Download a copy of this newsletter

Table of Contents

THIRD QUARTER MARKET REVIEW: THE PRETTY GOOD

REOPENING

OUTLOOK: THE FED’S JOB GETS HARDER

POSITIONING: CHALLENGES CREATE OPPORTUNITIES

LVW NEWS

Welcome to the fall 2021 edition of The Serious Investor. In this issue, we review the swirling mosaic of factors that affected the economy and the markets in the third quarter, reflect on the risks and opportunities the current backdrop presents, and consider what it all means for our clients.

Quick Take:

-

The economic recovery decelerated in the third quarter amid unexpectedly high and persistent inflation.

-

An unclear outlook for economic growth, inflation, government policy, taxes and other factors complicates matters for the Federal Reserve and for investors.

-

We believe this complex backdrop presents considerable challenges to broad market benchmarks.

-

It also is leading to mispricing of individual securities, in our view, so we are favoring managers we believe have the skills to capitalize.

THIRD QUARTER MARKET REVIEW: THE PRETTY GOOD REOPENING

We titled the Market Review section of our summer issue “The Great Reopening,” assuring readers that a U.S. economic renaissance was underway as the country emerged from the pandemic. We were only partly right: The economy did reopen, but not as much as we expected.

Economic activity sprinted at first, then decelerated. By July, rapid vaccine distribution had contributed to plummeting cases of COVID-19, unleashing pent-up demand to travel, shop, eat at restaurants, start home improvements and otherwise return to a version of normal life. At the same time, fiscal spending and accommodative monetary policy ensured that consumers and businesses had enormous amounts of cash on hand. Jobs, wages and consumer savings increased rapidly.

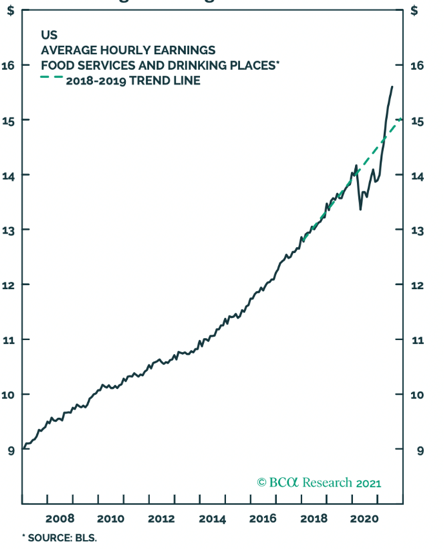

Restaurant Wages Jump

But by midsummer, the delta variant had emerged and vaccine uptake had slowed, bringing a new spike in COVID cases, hospitalizations and deaths. Economic activity eased as people came to realize that the pandemic wasn’t over and adjusted their behavior accordingly.

The labor market illustrated this two-steps-forward, one-step-back dynamic. Hiring exploded in July as the economy added more than a million new jobs, then slumped in August (366,000) and September (194,000).1 Growth in labor force participation stalled out. Women were disproportionately likely to stop seeking work, for reasons including support from government unemployment benefits and a COVID-related lack of childcare.

The U.S. Economic Surprise Index, which measures the degree to which the economy exceeds or falls short of forecasts, sank into negative territory in May for the first time since June 2020, and stayed there throughout the third quarter.

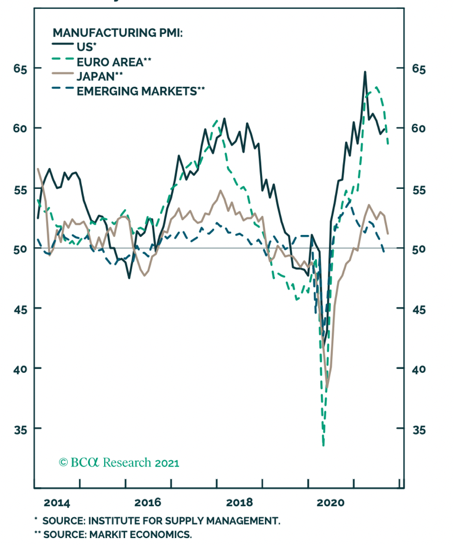

Although the economy decelerated, it continued to grow. GDP growth around the world moderated this year but remains much faster than it was prior to the pandemic. Those conditions show up in the Manufacturing Purchasing Managers Index (second chart below), which remains near long-term highs even after a drop in recent months.

GDP Growth vs. Trend

Manufacturing Remains Strong

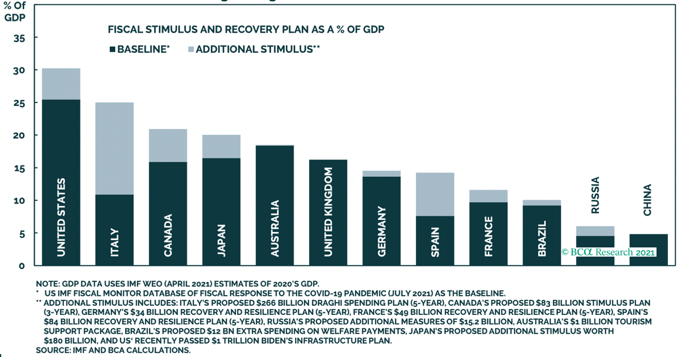

Ongoing fiscal stimulus helped keep the economy from stalling out late in the third quarter. U.S. fiscal spending amounted to more than 25% of GDP, with more on the way, and the combination of current and coming fiscal stimulus should continue boosting other major economies as well.

Fiscal Stimulus Continues to Boost Economies

This fiscal support continues to bolster household finances. Households in the United States and Europe had $2.7 trillion in excess savings as of mid October.2 Consumers’ strong cash position has helped pump up retail sales in recent months,3 while corporate earnings have come in even better than expected despite the impact of delta.

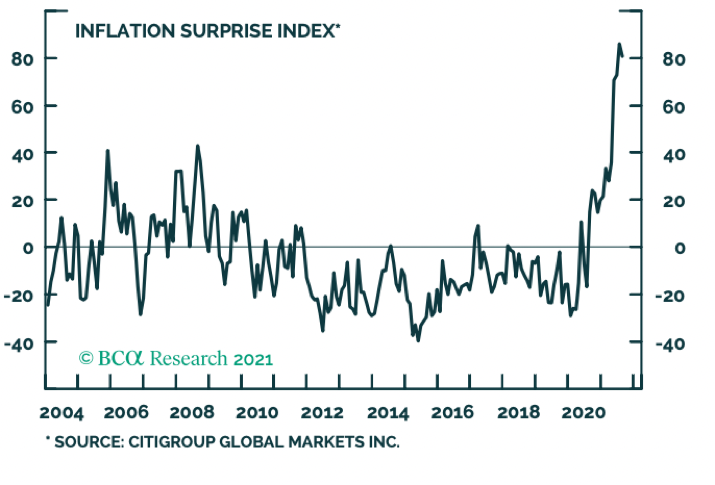

Meanwhile, pandemic-related supply chain bottlenecks and a tight labor market boosted inflation, which proved to be stickier and more broad-based than expected. A measure of core CPI that excludes pandemic-related items recently had its largest six-month increase in a decade, and wages increased by 4.6% during the 12 months through September.4 Developments like these suggest a significant increase in the risk that inflation will become more persistent and embedded in consumer and business decisions.

Inflation Keeps Exceeding Expectations

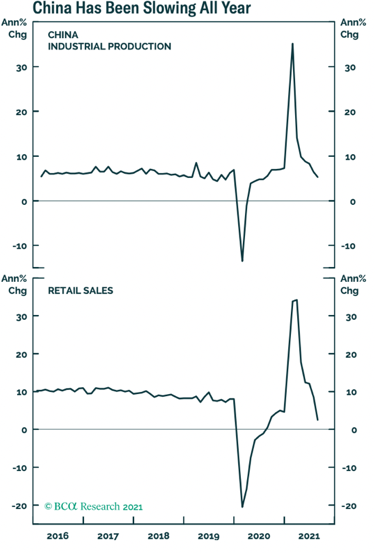

China’s economy also slowed. The country’s economic growth weakened throughout 2021, and late in the third quarter, investors got spooked by the possibility that Chinese real estate company Evergrande might default on its colossal debts. Chinese authorities have few good options, so the country’s economic deceleration looks likely to continue, potentially weighing on economies and companies that depend on demand from China.

Financial market indices appeared to take the economic crosscurrents in stride through early September. Equity indices moved steadily higher during the first eight months of the year, with the S&P 500 gaining more than 20% from January 1 through September 2. Stocks as measured by benchmark indices even got less expensive as the market rose, as booming earnings pulled down valuations.

Then in September the S&P 500 dropped 5.1%, ending the longest string of trading days without a 5% pullback since January 2018. (Pullbacks of 5% or more historically have happened roughly three times a year, on average.5)

The stock market’s apparent calm through August masked major changes beneath the surface. Prior to this spring, the market had broadened considerably as cyclicals rallied in anticipation of the economy’s reopening. But as the delta variant surged, market leadership reverted to a narrow group of growth stocks, and investors sold off cyclical sectors such as energy and financials. As of October 1, more than 90% of the S&P 500’s constituents and 98% of the Russell 2000’s had corrected at least 10% from their highs.6

Like the stock market, the bond markets stayed calm until the end of the quarter. The yield on the 10-year Treasury lingered in a tight band between about 1.2% and 1.4% until the last week of September, after which it shot up, passing 1.6% on October 8. The yield on the 30-year Treasury bond increased by almost a fifth between September 22 and October 8, reflecting increased concern about inflation.

OUTLOOK: THE FED’S JOB GETS HARDER

Since early summer, the world has gotten used to the idea that we’ll be living with COVID for the foreseeable future—that the endgame for the pandemic will be more like a dimmer than a light switch, and that new strains could present new challenges. That said, we see several reasons for optimism that the worst days of the pandemic are behind us.

In the United States, the seven-day averages for new cases and hospitalizations have fallen by more than 50% and 40%, respectively,7 as COVID continued to follow a poorly understood two-month cycle of expansion and contraction. The pace of vaccination reaccelerated; two-thirds of American adults are now fully vaccinated.8 The FDA looks likely to approve a vaccine for five-to-11-year-olds this fall or early winter, and new treatments such as Merck’s recently announced pill should help manage the virus. All these advances should help prevent future strains from disrupting the economy to the same degree as delta.

That said, it remains to be seen whether the U.S. economy can regain its momentum. Economic data and conditions currently are exceptionally noisy and difficult to interpret, and projections are all over the place. For example, the Atlanta Fed’s GDPNow forecast of third-quarter economic growth fell from more than 6% in July to just 2.3% in early October, but the Blue Chip consensus third-quarter GDP estimate increased from about 5% to nearly 6.5% over the past month.

Inflation clearly is a wild card. We continue to think inflation will trend higher, but high inflation may prove transitory. Pandemic-related bottlenecks have had an outsized impact on recent inflation jumps. For example, shipping container rates more than tripled this year,9 and that kind of rise is unlikely to happen again. But the transition may be uncomfortably long, and the risk of persistently higher inflation has increased considerably. The combination of hotter inflation with weaker economic growth raises fears of 1970s-like stagflation. We’re not in the stagflation camp, however. Key metrics such as productivity are in better shape than they were then, the economy continues to grow, and monetary policy is far more supportive to growth and inflation than it was in the 1970s.

The direction of monetary policy is another source of uncertainty. The Fed in September announced that it intends to begin tapering off its asset purchases in short order, likely before the end of the year, and expects to raise interest rates in 2022. Central bankers have repeatedly insisted they are willing to tolerate periods of relatively high inflation in pursuit of economic growth and job creation. Their assurances suggest that they’ll be slow to tighten, but if inflation continues to rise, the Fed may feel the need to change its tack and tighten sooner than expected. Speculation that Fed Chair Jerome Powell might not be reappointed complicates the issue further.

Politics confuses matters as well. Ongoing negotiations over raising the debt ceiling and spending on infrastructure and other pieces of the Biden agenda cloud the economic outlook—but successful resolutions to them could drive renewed growth. On a related note, big potential changes to the tax code introduce yet another source of uncertainty. Increases in the corporate tax rate and capital gains rates look likely, and could slow down transactions, economic activity and corporate earnings, but the details will be key.

Meanwhile, the world faces simultaneous energy crises in Europe, China, the United Kingdom and elsewhere. Oil prices increased more than 25% since late August, to more than $80 a barrel, while natural gas prices leaped more than 60%. High energy prices increase input costs and act as a tax on consumers, both of which weigh on the economy. In the past, this scenario might have led to greater energy output, increasing supply and bringing down prices, but pressure to cut carbon emissions has reduced companies’ and countries’ willingness to make the necessary investments.

How much high energy prices will hurt the economy is hard to say, however. Eighty-dollar oil isn’t as big a problem as it once was, in part because gasoline is a much smaller piece of consumer expenditures than it used to be. Fundstrat reports that oil would have to reach $252 per barrel to match the impact high prices had in 2008 and $110 to match oil prices’ impact in 2014. The challenge in discerning the impact only adds to the Fed’s degree of difficulty.

What does all this mean for the markets? The big question now is whether earnings growth and margins have peaked or if recent declines represent a pullback in a longer-running expansion—and no one knows the answer.

How it makes sense to respond as an investor depends on your time horizon:

If you have a short time horizon (less than one year)

Short-term equity market returns are effectively random, so stocks generally don’t make sense for money you’ll need in the next couple of years. That pillar of investing is as pertinent as ever, since the factors described above— the potential for higher inflation surprises, Fed tapering, higher taxes and negative political developments—may heighten the potential for a short-term investor to incur a permanent loss.

That said, poor performance isn’t a foregone conclusion. One positive sign: Retail investors have turned bearish. Only 40% of investors surveyed by Investor Intelligence recently described themselves as bullish, the lowest point since the early days of the pandemic. As we’ve mentioned in previous issues of this newsletter, investor sentiment historically has been a reasonably reliable contrarian indicator. It suggests a great deal of pessimism is already priced into the market, leaving room for positive surprises to pull the market higher. It’s possible to imagine a scenario in which inflation levels out, COVID continues to decline, the economy reopens further, profits climb and stocks enjoy a broad-based rally

If you have an intermediate time horizon (two to five years)

Although equity market returns are effectively random in the short term, returns over longer periods historically have been inversely correlated with starting valuations: Lower starting valuations tend to lead to higher returns over the next several years, and higher starting valuations have been associated with lower returns. With the S&P 500’s valuations high as of this writing, we do not expect the index to match its returns of the last several years. The challenges facing the economy reinforce those relatively low expectations.

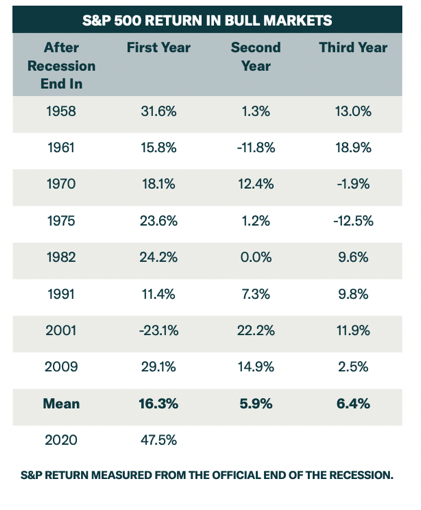

Moreover, S&P 500 returns historically have been lackluster in the second year of a bull market (see table below) and have tended to struggle during periods with high inflation surprises. And reining in big tech seems to be the one thing politicians of all stripes can agree on; it wouldn’t be surprising to see greater regulation undermine the stocks that currently are holding up market indices.

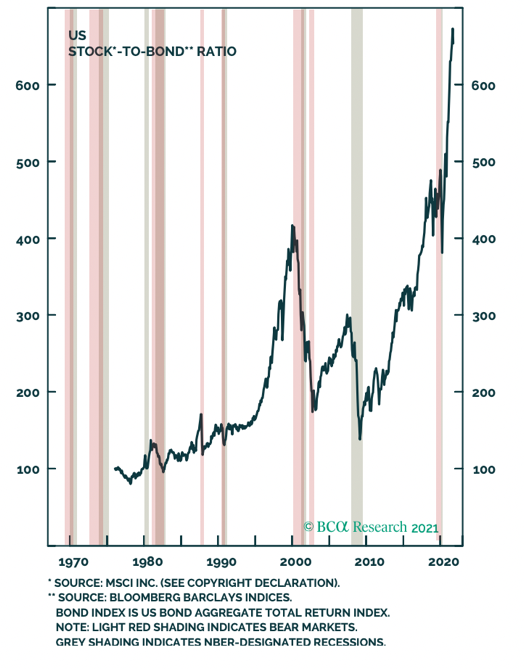

If you have a long time horizon

We believe investors allocating money for goals a decade or more in the future have no real alternative to equities’ long-term growth potential. Moving money to bonds is especially unattractive: Bonds historically tend to underperform equities when the economy isn’t entering or early in a recession, and bonds’ low interest rates raise the possibility of a negative return over the next 10 years.

Rather than move out of stocks, investors should consider maintaining a diversified portfolio and seek to rebalance into downturns to capture attractive entry points.

At LVW, we believe a disciplined investment and planning process is a key tenet of generating successful outcomes. Understanding your time horizon, risk tolerance and planning goals and marrying those with an integrated plan are essential when seeking to achieve long-term objectives.

POSITIONING: CHALLENGES CREATE OPPORTUNITIES

The current environment is exceptionally challenging for investors. We think that can be a good thing.

All the shifting variables discussed above—inflation, COVID, economic growth, monetary policy, energy prices and more—create a complex mosaic that investment managers must navigate. Challenging, complex environments distinguish winning companies from losing companies and widen the gap between them. These discrepancies create investment opportunities for managers with the skill and resources to capitalize on them.

We are looking to position our portfolios to invest with those managers we believe possess those skills and resources—managers that understand the ways the various swirling factors affect company earnings, balance sheets, competitive positions and prospects for the future, and that we believe can identify companies that have put themselves in a position to thrive going forward.

Discriminating managers in public equity markets now have a larger, better-stocked pond to fish in than they did a couple of years ago. The number of public companies has jumped, thanks to a surge in IPOs and SPACs, at the same time that Wall Street has reduced coverage of individual companies and fewer active managers are looking to find companies offering attractive value.10 In our opinion, the result is a less-efficient market in which more securities are likely to be mispriced, especially for companies at the smaller end of the market cap spectrum.

Many companies have had to restructure in the last two years. Certain of these companies may be emerging from bankruptcies or other restructurings stronger, with equity and credit prices that don’t yet reflect the improvements. Within this arena we may employ a restructuring-focused manager. That manager seeks to identify opportunities for financial and operational restructuring to support higher security prices, and currently sees potential in specific companies in aerospace, cosmetics, mining, power generation and other industries.

Private equity fundraising is expected to surpass $350 billion in 2021, and increased competition and low rates have pushed up the average EV/ EBITDA multiple. Our emphasis continues to be on smaller niche strategies, operating in the middle market where we believe pricing inefficiencies are more prevalent and the opportunity set is wider. Smaller transactions reduce the competitive pricing dynamics and, in our view, generally lead to more attractive entry points. Seasoned managers, particularly in the middle market, are limiting financial leverage and, in some cases, structuring preferred/creditlike structures and staying disciplined to their underwriting standards.

We believe real estate also presents numerous appealing investment possibilities for managers with sufficient skill, experience, resources and industry knowledge. The pandemic has reduced the value of many types of real estate in prime locations, including high-quality office buildings and hospitality facilities. Managers with the expertise to evaluate a variety of potential pandemic and economic scenarios effectively, and invest accordingly, may be presented with opportunities to invest at significant discounts.

At LVW Advisors, we are investors, not speculators or market timers. The mosaic of variables that makes up the investment environment today makes speculation or market timing an even greater folly than it usually is, in our opinion. But for real investors—those who use skill and insight as they seek to identify assets available for less than their true value—the complexity today means opportunity. We are committed to helping our clients seek to benefit from that opportunity in ways that suit their particular situations and needs. Thank you for your faith in us as we navigate this unprecedented time together.

LVW NEWS

Awards and Accolades

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, was ranked on the Forbes Top 250 Wealth Advisors list for the fourth consecutive year. This year, Forbes received more than 33,000 nominations for consideration. Lori ranked at No. 84 with $2.1 billion in LVW team assets under management.

View the full list of America’s Top Wealth Advisors here >

Click here for important disclosures regarding these awards.

Staying Current

On October 6, 2021, LVW Advisors CEO and Founder Lori Van Dusen, CIMA, had the exciting opportunity to host a webinar titled “Expert Perspectives on the Markets and a Washington Watch Update” with Liz Ann Sonders, Schwab’s Managing Director and Chief Investment Strategist, and Mike Townsend, Schwab’s Managing Director and resident Washington insider.

We hope all who attended the webinar found it very informative. Stay tuned for more upcoming LVW webinars!

In our latest video, Joseph Zappia, CIMA, CCO/Co-CIO, and Jonathan Thomas, CFP®, Private Wealth Advisor, discuss second-quarter asset class returns, the economic recovery and GDP growth projections, whether inflation is a concern, the overall outlook for equities and bonds, and the data surrounding generational wealth transfer to millennials.

Watch the Third Quarter State of the Markets video here >

On September 13, 2021, the House Ways and Means Committee unveiled a government-funding proposal involving a series of tax hikes and reforms. We have outlined a summary of the proposals that may affect individual taxpayers. If you have specific questions about potential tax implications, please contact your advisor.

Lori Van Dusen, CIMA, was recently elected as chair of the Monroe Community College Foundation Board of Directors.

Lori, a longtime Monroe Community College board member, donor and former chair of the Monroe Community College Board of Trustees, will now serve as chair of the foundation board for the next two years.

Community colleges offer individuals a first step toward a stable career and financial security.

Lori invites you to consider supporting your local community college. If you reside in New York State, you might be able to take advantage of the NYS Charitable Tax Credit program. Until November 30, 2021, qualified contributions made to the SUNY Impact Foundation and designated to a SUNY campus of the donor’s choice could receive an 85% NYS income tax credit. Gifts ranging from $10,000 to $100,000 qualify for the program. NYS has made only $10 million available to fund this program; you may want to consider acting before this funding runs out. As always, consult with your tax advisor to see if this program is right for you.

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog posts below.

History of Stocks Trading at 10x Sales >

Beyond the FAANGs: Tech-Savvy Companies in Non-Tech Sectors >

It’s a Good Time to Be a Borrower >

Employee News

Darian Saracevic joined the LVW team in September as our Research Associate.

Darian is a recent graduate of Northeastern University in Boston where he received a B.A. in Finance and Entrepreneurship with a minor in Mathematics. While at Northeastern, Darian completed co-ops with Congress Asset Management, a 60-person investment company focused on mutual funds across various equity strategies, and Windrose Advisors, a 25-person wealth advisory office.

Outside of work, Darian’s hobbies mostly focus on following and playing various sports including golf and volleyball.

Welcome, Darian!

In August, the team at LVW held a team building day where we learned to play pickleball, attended a workshop on emotional intelligence and enjoyed spending time together having dinner at Kettle Ridge Farm in Rochester, New York.

Newsletter Citations:

1 https://www.cnbc.com/2021/10/08/september-jobs-report.html.

2 Bloomberg, “$2.7 Trillion in Crisis Savings Stay Hoarded by Wary Consumers.”

3 https://messaging-custom-newsletters.nytimes.com/template/oakv2?campaign_id=9&emc=edit_nn_20211018&instance_id=43126&nl=themorning&productCode=NN®i_id=70374114&segment_id=71949&te=1&uri=nyt%3A%2F%2Fnewsletter%2F50755a24-5c75-5272-9a7daade8dae725b&user_id=e862c509b4b2e9b127c7d360f9889527.

4 https://www.nytimes.com/2021/10/13/business/economy/september-2021-cpi-inflation.html.

5 https://www.capitalgroup.com/advisor/ca/en/insights/content/articles/6-charts-that-explain-market-declines.html.

6 Schwab, October 2021.

7 New York Times COVID tracker.

8 New York Times COVID tracker.

9 BCA.

10 SEG.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.