By Joseph Zappia, Co-CIO, Managing Partner, LVW Advisors

Introduction

As trusts become increasingly complex and long-term, the role of trust protector has emerged as a valuable addition to traditional trust structures. This whitepaper explores the role of trust protectors in modern estate planning. It examines their functions, how they differ from trustees, and the considerations for determining whether to include a trust protector in a trust structure. The paper aims to provide a comprehensive overview for individuals and professionals involved in trust planning and management, as well as an outline of its benefits and potential drawbacks.

The Trust Protector: Definition and Function

A trust protector is an individual or entity appointed to oversee certain aspects of a trust’s administration. Unlike trustees, who manage the trust’s assets and carry out its provisions, trust protectors serve as an additional layer of oversight and flexibility.

The key functions of a trust protector include modifying trust provisions, overseeing trustee actions, resolving disputes, and adapting the trust to changing laws or circumstances.

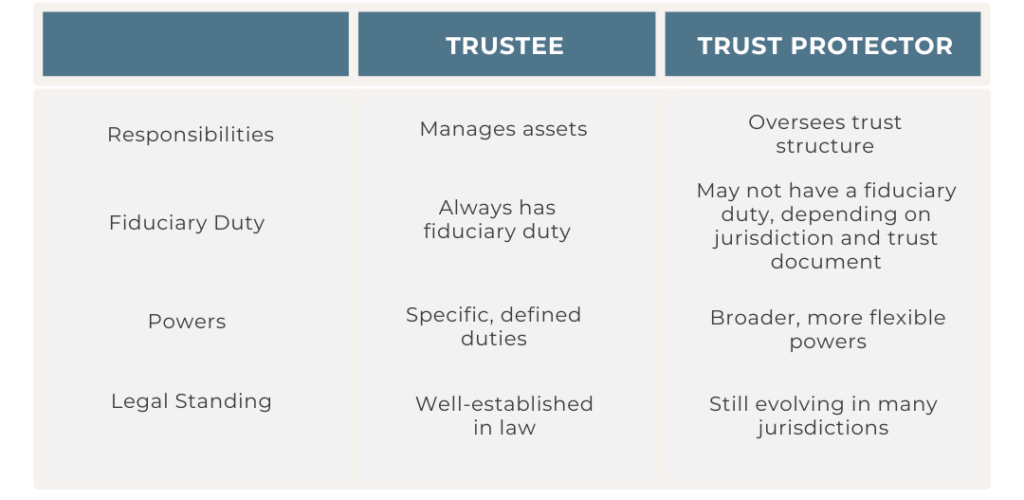

Trust Protector vs. Trustee: A Comparison

While both roles are integral to trust management, they differ significantly:

Benefits of Including a Trust Protector

Some of the potential benefits of engaging a trust protector include:

- Enhanced flexibility for long-term trusts

- Additional oversight of trustee actions

- Ability to modify trust provisions without court intervention

- Potential for dispute resolution

- Adaptation to changing laws and family circumstances

Potential Drawbacks

There may be potential drawbacks to using a trust protector as well, such as:

- Increased complexity in trust administration

- Potential for conflicts between trustee and protector

- Additional costs

- Unclear legal precedents in some jurisdictions

There are many factors to consider when determining if a trust protector is right for your situation. Some of these are:

- Trust complexity and duration

- Anticipated need for flexibility

- Asset protection requirements

- Family dynamics

- Desired level of trustee oversight

- Cost considerations

- Specific powers needed

Individuals and professionals involved in trust planning and management should consider the long-term implications of including a trust protector. If it is concluded that a trust protector is appropriate, the trust protector’s role and powers should be clearly defined in the trust document. The need for a trust protector and the effectiveness of the individual serving in that role should be regularly reviewed. Lastly, it is important to stay informed about evolving laws and precedents regarding trust protectors in relevant jurisdictions.

Here’s a case study that illustrates how using a trust protector can add value:

John and Mary set up an irrevocable trust for their three children, with assets of $5 million. The trust is designed to provide income and support for their children over their lifetimes. Ten years after establishing the trust:

- Tax laws change significantly, creating unfavorable tax consequences for the trust structure.

- One of their children develops a substance abuse problem and is no longer able to manage money responsibly.

- The appointed trustee is not performing well and making poor investment decisions.

Without a trust protector, John and Mary would have limited options to address these issues, as the trust is irrevocable. However, they had wisely included a trust protector provision when setting up the trust. The trust protector is able to:

- Modify the trust terms to optimize the tax structure under the new laws, potentially saving hundreds of thousands in taxes.

- Adjust distribution provisions for the child with substance abuse issues, setting up a system where distributions are tied to maintaining sobriety and completing treatment programs.

- Remove the underperforming trustee and appoint a new, more capable trustee to manage the trust assets.

These actions by the trust protector allow the trust to adapt to changing circumstances and continue fulfilling John and Mary’s original intentions for supporting their children. Without a trust protector, the trust would have been locked into its original terms, potentially leading to negative tax consequences, enabling destructive behavior, and suffering from poor asset management.

Conclusion

The role of trust protector can significantly enhance the effectiveness and longevity of a trust. However, the decision to include a trust protector should be made carefully, considering the specific circumstances of the trust and the settlor’s intentions. As with all aspects of estate planning, consultation with experienced legal professionals is crucial in making this determination. By understanding the role of trust protectors and thoughtfully considering their inclusion, settlors can create more robust, flexible, and effective trust structures to meet their long-term estate planning goals.

This material is for general informational and educational purposes only. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice.

Sources

[1] Trust Protectors: Adding an Extra Layer of Protection to Dynasty Trusts https://fastercapital.com/content/Trust-Protectors–Adding-an-Extra-Layer-of-Protection-to-Dynasty-Trusts.html

[2] What is a Trust Protector and Do I NEED One? Estate Planning Tips https://www.youtube.com/watch?v=I7ctzjpEmaQ

[3] What is a Trust Protector and Do I Need One? Estate Planning Tips https://www.cunninghamlegal.com/what-is-a-trust-protector-and-do-i-need-one-estate-planning-tips/

[4] Trust Protectors for Special Needs Trusts – SNA https://www.specialneedsalliance.org/the-voice/trust-protectors-for-special-needs-trusts/

[5] Trust Protectors: Rescuers of Irrevocable Trusts | Estate Planning https://www.borcherslaw.com/trust-protectors-irrevocable-trusts-estate-planning/

[6] [PDF] trust-protector-planning-key-considerations.pdf – Squire Patton Boggs https://www.squirepattonboggs.com/-/media/files/insights/publications/2020/09/trust-protector-planning-key-considerations/trust-protector-planning-key-considerations.pdf

[7] [PDF] The Case Against the Trust Protector https://www.naepcjournal.org/journal/issue11f.pdf

[8] Providing Flexibility by Adding Trust Protectors to Your Estate Planning https://estatewi.com/providing-flexibility-by-adding-trust-protectors-to-your-estate-planning/