in them can add value through greater experience and access to information.

Within the private markets, we continue to advocate selectivity and a focus on small-to-midsize businesses with real growth prospects and companies that can create true value rather than rely on financial engineering to deliver results, as well as high-quality secondary investments.

On balance, we are cautious yet constructive. We see madness in some asset classes that will ultimately create opportunities. We remain invested in equities to follow the markets higher, but with caution. We continue to emphasize quality.

There are ultimately two different risks we face as investors: the risk of lost principal and the risk of lost opportunity. Today, after one of the strongest first six-month periods in history, we view the former as the risk that merits the most attention.

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO, was ranked fifth in Forbes’ Top Women Wealth Advisors list, which was published in the June print edition of Forbes.

The Rochester Business Hall of Fame selected Lori Van Dusen, CIMA, Founder and CEO, for induction later this year into its 2019 class of honorees. The Rochester Business Hall of Fame is designed to publicly honor successful business people that have made outstanding contributions to the Rochester Community. Lori joins an elite group of 127 leaders in Rochester’s history that

have been inducted since the inception of the honor in 2001.

Lori Van Dusen, CIMA, Founder and CEO, will be honored in September by the Girl Scouts of Western New York at the annual Women of Distinction Dinner & Awards Ceremony to be held in Buffalo. The program is part of the nationwide Girl Scouts of the USA program that is designed to recognize the achievements of women, provide mentoring opportunities for older Girl Scouts and fund local Girl Scout educational opportunities and programs for girls aged 5 to 17. Lori will be recognized for her demonstrated leadership in her career and in the community through public service.

Christopher Van Buren, CFP® CPWA®, Private Wealth Advisor, received his Certified Private Wealth Advisor® certification in May. This is an advanced professional certification for advisors who serve high-net-worth clients.

Lori Van Dusen, CIMA, Founder and CEO, was honored to be a featured judge at the 11th annual Young Entrepreneurs Academy (YEA!) Saunders College Competition hosted by Rochester Institute of Technology’s Saunders School of Business in May. It was a truly amazing and inspirational experience highlighting future entrepreneurs!

Employee News

Sarah Bass joined LVW as Assistant Office Manager as of July 8. Sarah most recently worked as registrar at the Ellwanger Barry Nursery School and continues to serve on the school’s board. The school’s leaders said Sarah was their “go-to person for anything that needs to get done,” and she has quickly become our go-to person, too.

Sarah grew up in Houston, Texas, and moved to Rochester with her family three years ago. She quickly fell in love with the area and spends her free time obsessively learning about local history, as well as camping, knitting and winemaking.

Sarah will be the first person to greet you when you visit the LVW offices!

Staying Current

Catie Arnold, Private Wealth Advisor, recently attended the Financial Planning Association’s Rochester Annual Symposium, where advisors discussed current technical and practice management topics.

In May, members of the LVW team headed to Austin, Texas, to attend the annual Tamarac Summit Conference. It was a great opportunity to connect with other professionals in the financial industry, with whom we shared best practices and discussed the latest trends and their implications.

As Manager of Research, Paul Salvetti is responsible for continually seeking out unique investment opportunities. In May, he attended the Ares Conference in NYC to get an update on the firm and hear about the progress of and prospects for each of its current funds. Ares European Direct Lending Funds II, III & IV (closed to new investment) are private funds that are LVW-approved options.

In April, Rick Van Kuren, Senior Partner, attended the Fifth Annual Registered Investment Advisor Central Investment Forum in Chicago, where he had the honor of moderating presentations focused on emerging markets, venture capital and using fixed income ETFs to construct custom portfolios. The forum also covered the practice management techniques and investment

strategies that leading independent, fee-based firms deploy to compete in an increasingly crowded and rapidly changing market.

Citations:

1 “Many Assets Are Winners So Far in 2019 … So Beware,” Mohamed El-Erian. Bloomberg, July 1, 2019.

2 “A ‘Particularly Bright’ Moment Brings Another Fed Rate Increase,” Binyamin Appelbaum. New York Times, Sept. 26, 2018.

3 “Powell says economy facing growing uncertainties,” Martin Crutsinger. AP News, June 25, 2019.

4 “Some Fed officials believe the case for a rate cut is strengthening,” Jeff Cox. CNBC.com, June 19, 2019.

5 “Those U.S. Jobs Revisions are Hard to Ignore,” A. Gary Shilling. Bloomberg, July 1, 2019.

6 “Industrial Production and Capacity Utilization.” Federal Reserve, June 14, 2019.

7 “Gross Domestic Product, First Quarter 2019 (Third Estimate).” U.S. Bureau of Economic Analysis, June 27, 2019.

8 “JP Morgan slashes second-quarter GDP forecast to just 1%,” Patti Domm. CNBC.com, May 24, 2019.

9 Current Consumer Price Index. InflationData.com, June 12, 2019.

10 “Probability of US Recession Predicted by Treasury Spread.” NY Federal Reserve, July 5, 2019.

11 “Global Asset Allocation.” BCA Research, July 1, 2019.

12 “Composite Leading Indicator.” Organization of Economic Co-operation and Development.

13 “Those U.S. Jobs Revisions are Hard to Ignore,” A. Gary Shilling. Bloomberg, July 1, 2019.

14 “Broad-based decline in manufacturing output in June.” IHS Markit Global Sector PMI, July 5, 2019.

15 “Global Asset Allocation.” BCA Research, July 1, 2019.

16 “Global Asset Allocation.” BCA Research, July 1, 2019.

17 “Strong job growth is back,” Jeff Cox. CNBC.com, July 5, 2019.

18 “IPO Boom Will Continue, Despite Uber and Lyft’s Travails,” Aaron Back. Wall Street Journal, May 19, 2019.

19 “Global Asset Allocation.” BCA Research, July 1, 2019.

20 “Market Observations and Analysis.” Gotham Asset Management, June 2019.

21 “A Song of Ice and Fire,” Ben Hunt. Epsilon Theory, May 27, 2019.

22 Capital Group searched Morningstar’s database for large-cap actively managed funds that were both the lowest quartile ranked by expense ratio and the highest quartile ranked by manager ownership at the fund level.

23 “Many Assets Are Winners So Far in 2019 … So Beware,” Mohamed El-Erian. Bloomberg, July 1, 2019.

Disclaimer: This report is provided for informational purposes only. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.

The Forbes ranking of America’s Top Women Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors with a minimum of seven years of experience and weighing factors like revenue trends, assets under management, compliance records, industry experience and best practices learned through telephone and in-person interviews. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings.

The Rochester Business Hall of Fame is presented by Junior Achievement of Rochester New York Area Inc., the Rochester Business Journal and Rochester Museum & Science Center. The Hall of Fame Committee, advised by an independent group of past inductees, selects each year’s honorees. Members of the Hall of Fame are selected on the basis of their business contributions to the Rochester New York area.The honorees for the Girl Scouts of Western New York annual Women of Distinction Award were nominated by members of the community because of their demonstrated leadership in their careers and in their communities through public service. These women are considered role models for all girls, and, in accepting this award, they commit to mentoring the young women involved with the Women of Distinction event.