By Joseph Zappia, CIMA, CCO, Co-CIO and Jonathan Thomas, CFP®, Private Wealth Advisor

“It took the S&P 500 only 22 trading days to fall 30% from its record high reached on February 19, 2019, making it the fastest drop of this magnitude in history.”1 Markets are moving faster than investors can react. By almost all accounts, the total stock market, referred to as the “market” unless otherwise indicated, is pricing in a bad recession alongside massive outbreaks of COVID-19 cases and more American fatalities. For the first time in our nation’s history, the economy has effectively shut down. It’s shocking how much our way of life, seemingly overnight, has changed.

Let’s try to put current events into perspective. We’ve had 24 bear markets since 1928. A bear market is defined as a drop greater than 20%. The average bear market peak to trough drop has been 33%.2 As of March 22, 2020, the S&P 500 stands 35% off its peak.3 This has happened before and will likely happen again.

Below, we have outlined strategies utilized in seeking to manage risk before a bear market as well as how to manage investor behavior during a bear market in seeking to take advantage of opportunities.

Step 1: Prepare

Anticipate the occurrence of bear markets and build it into your long-term expectations. Long-term returns for the stock market are in the 9-10% range4 but those returns include the Great Depression, pandemics, wars, recessions, and panics. No one knows when they’ll occur or how severe they will become but you must build investment plans with the understanding that these downturns are going to happen.

Step 2: Manage Risk

Portfolio Stress Testing

We stress test all of our portfolios in seeking to understand how they will act under different market environments and economic events. For example, when the S&P 500 has fallen 30% in the past, how has this portfolio performed?

Liquidity

While needs and portfolios vary from client to client, we generally recommend that clients have a minimum of 12 months of living expenses in cash. We never want to have to be forced to sell stocks after steep losses. While bonds can act as protection in down markets, there’s nothing as liquid or as stable as a money market fund.

Risk Tolerance

What is the proper allocation between stocks and bonds? We observe risk in two ways: Ability and willingness. We build financial plans to asses our clients’ ability to take risk. Given your financial goals, assets and financial resources, how much risk is appropriate? Willingness refers to how much risk (volatility) you can withstand. Willingness trumps ability every single time. The best portfolio is the one that you can stick with for the long term.

Step 3: Manage Behavior

The ultimate goal here is to stay the course. Adhere to the plan you’ve designed and control your inclination to want to “sell everything!”.

Major declines in stock prices are cyclical, temporary and absolutely necessary. If the declines went away, the returns would disappear. An efficient market extracts those returns as compensation for the length, depth and frequency of the declines. Reward is always commensurate with risk.

While past performance may not be indicative of future performance, a large percentage of the market’s gains present in the big breakaway upsurges immediately following major bottoms. The only way to be sure of catching all of the permanent “ups” is to resign yourself to riding out all of the temporary “downs.”

Bear markets are painful, no question. We are here, as your trusted advisor, to navigate this with you now and through all future market environments.

Step 4: Seek Opportunities

Financial markets are THE leading economic indicator, meaning the market is likely to turn higher before the dust settles. If you’re waiting for the “all-clear” signal, you may be waiting much longer AFTER the bottom occurs. “The bottom” is the day before the recovery begins. Thus it’s absolutely impossible to know when the bottom has been reached . . . ever.

Here are two reasons you may feel optimistic about returns going forward, after the recent drop in the market:

1. Forward returns are very attractive after big declines

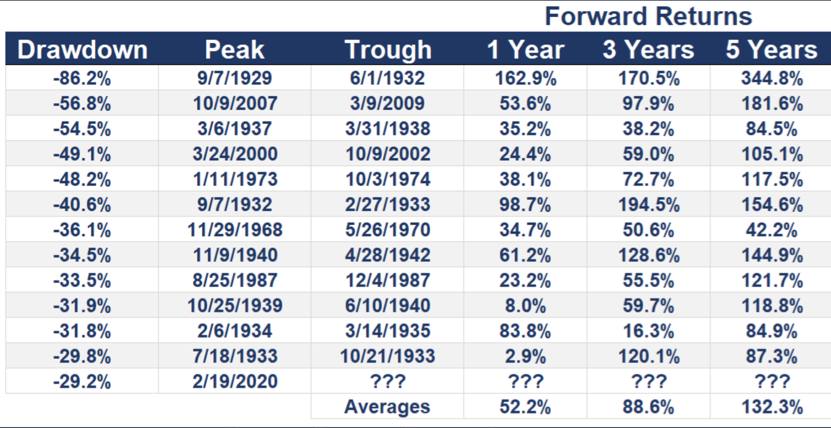

While we could go lower from here, there’s no question forward returns are much more favorable from current levels than they were 6 weeks ago. The average one-year forward return after the 12 worst market declines in history is 52.2%.

3Chart source: https://www.koyfin.com/

2. The recovery

If you think there’s a good chance the market will recover as the curve flattens and the number of new COVID-19 cases falls, then you should feel confident about deploying new money into stocks. Nick Maggiulli of Ritholtz Wealth Management wrote that from these levels (-33%), if the Dow Jones Industrial Average were to recover in:

- 1 year, then your expected annual return = 50%

- 2 years, then your expected annual return = 22%

- 3 years, then your expected annual return = 14%

- 4 years, then your expected annual return = 11%

- 5 years, then your expected annual return = 8%6

The average time to get back to even after a bear market since 1928 has been 26 months, or just over two years.7 Please understand that the above is not meant to be indicative of any possible returns to be achieved by any investor, but is for informational purposes regarding the compounding effects of participation in a rising market, as represented by the Dow Jones, at the earliest possible point of recovery.

So, what else can you do?

- If you have cash for investment, now may be a good time to put some of it to work.

- Rebalance your portfolio back to your original target allocation. Rebalancing is a forced discipline of buying low and selling high. Meaning if stocks have declined below your equity target and bonds have moved above your bond target (which is likely the cash in this decline).

- Make your annual retirement contributions early.

- Increase % allocation into your company’s 401k plan.

We believe we will get through this latest crisis, like we have all previous crises. Once this is all said and done we believe a new bull market will arise from the ashes. How long until that happens? We have no way of knowing. We’re confident that following our “Playbook” will get us through this bear market, and leave us better prepared for ones still to come.

Sources:

1 https://www.cnbc.com/2020/03/23/this-was-the-fastest-30percent-stock-market-decline-ever.html

2 Tony Robbins and Peter Mallouk, Unshakeable: Your Financial Freedom Playbook (New York: Simon & Schuster, 2017)

3 https://www.koyfin.com/

4 John Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (New Jersey: John Wiley & Sons Inc., 2017)

5 https://awealthofcommonsense.com/2020/03/returns-from-the-bottom-of-bear-markets/

6 https://ofdollarsanddata.com/buying-during-a-crisis/

7 https://awealthofcommonsense.com/2020/03/how-long-does-it-take-to-make-your-money-back-after-a-bear-market/

Disclosure: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor. Past performance is no guarantee of future results.