Download a copy of this newsletter

Table of Contents

FIRST QUARTER MARKET REVIEW: RUSSIA INVADES AND MARKETS FALL

OUTLOOK: CAUTION, NOT PESSIMISM

POSITIONING: SEEKING OPPORTUNITIES IN CHALLENGING MARKETS

LVW NEWS

Welcome to the spring edition of The Serious Investor. The first quarter was unsettling, to say the least, as Russia invaded Ukraine, inflation soared and financial markets corrected. We believe trusted financial advisors prove their value at times such as these. We continue to take the long view, applying our investment discipline to manage risks and capture potential opportunities in support of your needs.

Quick Take:

-

Russia’s invasion of Ukraine caused commodity prices to jump in the first quarter, exacerbating already-high inflation.

-

The Federal Reserve raised interest rates for the first time this cycle and signaled a willingness to tighten aggressively to rein in price increases.

-

Simultaneous losses in stocks and bonds made the first quarter unusually challenging for investors.

-

The yield curve inverted, signaling that we have entered the late stage of the market cycle.

-

Stocks’ declines made their valuations more appealing, but the risk of recession has increased.

FIRST QUARTER MARKET REVIEW: RUSSIA INVADES AND MARKETS FALL

We entered 2022 expecting a challenging year. Our concerns were realized very quickly, but not for reasons we foresaw.

Russia’s invasion of Ukraine unleashed a massive humanitarian crisis, and the Western world responded with sanctions that effectively expelled Russia from the global economy. The price of crude oil, already approaching $100 a barrel, jumped 35% in less than two weeks, while wheat futures spiked by 50%.1 Overall, the Bloomberg Commodity Index was up roughly 30% for the first quarter as of late March. The explosion in commodity prices only exacerbated inflation, which already was running at a 40-year high due to a combination of surging consumer demand and pandemic-related supply chain disruptions. Looking to rein in price gains, the Federal Reserve kicked off its tightening cycle in March, increasing the federal funds rate by a quarter percentage point and adopting a more hawkish tone. As of quarter-end, the bond market priced in seven rate hikes for 2022.

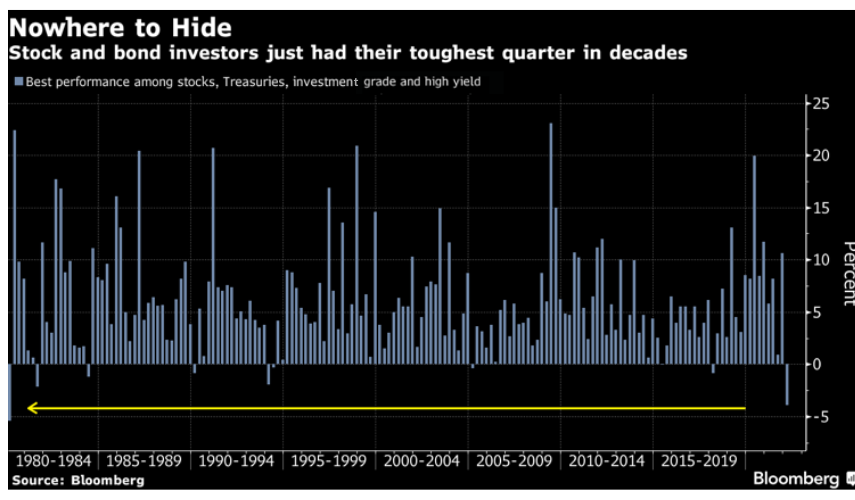

Stocks and bonds both fell for the quarter as a whole. The S&P 500 and high-yield bonds lost 4.9%, Treasurys dropped 5.6% and investment-grade credit fell 7.8%.2

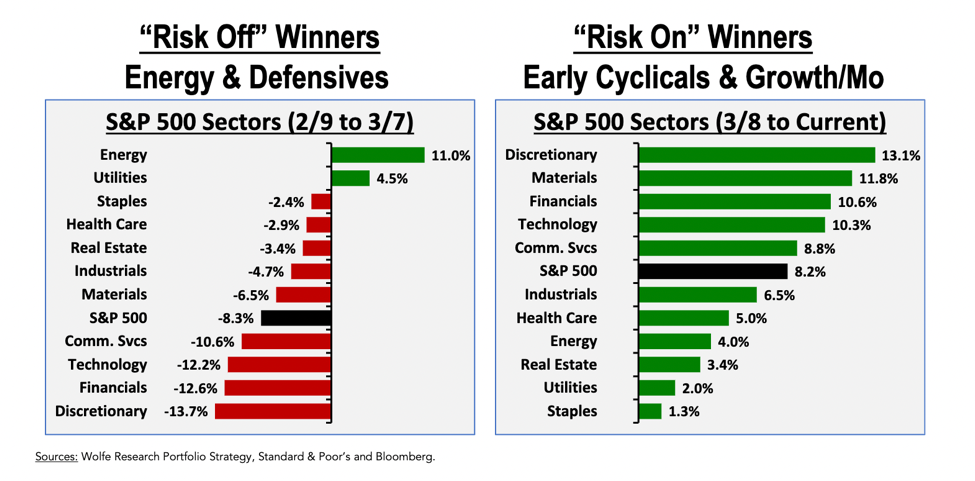

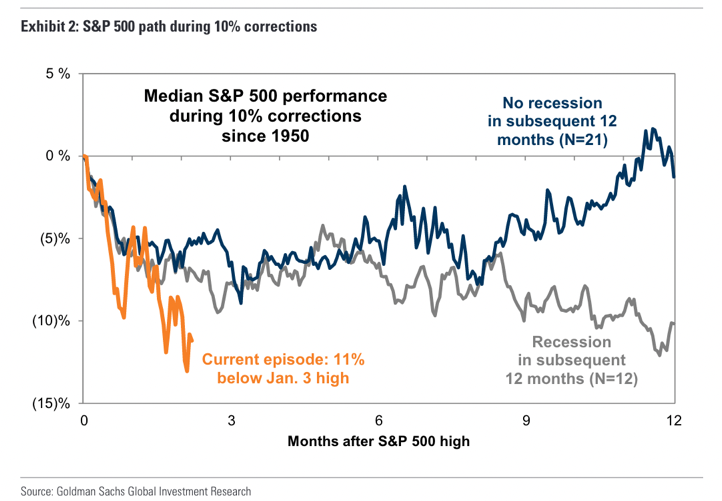

In the stock market, investors swung between risk-off and risk-on stances as they digested developments related to Ukraine and Russia, inflation, Fed policy and other factors. The S&P 500 was down 13% from its January 3 peak as of March 8, then bounced 8.6% through the end of the quarter.

Bond returns represented one of their worst stretches in 50 years, with the Bloomberg Treasury index registering the largest drawdown since its 1973 inception. Bonds are now effectively in a bear market. Simultaneous declines in stocks and bonds presented challenges for investors who count on fixed income to hedge equity risks. We have been concerned about this possibility for some time and have looked for other ways to play defense against a potential equity downturn.

Bond returns represented one of their worst stretches in 50 years, with the Bloomberg Treasury index registering the largest drawdown since its 1973 inception. Bonds are now effectively in a bear market. Simultaneous declines in stocks and bonds presented challenges for investors who count on fixed income to hedge equity risks. We have been concerned about this possibility for some time and have looked for other ways to play defense against a potential equity downturn.

The U.S. economy remained strong through the financial market turmoil. New jobless claims (an indicator of layoffs) hit their lowest level in more than 50 years, the economy added almost 1.7 million jobs—maintaining 2021’s pace—and the unemployment rate fell to 3.8%. The country moved closer to exiting the pandemic, as the omicron wave receded and COVID-19 cases, hospitalizations and deaths plummeted throughout the United States. Yet the emergence of the omicron BA.2 subvariant in March served as a reminder that we will likely be dealing with COVID-19 for years.

The U.S. economy remained strong through the financial market turmoil. New jobless claims (an indicator of layoffs) hit their lowest level in more than 50 years, the economy added almost 1.7 million jobs—maintaining 2021’s pace—and the unemployment rate fell to 3.8%. The country moved closer to exiting the pandemic, as the omicron wave receded and COVID-19 cases, hospitalizations and deaths plummeted throughout the United States. Yet the emergence of the omicron BA.2 subvariant in March served as a reminder that we will likely be dealing with COVID-19 for years.

OUTLOOK: CAUTION, NOT PESSIMISM

As we have said many times in past letters, our role is to advise clients within the framework of a disciplined and structured approach, informed by collective experience and historical reference. We are in particularly precarious times. That said, we have known for years that monetary easing has inflated valuations in all kinds of assets, and that easing would end at some point. We have tried to the best of our abilities to prepare client portfolios for the market dynamics we see today.

No one can predict geopolitical events, the timing of market sell-offs or when recessions might occur. Bill Miller of Miller Value Partners put it well recently: “The important point to keep in mind is [both bullishness and bearishness] are just guesses. No one has privileged access to the future … No one knows how long the war in Ukraine will last nor what its outcome will be. No one knows how high inflation will go nor when it will begin to subside. No one knows if oil prices will stay above $100 or begin to decline or even double from here. No one knows how many times the Federal Reserve will raise rates nor what impact, if any, reducing its balance sheet will have on the economy.”

Instead of prognosticating, we aim to understand the risks and probabilities in the market to the best of our ability, recognizing that the future is unknowable and always changing. Then we apply our investment discipline, built on the pillars of valuation, growth and liquidity and informed by a study of history, as we seek to maintain diversified portfolios that don’t require us to know the future.

Economic outlook: Recession is more likely but not a certainty

We came into 2022 recognizing that the macroeconomic backdrop presented a wide range of risks to the markets. Russia’s invasion of Ukraine and the crisis and market disruptions that ensued have only increased the range of potential outcomes.

We don’t know if a recession will happen in the near term. Most traditional recession indicators are not signaling a contraction in GDP,3 but it’s clear that the odds have increased and the economy has become more vulnerable.

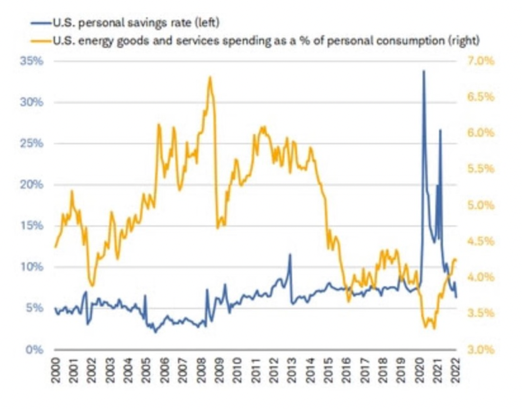

One big question: Will strong employment, wage growth and household balance sheets be enough to keep consumers spending in the face of high inflation, rising interest rates and fading fiscal stimulus? It’s impossible to say. Consumers are saving less and spending more on essentials, while certain leading consumer indicators are declining, including manufacturers’ consumer goods orders and consumer expectations for business conditions. On the other hand, good jobs remain plentiful, and households hold $4 trillion more in cash than they did at the start of the pandemic.4

Inflation Eats Into the Savings Rate

The Fed wants to engineer a soft landing to bring down inflation and correct imbalances in the job market while minimizing the pain to the economy. It is counting on healthy consumer and corporate finances to support the economy’s momentum as it tightens monetary policy.

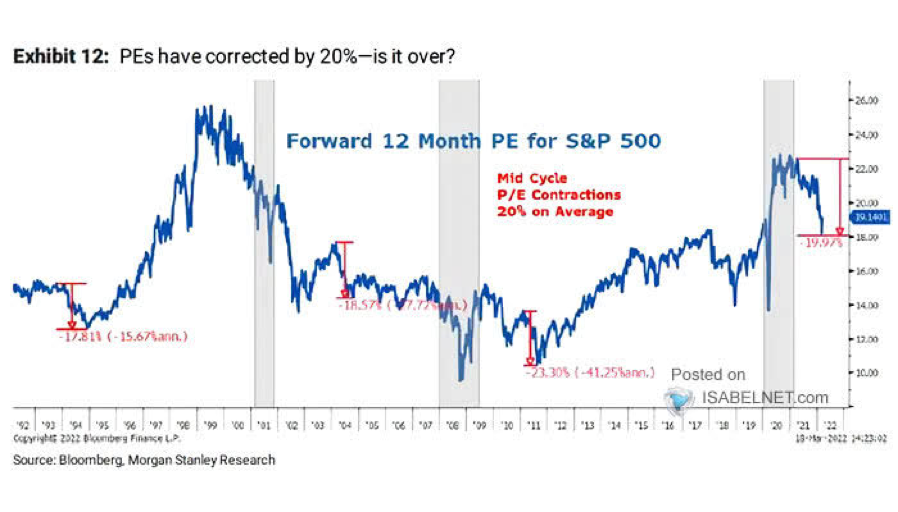

The corporate earnings outlook remains healthy. S&P 500 earnings grew 4% in the first quarter, while multiples contracted by 9.1%—a valuation correction, not an earnings recession. As of late March, 2022 profits were expected to grow more than 9% in the United States (S&P 500) and United Kingdom, more than 15% in Canada and Japan, and more than 6% in Europe despite the war in Ukraine.

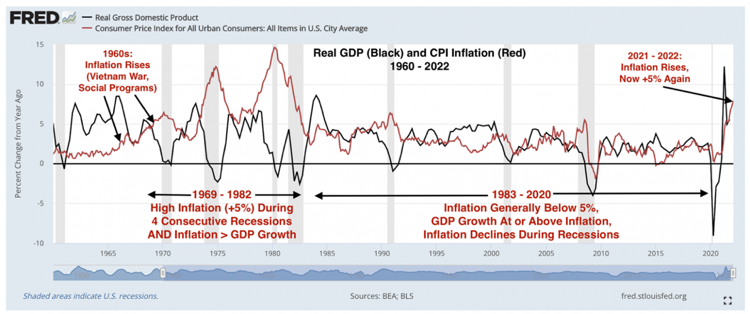

Still, the Fed’s objective was never going to be easy to achieve, and Putin’s invasion has made it harder. Spiking energy and food costs could drag on spending and accelerate an economic slowdown. If so, the Fed may feel its hands are tied—that it has to keep tightening to maintain its credibility and fend off an inflationary spiral, even if that means recession. It’s worth noting that historically, it has taken a recession to rein in inflation greater than 5%.

Energy and food prices look likely to stay high. The world has underinvested in energy production for years and now is trying to cast the No. 2 producer of both oil and gas out of the global economy. Schwab Chief Investment Strategist Liz Ann Sonders noted in a recent webinar with LVW Advisors founder and CEO Lori Van Dusen that high energy prices have been a precursor to almost every modern recession. In addition, Russia and Ukraine are the No. 1 and No. 5 exporters of wheat, respectively. The war will largely prevent planting in Ukraine this year, and it is already disrupting shipments of raw materials needed for fertilizer used throughout Europe.

These dynamics are likely to contribute to higher-than-average inflation for the foreseeable future. Nevertheless, core inflation still seems likely to ease over time. Supply chain issues related to the economic stops and starts of the pandemic caused a significant portion of the past year’s price increases. Those stops and starts may continue, as they have this year with shutdowns in China, but it would be a mistake to extrapolate that recent history will continue indefinitely.

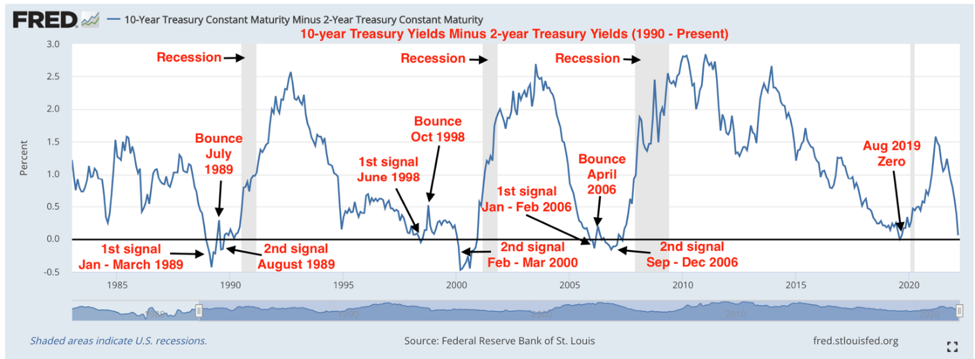

The bond market reflects the rising risks to economic growth. The yield curve has inverted between two and 10 years, historically a sign of potential recession in the next couple of years. Yet the curve between three months and 10 years—historically the most reliable recession predictor and the Fed’s favorite—remains steep. These developments spurred vigorous debate about the possibility of recession in the coming year or two.

To us, the important point is that the curve suggests the current expansion is in its final phase, and portfolios should be positioned accordingly. Late in the cycle, economic output is running close to potential, markets are wrestling with the potential for a Fed policy mistake, and the economy is especially vulnerable to exogenous shocks. An inverted yield curve doesn’t necessarily scream recession; it simply means “be careful.”

We think it’s important to note that the curve historically has tended to invert twice before recessions, suggesting that investors shouldn’t rush to assume an economic contraction is imminent. Since 1969, the 2-year/10-year Treasury slope has inverted about 16 months before the start of the next recession, on average, and about 10.5 months before the S&P 500 peaked.

The Curve Inverts Twice Before Recession

No one knows what the future holds. Even if the yield curve was unambiguously signaling recession, the information wouldn’t be enough to invest on. Equities often post considerable gains after the two-to-10-year curve inverts: The S&P 500 gained more than a third after the curve inverted in 1989 and more than a quarter after inversion in 2005. On average, the S&P historically has gained 13% over the 12 months following the inversion of the yield curve.

Equity outlook: Both opportunities and risks have increased

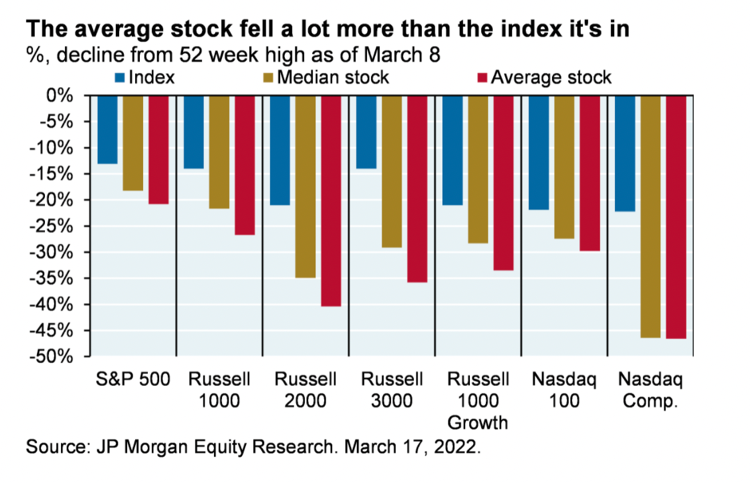

The S&P 500’s slump doesn’t meet the common definition of a bear market, but much of the market is already well into bear territory. Both the Russell 2000 small cap benchmark and the Nasdaq 100 index of tech giants are down more than 20%, as are the average and median stocks in most major indices.

The trajectory of U.S. equities is likely to hinge on whether the economy enters recession or not. If it does, the stock market would likely sniff out the economic contraction and drop; if not, stocks would likely recover.

Some tail risks are no longer vanishingly small, such as the possibility of the United States being dragged into an escalating war with Russia, so portfolios need some protection against them. Rising risk of recession—whether caused by a Fed policy error, a drop in consumer spending or other reason— also suggests greater need for defense. Higher rates also pose risks to the financial system. For example, rising commodity prices force highly levered commodity trading firms to put down more capital, which becomes more difficult as rates rise.

Valuations have come off their highs, but they could compress more if corporate profit growth decelerates. That said, valuations are already below average for the vast majority of companies.

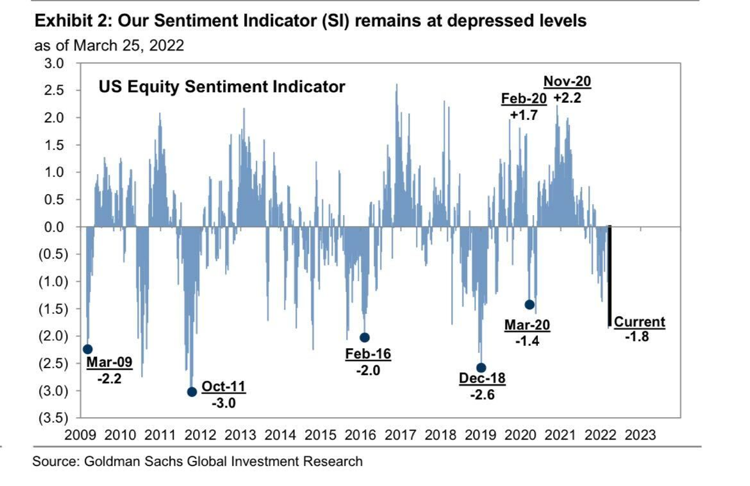

In a way, the bad news in the market may be good news. News typically follows stock prices, not the other way around: The equity market tends to gain before the headlines improve and fall before they worsen. That’s one reason investor sentiment can be a useful contrarian indicator. Sentiment now looks terrible, despite the late-March rally. Such poor investor sentiment is unusual in a strong economy; historically, times like these have been buying opportunities.

In a way, the bad news in the market may be good news. News typically follows stock prices, not the other way around: The equity market tends to gain before the headlines improve and fall before they worsen. That’s one reason investor sentiment can be a useful contrarian indicator. Sentiment now looks terrible, despite the late-March rally. Such poor investor sentiment is unusual in a strong economy; historically, times like these have been buying opportunities.

Moreover, corrections historically increase the odds of future gains, especially when the economy stays out of recession. Viewed historically, as markets correct, entry points become more appealing, and expected long-term returns improve. When stocks have fallen 10% and the economy has avoided recession, the market has gained an average of 15% over the next 12 months.5 We never try to time market bottoms; instead, we work to dollar-cost average into corrections, seeking to increase our portfolios’ exposure to potential growth and the odds of better forward returns.

As Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management, put it in a recent interview with Bloomberg Radio, “As you get into late 2022 and into 2023, it’s possible that you’re in a lower inflationary environment naturally, both because of what the Fed has done and perhaps supply chains get better, perhaps omicron or COVID-19 gets put behind us. And you might see yourself in a world in which you have low inflation, decent growth, a Fed which has most of its work behind it, and decent valuations in stocks.”

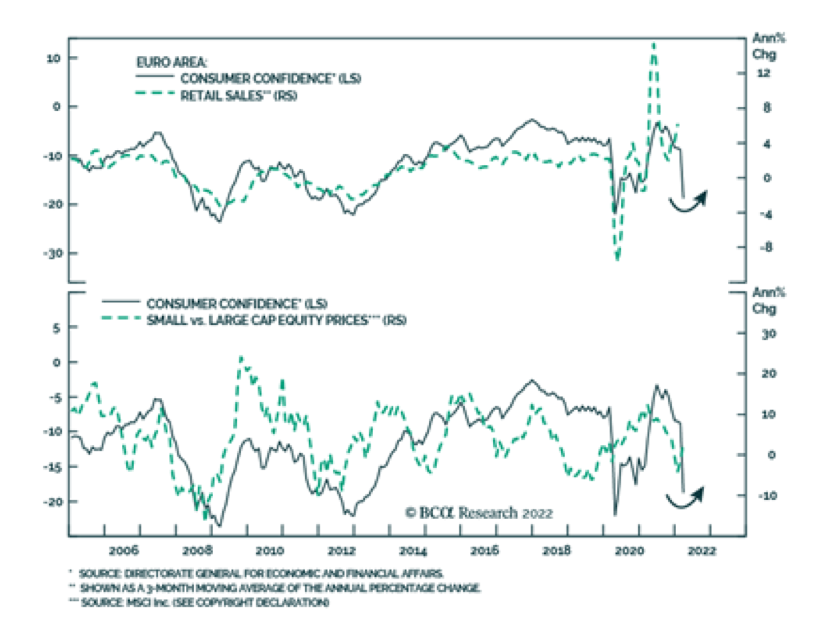

Europe, which is obviously far more exposed to the impacts of the Russia- Ukraine war than the United States, has higher odds of falling into recession. Consumer sentiment there has plummeted, reflecting the surge in energy prices, and fears of stagflation have risen. But it’s possible that much of the financial market damage has already occurred. The outlook there could improve later in the year, particularly if smoother supply chains and lower demand help inflation recede and governments provide greater fiscal support. In the meantime, European equities have priced in a great deal of bad news.

POSITIONING: SEEKING OPPORTUNITIES IN CHALLENGING MARKETS

The enormous range of potential market outcomes today makes this a bad time for large asset-class bets, in our opinion. We continue to focus on maintaining diversification and emphasize the kinds of managers that we believe can capitalize on the volatility and dispersion in today’s markets.

In our view, today’s climate offers many opportunities for those kinds of investors. There are major changes occurring in the world, with alliances and supply chains shifting and strengthening. Change can be unsettling, but it also creates openings for investors with understanding of individual companies, industries and sectors. Such opportunities may exist throughout the markets, from beaten-down software firms to resurgent energy companies to traditional value stocks.

We continue to favor dividend and dividend-growth stocks in our large-cap U.S. exposure. Historically, these types of stocks have tended to grow their dividend payments at least as fast as the rate of inflation. Moreover, current income makes up a larger component of expected returns for these stocks than it does in the broad-market index, helping make them less volatile.

We are eyeing high-quality fixed income more carefully as yields rise. For example, the yield available on short-to-intermediate-duration bonds today may make them a useful option for relatively short-term assets. And if long-term inflation expectations stay grounded, high-quality long-term bonds may regain their ability to help hedge against equity downturns. For the time being, however, elevated inflation and low and rising bond yields will continue to be a headwind for bond investors. We generally favor inflation-protected bonds over nominal securities.

In addition, we continue to favor exposure to what we believe to be two of the most resilient sectors in real estate today—multifamily and industrial, specifically last mile logistics. We believe that these opportunities, structured properly, can provide healthy cash flow yield, further diversify portfolios and help to buffer portfolios against high levels of inflation.

As spring begins, we encourage you not to let the news drive your investments. You rely on your advisors to make prudent, unemotional investment decisions within the context of a portfolio built around your needs and your plan. Everything in that portfolio is there for a reason: At LVW, we don’t collect investments; we position them based on our understanding of their underlying sources of return and risks. We commit to continuing to invest your money with discipline, drawing on the lessons of history and our investment pillars of valuation, growth and liquidity to steward your assets over time. Thank you for your trust in us through these challenging times.

LVW NEWS

Awards and Accolades

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, has been ranked on Barron’s 2022 Top 1,200 Financial Advisors list.

The list is among the most extensive and comprehensive annual lists of advisors, analyzing data from around 6,000 advisors nationwide. The ranking evaluates assets under management, revenue generated by firm advisors, the quality of practice and philanthropic work.

Congratulations to Lori!

Click here for important disclosures regarding these awards.

Staying Current

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, recently appeared on a “CAIS in Common” webinar with Abby Salameh, the chief marketing officer at CAIS, and Cara Williams, the global wealth leader at Mercer, in celebration of Women’s History Month. During the panel, Lori shared her insights and experiences regarding opportunities and challenges women experience in the financial sector.

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, was interviewed by RIA Intel on why she thought this Women’s History Month would be different. In the interview, Lori discussed navigating a career in a male-dominated industry and offered advice to young women pursuing professions in wealth management.

RIA Intel is an Institutional Investor publication.

Read the full RIA Intel article here >

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, was featured in a recent Barron’s “The Big Q.” The article dove into how financial advisors are playing the rotation out of growth stocks. Lori discussed LVW’s outlook on reacting to corrections and rebalancing portfolios.

In our latest quarterly video, “2022 First Quarter State of the Markets,” Co- Chief Investment Officer Joseph Zappia, CIMA, and Jonathan Thomas, CFP®, Private Wealth Advisor, reviewed 2021 fourth-quarter asset class returns and discussed the power of portfolio diversification, our perspective on growth vs. value, interest rates and more.

Employee News

Allie Bell joined the LVW team in March as a Senior Client Service Associate.

Allie comes to us with more than eight years of experience in the finance industry. Allie attended Hobart and William Smith Colleges and graduated magna cum laude with a bachelor’s degree in economics.

Outside of the office, Allie enjoys fishing, skiing and being outdoors, along with spending time with friends and family.

Welcome, Allie!

Community Support

LVW Advisors is passionate about making a difference in the community. In March 2022, LVW sponsored Double H Ranch’s annual Naples Golf Tournament. The sold-out event raised $120,000 toward the organization’s mission to provide support and programs for children and families coping with life-threatening illnesses. LVW has supported Double H Ranch for the past two years.

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog posts below.

Factoring Inflation Into Your Retirement Plan >

Newsletter Citations:

1 WSJ.com

2 “Losing 5% Was Best You Could Do in Stocks and Bonds This Quarter,” Bloomberg, March 31, 2022.

3 “The Fulcrum Between Growth and Recession,” Wolfe Research, March 28, 2022.

4 Goldman Sachs U.S. Weekly Kickstart, March 29, 2022.

5 “Lowering our S&P 500 EPS estimates and price targets,” Goldman Sachs U.S. Equity Views, March 11, 2022.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.