By Joseph P Zappia, Co-Chief Investment Officer

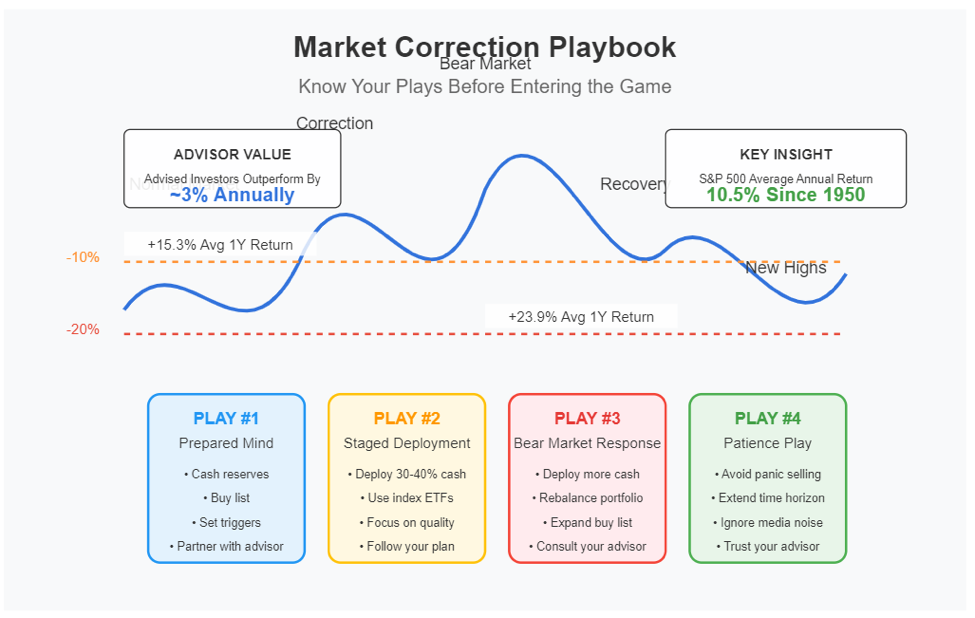

Market corrections and bear markets are inevitable parts of the investing cycle. Since 1950, we’ve experienced 36 market corrections (10%+ declines) and 12 bear markets (20%+ declines). But here’s the critical insight: these periods of market stress consistently create opportunities for disciplined investors.

Instead of reacting emotionally when markets tumble, successful investors prepare in advance. They develop a playbook of strategic moves to execute when specific market conditions arise, often with the guidance of a professional investment advisor. This article outlines a comprehensive playbook for navigating market corrections, based on decades of market data and proven investment principles.

Understanding the Odds: What History Tells Us

Before developing your playbook, it’s essential to understand the historical context:

- Long-term returns: The S&P 500 has delivered average annual returns of approximately 10.5% since 1950 (about 11.7% with dividends reinvested)

- Frequency: Market corrections (10%+ declines) occur approximately every 2 years

- Progression: Only 33% of corrections develop into bear markets (20%+ declines)

- Recovery: The average correction takes 4-5 months to recover

- Opportunity: Buying during 10% corrections has historically improved 5-year returns by 9 percentage points

- Enhanced opportunity: Buying during 20% bear markets has historically improved 5-year returns by 25 percentage points

These statistics aren’t just interesting trivia—they’re the foundation of your correction playbook. They remind us that market declines are normal, typically temporary, and represent enhanced entry points for long-term investors.

Play #1: The Prepared Mind Strategy

When to execute: Before any correction begins

The best time to prepare for a correction is before it happens. This play involves:

- Set cash reserves: Determine in advance what percentage of your portfolio you’ll keep in cash (5-20% depending on your risk tolerance)

- Create your buy list: Identify high-quality companies or ETFs you’d love to own at a discount

- Set your triggers: Decide exactly what market conditions will prompt you to act (specific percentage declines or valuation metrics)

- Review your asset allocation: Ensure your current mix matches your long-term goals and risk tolerance

- Partner with an advisor: Work with a professional investment advisor who can provide objective guidance and help you stick to your plan when emotions run high

This preparation eliminates the need for complex decision-making during emotionally charged market conditions.

Play #2: The Staged Deployment

When to execute: When markets decline 10%

When markets drop 10% (entering correction territory), implement your first stage of buying:

- Deploy 30-40% of your reserve cash: This captures the improved returns typically available at this level while preserving capital for potential further declines

- Focus on quality and value: Prioritize broad market index ETFs like SPY (S&P 500) or QQQ (Nasdaq 100) to capture the overall market recovery

- Consider individual quality companies: Supplement index ETFs with high-quality companies that have strong balance sheets and sustainable competitive advantages

- Maintain discipline: Stick to your predetermined buy list rather than chasing seemingly attractive “bargains”

Historical data shows that buying at 10% down has improved 1-year returns by nearly 5 percentage points and 5-year returns by 9 percentage points compared to average market timing.

Play #3: The Bear Market Response

When to execute: When markets decline 20%

If the correction develops into a bear market (20%+ decline), it’s time for a more aggressive response:

- Deploy another 30-40% of your reserve cash: This captures the substantially improved returns typically available at this level

- Consider rebalancing your portfolio: Sell bonds to buy more equities to maintain your target asset allocation

- Look beyond your initial buy list: Consider high-quality companies that may have been too expensive before but now present value

Buying during 20% downturns has historically improved 1-year returns by over 13 percentage points and 5-year returns by 25 percentage points. The deeper the decline, the better the subsequent returns tend to be.

Play #4: The Patience Play

When to execute: Throughout the correction and recovery

Perhaps the most underrated strategy is simply having the patience to wait out market turbulence:

- Avoid panic selling: Remember that corrections are temporary—every correction in history has eventually been followed by new market highs

- Extend your time horizon: Focus on where your investments will be in 5-10 years, not 5-10 months

- Ignore the noise: Limit consumption of financial media, which tends to amplify short-term fears

- Review, don’t react: Use market volatility as an opportunity to review your strategy, not drastically change it

- Leverage your advisor: This is when investment advisors provide their greatest value—helping clients maintain discipline and perspective when fear and uncertainty are at their peak

The data is clear: investors who stay invested through corrections historically have outperformed those who try to time the market.

Warren Buffett’s advice to be “fearful when others are greedy and greedy when others are fearful” is backed by market data showing exceptional returns from investing during periods of extreme pessimism.

Maintaining Your Playbook: Post-Game Analysis

After each correction or bear market, conduct a thorough review:

- Evaluate your performance: Did you stick to your playbook? What worked and what didn’t?

- Refine your triggers: Were your buying thresholds appropriate, or should they be adjusted?

- Assess your emotional response: Were you able to maintain discipline, or did emotions interfere?

- Update your buy list: Based on the changing market environment, should your target investments change?

This continuous improvement process ensures your playbook evolves with both the markets and your investing sophistication.

The Critical Role of Investment Advisors During Market Corrections

While a well-designed playbook is essential, having a professional investment advisor guide you through market turbulence can be the difference between success and failure. Here’s why advisors are particularly valuable during corrections:

- Emotional circuit-breaker: Advisors provide an objective voice of reason when fear threatens rational decision-making

- Accountability partner: They help ensure you stick to your predetermined plan rather than abandoning it at precisely the wrong time

- Perspective provider: Experienced advisors have navigated multiple market cycles and can put current volatility in proper historical context

- Opportunity identifier: They can help spot specific opportunities unique to each correction that an individual investor might miss

- Behavioral coach: Research shows that advised investors achieve returns approximately 3% higher annually than non-advised investors, largely due to behavioral coaching during market stress

- Comprehensive view: Advisors see beyond just your investment portfolio to how corrections impact your overall financial plan

Dalbar’s annual Quantitative Analysis of Investor Behavior consistently shows that individual investors underperform market indices primarily due to behavioral mistakes during corrections. A good advisor’s primary value is often not in picking investments but in preventing costly behavioral errors when markets decline.

The Index ETF Advantage

A key component of an effective correction playbook is utilizing broad market index ETFs like SPY (S&P 500) and QQQ (Nasdaq 100). These instruments offer several advantages during market downturns:

- Instant diversification: Rather than picking individual winners and losers, index ETFs provide exposure across hundreds of companies

- Reduced company-specific risk: Company-specific problems won’t significantly impact overall returns

- Lower costs: Index ETFs typically have much lower expense ratios than actively managed funds

- Tax efficiency: Less trading activity results in fewer taxable events

- Historical resilience: Major indices have recovered from every correction and bear market in history

- Simplicity: Removes the complexity of individual stock selection during emotionally charged markets

While individual stocks may offer higher potential returns, broad market ETFs provide a more reliable way to capture the statistical advantage of buying during market declines without requiring in-depth analysis of individual companies.

Final Thoughts: The Advantage of Preparation

Market corrections test investors’ resolve, but they don’t have to test your performance. By developing and implementing a correction playbook before market turbulence begins—ideally with the guidance of a professional investment advisor—you transform potentially stressful situations into strategic opportunities.

Remember:

- The S&P 500 has returned approximately 10.5% annually since 1950 despite numerous corrections and bear markets

- 67% of corrections never become bear markets

- The average 10-year return after a 20% decline is 217%

- Investors who buy during corrections tend to outperform those who don’t

- Advised investors typically outperform non-advised investors by about 3% annually, largely due to better behavior during market stress

The key to success isn’t perfect timing—it’s having a disciplined, predetermined approach that takes advantage of the market’s inevitable cycles, supported by the guidance of an experienced advisor who can help you stay the course when emotions run high.

The key to success isn’t perfect timing—it’s having a disciplined, predetermined approach that takes advantage of the market’s inevitable cycles. By knowing your plays before entering the game, you position yourself to not just survive market corrections, but to thrive because of them.

Sources and Further Reading

- Schwab Center for Financial Research. “Market Correction: What Does It Mean?” Charles Schwab, 2022.

- JP Morgan Asset Management. “Guide to the Markets.” Quarterly market analysis, 2023.

- Morningstar Research. “How Stocks React to Market Corrections,” 2021.

- Vanguard Research. “Quantifying the Impact of Staying Invested During Market Turbulence,” 2022.

- S&P Dow Jones Indices. “S&P 500 Bear Markets and Recoveries,” Historical analysis, 2023.

- Fidelity Investments. “The Power of Staying Invested,” Market analysis, 2022.

- BlackRock Investment Institute. “Market Corrections: Historical Context and Investment Implications,” 2021.

- Hartford Funds. “10 Things You Should Know About Market Corrections,” Investor education, 2023.

- Dalbar, Inc. “Quantitative Analysis of Investor Behavior,” Annual study, 2023.

- Vanguard Research. “Putting a Value on Your Value: Quantifying Advisor’s Alpha,” 2019.

Disclaimer: This material is provided by LVW Advisors for general information and educational purposes based upon publicly available information from sources believed to be reliable. LVW Advisors cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. It is not specific to any individual’s personal circumstances and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product.

Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. Investing involves risk, including the potential loss of principal. Past performance is not a guarantee of future results.