Download a copy of this newsletter

Table of Contents

SECOND QUARTER MARKET REVIEW: THE GREAT REOPENING

OUTLOOK: ROSE-COLORED GLASSES

LVW NEWS

Welcome to the summer issue of The Serious Investor. We hope that with the pandemic easing you’re enjoying a return to more ordinary life—traveling, spending time with loved ones and celebrating summer weather. In this issue, we explain our take on the optimism in today’s markets, and why investors should consider thinking outside the box to pursue returns in the years ahead.

Quick Take:

-

The economy accelerated in the second quarter. Equity and bond valuations soared.

-

High valuations suggest low long-term returns.

-

In our view, the potential for a Fed misstep presents the greatest risk to the economy and markets. High valuations reduce equity benchmarks’ long-term return potential and could contribute to greater volatility.

-

Investors should consider new thinking to pursue returns while managing risk.

-

The rise in inflation appears likely to be temporary, but time will tell.

SECOND QUARTER MARKET REVIEW: THE GREAT REOPENING

The U.S. economy’s reopening is underway. By the end of June nearly half the U.S. population was fully vaccinated against COVID-19 and 55% had received at least one dose. Inoculations rapidly pulled down disease transmission, with the seven-day average of new cases falling from more than 64,000 at the end of March to fewer than 12,000 on June 30. While the rise of the more contagious delta variant increased the likelihood of further outbreaks, evidence of the vaccines’ effectiveness against it suggested that cases, especially severe ones, would continue to fall.

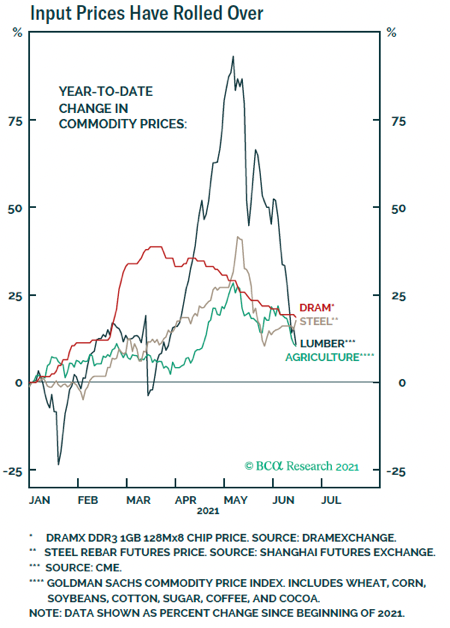

As people resumed their lives—working, traveling, attending events and visiting stores—the reopening accelerated. The Atlanta Fed’s GDPNow model as of July 1 estimates that U.S. GDP grew 8.3% in the second quarter, and the most recent Blue Chip consensus estimate exceeded 9.5%. The surge in economic activity contributed to a jump in inflation. Monthly U.S. core inflation in April and May hit its highest point since the early 1980s,1 and commodity prices spiked before easing late in the quarter.

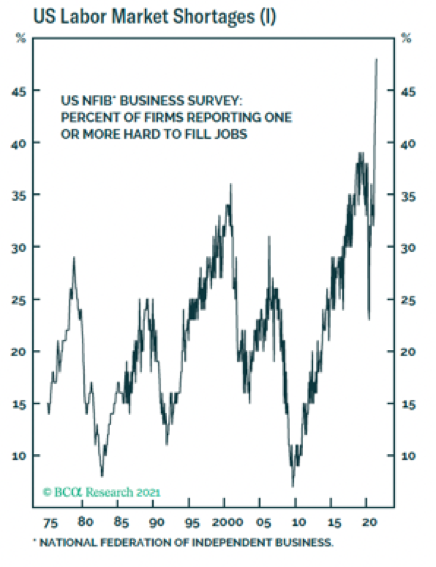

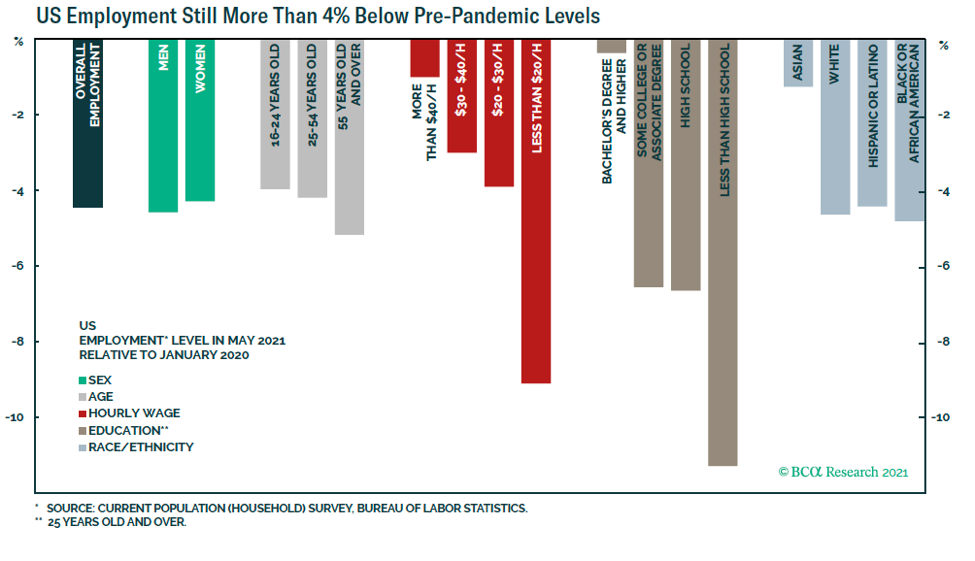

The job market continued to improve, but progress wasn’t always smooth. The number of jobs increased by 1.7 million during the second quarter as job growth sped up after weak results in April. Yet workforce participation remained low, as a variety of factors—including high unemployment benefits, health safety concerns and lack of child care—slowed the return to work. Businesses eager to hire faced major worker shortages.

The job market continued to improve, but progress wasn’t always smooth. The number of jobs increased by 1.7 million during the second quarter as job growth sped up after weak results in April. Yet workforce participation remained low, as a variety of factors—including high unemployment benefits, health safety concerns and lack of child care—slowed the return to work. Businesses eager to hire faced major worker shortages.

These shortages led to fears that wages and inflation expectations could climb rapidly, potentially embedding high inflation in the economy. The Federal Reserve officially maintained that the jump in inflation would be transitory. But at the Fed’s June meeting, Chair Jerome Powell struck a less dovish tone than at previous meetings, and the Fed bumped up its expected timeline for interest-rate increases from 2024 to two hikes in 2023.

Financial markets posted strong gains against that backdrop. The S&P 500 gained 8.2% in the second quarter, led by real estate, technology and communications services stocks, bringing the benchmark’s first-half return to 14.4%. The market had rotated powerfully into cyclicals and small caps for several months prior to the second quarter, but that trend reversed between April and June:

- The Russell 3000 Growth Index jumped more than 11%, while the Russell 3000 Value Index returned a little over 5%.

- Large stocks beat out small stocks, with the Russell 1000 returning 8.5% and the Russell 2000 gaining 4.3%.

- Foreign stocks lagged U.S. shares, as the MSCI All Country World ex-US Index gained 4.75%.

Bonds also posted a turnaround following a brutal first quarter. The yield on the 10-year Treasury fell about 25 basis points, ending the second quarter below 1.5%. With bond rates low, yield-seeking investors rushed into the credit markets, causing credit spreads to tighten to their lowest level in history.2

Cryptocurrencies were exceptionally volatile. Bitcoin lost nearly half of its value from mid-April through the end of the quarter,3 demonstrating that investors should be wary about considering it a store of value. Cryptocurrencies’ gyrations did not appear to affect the stock or bond markets however.

OUTLOOK: ROSE-COLORED GLASSES

We’re living through a period of profound optimism. After almost a dozen years of consistent strong gains, individual U.S. investors now expect to earn long-term annual returns of 17.5%, according to a study by investment manager Natixis. By contrast, U.S. financial professionals expect long-term returns of 6.7%.

The surging economy is reinforcing those rosy expectations. The Fed in June upped its 2021 GDP growth forecast from 6.5% to 7.0%, which if achieved would be the fastest calendar-year growth since 1984 and the second-fastest since at least 1961.4 All that economic activity is supporting gaudy corporate earnings growth, especially compared with last year’s economic stop.

Analysts think S&P 500 companies’ profits jumped almost 62% year-over-year in the second quarter and forecast earnings growth of almost 35% for 2021 as a whole.5

Liquidity also is supporting elevated asset prices (for now, at least—more on this below). The U.S. money supply increased between 22% and 31%, yearover- year, every single month from April 2020 through March 2021, then rose another 12% in April.6 (For comparison, money supply grew at an annual rate between 3% and 7% from 2015 through early 2020.)

All this optimism and money are combining to fuel the kinds of behaviors that typically emerge only very late in market cycles:

- The explosion of special purpose acquisition companies (SPACs), aka blank check companies, characterized by what we would describe as flimsy underwriting and ballooning values. There were 362 SPACs in the first six months of 2021, 50% more than in all of last year. They raised $111 billion, more than the total between 2003 and 2019.7

- A surge in IPOs: 213 IPOs raised $70 billion during the first half of 2021— more than the annual average over the past decade. June had more IPOs than any month since August 2000, the peak of the tech bubble.8

- Massive issuance of corporate debt: Investment bankers awash in prospective buyers have been calling companies to persuade them to issue more bonds. CCC-rated bond issuance as of mid-June was running 35% above its previous record pace.9

- A rush of deals: Private equity firms struck more than $500 billion worth of deals in the first half of the year, the fastest pace in at least 40 years.10

- Investor enthusiasm: Investors have flooded into meme stocks, cryptocurrencies and stocks trading above 20 times revenue—valuations reminiscent of the dot-com bubble.

High growth, valuations and risk

Our investment discipline is built on the three-legged stool of growth, liquidity and valuation.

Growth is tremendous, as described above.

Liquidity is extremely high—but any decline from here would likely shake markets. In our view, a Fed misstep is the greatest risk to the economy and investors.

The Fed is trying to thread a very small needle as it tries to bring monetary policy closer to normal. If it tightens too quickly, it risks crashing financial markets and sending the economy back into recession. If it moves too slowly, it risks allowing inflation to spiral higher and losing the confidence of investors and policymakers around the world.

Powell’s comments in the Fed’s June meeting seem to suggest that it is moving closer to tapering its asset purchases, possibly even later this year. In our opinion, markets haven’t priced in that possibility, counting on the Fed’s assurances that it intends to wait to tighten until full employment and healthy inflation appear sustainable. That moment could come sooner than investors are expecting, especially if rising inflation starts to look structural, rather than cyclical.

At the same time, valuations look exceptionally high compared to history. The S&P 500’s average price-to-earnings ratio was 22.4 as of mid-June, based on projected earnings for the next 12 months. That’s almost 25% higher than the five-year average and 40% higher than the 10-year average.11

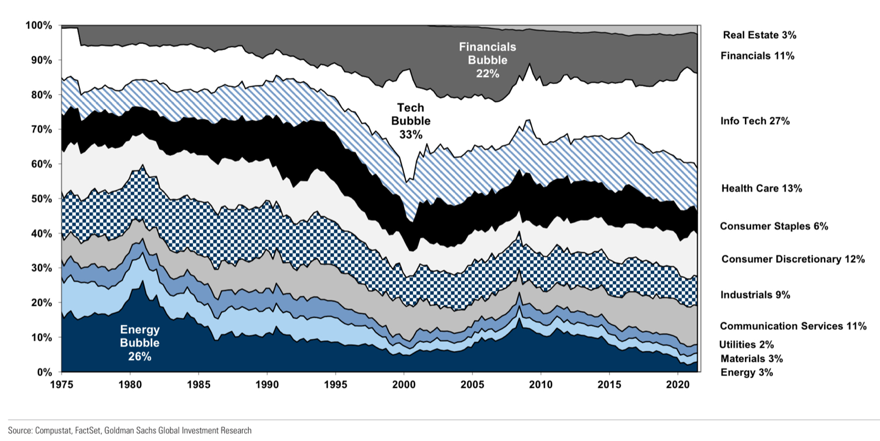

The price-to-earnings ratio can be misleading, however. The composition of the S&P 500 has changed dramatically over the past 20 years (see chart below). The benchmark’s largest companies are growing earnings much more quickly today than they were 20 years ago. Faster growth justifies a higher P/E—but it’s difficult to say how much higher.

S&P 500 Composition Over Time

The chart below compares large caps’ actual returns over time with estimated 10-year returns based on cyclically adjusted valuations. As you can see, the estimates have been fairly reliable in the past and imply very low single-digit returns over the next 10 years. Currently, our internal capital market assumptions project 4% annualized returns for U.S. large cap stocks from current levels, with somewhat higher returns for value, small cap and international equity.

![]()

Return forecasts generally are simpler for bonds. Over time, bonds tend to return what they yield when you buy them; our capital market assumptions currently assume 1.7% annual returns for U.S. fixed income.

For many investors, the traditional 60/40 portfolio probably won’t cut it. Our current assumption is that a typical 60/40 portfolio may return 2.6% per year (subject to wide variation based on many factors)—likely lower than the rate of inflation. Our job as financial advisors is not simply to accept these lower returns, but to work harder as we seek pockets of value or alternative sources of return with the potential to improve the results of our clients’ overall portfolios.

The bull case

It can be hard to point out the market’s exuberance without sounding bearish. We’re not. We don’t try to call market tops or bottoms—no one knows when this bull market will end.

And it’s possible to make a strong case for an extended bull market. High growth and liquidity make for powerful tailwinds. As we noted in the spring issue of The Serious Investor, today’s environment bears a resemblance to the post-WWII era, when massive pent-up demand and huge fiscal spending helped fuel almost two decades of strong, noninflationary economic growth and powerful market gains. The government is the largest consumer in the economy, and infrastructure spending, though inefficient in many ways, will make its way to U.S. companies through government contracts, leading to employment and GDP growth.

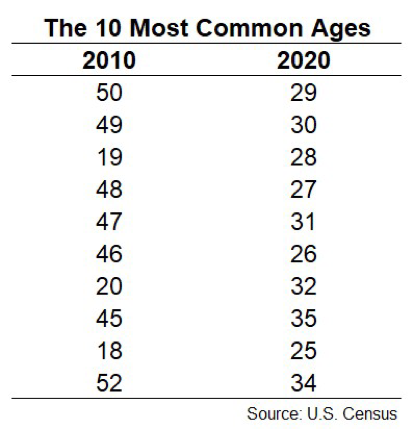

What’s more, demographics have improved. Millennials now make up our country’s biggest generation at more than 72 million people and growing.12

These young adults will be funding their own retirements. They increasingly are defaulted into retirement plans, making them forced savers and investors. There are now 600,000 401(k) plans, which have:

These young adults will be funding their own retirements. They increasingly are defaulted into retirement plans, making them forced savers and investors. There are now 600,000 401(k) plans, which have:

- 60 million participants

- $6.9 trillion in assets, more than double the amount 10 years ago

- 70% invested in stocks

- One-fifth of the U.S. equity market’s assets13

The growing role of 401(k)s means every two weeks there is a massive, automatic inflow into the stock market, regardless of valuations or macroeconomic considerations.

The new 60/40

Still, investors should be mindful that risks are high and long-term return prospects from current valuations are low. To paraphrase Howard Marks, risk is greatest when it appears as if there is none.

The past decade included many sudden shifts from periods of very low volatility to periods of very high volatility. We believe the frequency of such market spasms is related to the growing influence of systematic, algorithm-driven trading firms and the effects they have on stock liquidity. To paraphrase Marks again, liquidity in the equity market is more illusory than ever: abundant when you don’t need it, gone as soon as you do.

Investors need to be prepared now. We believe they have a fundamental choice as they prepare their portfolios for the future: either maintain their target risk level and accept the likelihood of lower returns or take on more risk in pursuit of returns closer to historical norms.

The first step in making that decision is introspection. All investors, whether they’re families or foundations, should be clear about their most important objectives and what they need from their investments to reach them. And they should think deeply about the amount of risk they are and aren’t willing to take in pursuit of those goals.

Investors who decide to assume greater market risk in pursuit of returns might decide to increase the size of their equity allocation, based on the amount of additional risk they are willing to accept. The portfolio will become more volatile, with larger drawdowns. But drawdowns become losses only if you sell into them. Investors who maintain enough liquidity can avoid having to do that. They can use market declines as opportunities to rebalance— investing when lower valuations may present better prospects for long-term returns.

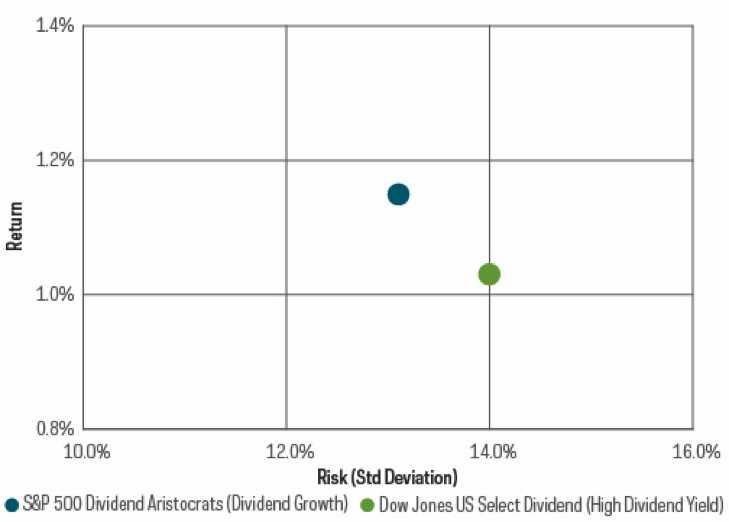

Investors increasing their equity allocation might invest the additional percentage in ways that may help manage the additional risk, such as emphasizing dividend growth strategies.

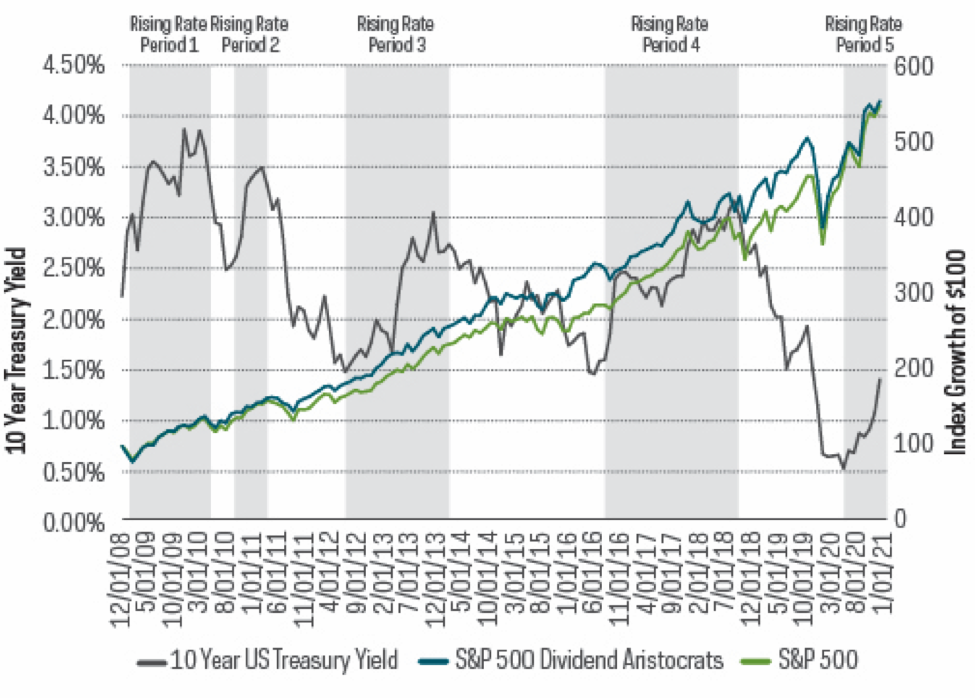

Valuations on dividend-paying stocks are relatively low. And with profits booming, Goldman Sachs expects dividends to increase 6% this year and next, and to average 4.5% per year over the coming decade. That return of capital may help reduce the stocks’ volatility and hedge inflation. While historical performance is not always an indicator of future performance, dividend growth strategies also have a strong track record when Treasury yields rise: Compared to high-dividend stocks overall, since 2005 dividend growers have produced higher returns and lower volatility during months that the 10-year Treasury yield increased (see charts below).

Dividend Growers’ Strong Performance Amid Rising Bond Yields

Source: Bloomberg, data from May 2, 2005, through March 31, 2021. Chart reflects the average monthly return and standard deviation for the indexes during months when the 10-year Treasury yield increased during the data period. Past performance is no guarantee of future results.

Source: ProShares.

Investing with skilled, risk-conscious active managers also may help capture opportunities and manage risks. Record IPO and SPAC activity has infused young, fast-growing companies into the public markets, presenting discerning investors with opportunities for growth. Many of these less-mature companies will fail; others could become blue chips. Distinguishing the winners from the losers will require considerable expertise. Opportunistic, skill-based managers will seek to take advantage of volatility to add to positions as warranted. Where appropriate, investors may want to consider investing with active managers who seek to reduce risk by hedging.

Thinking outside the box may unveil other opportunities to add diversified and return potential. For example, currently our capital market assumptions anticipate that direct real estate investments may offer higher return than stocks, with low correlation to equities. For appropriate portfolios, market-neutral or hedged equity may produce better returns than passive exposure to the broad equity market, especially on a risk-adjusted basis.

In the income portfolio, investors who size their liquidity needs can consider covering them with cash and high-quality bonds, while hedging inflation with Treasury Inflation-Protected Securities (TIPS). Then they can consider seeking greater yield and total return from other types of differentiated, uncorrelated assets, such as income-generating real estate and private credit.

Meanwhile, improved methods for managing taxes offer the potential to add considerable value—especially with taxes likely to rise.

We believe that the confluence of zero commission trading and artificial intelligence will enable us to build more efficient portfolios through direct indexing. We can work with clients to explore customizing index and factor-based portfolios for them, letting us accommodate concentrated positions or tilt toward or away from stocks based on an investor’s environmental, social or governance-based beliefs. Such portfolios have the potential to be more tax- and fee-efficient than traditionally managed portfolios, subject to a multitude of market, economic and client-specific factors.

Our thoughts on inflation

Will the rise in inflation be transitory or persistent? Our take: The recent jump probably will prove temporary, but rising prices could become a problem over the long term. That said, we’re not overconfident about our stance, because there’s a lot that economists don’t understand about inflation’s causes and effects.

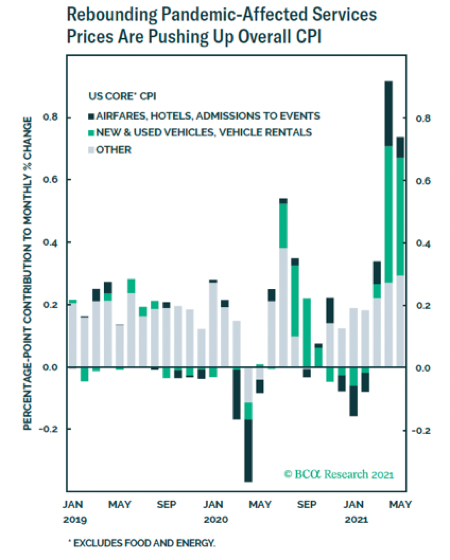

It seems clear that the spring leap in inflation stemmed almost entirely from supply chain factors related to reopening. For example, more than half of the core inflation increase in April and May came from a combination of higher vehicle prices and a rebound in pandemic-related service prices such as airfares.

Materials prices have already rolled over, as we noted earlier. Moreover, a likely slowdown in Chinese credit growth would dampen demand for metals and weigh on metals prices.

Will labor shortages lead to an inflationary spike in wages? We don’t think so. Wages have grown, but productivity has grown faster, offsetting the impact on inflation. Employment remains well below pre-pandemic levels, and even at current rates won’t catch up until mid-2022.14

Despite this underemployment, companies face pressing labor shortages, as noted above. But several of the factors constraining the labor supply look likely to ease by fall:

- About half of the states have already ended enhanced unemployment benefits, and the rest will expire in September.

- Progress toward COVID herd immunity, enabled by vaccines, could make employees more comfortable returning to work.

- Reopening of schools and child care facilities will relieve parents’ need to stay home.

- Migration is poised to increase after cratering last year, now that COVID is in retreat in the U.S. and the Biden administration has revoked the ban on new visas.

- Fewer workers are likely to retire, after a year in which many late-career employees opted to retire early.

Even if the labor force normalizes and we reach full employment, inflation probably wouldn’t jump immediately. In the past, inflation hasn’t started to climb until unemployment stays at very low levels for an extended period. Consider the 1960s: The economy hit full employment in 1962, but inflation didn’t take off until around 1966.15

All that said, we think a combination of baby boomer retirements, retreating globalization, weak trend productivity growth and other factors increases the risk of rising inflation in the next three to five years. With that outlook, as well as the knowledge that near-term inflation could surprise us and the Fed, we think investors should currently consider a degree of inflation protection in their portfolios.

TIPS may provide one hedge. Dividend growth stocks may offer another. For example, inflation averaged 6% during the 1970s and ’80s—but so did dividend growth, working to offset the impact on shareholders.16

In a sense, stocks are the ultimate real asset—another reason that investors willing to manage greater volatility and drawdown risk may want to consider a judicious increase in their equity exposure. That approach may be unconventional. But adapting to the realities of changing markets is part of being a serious investor.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was ranked for the second year in a row on Barron’s 2021 Top 100 Women Financial Advisors list. The Top 100 Women ranking reflects assets under management, revenue the advisors generate for their firms and the quality of their practices.

View the Top Women Wealth Advisors list here >

Click here for important disclosures regarding these awards.

Staying Current

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was recently interviewed on Mindy Diamond’s podcast episode “From Bigger to Better: How a Former Smith Barney Superstar Found Her Competitive Advantage in Independence.”

On the podcast, Mindy interviews Lori about her start in finance at Shearson Lehman Brothers in 1987 and her transition to independence by starting LVW Advisors in 2011 with the mission of always putting the client first.

Listen to the podcast episode >

Kim Pugliese, COO of LVW Advisors, presented on June 28 at the Focus Financial Partners’ annual Operations, Compliance and Finance Summit in Las Vegas as part of the panel titled “A Year of Running Remote: Lessons That Will Endure into the Future.”

Kim spoke about how LVW Advisors broadened client communications over the past year and a half, continued to prioritize a focus on firm culture and invested in upgraded systems and technology to benefit both clients and employees.

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was featured in a session of CAIS’ CXO video series, “Building a Best-in-State Wealth Advisory Firm.”

In the interview with Nic Millikan, Managing Director of Intelligence and Insights at CAIS, Lori spoke about her start in the finance industry, her career trajectory and how she ultimately founded LVW Advisors.

On May 26, LVW Advisors Founder and CEO Lori Van Dusen, CIMA, and Senior Advisor and Co-Founder of BGO Strategic Capital Partners David Sherman held a webinar to discuss trends in the real estate industry and potential real estate opportunities both in the United States and around the world.

On the webinar, Lori and David covered various segments within the real estate industry including the housing and rental markets, how retail and hospitality real estate has been affected by COVID-19, the outlook for those industries and shifts in the work-from-home trend.

Conner Boillat, CFP, received a certification in Blockchain and Digital Assets® through the Digital Assets Council of Financial Professionals.

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog posts below.

[Video] Second Quarter State of the Markets >

The Fed Cannot Control Inflation >

Big Cap Pharma Stocks Still Look Like a Good Place to Invest Among U.S. Equities >

Responding to a Data Breach Guide >

Employee News

LVW Advisors is happy to announce the addition of two new employees!

Danny LaCrosse joined the team last month as our new Client Service Associate. Originally from Canandaigua, New York, Danny is a graduate of Colgate University, where he played Division I lacrosse. Danny has prior experience in the financial industry and is excited to get to know and support LVW’s clients.

Outside of the office, Danny is an avid golfer, hunter and reader.

Welcome, Danny!

Karen Krieger joined the LVW team in May as Lori Van Dusen’s Executive Assistant. Karen is based in Naples, Florida, and is originally from New Jersey. Karen has lived in New York City, San Francisco and Los Angeles and has worked for large fashion companies including Ralph Lauren and Giorgio Armani, marketing their brands in the Far East and Europe.

Outside of the office, Karen spends time with her daughter, Alex, who will be attending the University of Florida starting in August.

Welcome, Karen!

Kim DeWitt, Client Operations Specialist, welcomed her first son, Cole, on April 29. Congratulations, Kim!

Private Wealth Advisor, Jonathan Thomas, CFP, welcomed his second son, Quinn, on May 25. Congratulations, Jonathan!

Newsletter Citations:

1 Bloomberg.

2 Coinbase.

3 Macrotrends.com.

4 Factset.

5 Reuters, June 17, 2021.

6 SPACdata.com.

7 CNBC, June 30, 2021.

8 Wall Street Journal, June 14, 2021.

9 Financial Times, July 1, 2021.

10 Factset.

11 Pew Research Center, April 2020.

12 Investment Company Institute.

13 Goldman Sachs S&P 500 Dividend Update, June 23, 2021.

14 New York Times, July 2, 2021.

15 HistoryCentral.com.

16 Bloomberg and http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/spearn.htm.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.