Contributed by: Joseph Zappia, CIMA®, Principal, LVW Advisors

This information is provided by LVW Advisors for general information and educational purposes based upon publicly available information from sources believed to be reliable – LVW Advisors cannot assure the accuracy or completeness of these materials. Any opinions expressed herein do not necessarily reflect the views of LVW Advisors. This information may change at any time and without notice. Past performance is not a guarantee of future returns.

Investors are more than ready to turn the page on a turbulent 2022 — an unprecedented year in most of our lives. Inflation soared. Central banks aggressively increased interest rates, reversing a 40-year cycle of falling rates. Asset prices tumbled, and war broke out in Ukraine.

What’s next for 2023?

Heading into the new year, inflation remains elevated, the war in Ukraine drags on, and with recession looming in the U.S. and abroad, investors will likely see additional market volatility. Some of these developments are seismic shifts that will likely reshape the investment landscape for years to come.

The new year no doubt will bring its own unique set of opportunities. Whichever way the wind blows, here are four key actions for 2023.

1. Dividends Matter – Make Them a Bigger Part of Your Portfolio

During the recent bull market, investors had to get one thing right: recognize that leading U.S. internet companies with strong growth potential could generate the greatest returns.

In today’s more volatile markets, with the cost of capital rising and investors less eager to pay up for high-multiple growth stocks, dividends are getting more attention. “After several years of underperformance, we are at the beginning of what I expect to be a renewed emphasis on the importance of growing cash flow and growing dividends in equity portfolios,” says Joe Zappia, Co-CIO and portfolio manager of the LVW Quality Rising Dividend Portfolio. “Going forward, dividends should be a more significant and stable contributor to total returns.”

While dividends accounted for a slim 16% of total return for the S&P 500 Index in the 2010s, historically they have contributed 38% on average. In the inflationary 1970s, they climbed to more than 70%. “When you expect stock market returns in the mid-single digits, dividends can give you a head start,” Joe adds. “Dividends can provide downside protection in bear markets. The key to outperforming in the long-term is losing less in bear markets.”

Source: S&P Dow Jones Indices LLC. 2020s data is from 1/1/26 through 11/30/22. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade. Past results are not predictive of results in future periods.

2. Think Global – Expect More from International Stocks

For years, maintaining sizable investments in international stocks has required patience and a strong stomach. After all, returns for non-U.S. markets have persistently lagged the U.S. amid waves of disappointing economic and geopolitical developments.

A look at news headlines suggests more of the same in 2023. A strong U.S. dollar, the war in Ukraine, and weak economies in Europe, Japan and emerging markets have created a cloudy near-term outlook.

Strong global businesses in Europe and Asia are trading at compelling valuations. If the news simply gets less bad, shares for many of them could rebound.

Investors would also do well to remember that there’s a difference between top-down macroeconomic conditions and the fundamental, bottom-up prospects for individual companies. Now, more than ever, company-specific developments are driving returns outside the U.S., placing added importance on rigorous investment research and individual stock picking. For this reason, LVW focuses on an active approach for our non-U.S. Stock investments.

Source: Empirical Research Partners. As of 9/30/22. Analysis provided by Empirical Research Partners using their developed market and emerging market stock universes that approximate the MSCI World Index and MSCI Emerging Markets Index, respectively. Data shows the percentage of market returns that can be attributed to various factors over time, using a two-year smoothed average. Past results are not predictive of results in future periods.

3. Expect Bonds to Play a Bigger Role in Portfolio Returns

In 2022, core bond portfolios failed to do what was expected: fulfill their traditional role as a ballast against market volatility. In a year when global stocks slid 14.5%, investment-grade bonds (BBB/Baa and above) declined 12.8%.

It is understandable if investors are disappointed, but outcomes like this have been rare. In fact, last year was the only time in the past 45 years that stocks and bonds fell in tandem. The conditions that led to this outcome also have been rare. At a time when rates were near or below zero, the U.S. Federal Reserve and other major central banks initiated a series of aggressive rate hikes to tamp down inflation.

Rarely do bonds and equities decline in tandem. Bonds should once again offer diversification from equities in 2023.

Sources: Capital Group, Bloomberg Index Services Ltd., MSCI. Returns above reflect annual total returns in USD for all years except 2022, which reflect the year-to-date total return for both indexes. As of 11/30/22. Past results are not predictive of results in future periods.

Inflation has already shown signs of slowing. At its December meeting, the Fed moderated its approach and lifted rates by just a half percentage point to a range of 4.25% to 4.50%. But officials underscored that they will continue to raise rates, with the potential to go above 5% next year. Further evidence of slower inflation or slowing growth could allow the Fed to slow or pause its rate hikes.

LVW believes we are close to the point. Once the Fed stops raising rates, high quality bonds should offer relative stability and greater income.

4. Do Not Sit on the Sidelines

A steady drumbeat of bad news can be discouraging to even the most seasoned investors.

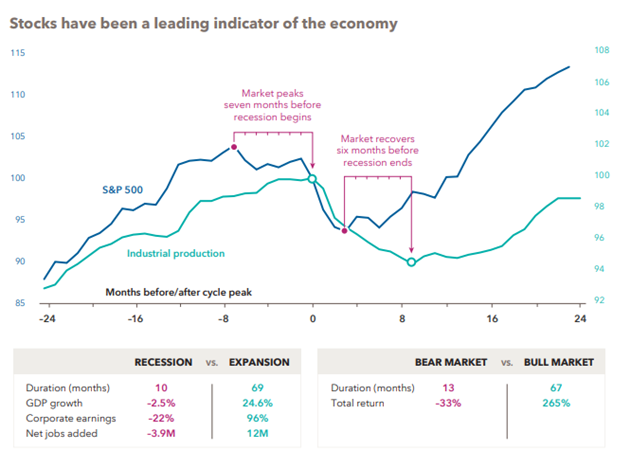

Well-managed companies are adjusting to shifting conditions, and ultimately the best companies have learned to thrive in the new reality. Markets themselves have a history of adjusting to setbacks. Indeed, stock markets historically have recovered before a recession ends, anticipating a better future ahead. If history is a guide, they could rebound about six months before the economy does.

What is important for investors is to stick with their long-term investment plans. Abrupt and dramatic change often triggers powerful emotions that can lead to impulsive action, like moving cash to the sidelines. From May 2022 through the end of the year, investors shifted about $160 billion into money market funds, according to the Office of Financial Research. But taking your money out of the market on the way down means that if you don’t get back in at exactly the right time, you can’t capture the full benefit of a recovery.

Sources: Capital Group, MSCI, RIMES. As of 12/31/21. MSCI returns above reflect total returns, including the impact of reinvested dividends.

Even missing a few trading days can take a toll. Consider an example of a hypothetical $1,000 investment in the MSCI ACWI from January 1, 2012, to December 31, 2021. An investment for the full period would have grown to $3,065. But missing even the 10 best days of the subsequent 10 years would have significantly hurt long-term results — and the more missed “good” days, the more missed opportunities.

Sources: Capital Group, Federal Reserve Board, Haver Analytics, National Bureau of Economic Research, RIMES, Standard and Poor’s. Data reflects the average of completed cycles in the U.S. from 1950 to 2021, indexed to 100 at each cycle peak. Corporate earnings calculated by Strategas for all completed cycles from 1/1/28–11/30/22. Other data includes all completed cycles from 1/1/50–11/30/22. Industrial production measures the change in output produced by manufacturers, mines and utilities and is used here as a proxy for the economic cycle. Past results are not predictive of results in future periods.

The strongest gains have often occurred immediately after a bottom. Therefore, waiting on the sidelines for an economic turnaround is not a recommended strategy.

As the old Wall Street adage goes, ‘no one rings a bell at the bottom.’ And stocks, on average, bottom six to nine months before an economic recession ends. There’s a good chance that the lows for this bear market were in October of 2022.

Source: Capital Group 2023 Outlook