By Jonathan Thomas, CFP®, Private Wealth Advisor

Think of the S&P 500 Like Your Forever Home: A Long-Term Investment Mindset

When you’re searching for your forever home—the place where you’ll build memories, raise a family, or simply settle into life’s next chapter—you don’t obsess over whether you’re paying a little too much today. Why? Because you’re not planning to flip it next year. You’re buying it for the long haul, knowing that over time, its value will grow, the neighborhood will thrive, and it’ll be worth far more when you eventually decide to pass it on. The same logic applies to investing in the S&P 500—especially now, when headlines are buzzing with fears of an overvalued market, looming tariffs, and creeping inflation. Let me explain why overpaying a bit today isn’t something to fear—and why market dips are your golden opportunities.

It’s Okay to Overpay for Something You’ll Never Sell

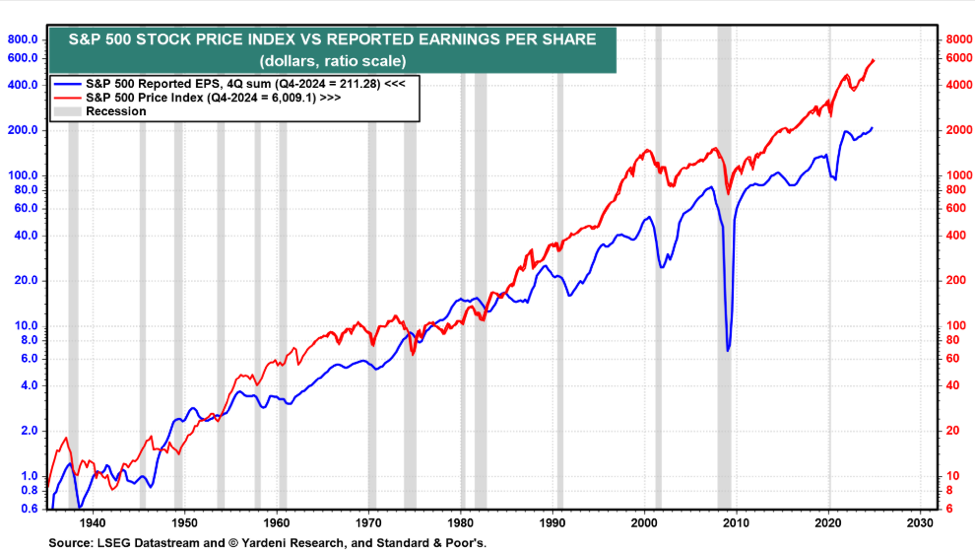

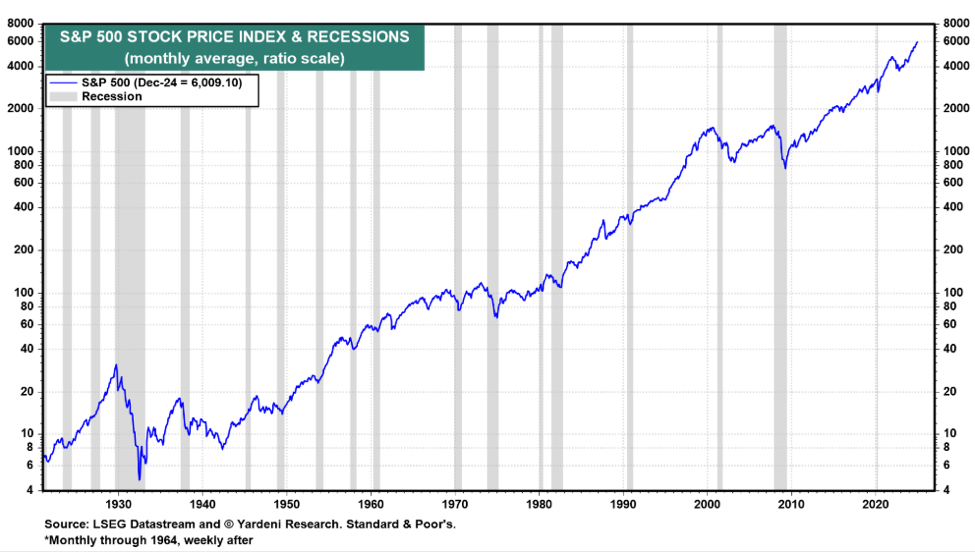

Yesterday, March 3, 2025, the S&P 500 closed at 5,849, down sharply from its recent highs, with news of 25% tariffs on Canada and Mexico sparking a 1.8% drop—the biggest single-day decline this year. Analysts are shouting “overvalued!” pointing to two years of 20%+ growth—think 2023 and 2024, when the index soared from 3,800 to nearly 6,000—fueled by sky-high earnings expectations. The bar’s set high, no doubt. And if you turn on CNBC, you’ll hear the flippers freaking out—telling you to sell before the crash, buy the dip, sell again. Ignore them. We’re not flippers; we’re long-term investors. The stock market isn’t the economy—it’s a rollercoaster of sentiment in the short run, but over decades, it follows corporate earnings, and those have a proven track record of climbing.

Picture this: You find your dream house—great location, solid foundation, room to grow. The price tag’s a little steep, maybe 10% more than you hoped. But you’re not buying it to sell next month. You’re buying it because you see yourself there in 20, 30, or even 50 years. Over time, the market shifts, the area improves, and that “overpriced” home becomes a multi-million-dollar asset. The S&P 500 is that forever home in the stock market. Historically, it’s delivered an average annual return of about 10% before inflation over the long run. If you invest today at 5,849 and hold for 30 years, assuming that 10% growth, the index could hit around 102,000 by 2055. That’s over 17 times your money—turning a $10,000 investment into roughly $174,000—tariffs, inflation worries, and all.

You’re not just buying a price today—you’re buying 500 of America’s strongest companies, like Apple, Microsoft, and Amazon, driving innovation and growth. The beauty of an S&P 500 index fund? It’s self-cleansing. Today’s winners—like tech giants dominating recent gains—can become tomorrow’s laggards, while new leaders rise. Remember Kodak? A powerhouse in the 20th century, it faded as digital photography took over. Or Sears, once a retail titan, now a shadow of itself. The S&P 500 doesn’t cling to the past—it swaps out underperformers for fresh blood, letting the cream rise to the top. That’s why, as Vanguard founder Jack Bogle famously said, “Don’t look for the needle in the haystack. Just buy the haystack!” You don’t need to pick winners—just own the whole bundle, and time does the rest.

Market Dips Are Like a Market Discount

Now, let’s talk about today’s headlines. Tariffs are spooking investors, inflation’s ticking up, and consumer confidence is wobbly. CNBC’s screaming “sell!” again, but for us long-term investors, this is a market discount. Imagine your dream home’s price drops 15% because of a temporary slump. Short-term speculators panic, but you? You see a deal—more house for your money, knowing it’ll rebound and grow over decades.

The S&P 500’s no different. A 10% correction or a bear market isn’t a crisis—it’s a chance to buy more shares of that 102,000 future at a lower price. Look at 2008: The index crashed nearly 50%, bottoming at 676. Scary if you were selling, but if you bought—or held—your investment’s up over 780% to today’s 5,849. Even after two years of stellar growth, dips reset the stage for the next climb. History shows that 10% average annual return—tied to those rising corporate earnings—smooths out the noise.

The Forever Mindset: Your Wealth’s Foundation

Investing in the S&P 500 like it’s your forever home means tuning out the daily drama—whether it’s 5,849 today or 5,500 tomorrow, whether CNBC’s flipping out or not. Yes, the market’s had a hot run, and yes, tariffs and inflation could stir the pot. But you’re not here for a quick flip. You’re building wealth for retirement, your kids’ future, or whatever “forever” means to you. From today’s 5,849 to a potential 102,000 in 30 years, that’s the power of patience—and the self-cleansing genius of an index fund that keeps the best and sheds the rest.

Investing in the S&P 500 likely isn’t your whole portfolio—it’s part of a diversified strategy, balanced with bonds, real estate, or other assets tailored to your goals. But it’s the best example of a long-term winner. Treat it like your forever home: Buy it, love it, hold it, and watch it grow into something far greater than you imagined.

As always, I’m here to help you navigate this journey—let’s talk about how it fits into your plan.

Source: Yahoo Finance

This material is for informational purposes only, it is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Commentary is based upon publicly available information from sources believed to be reliable. LVW Advisors cannot assure the accuracy or completeness of these materials. Opinions expressed herein are based on economic and market conditions at the time this material was written, and do not necessarily reflect the views of LVW Advisors. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Past performance is not a guarantee of future returns.