Table of Contents

THIRD QUARTER MARKET SUMMARY

MARKET OUTLOOK

THE ELECTION

INVESTMENT IMPLICATIONS

LVW NEWS

Welcome to the autumn issue of The Serious Investor. In this edition, we share our thoughts on a wide range of potential outcomes for the economy and the markets, and explain how we’re investing in today’s unusual and unpredictable environment.

Quick Take

-

Economic growth surged, then slowed in the third quarter.

-

The direction of the economy and the markets from here will hinge on fiscal stimulus and success against COVID-19.

-

Market gains could broaden in the event of progress on the pandemic and strong fiscal stimulus.

-

We are investing cautiously and preparing for a wide range of potential scenarios.

THIRD QUARTER MARKET SUMMARY

The Recovery Slows

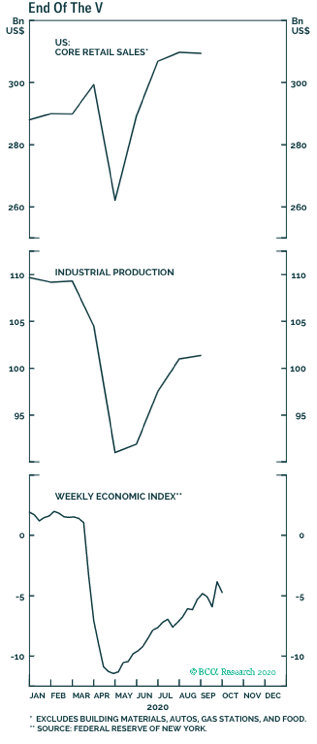

The massive monetary and fiscal stimulus measures enacted in the second quarter of 2020 jolted the economy to life during the third quarter. The Federal Reserve’s Nowcast projection estimates that U.S. GDP, which shrank at an annualized rate of more than 30% between April and June, grew 32%, annualized, between July and September.1 U.S. retail sales and industrial production jumped (see the chart on the following page), and the economy added about 3.9 million jobs (albeit from a diminished base).2 Late in the quarter the recovery weakened as slackening in fiscal stimulus and a renewed rise in COVID-19 infections put the brakes on parts of the economy. International economies generally strengthened for the quarter as a whole.

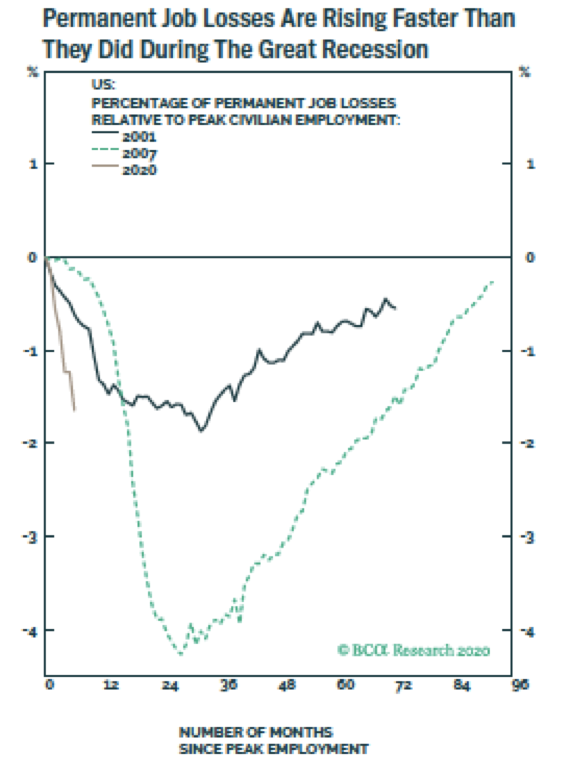

In the United States, the stimulus-fueled economic rebound is fizzling. The Wall Street Journal recently noted that even excluding industries most directly hit by the pandemic, such as air transportation, hospitality and education, America had 4.6% fewer jobs in September than it did in February—a decline similar to the total employment downturn during the entire Great Recession. Industries that took direct hits are shedding workers. For example, Disney recently announced that it would cut 28,000 jobs, while American Airlines and United Airlines plan to ax a combined 32,000 positions. The result: Permanent job losses are rising faster than they did during the Great Recession (see the chart below).

Meanwhile, mortgage delinquencies are on the rise, while bank lending standards have tightened.3 The damage could be long-lived. Consensus estimates project U.S. GDP to be 4% lower than its pre-COVID-19 trajectory at the end of 2022.4

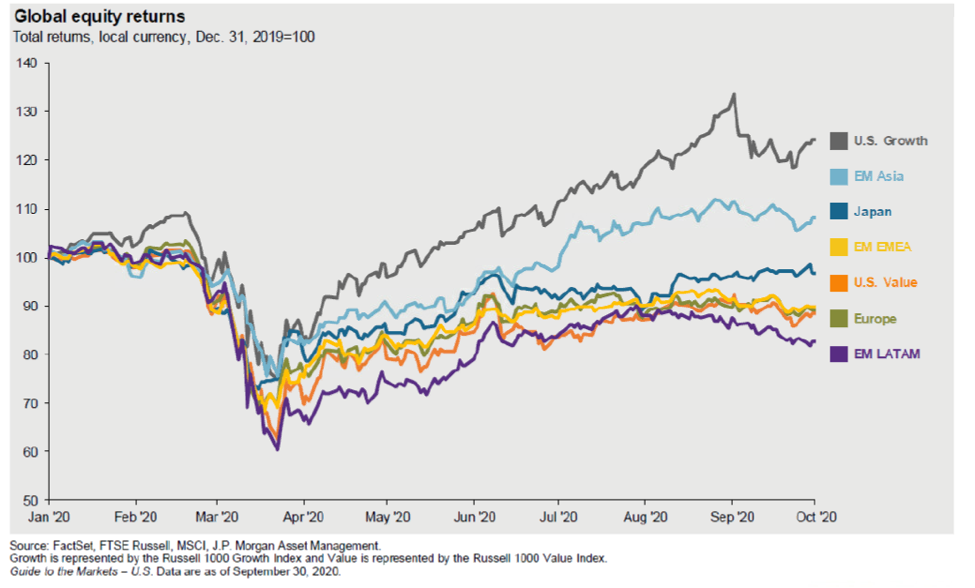

Not all of the news is bad: For example, housing has been buoyed by improving affordability, driven by low interest rates. Global equities for most of the third quarter built on the previous quarter’s rally, surging 55% between March 23 and September 2, with much of the gain generated by a concentrated group of market-dominating tech firms. Worldwide stock markets subsequently corrected by 8% as worries about rising numbers of COVID-19 cases, delays in the development of an effective vaccine, waning stimulus, the potential for a contested U.S. presidential election and other factors weighed on the markets.5

Many factors help explain large tech stocks’ gains since March, including the companies’ powerful businesses and strong earnings, the scarcity of growth elsewhere and low interest rates (which help to justify high valuations for growth). Another factor is a colossal rise in the volume of call options bought by retail speculators through friction-free trading sites such as Robinhood6 — the kind of froth that historically has contributed to excessive valuations.

MARKET OUTLOOK

No One Knows the Future

The future is never predictable, but the range of possibilities for the economy and the markets looks wider than at any time in memory. The outcomes in the markets will depend largely on two main factors:

- The degree to which the world controls the coronavirus

- The timing and efficacy of additional U.S. fiscal stimulus

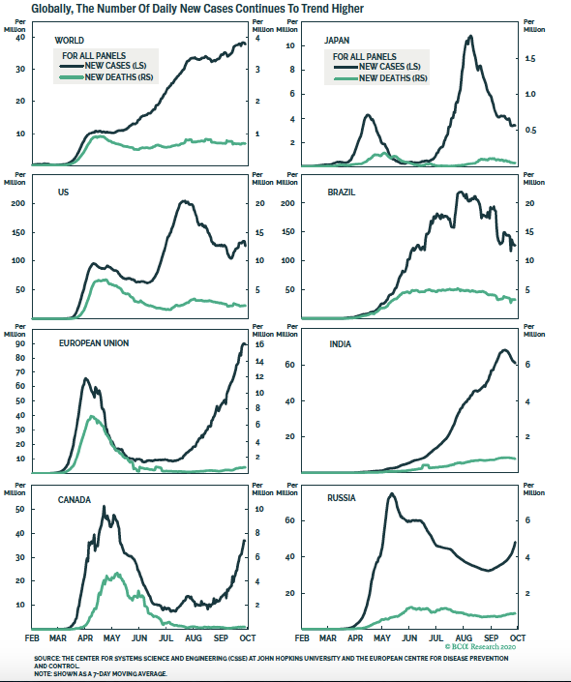

The world has seen a sharp rise in new COVID-19 cases since the summer, with daily infections higher than their mid-April peaks.7 This trend obviously is disconcerting as much of the world’s population heads into winter and flu season. That said, improvements in testing and treatments have helped to keep COVID-19 deaths relatively low.

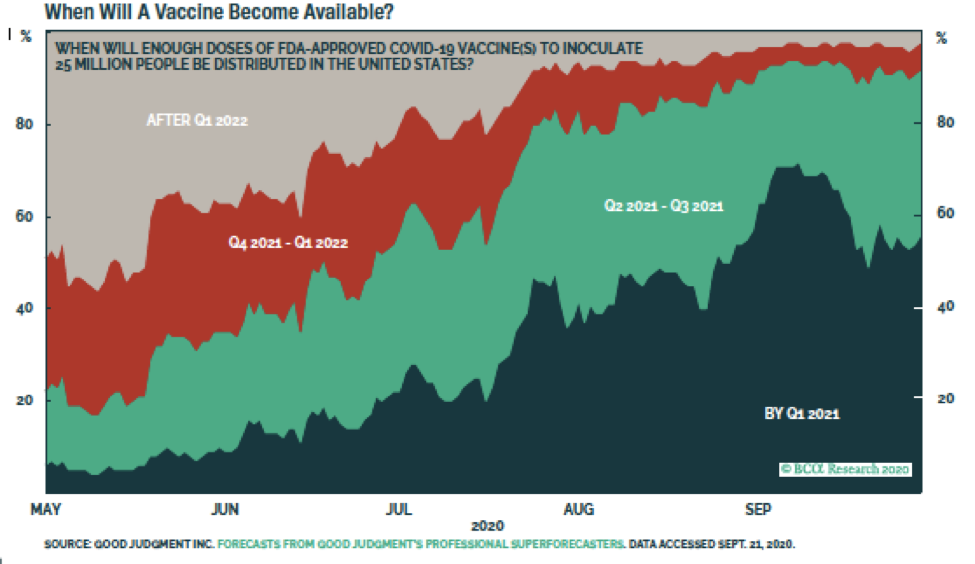

The outlook for a vaccine has improved, with more than half of experts predicting that one will be widely available in the United States within the next six months (see the chart below). Quick approval, rapid dissemination and acceptance by the public of an effective vaccine would be tremendous for public health and could jump-start the economy.

Fiscal stimulus will be necessary to keep the economy afloat until the pandemic is contained enough to return to something resembling business as usual. In Europe, China and elsewhere, governments have implemented large, long-term fiscal stimulus. The U.S. government will need to follow suit with a smart, strategic plan to prevent a feedback loop in which rising joblessness leads to lower spending, leading to further job losses.

Fiscal stimulus will be necessary to keep the economy afloat until the pandemic is contained enough to return to something resembling business as usual. In Europe, China and elsewhere, governments have implemented large, long-term fiscal stimulus. The U.S. government will need to follow suit with a smart, strategic plan to prevent a feedback loop in which rising joblessness leads to lower spending, leading to further job losses.

In the most optimistic scenario, an effective vaccine, improved treatments and an ever-growing understanding of the coronavirus help to beat back the pandemic in the next six months, while Congress and the president enact fiscal stimulus to accompany the Fed’s accommodative monetary policies. These developments could help reverse much of the damage the economy has suffered this year. A release of pent-up demand could flood an economy that already features low interest rates, a Fed willing to tolerate rising inflation, low energy costs, plentiful liquidity and major fiscal stimulus occurring around the world. Goldman Sachs estimates that a vaccine alone would boost GDP growth by 3% in the United States and by 2% in Europe.8

The markets have risen during the week leading up to this writing, apparently on hopes that this optimistic version of events may come to pass: that a vaccine is in the offing and a blue wave in the election might lead to a robust fiscal package that supports the real economy, not just the financial markets, and helps to maintain the innovation that has surged since March. But a lot could go wrong. Lack of progress on a vaccine, lack of improvement on COVID-19 treatments and the move indoors as winter approaches could lead to a further rise in the pandemic. Gridlock could prevent Congress from enacting an effective fiscal stimulus, especially if Democrats take the White House and Republicans hold the Senate. (That said, even a divided government is likely to pass significant stimulus.)

Any large additional fiscal spending will require a similarly big increase in the government’s debt load. But with interest rates near zero, there would be little near-term cost. Even after the massive debts taken on earlier in 2020, the United States’ net interest expense is expected to fall over the next couple of years to its lowest level in six decades. Or consider Japan: The government now earns more interest than it pays on its debt, because two-thirds of all Japanese debt bears negative yields—in effect, Japan is both borrower and lender.9

The COVID-19 recession, like all major recessions, will reshape the economy. The companies that make it through in the most challenged industries— travel, hospitality, energy, advertising and others—will come out on the other side with little competition, positioning them to dominate their markets in the future. Meanwhile, a historic wave of innovation is transforming the business landscape. Legendary tech investor Gavin Baker suggests that “COVID has pulled the world into the years between 2025 and 2030,” as pandemic lockdowns have forced the adoption of new technology-enabled models in health care, education and almost every other part of the economy. Advances such as artificial intelligence and 5G will continue to drive productivity gains, while creating enormous wealth for the companies that make them and those that harness them most effectively. The changes in the Dow Jones Industrial Average are emblematic of the economy’s shifts: Exxon Mobil is out; softwareas- a-service pioneer Salesforce.com is in.

Whichever direction the pandemic and the economy take, the markets are likely to anticipate it before individual investors do.

A Rotation Waiting to Happen?

Global equity markets’ stimulus-driven rally since the second quarter brought valuations back to extreme levels, even after the correction at the end of September.

The S&P 500 recently traded at a price-to-earnings ratio of 21.5, based on earnings forecasts for the next 12 months, near the top of its 10-year range and a 40% premium to its 10-year average. Large growth stocks measured by the Russell 1000 Growth Index sported a P/E over 30.10

But those capitalization-weighted index averages don’t tell the whole story. We’ve repeatedly pointed out that market cap-weighted indices like the S&P 500 don’t accurately reflect the market as a whole, and that most companies’ stocks have been left out of that index’s post-April surge. While the market cap-weighted S&P 500 was up more than 5.5% in the first nine months of the year, the equal-weighted version of the index was down 4.75%11. And outside of U.S. growth stocks and emerging-market Asian stocks, most parts of the global markets have declined this year.

Growth is extremely expensive; value is extremely cheap. High-growth stocks now trade at the largest valuation premium to value stocks in 20 years.12 COVID-vulnerable cyclical stocks are especially battered. Consider the yearto- date returns of Disney (-15%), American Airlines (-55%) and United Airlines (-60%), compared with Amazon (+82%).

There are good reasons for the disparities between value and growth. Many value stocks face brutal conditions for at least the next couple of years. By contrast, Apple, Microsoft, Amazon, Google and Facebook are forecast to increase sales at an annual rate more than five times faster than the overall market from 2018 to 2022—all while low interest rates make growth particularly valuable.

These concentrated, mostly tech winners are some of the best businesses in human history. Still, a great company is not a great stock if its price is too high. (For more on this topic, read LVW Co-CIO Joe Zappia’s blog post about Apple.) With so much future growth priced in, it may be hard for today’s market leaders to keep leading the pack.

Joel Greenblatt, founder of Gotham Capital and a professor at Columbia Business School, argues that the greatest risk in the market resides not in those behemoths, but in the hundreds of companies that people speculate could join them as market leaders. His analysis found that in 2019 there were 261 money-losing companies with market caps over $1 billion–and if you had invested equally in all of them at the start of 2020, you would have had a 65% year-to-date return through early October.13

If the positive scenario plays out for the economy, the outlook for beaten-down industries would improve dramatically, and market gains could broaden. It’s possible, though far from certain, that such a rotation could cause declines in tech stocks, especially in the event of an exodus by retail day-traders. A vaccine would stimulate consumption in cyclical parts of the economy. It also would accelerate progress toward higher inflation and long-term interest rates—especially given the enormous stimulus in the financial system—which would undermine growth stocks’ valuations.

If the negative economic scenario comes to pass, a rotation may not materialize. But even in this event, a renewed bear market wouldn’t be a sure thing. Equities would continue to get support from an all-in Fed that is now, for the first time, coordinating monetary policy with the U.S. government’s fiscal policy. Those efforts, along with the lack of alternatives to equities, make it hard to take a strong stance against stocks these days.

Considering the global equity markets, we think leadership eventually will shift from the United States to international stocks, particularly European shares. U.S. stocks are at 20-year highs as a percentage of global market capitalization (see the chart below). The Fed and the U.S. Treasury have telegraphed their intention to let the dollar weaken, which would benefit international stocks relative to the United States. Meanwhile, Europe has better contained the coronavirus and has locked in fiscal stimulus for the next three to five years, and in Germany, expectations for economic growth are the highest they’ve been in 20 years.14

All of these developments suggest that international equities have the potential to outperform the United States over the next cycle. That said, we believe that investing in international markets, and especially in Europe, is about the company, not the country. European indices are heavily weighted to financials and energy companies in secular decline. Skilled active managers seek to emphasize the parts of international markets that they view as offering greater opportunity.

THE ELECTION

Be Ready for Volatility

In the near term, the election is likely to drive market volatility. Polls and betting markets suggest a Biden victory, but a delay in the result seems certain and a contested outcome looks possible. The Electoral College may not be ready to certify a winner when it meets on December 14. These developments would throw our political system into uncharted territory, and the ensuing weeks would be, to quote a recent report from J.P. Morgan, “fraught with potential for legal uncertainty, judicial interpretation and political gamesmanship.”

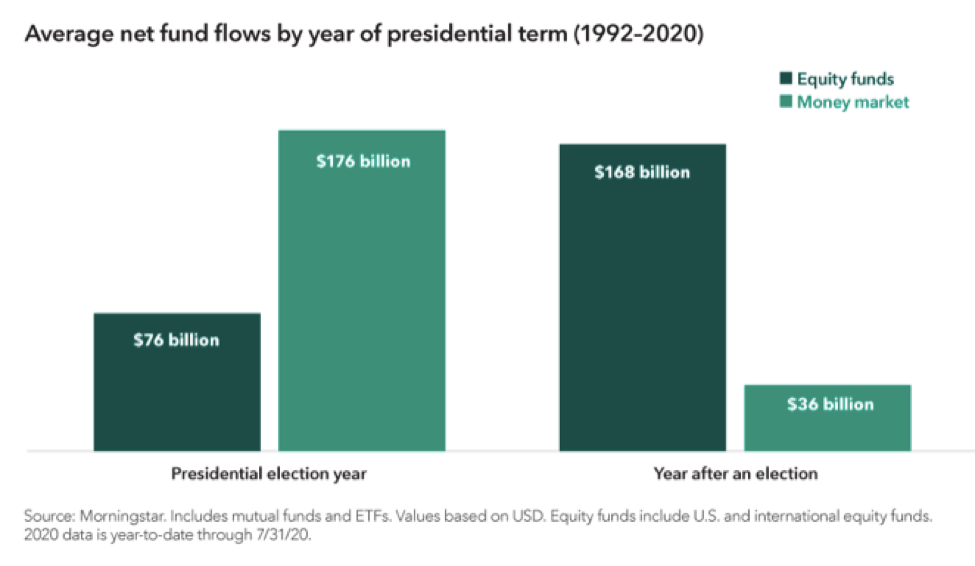

A rise in volatility is typical approaching elections, and all of these unknowns probably will amplify it. Large market swings will be uncomfortable, especially if they’re accompanied by anxieties about our democracy. But we believe investors should continue to invest for the long term. As you can see in the chart below, voters often move to cash during an election year, only to move back into stocks the next year.

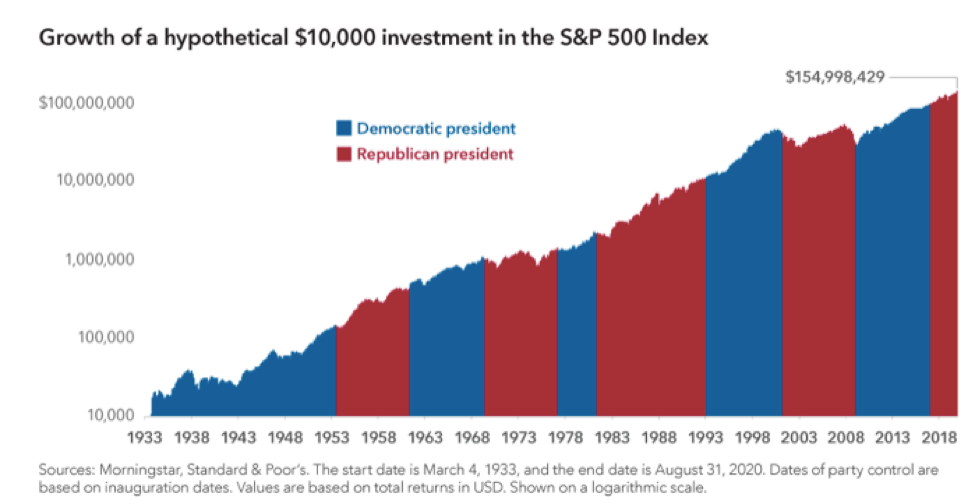

We caution investors not to presume that a particular electoral outcome will have obvious ramifications for the markets. For example, although a blue wave is considered likely to result in higher taxes, the negative impact on the markets might be mitigated by larger stimulus or other factors. And historically, the market has tended to grow roughly equally under both Democratic and Republican presidents (see chart below).

INVESTMENT IMPLICATIONS

Anyone who says they know how and when all of these variables will play out in the markets is lying or foolish. There are too many variables in play to take a strong stance for a particular outcome, so we approach investing with caution.

As an example, we currently view cash favorably, in part because holding cash over bonds is no longer a drag on portfolio returns. We believe the path to better investor returns will be to add to risk assets during times of duress, and to reduce exposure to risk assets when the reward is not worth the risk.

Stocks worldwide stand to benefit from “TINA”: There is no alternative. It’s hard to concoct a future in which government bonds produce a better result than the stock market. The dividend yield on the S&P 500 recently was 1.67%, a point higher than the yield of the 10-year Treasury note. Even if dividends per share didn’t rise at all—which would be a historical anomaly— the S&P 500 would have to fall by 10% over the next decade not to beat that bond’s return. If we assume 1.9% annual inflation, stocks would have to fall more than 25%.15

The picture is even more dramatic outside the United States. Euro-area stocks would have to fall by more than 30% to trail euro bond returns, while in the United Kingdom, equities would need to fall more than 50%. In short, stocks are likely to outperform government bonds over the next 10 years in every scenario except a catastrophic, historically unparalleled long-term decline in the stock market.

Of course, other types of bonds pay higher yields than Treasuries. But the Fed’s bond-buying programs have pushed down spreads, so corporate and high-yield bonds offer little compensation for their extra credit risk. What’s more, no one knows whether the Fed will hold its massive corporate bond purchases indefinitely or sell them off at some point.

These are key reasons that long-term investors need to consider holding equities, despite high valuations and challenging conditions. Investors should remember too that recessions birthed some of the greatest companies, including Microsoft and GE. Entrepreneurs will continue to start and grow new businesses. The events of the past seven months have shifted the landscape seismically—witness the rise of telemedicine and the acceleration of everything digital. New companies will emerge to shape a new status quo, creating opportunities for stock investors.

In equities, credit and elsewhere, we utilize managers who we believe are intimately familiar with the assets in which they invest, have the flexibility to manage risk and invest opportunistically, and can try to capitalize as the COVID-19 recession separates the winning businesses from those models that will be challenged either temporarily or permanently. For qualified investors, we are exploring investments in distressed debt, seeking opportunities in providing liquidity to one of the few parts of the market not distorted by government intervention.

The months to come are likely to be turbulent and challenging. We encourage investors to keep their emotions in check and focus on their goals and their strategic plans for achieving them, and to reach out to us with any questions.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, ranked in the top 50 on Barron’s Top 100 Women Financial Advisors list of 2020. This year marks the 15th edition of the ranking. Barron’s states that “over that time the leading women advisors have shown themselves to be outsize champions and proponents of diversity.”

View the full 2020 Top 100 Women Advisors list >

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was ranked for the third consecutive year on Forbes’ Top 250 Wealth Advisors list. This year, Forbes/SHOOK Research received more than 32,000 nominations for consideration. Through a combination of quantitative data review and qualitative interviews, Forbes compiles a list of America’s top wealth advisors.

View the full list of America’s Top Wealth Advisors here >

Click here for important disclosures regarding these awards.

Staying Current

Joseph Zappia, CIMA, Principal and Co-CIO of LVW Advisors, and Jonathan Thomas, CFP, Private Wealth Advisor, have released two new videos in their financial planning video series.

In “The Power of Dividend Growth Stocks” video, Joe and Jonathan discuss how dividend growth stocks can supplement your portfolio and provide a growing income stream. Dividend growth stocks are derived from companies whose dividend payments increase every year.

In the video, “How to Take Advantage of Today’s Low Mortgage Rates,” Joe and Jonathan cover how it’s an opportune time to save years of interest payments by locking in a new low rate.

Joseph Zappia, CIMA, Principal and Co-CIO of LVW Advisors, moderated an RIA Institute webinar on July 22, “Why Interval Funds and Where They Fit in Your Clients’ Portfolios.” The panelists explained what interval funds are, the type of investments included in these funds, how to best implement them in a portfolio and the overall risk and reward of using them in the current market environment.

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was a panelist on the U.S. Institute/Institutional Investor’s CEO Roundtable webinar titled, “How Are Investors Looking at the Post-COVID World?” on July 22. Lori and fellow panelists, Paul Colonna, President and CIO at Lockheed Martin, and Carl Gagnon, AVP, Global Financial Wellbeing & Retirement Programs at Unum, discussed alternative investments and private credit, what they expect from managers in today’s market and their thoughts on ESG (environmental, social and governance) investing.

Watch a segment from the roundtable >

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog posts below.

Tax Saving Strategies for IRAs in 2020 >

Apple — Understanding the Difference Between a Great Company and a Great Stock >

Value Does Not Always Equal Price >

When Will Cinderella Leave the Ball? Why Value Investing Works >

Employee News

Mina Levin recently joined LVW Advisors as Lori Van Dusen’s Executive Assistant. Mina has more than 10 years of experience overseeing administrative functions and supporting executive managers.

Outside of the office, Mina enjoys boating, diving, fishing and spending time outdoors with her young daughter.

Welcome, Mina!

Newsletter Citations:

1 “BCA Research, October 1, 2020.

2 Bureau of Labor Statistics.

3 BCA Research, October 1, 2020.

4 “50 Years of Economic History Say Expect L, Not V, for Recovery.” Bloomberg, Dan Hanson and Yelena Shulyatyeva, October 8, 2020. 5 BCA Research, October 1, 2020.

5 BCA Research, October 1, 2020.

6 “The Wild Summer of 2020 Turned Small Investors into Whales.” Bloomberg, September 17, 2020.

7 BCA Research, October 1, 2020.

8 Goldman Sachs Strategy Espresso, September 23, 2020.

9 BCA Research, October 1, 2020.

10 Eaton Vance, October 2020.

11 Bloomberg, September 30.

12 Goldman Sachs Strategy Espresso, September 23, 2020.

13 Joel Greenblatt on Relative Value Investing.” Masters in Business with Barry Ritholtz, Bloomberg Radio, Oct 9, 2020.

14 361 Capital.

15 BCA Research, Sept 29, 2020.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.