By Joseph P Zappia, Co-Chief Investment Officer

Even as a financially successful investor, one question likely keeps you up at night: Will your money last throughout retirement? Your retirement could span 25+ years, with inflation potentially cutting your purchasing power in half. The first 5-10 years of retirement represent your period of greatest vulnerability. We have prepared this guide to outline some key considerations and strategies for retirement planning.

The big picture

Affluent retirees face several unique challenges that traditional approaches to retirement planning might fail to address:

- Being too conservative erodes wealth — Inflation and healthcare costs outpace ultra-conservative returns

- Static plans can’t adapt to market realities — Set-it-and-forget-it strategies do not respond to changing conditions

- Generic withdrawal rules don’t account for complexity — Your wealth requires more sophisticated management

The danger: Playing it too safe

Playing it ultra-safe actually increases your risk.

- 3% inflation cuts purchasing power in half over 25+ years

- Healthcare costs rise faster than general inflation

- Tax obligations continue regardless of return levels

- Legacy goals falter when growth stagnates

The bottom line: Conservative portfolios often fail to generate the growth needed to sustain 30+ years of retirement.

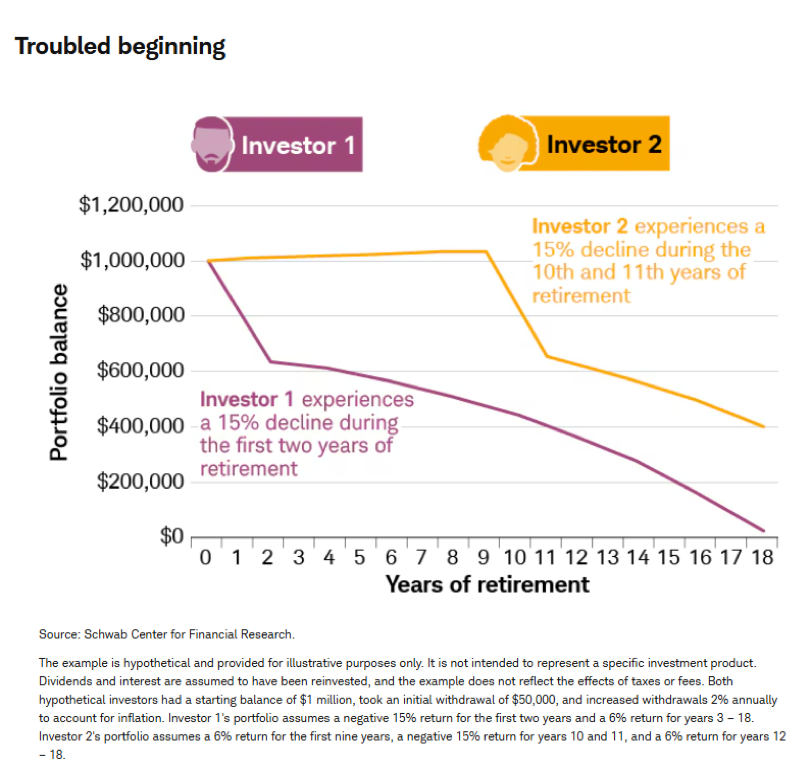

Your early retirement vulnerability

The first decade of retirement carries disproportionate risk:

- You’re now withdrawing from (not adding to) your portfolio

- Market downturns + withdrawals = accelerated depletion

- Less capital remains to participate in recoveries

- A 20% loss requires a 25% gain just to break even

Smart strategies to protect you:

- Strategic liquidity reserves: 1-2 years of cash reduces need to sell during downturns

- Time-segmented portfolio: 5-year Treasury Inflation Protected Securities (TIPS) ladder “quarantines” near-term spending from volatility

- Flexible withdrawals: Temporarily reduce discretionary spending during market stress

Our approach: Dynamic retirement planning

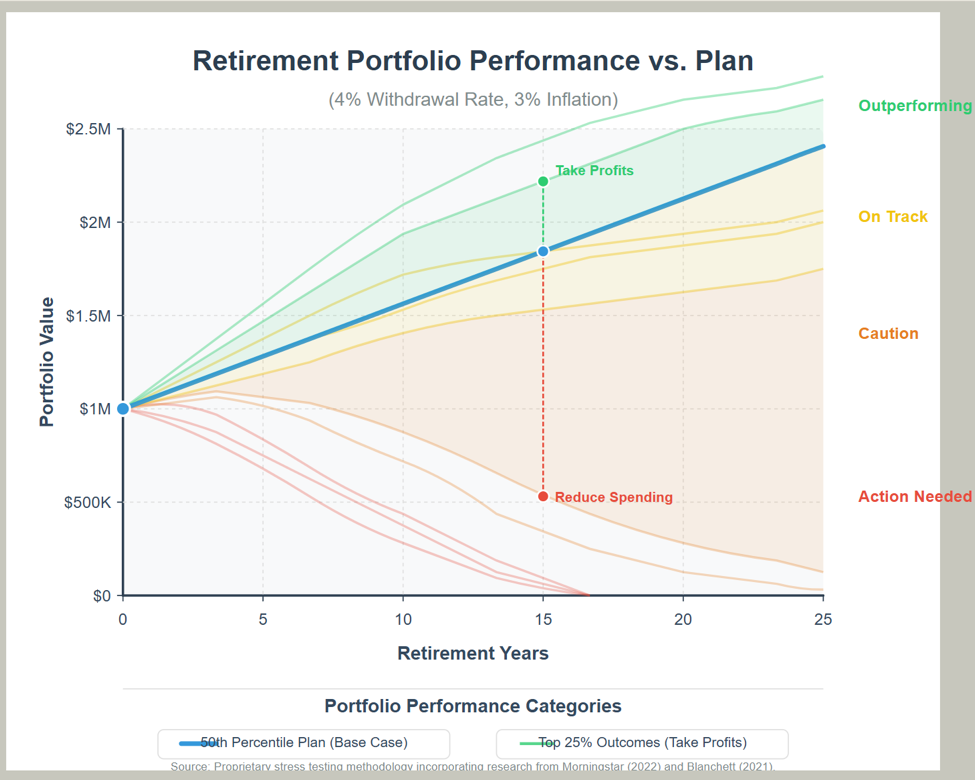

We stress-test your portfolio against thousands of scenarios:

- Establish a baseline (50th percentile) with 4% initial withdrawal and 3% inflation adjustment

- Monitor actual performance against this baseline

- Create clear action triggers based on portfolio performance:

- Outperforming? Enhance lifestyle or boost legacy provisions

- On target? Maintain course with regular monitoring

- Underperforming? Make tactical adjustments before problems become severe

Three pillars of your retirement security

- Sophisticated Portfolio Construction

- True diversification across public and private markets

- Real assets (real estate, infrastructure) as inflation hedges

- Strategic income generation from multiple sources

- Tax-Optimization Strategy

- Strategic Roth conversions during optimal windows

- Tax-loss harvesting to offset gains

- Location optimization (taxable vs. tax-deferred vs. tax-free)

- Healthcare & Legacy Protection

- Medicare optimization strategies

- Long-term care contingency planning

- Strategic trust structures for efficient wealth transfer

What’s next

Your personalized retirement plan includes:

- Comprehensive financial analysis

- Customized withdrawal strategy

- Investment allocation aligned to your specific needs

- Ongoing monitoring with clear action triggers

Ready to secure your retirement? Contact us to schedule your confidential consultation.

Sources and Further Reading

- Blanchett, D., & Straehl, P. (2022). Dynamic Withdrawal Strategies for Affluent Retirees. Morningstar Investment Management.

- Blanchett, D. (2019). The True Cost of Retirement: Using Dynamic Simulation to Model Longevity, Asset Allocation, Spending, and Medicare. The Journal of Retirement, 7(1), 9-27.

- Blanchett, D., Finke, M., & Pfau, W. (2018). Low Returns and Optimal Retirement Savings. The Journal of Retirement, 5(3), 69-83.

- Fidelity Investments. (2023). Retiree Health Care Cost Estimate. Fidelity Benefits Consulting.

- Guyton, J.T., & Klinger, W.J. (2019). Decision Rules and Maximum Initial Withdrawal Rates. Journal of Financial Planning, 22(3), 38-48.

- HealthView Services. (2022). Healthcare Cost Data Report: Trends in Healthcare Expenses for Affluent Americans.

- Jaconetti, C.M., Kinniry, F.M., & DiJoseph, M.A. (2020). From Assets to Income: A Goals-Based Approach to Retirement Spending. Vanguard Research.

- Johnson, R.W., Smith, K.E., Cosic, D., & Wang, C.X. (2017). Retirement Prospects for the Wealthy: Financial Security for Life. Urban Institute.

- JPMorgan Asset Management. (2023). Guide to the Markets. Long-Term Capital Market Assumptions.

- Kitces, M. & Pfau, W. (2021). The 4% Rule and the Search for a Safe Withdrawal Rate. Journal of Financial Planning, 34(3), 44-53.

- Kitces, M. (2020). Mitigating Sequence Risk with Bucket Strategies and Buffer Assets. Kitces Report.

- Pfau, W. (2018). Understanding Sequence of Return Risk. Journal of Financial Planning, 31(8), 48-56.

- Reichenstein, W., Meyer, W., & Evensky, H. (2020). Tax-Efficient Withdrawal Strategies. Financial Analysts Journal, 76(3), 34-48.

- Society of Actuaries. (2023). Longevity Illustrator. Retrieved from https://www.longevityillustrator.org/

This material is provided by LVW Advisors for general information and educational purposes based upon publicly available information from sources believed to be reliable. LVW Advisors cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. It is not specific to any individual’s personal circumstances and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Investing involves risk, including the potential loss of principal. Past performance is not a guarantee of future results..