Contributed by: Joseph Zappia, CIMA, Principal, LVW Advisors

This information is provided by LVW Advisors for general information and educational purposes based upon publicly available information from sources believed to be reliable – LVW Advisors cannot assure the accuracy or completeness of these materials. Any opinions expressed herein do not necessarily reflect the views of LVW Advisors. This information may change at any time and without notice. Past performance is not a guarantee of future returns.

Many companies around the world resumed paying dividends last year as COVID-19 vaccines were rolled out and businesses reopened. Capital Group Equity portfolio manager Caroline Randall keeps a close watch over dividend payers, but she’s especially interested in dividend growers.

“I’m very focused on companies with strong underlying earnings growth that have demonstrated a commitment to raise dividends over time,” Randall says. “Increasing dividend payouts can be seen as a signal of management’s confidence in future earnings growth.”

But can past earnings growth suggest solid return potential for investors? Consider the following hypothetical illustrations.

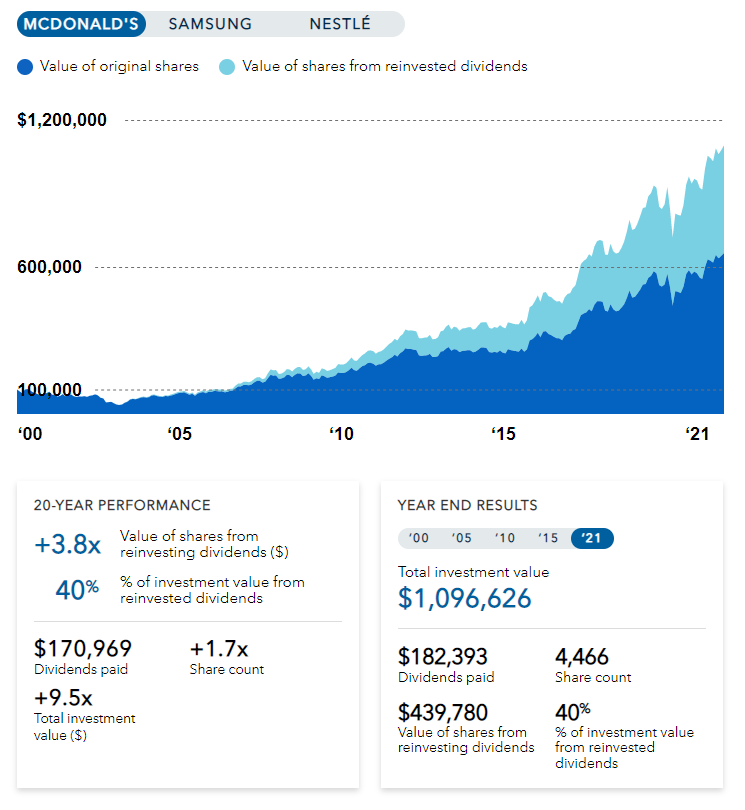

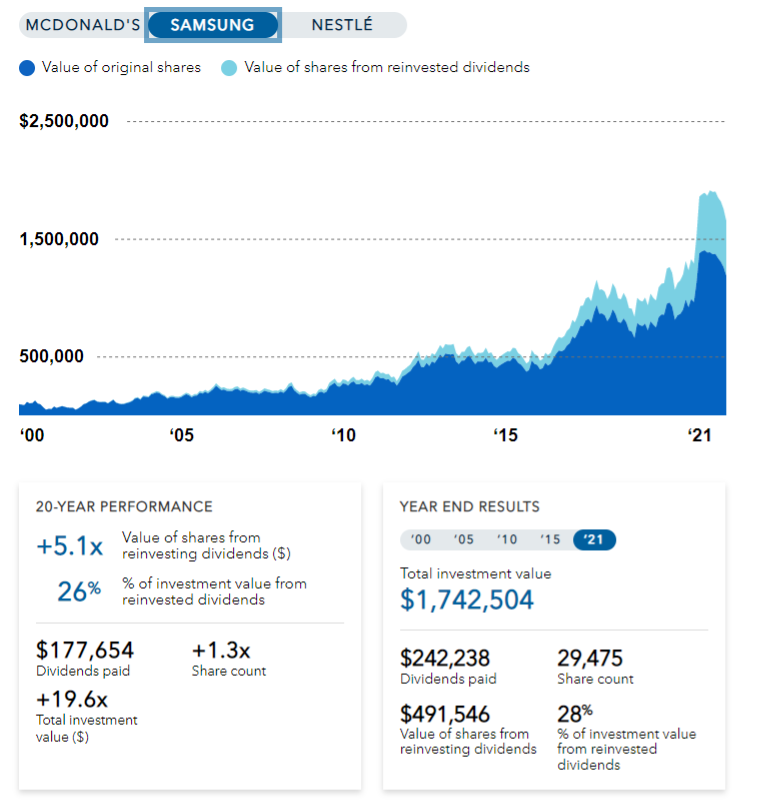

The charts below show the returns for hypothetical $100,000 investments in three historically consistent dividend growers — McDonald’s, Nestlé and Samsung — for the 20 years ended December 31, 2021. See the year-end results and how those initial investments would have fared over the two decades, with all dividends reinvested.

Looking at McDonalds, that initial $100,000 would have grown to $1,096,626 by 2021.

Looking at Samsung, that initial $100,000 would have grown to $1,742,504 by 2021.

Looking at Nestlé, that initial $100,000 would have grown to $694,518 by 2021.

“Dividend growers historically have tended to generate greater returns than other dividend strategies, while also keeping up with the broader market,” Randall adds.

The key to those strong returns is in the reinvestment of dividends.

In the case of Nestlé, reinvested dividends would have generated 36% of the total investment value, or $248,301, over 20 years.

McDonald’s, reinvested dividends would have generated 40% of the total investment value, or $439,780.

Samsung, reinvested dividends would have generated 28% of the total investment value, or $491,546

Of course, not all dividend-paying companies have kept pace with the broader market, and past results aren’t predictive of future outcomes. But the illustration suggests that dividend growers may be a good option for long-term investors who seek increasing income and inflation protection.

—

Source: Caroline Randall. “What $100k could have become in 20 years.” Capital Group Insights, August 10, 2022.

Caroline Randall is an equity portfolio manager with 24 years of experience (as of 12/31/2021). She also covers European utilities as an analyst. She holds master’s and bachelor’s degrees in economics from Cambridge.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. Investors should carefully consider investment objectives, risks, charges and expenses.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

American Funds Distributors, Inc., member FINRA.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.