Table of Contents

FIRST QUARTER MARKET SUMMARY

LESSONS FROM PAST BEARS

LVW NEWS

Our Thoughts on a Historic Quarter

We want to continue to wish you the best of health and share our thoughts about the evolving economic environment and financial markets. The spring issue of The Serious Investor reviews the historic events of the first quarter, including the coronavirus pandemic and the unprecedented fallout in the economy. We will outline how we’re investing in this changed landscape and the reasons for our approach. Our hope is that our insights and communication throughout the past few weeks have provided some reassurance.

Quick Take

- A health and economic crisis hit simultaneously in the first quarter.

- Leveraged investors sold assets furiously to raise cash in a liquidity-starved market.

- The equity market suffered its fastest bear market in history.

- In fixed income, high-grade assets sold off alongside lower-quality assets.

- The Federal Reserve acted quickly in an effort to head off a potential financial crisis, and Congress passed a huge stimulus package.

- Asset prices bounced in response to the stimulus and technical factors.

- Risks abound, and the markets could fall further.

- We are cautiously considering investments in equities and certain fixed-income sectors, and we are favoring active managers.

FIRST QUARTER MARKET SUMMARY

COVID-19: The Catalyst, Not the Cause

Let’s face it: No one predicted a pandemic as the catalyst for the next bear market and economic recession. Not us or anyone else.

Over the last two years we had become concerned that the market was approaching a tipping point. As we discussed at length in previous newsletters, the long period of easy money since 2009 had led to unsustainable risk-taking throughout the global financial markets. Famed economist Hyman Minsky once noted that market collapses are caused by reckless speculative activity that drives an unrealistic bullish period; in retrospect, it appears that the fourth quarter of 2019 may have been such a period.

Structural changes to the markets had increased risk. The rise of passive investments and algorithmic trading gave momentum enormous sway in the equity market. Meanwhile, the overregulation of the banking system led major banks to disappear as providers of liquidity, evidenced by repeated spikes in rates on repurchase agreements (repos) last fall. We wrote in our last newsletter, “Post-financial crisis regulations have changed the dynamics in the financial system in ways that the world is just beginning to appreciate; the Fed’s attempt to stabilize the repo market may just be one round in an ongoing game of financial system Whack-a-Mole.”

The catalysts for the bear market proved to be a black swan and an exogenous shock occurring simultaneously: The coronavirus disease (COVID-19) surged around the world at the same time that a price war between Saudi Arabia and Russia led to a historic collapse in oil prices, including a 30% decline in a single day.1 While those events provided the spark, we do not believe they were the cause of the bear market. The cause was the liquidity bottlenecks noted above, combined with high valuations and excessive leverage.

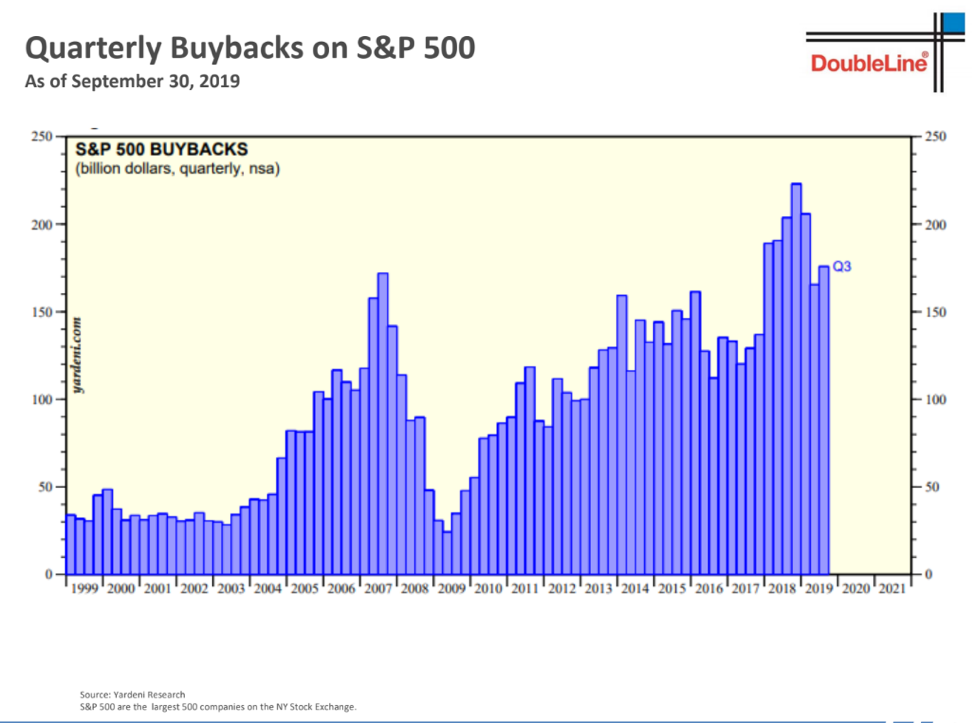

The last two factors were closely related. For years, corporations throughout the economy had spent cash and taken on debt to buy back stock. To give an extreme and timely example, airlines in recent years spent more than 90% of their free cash flow to purchase their own shares.2 These moves propped up many companies’ share prices, while leaving their balance sheets weak and highly leveraged.

These conditions created a perfect storm. At the end of February, we had the quickest-descending markets of all time, driven by hedge funds bringing in exposures and systematic sellers de-risking. After that, we saw violent oscillation caused by a collapse of liquidity. Market-wide circuit breakers had been engaged just once since the Securities and Exchange Commission introduced them more than 30 years ago; they were triggered four times in March.3

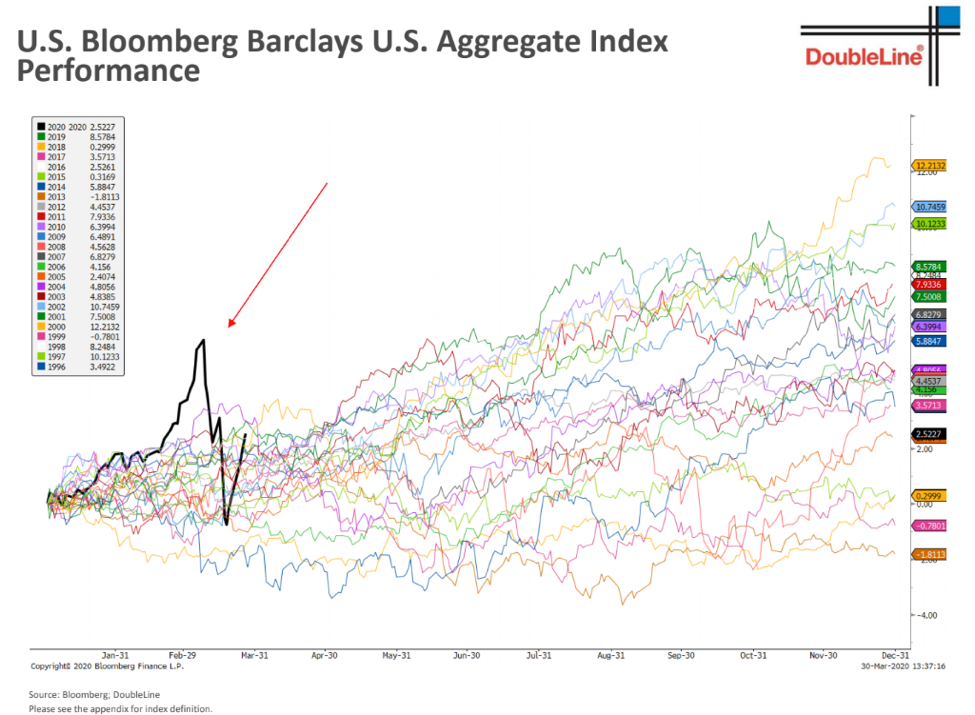

Even the high-grade fixed-income market suffered (see chart below), as forced sellers unloaded their most liquid positions. The liquidity crunch got so severe that bid/offer spreads on U.S. Treasuries reached the unheard-of level of 100 basis points, which effectively froze the rest of the bond markets.

Deleveraging investors sold off securities of cash-rich, blue chip market leaders to raise funds, not because of fundamental problems with the issuers. According to Morgan Stanley, those investors have mostly completed their selling, and in the company’s words, “it’s hard to imagine the kind of liquidation that we just witnessed in March could happen again from these much lower levels of leverage.” Meanwhile, the Fed’s unprecedented support should buttress the investment-grade market.

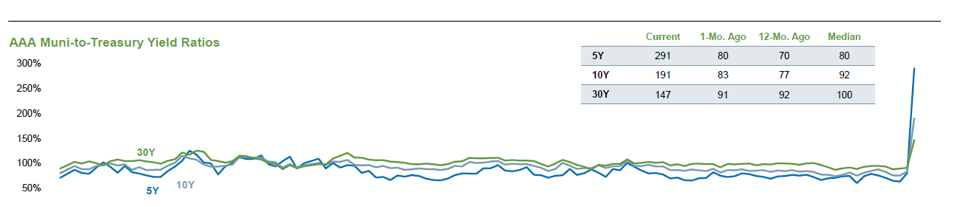

Similar dynamics played out among municipal bonds. Forced selling of the highest-quality munis pushed their yield spreads over Treasuries from negligible to 300 basis points (see chart below). A municipal bond manager recently noted that it had been reconsidering positions where they identified risk of revenue declines—largely bonds backed by travel-related revenues from sources such as hotel occupancy taxes, convention centers and airports. The manager noted that it is favoring securities it believes are backed by more reliable revenues and stronger balance sheets. As of this writing, the Fed’s intervention has helped the muni markets reverse at least 60% of the slide incurred between mid-February and mid-March.

![]()

Meanwhile, coronavirus containment measures brought parts of the economy to a halt (see chart below). The Wall Street Journal reported that eight in 10 U.S. counties, representing nearly 96% of economic output, were under lockdown orders as of early April, and that daily output had fallen by 29% since the first week of March.4 Economists at major banks projected that GDP would fall as much as 30% in the second quarter.5

LESSONS FROM PAST BEARS

Our senior investment professionals have experienced six recessionary bear markets since 1987. We have learned some essential lessons.

You manage bear markets before they happen, not just during them. No one knows when a bear market will start, so we are always vigilant about risk. We stress-test frequently, especially during periods of prosperity, and seek to take defensive positions when we deem them appropriate. One reason we stay watchful of risk is to avoid forced sales. Avoiding forced sales is a key to long-term investment success: Having to sell quality assets at depressed levels undermines potential long-term returns, whereas being in a position to play offense and invest in a liquidity-starved market can provide valuable opportunities for the disciplined investor.

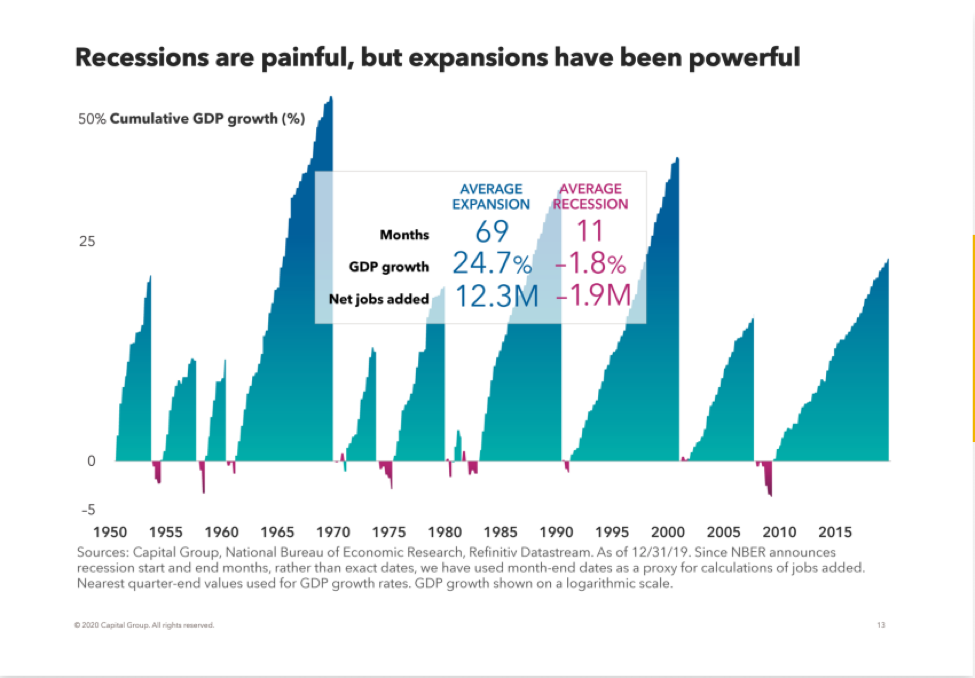

During a bear market, focus on probabilities rather than possibilities. All bear markets are frightening and confusing, and while they’re happening, the future is always opaque. At times during the days after 9/11, or after Lehman Brothers collapsed, the worst possible outcomes felt inevitable. Yet in those cases and countless others, people figured out a way forward and our society, economy and markets eventually recovered. Bear markets end with recessions; they do not begin with them.

We ground ourselves by focusing not on what may be possible, but on what appears most probable based on the facts we know and on lessons from history. Focusing on probabilities, not possibilities, helps us develop worst-case, base-case and best-case scenarios. This practice assists us in making decisions in a difficult environment in which there’s little short-term clarity. We continually evaluate and reevaluate our thinking as more material facts are known.

Our Investment Committee has been meeting daily since February to conduct these exercises. At the same time, Senior Partner Richard Van Kuren has led a group working to understand the trajectory and potential outcomes of the pandemic, much as meteorologists might track the path and scale of a hurricane.

What we think we know

Based on what we know about the current situation and lessons from history, we think the most probable outcomes are:

- The longer the outbreak lasts, the greater the devastation.

- It will take longer for the economy to get back to full speed than many people realize, and certainly longer than the time it took to stop it.

- As horrible as conditions are, they will improve eventually. How quickly health conditions improve may make the difference between the best-case and worst-case scenarios for the economy and markets.

- We are in a recession, and at this point, economists can only guess at its scale. Our base-case scenario assumes that parts of the economy will begin to reopen in the second quarter. Our bear-case is the economic shutdown extends into the fall.

- Large downside risks remain. Considering the magnitude of the economic stop—and the fact that when the market falls 30% in recession, earnings typically fall about 17%6— there may be significantly more bad news for the market to digest. Bear markets typically retest their lows and sometimes break through them. We would not be surprised to see equity markets potentially fall further before they recover.

- Our world eventually will figure out how to live with the coronavirus and how to get our economy back on its feet. The unprecedented intervention by the Federal Reserve, including cutting rates to zero and implementing $1.5 trillion in quantitative easing, has helped stabilize the financial system.

- The traditional banking system is much better capitalized than it typically is in recession, and the $2.2 trillion fiscal stimulus (with more likely to come) is intended to repair the economic damage. It remains to be seen how expeditious and effective this intervention will be in stopping the economy’s descent.

- The markets are forward-looking and as such will anticipate any inflection in the economy.

Taking a broader view of past bear markets helps inform our thinking about what outcomes are most probable from here. On average, in past recessionary bear markets:

- The S&P 500 fell roughly 30%.7

- The bear market lasted about a year.8

- The stock market tended to bottom about two months before the recession officially ended.9

Equity market declines in February and March were in line with both average and median peak-to-trough losses in historical bear markets. While historical performance may not be a guide to future performance, based on historical precedent and math, there may be more upside than downside over the coming years. On the other hand, stocks bounced dramatically off their March lows, and as of April 6 were down less than 20% since February 1910—a peak that in our estimation was characterized by very high valuations and complacency at the end of an 11-year bull market. There will likely be more bad news to come, and stocks may fall considerably in the short term.

What will the post-coronavirus environment look like?

When the economy and markets do recover, they will be changed. Every recessionary bear market alters the playing field. This one may mark an especially powerful paradigm shift, considering the ways that the coronavirus and measures taken to mitigate it have reordered people’s daily lives throughout the world.

Certain industries, businesses and innovations will benefit from the new landscape. For example, one of our managers is exploring firms involved with telemedicine and robotic surgery, which have grown in use as a result of the shutdown. Other industries and businesses, such as airlines and parts of commercial real estate, seem likely to struggle.

Likewise, certain geographic markets will recover more quickly and powerfully than others. We and our investment managers are working to determine which shifts are fundamental and long term, and the implications those changes have for portfolios. Some of the trends we see emerging post-crisis:

- A fundamental change in the way people conduct business, with less travel and better use of technology

- More fiscal spending and larger deficits

- Higher taxes, including a potential rollback of the corporate tax cut

- Changes to supply chains, with domestic manufacturing mandated by the government in certain cases

- Fewer corporate share buybacks

Actions we are taking

Considering the myriad uncertainties and the likelihood that the coronavirus damage will unfold over several months, we believe prudence and caution are wiser than aggressive opportunity-seeking. Over the last 30 days, equity markets have exhibited historically high levels of volatility, with average market moves of more than 4.8% per day.11 This kind of volatility would require any investment manager to move quickly when considering adding or reducing positions.

We approach investing through a crisis like flying a plane through trouble. You can’t do everything at once, so you prioritize. First, you adjust your airspeed: We have reviewed defensive investment types as we seek to ensure safety for our client accounts.

Next, you try to regain stability and lift. We have done a thorough review of the investments we employ for client accounts and have expected the investment managers we use to do the same. At the same time, we have worked to get a 360-degree view of the current environment through ongoing conversations with professionals throughout our extensive network of research providers, investment managers and clients.

We have continued to review equities and seek opportunities as prices have fallen, seeking investments where we believe the upside potential far outweighs the downside risk. We also continue to favor skilled managers who we believe can identify opportunities to invest in high-quality assets while they trade below their intrinsic value. We expect that there will be a great deal of restructuring coming out of this economic stop, and it is our opinion those conditions will create opportunities for managers who truly understand balance sheets. Financially strong market leaders historically have tended to take market share from secondary competitors during economic downturns and emerge in stronger competitive positions.

We will continue to seek opportunities in the equity markets. One of the good things about bear markets is that they make stocks cheaper. As Warren Buffett always says: “Stocks are the only things that people never buy when they go on sale.”

Many investors want to wait until conditions clear before they rebalance into lower-priced assets—they think they can take their time. History says otherwise. No one knows when markets will recover. As Howard Marks has said, “The ‘bottom’ is the day before the recovery begins. Thus, it is impossible to know when the bottom has been reached…ever. We reject the notion of waiting for the bottom; we buy when we can access value cheap.”

Source: Ritholtz Wealth Management

Financial markets rarely become as dislocated as they did over the past month. We believe those developments created the conditions to find potentially excellent investment opportunities, and further dislocations will as well. We believe that the decrease in prices has increased potential long-term returns, despite the likelihood of greater turbulence in the near term.

Shelby Davis once said, “You make most of your money in a bear market; you just don’t realize it at the time.” We believe that Davis’ assertion is true, but only for investors who are disciplined: those who manage for bear markets throughout the cycle and who have both the courage of their convictions and the liquidity to invest.

Thank you for your trust in us. We take the responsibility of managing your assets with the utmost seriousness, especially at times like these. Please reach out to us with any questions or concerns.

A note to our valued clients and partners

Amid the coronavirus pandemic, there has been an increase in coronavirus-related scam calls, emails and social media posts.

Here are some tips from the Federal Trade Commission to avoid coronavirus scams:

- Don’t respond to texts, emails or calls about checks from the government. As long as you filed taxes for 2018 or 2019, you do not need to do anything to receive the stimulus relief check. To set up direct deposit, communicate only with the IRS.

- Ignore online offers for vaccinations and home test kits. There are no products proven to treat COVID-19 at this time.

- Hang up on robocalls. Scammers will use robocall techniques to pitch everything from insurance to work-at-home opportunities.

- Watch for emails claiming to be from the Centers for Disease Control or World Health Organization. Use websites like coronavirus.gov or usa.gov/coronavirus to get the latest information.

- Vet charities before donating. Never donate in cash or by wiring money. Do your research before providing account information or credit card numbers.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO, was recently recognized as one of seven women selected for the Rochester Business Journal’s Circle of Excellence. The Circle of Excellence is a special group of women leaders identified by the publication as the women who other women want to emulate, the women who have broken the glass ceiling and the women whose success has impacted the next generation. These leaders have shown other women and the Rochester community that anything is possible.

Lori Van Dusen, CIMA, Founder and CEO, and Joseph Zappia, CIMA, CCO/Co-CIO, hosted a “Market Update” call on March 27 for all clients and partners. On the call, Lori and Joe provided a market recap, discussed LVW’s response and answered client-submitted questions. Listen to a recording of the call >

Lori Van Dusen, CIMA, Founder and CEO, spoke at the 2020 Forbes | SHOOK Top Advisor Summit in Las Vegas late February. Lori spoke on the panel, “How to Service a New $10MM Client,” and focused on the necessity to understand the psychology of a client, time horizon and cash needs. She provided examples of investment approaches for two different client sets: a business owner monetizing their business and a next-generation/millennial client.

Forbes interviewed Lori Van Dusen, CIMA, Founder and CEO, in early March about the market sell-off and coronavirus impact. In the article, titled “Here’s The Money Advice Top Wealth Managers Are Giving Their Wealthy Clients Right Now” Lori reinforces the LVW team’s position that they have been preparing for a drop in the market for over a year and are confident there will be buying opportunities going forward. Read the full article >

Lori Van Dusen, CIMA, Founder and CEO, was recognized for the second year in a row as No. 3 in Forbes’ Best-in-State Wealth Advisors ranking. Forbes received 32,000 nominations for the Best-In-State ranking. After research and thorough interviews, Forbes featured 4,000 top advisors across the country in its 2020 Best-In-State list. Click here for important disclosures regarding this ranking.

Joseph Zappia, CIMA, CCO/Co-CIO, attended RIA Institute’s Senior Delegates Roundtable on January 15. Joe was a panelist for the session, “Inside the Mind of the Advisor: What Every Asset Manager Should Know,” and discussed how top firms best utilize the resources of asset managers.

Employee News

Jonathan Thomas, CFP®, joined LVW as a Private Wealth Advisor. Jonathan graduated from the University of Pittsburgh and has previous experience at PNC Wealth Management and an RIA based in Pittsburgh. Jonathan enjoys spending time with his wife and young son, playing paddle tennis and golf, and volunteering with the local Rotary Club.

Welcome, Jonathan!

LVW welcomed Molly Breen as the new Compliance Manager. Molly recently relocated to Rochester with her family after living in Connecticut for 10 years. Molly has a breadth of experience in both operations and compliance. She most recently served as the chief compliance officer of a mid-sized RIA firm.

Molly and her husband have three little boys, ages 2, 3 and 6, who consume most of their free time.

Welcome, Molly!

Kaylee Glidden joined LVW as a Client Operations Specialist. Kaylee is a Rochester native and has spent the last five years as a client services associate. Kaylee and her husband have three rescue dogs, and she spends her spare time volunteering at a dog shelter. Kaylee is also a huge Buffalo Bills fan.

Welcome, Kaylee!

Conner Boillat, CFP®, Private Wealth Advisor, took his 10th annual Young Life mission trip to El Salvador in late February. This year, the group’s primary undertaking was the construction of a home for a single mother and her family in Taura. They also created a plan to build a greenhouse for the Rancho Grande community. Additionally, the group spent time building relationships with locals, running clinics and providing clothes and other items to families.

We’re proud of Conner’s involvement in making a difference in El Salvador.

Paul Salvetti, CFA®, Institutional Consultant and Manager of Research, and his wife welcomed their baby girl, Alexandra, into the world in early February. Congratulations to Paul and his family!

Newsletter Citations:

1 Bloomberg. WTI Ended Friday 3/6 at a price of $41.50. Opened Monday 3/9 at $28.66, a decline of 30.94%.

2 Bloomberg: https://www.bloomberg.com/news/articles/2020-03-16/u-s-airlines-spent-96-of-free-cash-flow-on-buybacks-chart.

3 Reuters: https://graphics.reuters.com/USA-MARKETS/0100B5L144C/index.html

4 The Wall Street Journal: https://www.wsj.com/articles/state-coronavirus-shutdowns-have-taken-29-of-u-s-economy-offline-11586079001

5 Bloomberg.

6 JP Morgan: https://am.jpmorgan.com/us/en/asset-management/gim/adv/what-will-earnings-recession-look-like.

7 CNBC: https://www.cnbc.com/2020/03/23/this-was-the-fastest-30percent-stock-market-decline-ever.html.

8 Bloomberg.

9 JPMorgan.

10 Based on TRA analysis in Bloomberg.

11 Bespoke Investment Group.

Disclaimer: This report is provided for informational purposes only. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.

Rochester Business Journal Circle of Excellence Honorees

The Rochester Business Journal Women of Excellence awards recognize high-achieving women for their professional experience, community involvement, leadership and sustained commitment to mentoring. Winners were selected by a panel of judges comprised of previous Circle of Excellence and Women of Excellence honorees. The Circle of Excellence recognizes women of longstanding, notable success in the community who are leading the way for other women. These honorees were selected by Rochester Business Journal editors.

Awards and recognitions by unaffiliated publications should not be construed by a client or prospective client as a guarantee that the client will experience a certain level of results; nor should they be construed as a current or past endorsement of the investment adviser or its representatives. Rankings published by magazines and others are generally based on information prepared and/or submitted by the recognized adviser.