By Joseph Zappia, Principal, Co-CIO

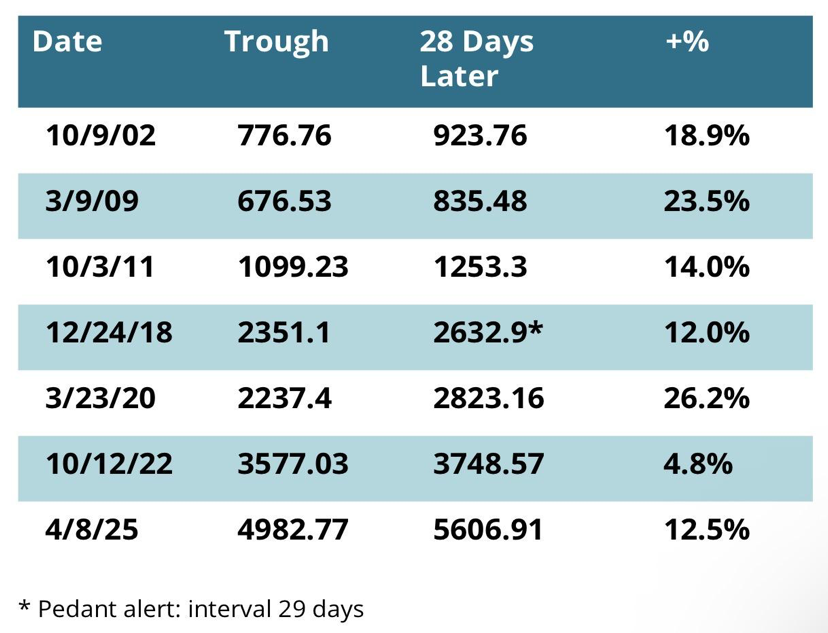

Over the last century, U.S. stocks have provided an average annual return of about 10%—well outpacing bonds and inflation. But every five years or so, it’s normal for the market to drop by around a third, which can trigger fear and lead many investors to move into cash in a bid for safety. History shows that the biggest risk in these moments isn’t further market decline—it’s missing the swift, powerful rebounds that nearly always follow, as the table of S&P 500 troughs and recoveries shows below.

These recoveries are typically “V-shaped,” rebounding quickly and catching investors off guard. In fact, after the last seven major S&P 500 downturns since 2002, the index returned an average of 16% in just the first 28 days after each bottom, with some rebounds—like in 2020 and 2009—exceeding 20%. Investors who sell near the bottom and wait on the sidelines often miss this surge; the longer the delay, the more recovery is lost. The most dangerous time to abandon a long-term plan is often when it feels “safest” to do so.

This is why the primary job of an advisor is not to simply maximize returns, but to deeply understand each client’s true tolerance for risk—including their ability to remain invested during unsettling downturns. The optimal portfolio is not the one that targets the highest return, but the one that aligns with an investor’s comfort level and financial goals, so they can stay the course through inevitable volatility.

An investor does not need to be fully invested in stocks chasing the theoretical 10% annual return—if that level of risk leads to selling at the worst possible time, the real-world results can be far worse. Instead, a prudent allocation matched to the investor’s actual risk tolerance may earn 7%, 8%, or 9% per year over time, while being sustainable through the ups and downs. This approach allows for true long-term compounding—a far more reliable path to building wealth than overreaching for returns that the investor cannot ultimately endure.

The real value an advisor provides is designing a plan that each client can stick with through thick and thin. True investment success comes not from timing the market, but from being invested through every phase, and never letting temporary declines derail the permanent advance of markets. Helping clients avoid the regret of missing recoveries is, in the end, the most important work we do.

Sources:

Nick Murray Interactive, “The Persistence of the V-Shaped Recovery, or 28 Days to Lifelong Regret,” September 2025 Newsletter

S&P 500 Historical Return Data: tradethatswing.com (2025 Update)

“Investment portfolios: Asset allocation models,” Vanguard, September 2025

“Common asset allocation rules of thumb,” Fidelity, September 2025

“How to Determine Your Risk Tolerance Level,” Schwab, August 2025

Disclaimer: This material is provided by LVW Advisors (“LVW” or the “Firm”) for general informational and educational purposes only. LVW Advisors is a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not constitute an endorsement of LVW Advisors by the SEC nor does it indicate that LVW Advisors has attained a particular level of skill or ability. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, and there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice.

Certain of the information contained in this report is derived from sources that LVW believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. The information in these materials may change at any time and without notice.