Welcome to the winter issue of The Serious Investor. Since our last newsletter, the markets have plummeted, as the U.S. stock market suffered its largest correction in a decade and the worst December since the Great Depression. This issue offers our take on where the downturn leaves us, and why we think it may present long-term opportunities for disciplined investors.

Quick take:

- Economies are slowing around the world.

- The combination of Fed tightening and computerized trading is amplifying volatility.

- The markets seem to expect recession, but fundamentals suggest otherwise.

- Higher interest rates have made high-quality bonds more attractive.

- Lower valuations on risk assets may present good entry points for long-term investors.

FOURTH QUARTER MARKET REVIEW

A year ago, we reported that 2017 had been the easiest year in history to be an investor. Since then, the markets have swayed between calm and mayhem. Calm prevailed at first, as new tax cuts pushed the market to its best January since 1987. The market corrected suddenly in February, and then tech stocks pulled the market steadily higher through early fall. When the fourth quarter arrived, the markets seemed to fall down an elevator shaft.

The S&P 500 lost 13.5% between October 1 and the end of the year, with a 9.0% drop in December—the market’s worst December since 1931. The decline included a 19.8% plunge between late September and Christmas Eve, and brought the index to its first calendar year in the red since 2008¹. Meanwhile, some segments fell into official bear markets, such as small caps, technology and non-U.S. developed equity. In fact, many of the world’s major stock markets are in bear territory².

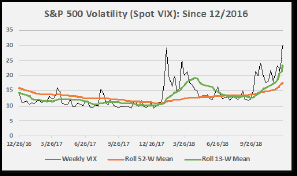

Volatility skyrocketed. The CBOE Volatility Index (VIX), which averaged 11 in 2017, averaged almost 17 in 2018 and spiked into the mid-30s in December. It has since settled to below 20.

The reasons for the downturn likely included some combination of concerns about slowing global growth and its implications for corporate earnings, the potential for the Fed to tighten monetary policy too quickly and hasten a recession, and the trade conflict between the U.S. and China.

The market’s move lower was rational, to an extent, but these factors don’t explain the severity of the moves. In our view, the spike in volatility came about for two primary reasons. First, the Fed is gradually removing quantitative easing, allowing volatility to return. Sharp swings in the prices of stocks, oil or other assets mean that more people are seeking liquidity rather than providing it.

Second, technical factors are driving short-term price moves. Strategies using computer and rules-driven trading have come to dominate market action, accounting for as much as 85% of daily trading volume according to The Wall Street Journal. (Many algorithmic and systematic trading programs are based on cross-asset correlations, volatility levels, some form of momentum or owning what everyone else owns, so much of the market tends to buy and sell as a herd, boosting the speed and severity of downdrafts.)

As LVW’s Principals, we have worked in the markets for decades and really have never seen anything like the intraday plunges and ricochets that were commonplace in December. Today’s volatility is a good reminder that the capital markets are perpetually evolving, so we must constantly learn, adapt, and not overreact.

The fourth quarter’s damage put every major asset class in the red for 2018—a stark contrast with 2017, when every major asset class ended in positive territory (see first chart below).

We’ve pointed out repeatedly—maybe ad nauseam—that higher valuations bring greater risk. The events of the fourth quarter demonstrate the truth of that axiom.

MARKET OUTLOOK: A Battle Between the Markets and Fundamentals In times of market turbulence, it’s helpful to take a deep breath [see recent article, Just Breathe]. As we try to assess the economic and market situation dispassionately, we see a battle between the markets and economic fundamentals.

At LVW Advisors, we start our investment process by assessing valuations. Prices relative to earnings matter—and following the markets’ declines, valuations have become more attractive. The average forward price-to earnings ratio of the S&P 500 has fallen from nearly 22 in September to less than 15, near its 10-year average.³ Based on historical returns, this decrease in the market’s P/E boosts its expected annualized five-year return to roughly 7%, from a previous range of 0%-4%.⁴

Valuations are considerably lower overseas, with the MSCI EAFE trading at a price-to-earnings multiple of 11.9 and the MSCI Emerging Markets index sporting a P/E of 10.5.⁵ Lower valuations discount the fact that foreign markets have produced less-stable growth than in the United States. Equity valuations suggest that we may have reached a fairly attractive entry point, as long as corporate earnings hold up. If not, valuations could fall further. That’s an important reason we consider the outlook for both economic and profit growth.

We believe that the United States is clearly in the late phase of its cycle. Fundamentals suggest that growth will slow but not turn negative. The Atlanta Fed estimates that U.S. gross domestic product expanded 2.8% in the fourth quarter, as compared to 3.4% in the third quarter, and 3.0% for the 12 months through September.⁶ The economy looks likely to continue its trend of starting the year slowly, thanks to weakness in auto sales and a cooling housing market. The price for the median Manhattan apartment recently dipped below $1 million for the first time since 2015.⁷

That said, GDP growth remains above the 2.3% post-crisis trend, and the Fed projects that the economy will match that average growth rate in 2019.⁸ Other indicators generally look solid. The National Federation of Independent Businesses (NFIB) survey of small business optimism remains near record highs. Retail sales jumped 4.2% over the last 12 months, and consumers are in good shape to spend further. The cost of consumer debt service is lower than it’s been since the 1980s, oil prices are low, and unemployment has fallen to 3.7%, with more job openings than applicants.⁹ Plunges in the stock market and a softening real estate market could hold back spending, but consumers’ balance sheets look fairly healthy.

The U.S. corporate outlook is less rosy. Profit margins have likely peaked; we believe it is doubtful that corporations will repeat the roughly 23% earnings growth they generated in 2018.¹⁰ They won’t get another one-time boost from tax cuts, while a strong dollar undermines earnings generated overseas, and rising interest rates, tariffs and a tight labor market are likely to increase costs.

Moreover, corporate debt levels are near record levels, so firms facing rising interest rates may need to turn their attention toward improving their balance sheet and away from shareholder-friendly actions like buy-backs and dividend increases. Case in point: Not a single high-yield bond was issued in December.

Still, the corporate outlook isn’t dire. Analysts have reduced their 2019 profit growth forecasts to a more reasonable and conservative 6% earnings forecast in recent weeks.¹¹ While Apple’s recent negative revision suggests a less-certain outlook for earnings, expectations now are much lower. At this point, earnings estimates for 2019 are below the post-crisis average but in

line with long-term averages, according to data from FactSet. Given the bad news priced into current valuations, mid-single-digit earnings growth could be positive for stocks, and there is room for upside surprises.

The Fed has been in the news a lot recently—never a good sign. But in our opinion, investors’ take on the Fed seems excessively negative. Inflation continues to be tame, with core CPI at 2.2% over the 12 months through November.¹² The Fed reduced its planned rate hikes for 2019 from three to two, and low inflation gives it greater flexibility to pause if the economy were to soften further. That said, generally tighter financial conditions point to continued volatility.

It’s possible that stock declines and higher credit spreads could hurt the economy and create a so-called “doom loop” like we experienced entering the last two recessions. But we think that scenario is unlikely. The lack of major financial and economic imbalances in the U.S., as well as the Fed’s ability to moderate the pace of rate hikes, we believe reduces the risk of a vicious cycle in which tighter financial conditions lead to slower economic growth and even tighter financial conditions. Yet the markets seem to think otherwise. The yield curve has flattened dramatically this year, and now the front-end (between six months and three years) is slightly inverted.

Like an inverted yield curve, declines in the price of commodities such as oil and copper have preceded economic weakness historically. Commodity prices have plunged recently. Likewise, credit spreads and yields on high-yield bonds have tended to jump prior to previous recessions, just as they did in the fourth quarter.

What’s more, the details of the stock market downturn suggest that investors lack confidence in the economy. The types of cyclical stocks that tend to fall first and hardest prior to recessions—including home builders, automakers and technology—have led the market downward, while defensive sectors such as utilities, staples and real estate investment trusts have held up

best. In the words of Stanley Druckenmiller, “The inside of the stock market, which is the best economist I know and which I’ve used every cycle when I’ve invested, is saying there’s something not right there.”

Foreign economies are weaker than the U.S. on fundamental measures, one reason that most global bourses are in bear-market territory. Trade spats are hurting countries around the world, not just the United States. The capacity for central banks to cut rates is more limited outside the U.S., and imbalances are greater abroad, in part because countries and companies gorged on debt

while it was cheap. The big story is China, which (like Europe) has slowed faster than expected. Third-quarter GDP growth was just 6.5%, the slowest rate since the financial crisis; fourth quarter growth looks likely to be the same.

While there are good reasons to be concerned about China—including very high debt levels and slowing industrial output—not all the news is bad, and we see the potential for growth to endure. China’s credit impulse recently rebounded into positive territory. Government policy has an outsized impact on the country’s market, and the government has a lot of tools in its toolbox. China has recently implemented personal income tax cuts (with more to come), reduced bank reserve requirements to encourage lending, and initiated infrastructure spending. Whether or not China succeeds at shoring up its economy will have a significant impact on growth globally.

In other major economies, growth rates are going from slow to slower. Again, not all the news is bad. Markets could get a boost from fiscal stimulus packages in Italy and possibly France, a weak euro and low oil prices. Japan also stands to benefit from inexpensive oil, and recent data suggest a pickup in economic activity.

The decline in stock prices worldwide reflects real concerns—but most of them aren’t new:

- The likelihood of slower economic growth in China and globally was evident for much of 2018.

- The U.S. tax cut was always expected to deliver a large immediate profit boost and smaller benefits over time.

- The Fed has telegraphed its monetary plans and has executed them in measured, prudent fashion.

- Washington has been dysfunctional for a long time, and since his days as a candidate, President Trump has consistently called for confrontation with China over trade.

What changed in the fourth quarter wasn’t the risks, but investors’ willingness to accept them. When the market changed direction, algorithmic trading fed on itself as steep drops triggered further selling.

Like most investors, we believe that asset prices reflect fundamentals over time. All of the bad news currently priced into the markets may come to pass, justifying today’s prices and possibly further losses. But it seems just as plausible that some of the concerns weighing on the market won’t turn out as badly as investors fear. And it’s not hard to imagine a bullish scenario. For example, President Trump, worried about the political fallout from a bear market, strikes a trade deal with China; a modest slowdown in the U.S. economy lets the Fed pause in March; the dollar declines against foreign currencies, boosting corporate profits; and consumers ramp up their spending.

All in all, to us, fundamental conditions don’t signal a major economic downturn in the U.S. over the next 12 months. While considering potential positives, it’s worth noting that the 12-month period following midterm elections has historically been among the best times to invest in U.S. equities. While historical performance may not be an accurate guide of future performance, since 1950, U.S. stocks have always generated positive returns in the year following a midterm election.¹⁴

We tend to be circumspect when the market seems extreme—whether stocks are marching higher, as in 2017 and over the summer, or are lurching lower, as they have been recently. We don’t know how things will play out, and neither does anyone else. But here are some things that we do know:

- Lower valuations are associated with better long-term returns (see chart above).

- A correction between 10% and 20% historically has occurred once a year, on average.

- Four out of five corrections have not become bear markets.

- Bad quarters usually have been followed by good years.

- Maintaining a long-term view has been the best way to invest in stocks.

LVW’s APPROACH

Considering what we know, and acknowledging what we don’t, we think that the markets’ volatile correction has given us a useful entry point into the market. During 2018 we increased our portfolios’ cash positions, in part because we expected that at some point a market downturn would present opportunities and we wanted to be ready to capitalize on them. We did exactly that in the fourth quarter and have continued to do so in 2019.

We’re not trying to time the bottom or ignoring the warning signals the market is sending. We expect market returns to be less than what has been experienced in recent years, with higher volatility. We know that we could be wrong in our belief that the economy won’t enter recession this year, and if so then valuations will fall further—the market’s P/E ratio tends to fall to

between 10 and 12 during recessionary bear markets. But as we approach the management of client portfolios, we take a long-term view rather than a view for just for the next several months. We will continue to seek opportunities in what we believe to be attractively priced assets as we work to position portfolios for the next few years. In a general sense, we favor quality in equity

and fixed-income portfolios, while working to maintain diversification in seeking to help weather volatility.

From a defensive perspective, two-year Treasury securities now offer the opportunity to capture a yield of 2.39%—higher than the dividend yield on the S&P 500¹⁵ for the first time since 2007. From an offensive perspective, we believe that hedged equity strategies are currently less attractive. It is our current belief that value oriented investment strategies are positioned to capitalize on price distortions resulting from recent volatility.

We also continue to look for opportunities in developed non-U.S. equities and are adding to emerging market equities, where we think we may be nearing peak pessimism. U.S. and international stocks historically have traded leadership over long periods, and their relative 10-year performance is at its widest gap since 2004.¹⁶

Source Bloomberg

In addition, given the opportunity set and current conditions, we currently believe the low-cost passive index approach is an efficient way to capture future upside potential. We have held minimal exposure to emerging market stocks in recent years, but have begun adding back gradually now that the broad emerging market universe trades at an average P/E ratio of just 10.5.

China dominates these indices, so it’s no surprise that concerns about global trade and China’s economic picture have caused the benchmarks to fall. Much of the Chinese market now discounts a great deal of bad news and presenting us with an opportunity to establish a long-term position at what we believe to be an attractive price. Broad emerging market indices also include significant exposure to India and Brazil, the only two large economies in the world in the early part of their business cycle.

![]()

Market cycles can be exhausting. In seeking to generate good long-term returns, investors need the conviction to buy when conditions feel terrible and sell when things feel great. We use valuations as our guidepost, taking earnings growth and liquidity conditions into consideration. At this point we are constructive on the markets as we seek to capitalize on what we view as future opportunities. Thank you for your faith as we navigate today’s challenging markets.

LVW NEWS: Awards & Accolades

Lori Van Dusen, CIMA, Founder and CEO, has earned a spot on the Forbes’ Best-In-State ranking for 2019. Congratulations, Lori!

Lori Van Dusen, CIMA, Founder and CEO, has been invited to join a speakers panel at the Forbes/SHOOK Top Advisors Summit in Las Vegas, Nev., in February.

Lori Van Dusen, CIMA, Founder and CEO, has been selected as Session Chair and Moderator for the 5th Annual RIA Institutional Investor Central Investment Forum, to be held in Chicago in April. The topic to be discussed is “Hidden Gems: Three Strategies to Give Your Portfolio an Edge.”

Newsletter Citations:

1 “No Place to Hide,” Pension Partners, December 19, 2018.

2 “From Shanghai to Frankfurt, these 8 stocks indices are in bear markets,” CNN, December 21, 2018.

3 FactSet, December 31, 2018.

4 Capital Group Outlook, January 2019, based on data from Standard & Poor’s and Thomson Reuters.

5 FactSet, December 31, 2018.

6 Federal Reserve Bank of Atlanta, January 8, 2019

7 “As Market Cools, Median Price for Manhattan Apartment Drops Below $1 Million (to $999,000)” The New York Times, January 3, 2019.

8 Federal Reserve, December, 2018. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20181219.pdf

9 Martin Advisory & Consulting Services, January 2, 2019.

10 Ibid

11 Ibid

12 Consumer Price Index Summary, Bureau of Labor Statistics, December 12, 2018.

13 “China third quarter GDP growth slows to 6.5 percent year-on-year, missing forecast.” Reuters, October 18, 2018.

14 Capital Group Outlook, January 2019, based on data from Capital Group, RIMES and Standard & Poor’s.

15 “Charts that matter: S&P 500 dividend yield drops below bond benchmark.” Financial Times, January 9, 2018.

16 Capital Group Outlook, January 2019, based on data from MSCI, RIMES, Standard & Poor’s and Thomson Reuters.

Disclaimer: This report is provided for informational purposes only. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any

reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The awards recognition and the due-diligence process conducted are not indicative of the advisor’s future performance. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Barron’s nor the firm receive a fee in exchange for rankings. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, ww.adviserinfo.sec.gov.