By Joseph Zappia, Co-Chief Investment Officer, LVW Advisors

The S&P 500, long considered a bastion of diversification, has become increasingly concentrated in recent years. As of 2024, the top 10 stocks in the index account for a staggering 37% of its total market capitalization, with the “Magnificent Seven” tech giants alone representing about 31%. This level of concentration is nearly double what it was a decade ago and represents the fastest growth in concentration since 1950.

This phenomenon has created a challenging environment for active fund managers and investors alike. The dominance of a handful of mega-cap tech stocks has made it difficult for diversified portfolios to keep pace with the broader market. Fund managers, constrained by SEC diversification rules, often find themselves underweight in these top performers, leading to underperformance relative to the index.

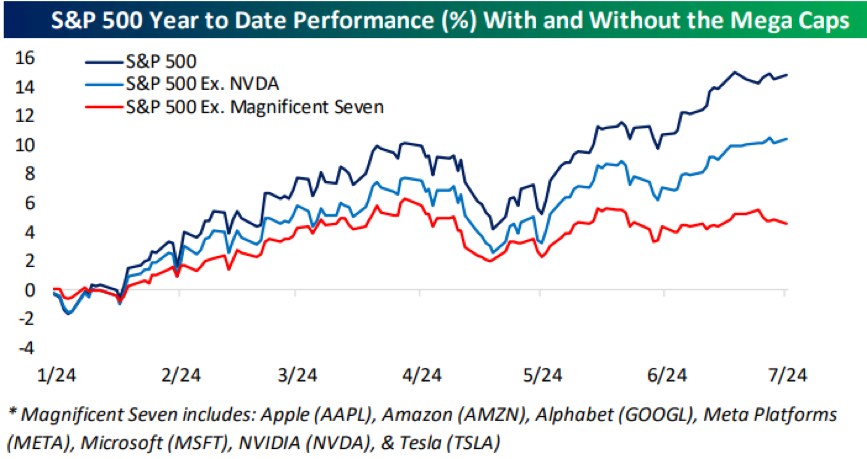

The concentration risk is further amplified by the fact that a significant portion of the S&P 500’s returns are being driven by a small number of stocks. For instance, 35% of the increase in the S&P 500’s market cap since the beginning of 2024 came from just one stock – NVIDIA. This extreme concentration makes the index more vulnerable to headlines affecting individual companies.

However, it’s important to note that the current concentration isn’t entirely unprecedented from a historical or global perspective. Moreover, unlike past market bubbles, today’s market leaders exhibit strong fundamentals, with robust profits supporting their high valuations.

So, what should investors do in this environment?

- Consider a core-satellite approach: Allocate a significant portion of your US large cap holdings to a low-cost index fund tracking the S&P 500 or a total market index. This ‘core’ provides broad market exposure and helps mitigate the risk of underperformance. Then, use ‘satellite’ positions in individual stocks, actively managed funds, or sector-specific ETFs to potentially enhance returns or express specific market views. This approach balances the benefits of indexing with the potential for outperformance.

- Diversify beyond the S&P 500: Consider equal-weight S&P 500 ETFs, which provide equal exposure to all 500 companies in the index, reducing concentration risk. Explore small-cap stocks, international markets, and alternative asset classes to further diversify your portfolio.

- Stay informed but avoid overreaction: While concentration levels are high, remember that these top companies have strong fundamentals. Drastic portfolio changes based solely on concentration concerns may not be warranted.

- Understand your risk tolerance: The current market structure may lead to higher volatility. Ensure your portfolio aligns with your risk tolerance and investment goals.

In conclusion, while the S&P 500’s concentration presents challenges, it also reflects the success of innovative companies driving economic growth. By staying informed, diversifying wisely, and maintaining a long-term perspective, investors can navigate this unique market environment effectively. Remember, market dynamics evolve, and today’s concentration may give way to new opportunities in the future.

This material is for general informational and educational purposes only. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice.

Sources

[1] A Closer Look At Concentration – Goldman Sachs Asset Management https://www.gsam.com/content/gsam/global/en/market-insights/gsam-insights/perspectives/2024/concentration.html

[2] What Are Index Funds, and How Do They Work? – Investopedia https://www.investopedia.com/terms/i/indexfund.asp

[3] A Guide to Core-Satellite Investing – Investopedia https://www.investopedia.com/articles/financial-theory/08/core-satellite-investing.asp

[4] S&P 500 concentration is at its highest level in over 30 years – Amundi https://www.amundi.com/usinvestors/Financial-Professionals/Financial-Professional-Resources/Charting-our-Focus/S-P-500-concentration-is-at-its-highest-level-in-over-30-years

[5] How to Use Large-Cap Stocks in a Portfolio – Morningstar https://www.morningstar.com/portfolios/how-do-i-use-large-cap-stocks-portfolio

[6] The power of the core-satellite investing strategy – Vanguard Australia https://www.vanguard.com.au/personal/learn/smart-investing/investing-strategy/core-satellite-investing

[7] How Magnificent 7 affects S&P 500 stock market concentration – CNBC https://www.cnbc.com/2024/07/01/how-magnificent-7-affects-sp-500-stock-market-concentration.html

[8] What are common advantages of investing in large cap stocks? https://www.investopedia.com/ask/answers/041015/what-are-common-advantages-investing-large-cap-stocks.asp

[9] Core and satellite approaches for income investors https://www.jhinvestments.com/viewpoints/portfolio-construction/core-and-satellite-approaches-for-income-investors

[10] Stock Market Concentration – Morgan Stanley https://www.morganstanley.com/im/publication/insights/articles/article_stockmarketconcentration.pdf

[11] What is an index fund and how does it work? – AP News https://apnews.com/buyline-personal-finance/article/what-is-an-index-fund-and-how-does-it-work

[12] How to Build a Core Satellite Investing Portfolio? – Smallcase https://www.smallcase.com/blog/core-satellite-investing/

[13] Is Stock Market Concentration Rising? | J.P. Morgan Research https://www.jpmorgan.com/insights/global-research/markets/market-concentration

[14] What Are Large Cap Growth Funds? – New York Life Insurance https://www.newyorklife.com/articles/what-are-large-cap-growth-funds

[15] What is a core and satellite investment strategy? – InvestSMART https://www.investsmart.com.au/investment-news/what-is-a-core-and-satellite-investment-strategy/151928