By Joe Zappia, Principal and Co-Chief Investment Officer

Apple is an amazing company. When the iPhone was introduced in 2007, no one could have imagined that it would completely transform how we interact and communicate with one another. The Apple App Store for the iPhone enabled entire industries to be created: ridesharing, food delivery, photo-sharing. Uber, Grubhub, Instagram and hundreds of other companies wouldn’t even exist today if the iPhone didn’t exist. With over 1.5 billion active devices in service, Apple has created a massive ecosystem.

Apple is also an extremely well-managed company. It is a cash flow generating machine that has amassed nearly a quarter of a trillion dollars in cash on its balance sheet. Shareholders have been well-rewarded as a result.

Over the long-term, stock prices follow earnings.

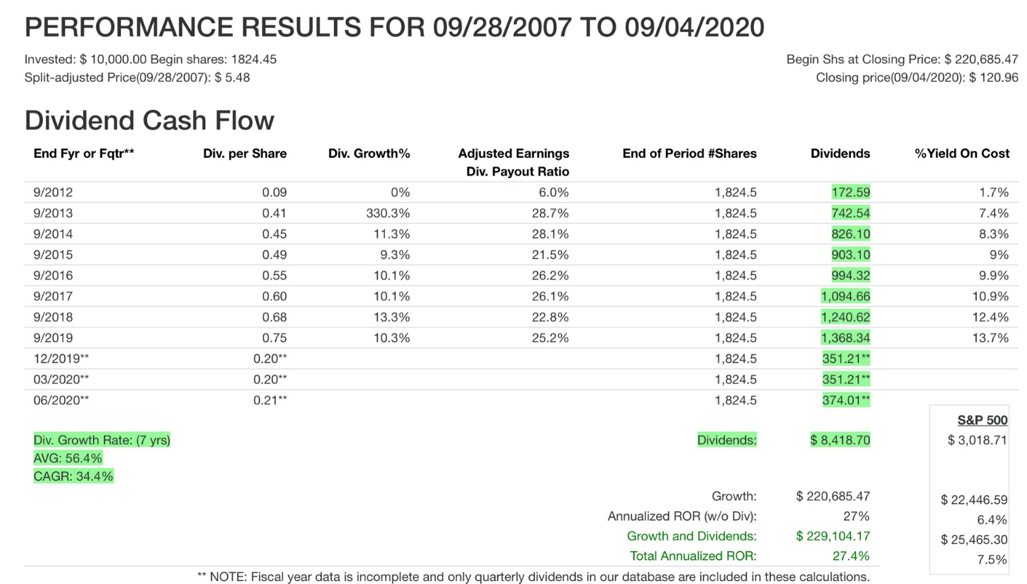

- EARNINGS – Since the introduction of the iPhone, Apple has grown earnings from $.77 per share in 2008, to $3.25 per share today — a 322% increase!

- DIVIDEND – Apple has also rewarded shareholders with a large and growing dividend. Apple paid its first dividend in 2011 of $.09 per share, and today, the dividend paid is $.80 per share — a 789% increase!

- STOCK PRICE – $10,000 invested in Apple in September 2007 is worth $220,685 today — a 22-fold increase!

Although over the long-term stock price follows earnings, in the short-term stock prices can become disconnected from underlying fundamentals. Investing in a “great company” at the wrong time, when the stock price exceeds fundamentals, can lead to disastrous results for the investor. Let’s take Microsoft for example. In 1999, at the peak of the “tech bubble,” if an investor had purchased shares of Microsoft at the high, break-even would not have been achieved for more than a decade, in spite of Microsoft growing their earnings and dividend at a similar rate to Apple’s most recent growth. Read our post, “Value Does Not Always Equal Price.”

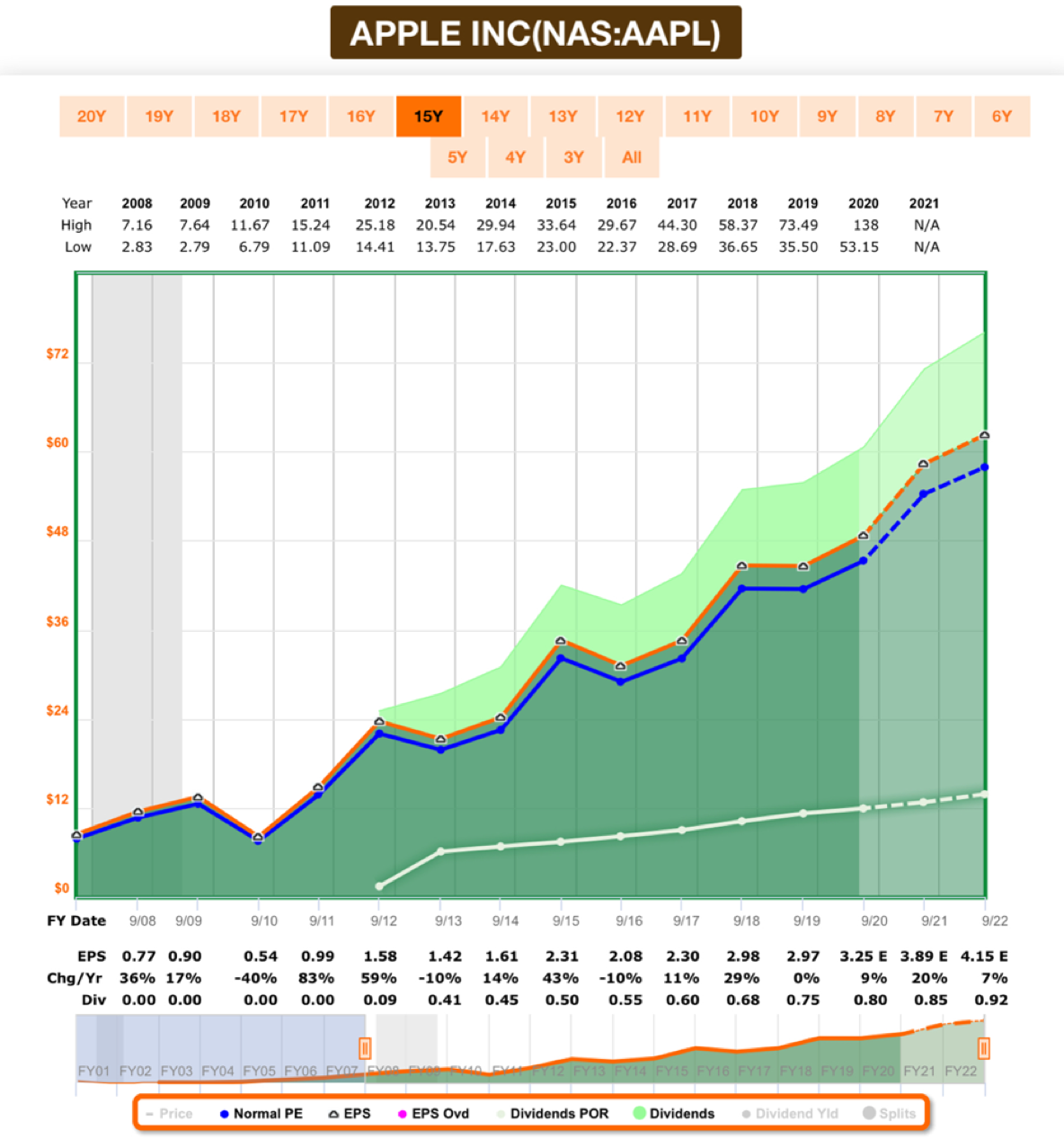

Let’s turn back to Apple. The graph below depicts the fundamentals of Apple from 2008 through today. The orange line represents Apple’s earnings; the white line represents Apple’s dividend. The rather consistent upward sloping lines are a tribute to Apple’s steady business.

Chart 1 – Apple from September 2008 – September 2020.

Chart 2 – The black line, representing Apple’s share price, has been overlaid on first graph. For the period 2008 through September 2019, the price per share fluctuated up and down, but generally followed the earnings.

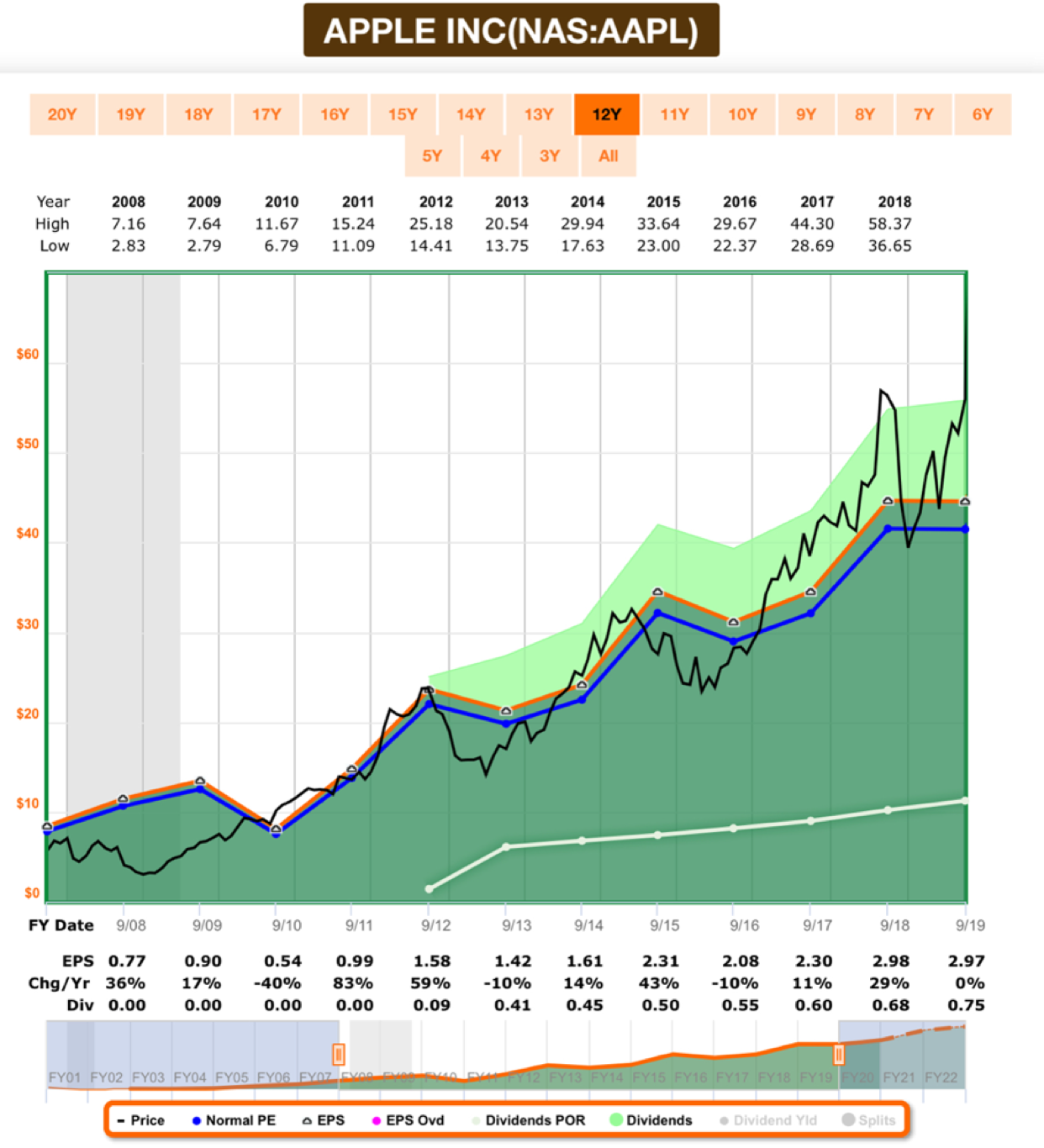

Chart 3 – This is a similar graph to graph 2, with the exception that the time frame has been extended through today. The price line has made a straight upward climb over the past year. This chart highlights just how disconnected Apple’s share price is relative to its underlying fundamentals. There is no fundamental analysis that can justify Apple’s current share price.

What does all of this mean? First, understand that an investor purchases shares of a stock, which are an ownership interest in an underlying business, on the basis that the share price offers value relative to the future discounted cash flow of the company. In this case, that means that unless Apple produces explosive and unexpected earnings growth in the next year. Apple stock is potentially extremely overvalued. Investors purchasing Apple stock today are not doing so based on the shares trading at a discount to the company’s underlying fundamentals, but rather in hopes that Apple surprises the world with another transformational product, or the next buyer is willing to pay more for the shares than the current investor did. Or put another way, purchasing Apple today is based on speculation rather than solid value investment based principles.

In summary, I am a shareholder of Apple. I love the products. I love the company and owning the shares has been very rewarding. However, in more than 33 years of being an investment professional, I have seen this movie many times and feel confident regarding the end. The likelihood of Apple stock generating a future return equal to its prior return is low. To justify today’s price is solely dependent on market participant’s willingness to overpay to own one of the world’s greatest companies. September is Apple harvest season in Upstate NY. Apple shareholders would be wise to consider harvesting some gains, understanding the possibility of lackluster or maybe even negative returns for the foreseeable future. New investors will want to consider waiting for what may be a better entry point.

Sources:

Bloomberg Terminal

http://www.fastgraphs.com

This material is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. The author of this piece maintains a position in Apple. The opinions expressed herein do not necessarily reflect the views of LVW Advisors and are based on economic and market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Past performance is not a guarantee of future returns.