Table of Contents

FIRST QUARTER MARKET SUMMARY

ECONOMIC OUTLOOK

MARKET OUTLOOK

POSITIONING

LVW NEWS

Welcome to the spring issue of The Serious Investor. This installment of our quarterly newsletter addresses the likelihood of a coming economic boom, higher inflation and rising interest rates—and what we think they all mean for investors.

Quick Take:

-

Accelerating vaccinations should allow the economy to reopen fully later this year.

-

Fiscal policy and pent-up consumer demand could drive powerful economic growth.

-

Inflation is likely to rise considerably, but the increase may be transitory.

-

High valuations reduce equity benchmarks’ long-term return potential and could contribute to greater volatility.

-

We favor active managers who can seek out underappreciated assets and work to capitalize on market fluctuations.

FIRST QUARTER MARKET SUMMARY

The likelihood of a powerful economic rebound to come pushed stocks higher during the first three months of 2021, with speculation abounding in many parts of the markets. Meanwhile, fears about inflation and interest rates led to a major sell-off in bonds and a correction in technology and related stocks.

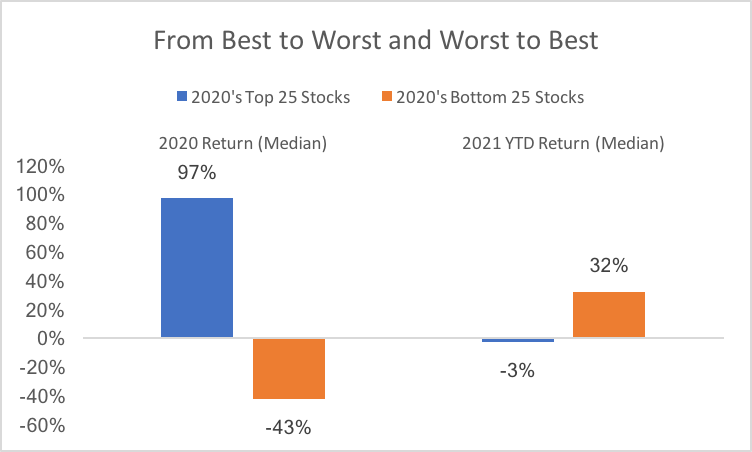

Growing investor optimism fueled a “great rotation,” continuing a trend that began in November. The types of cyclical, COVID-exposed stocks that suffered for most of 2020 led the market, while former leaders lagged.

Source: 2020 and YTD returns for the 25 best-performing stocks in the S&P 500 in 2020. YTD data as of 3/26/21. Source: Charlie Bilello, Compound Advisors Blog, 4/3/21.

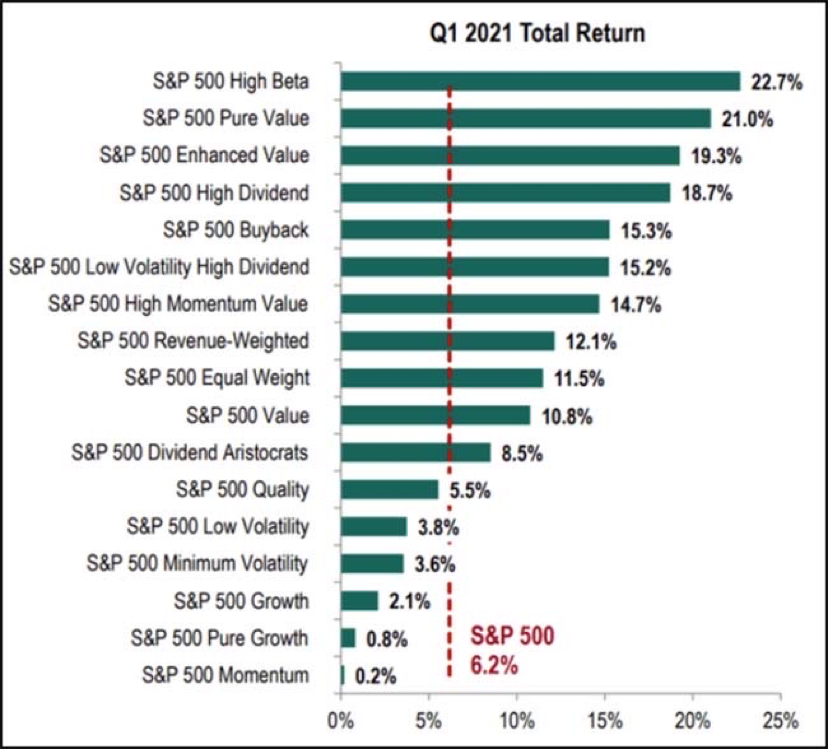

The S&P 500 posted a total return of 6.2% for the quarter, while small caps measured by the Russell 2000 more than doubled that gain. International markets also posted strong returns, with the MSCI World ex-US Index rising 4.9%. It was hard not to have a positive return in stocks during the first quarter. One exception was the economic shutdown’s big winners, enterprise software companies, which fell 25% peak to trough during the first three months of the year.

Source: S&P Global Market Intelligence via 361 Capital, 4/6/21.

The outlook for the pandemic hinged on a race between vaccinations and the spread of new, more-contagious variants of the coronavirus. Vaccination appeared to be winning the race in the United States, the United Kingdom and a handful of other countries. In the United States, the rollout accelerated quickly from fewer than one million shots a day in January to an average of more than three million at the end of the quarter, with a four-million-shot average within reach. Vaccination campaigns were less successful elsewhere in the world, particularly in continental Europe and many emerging markets.

Fiscal spending introduced another game-changing development. U.S. lawmakers passed a $1.9 trillion stimulus and recovery measure; the Organisation for Economic Co-operation and Development (OECD) estimates that in its first 12 months this package alone will boost U.S. GDP by nearly three percentage points and global GDP by a full point.1 The Biden administration in late March also unveiled a more than $2 trillion infrastructure bill, which included a proposal to raise corporate tax rates from 21% to 28%.

The prospect of renewed consumer demand, large government spending and easy monetary policy led to renewed expectations for inflation. As of March 31, the bond market priced in annual inflation above 2.5% over the next five years, up from 1.95% at the end of 2020.2 The likelihood of rising prices led a rout in the bond market. The yield on the 10-year Treasury jumped 0.8 of a point, the third-biggest single-quarter increase in the last decade.

Speculation bubbled over in many parts of the market, including so-called “meme stocks” like GameStop, cryptocurrencies, non-fungible tokens (NFTs), collectibles and special-purpose acquisition companies (SPACs), which are shell companies that go public with the stated intention to buy a promising private firm or firms later. Starwood Capital Group runs several SPACs; founder and CEO Barry Sternlicht in late March had this to say about the boom:

We lost several companies a couple of weeks before—one in particular where we wanted to do 60-day due diligence and the competitor said they’d do three-day due diligence … [That means] you check the letterhead and find if the company exists. It’s a lot out of control … Everyone is doing a SPAC because if Wall Street can sell it, they’ll sell it.

In another example of late-cycle froth, over-levered family office Archegos Capital—run by Bill Hwang, former manager of Tiger Asia, where he was subject to an SEC insider trading action—was forced to liquidate $20 billion worth of positions virtually overnight in late March. JP Morgan analysts estimate Wall Street companies could wind up losing $10 billion.3

ECONOMIC OUTLOOK: EXPECT GROWTH AND INFLATION

We expect the economy to stage a robust recovery this year. GDP, earnings and revenue growth could be substantial, and many industries may see levels of demand not seen in decades. Inflation will increase, but it’s not clear whether rising prices will prove to be a blip or a trend.

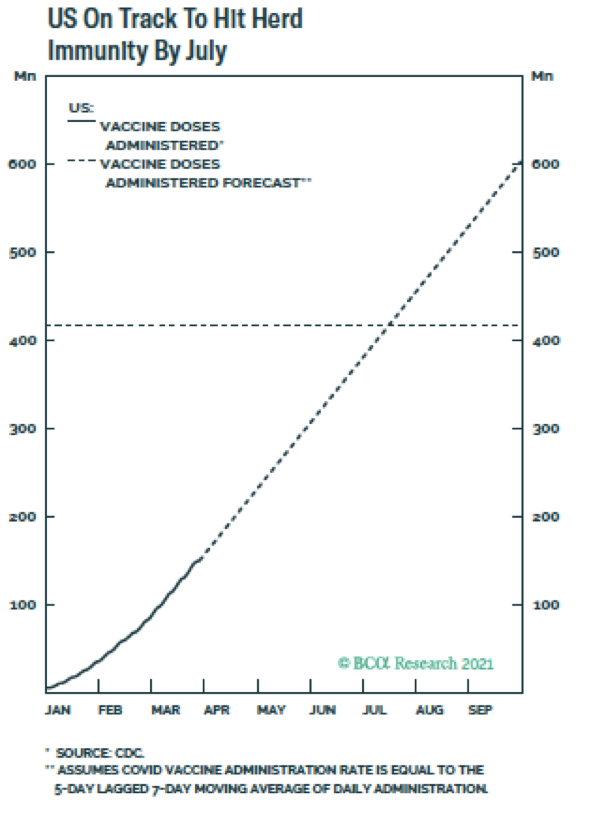

The surge in COVID-19 inoculations could help the United States reach herd immunity by mid-summer.

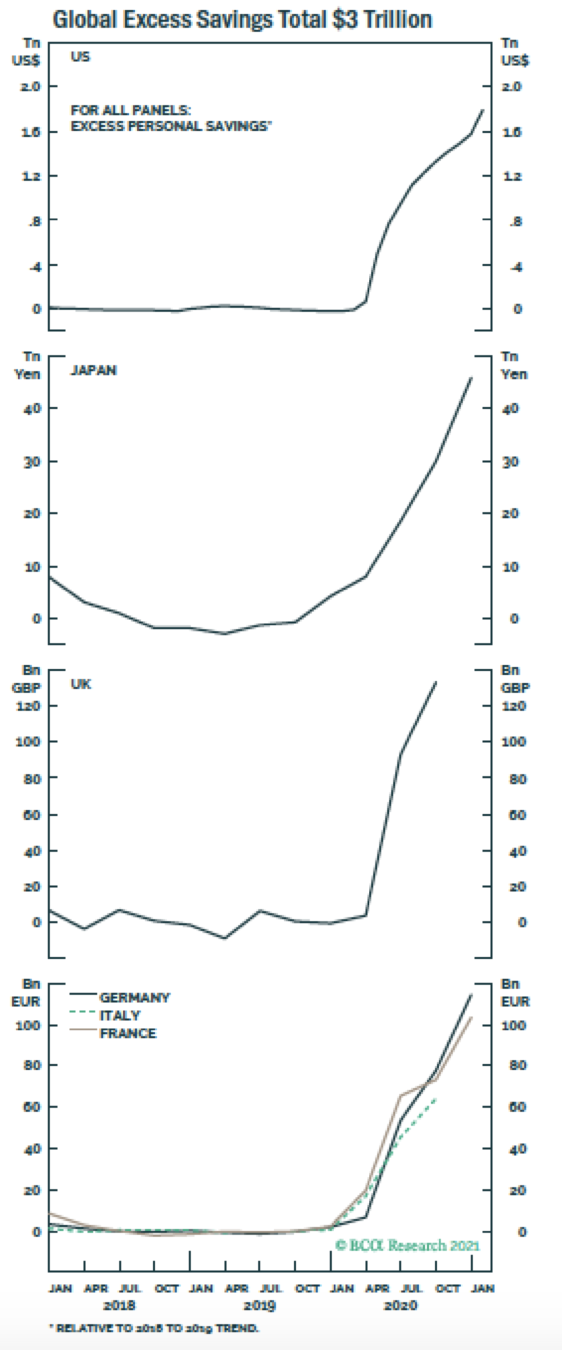

Achieving herd immunity would allow the economy to reopen fully, releasing pent-up consumer demand. And consumers have trillions of dollars of cash on hand, thanks to government programs and pandemic restrictions that curtailed spending.

Source: BCA.

The resultant spending, government expenditures and easy monetary policy create the conditions for a possible generational surge in economic growth. The OECD projects 6.5% U.S. GDP growth this year,4 which would make 2021 the fastest calendar-year expansion since 1984.

Inflation could come hot on its heels, as burgeoning demand clashes with messy global supply chains.5 Annual growth in the Core Producer Price Final Demand Index, which tends to lead consumer prices, recently jumped to a one-year rate of 2.5%, up more than two points since mid-2020. Meanwhile, the ISM Manufacturing Purchasing Managers Index (below) jumped to its highest point since the early 1980s.6

Source: The Daily Shot via 361 Capital, 4/6/21.

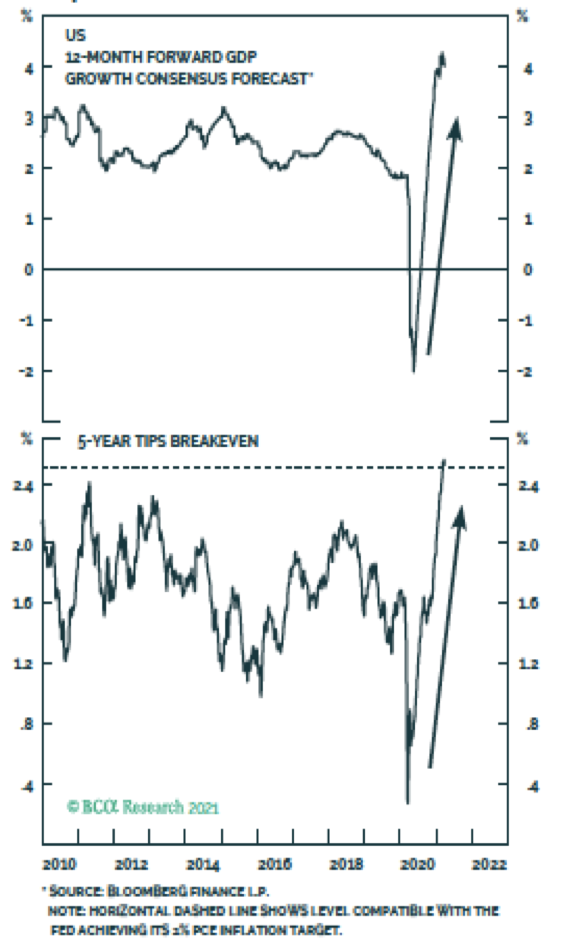

Growth and inflation expectations skyrocket

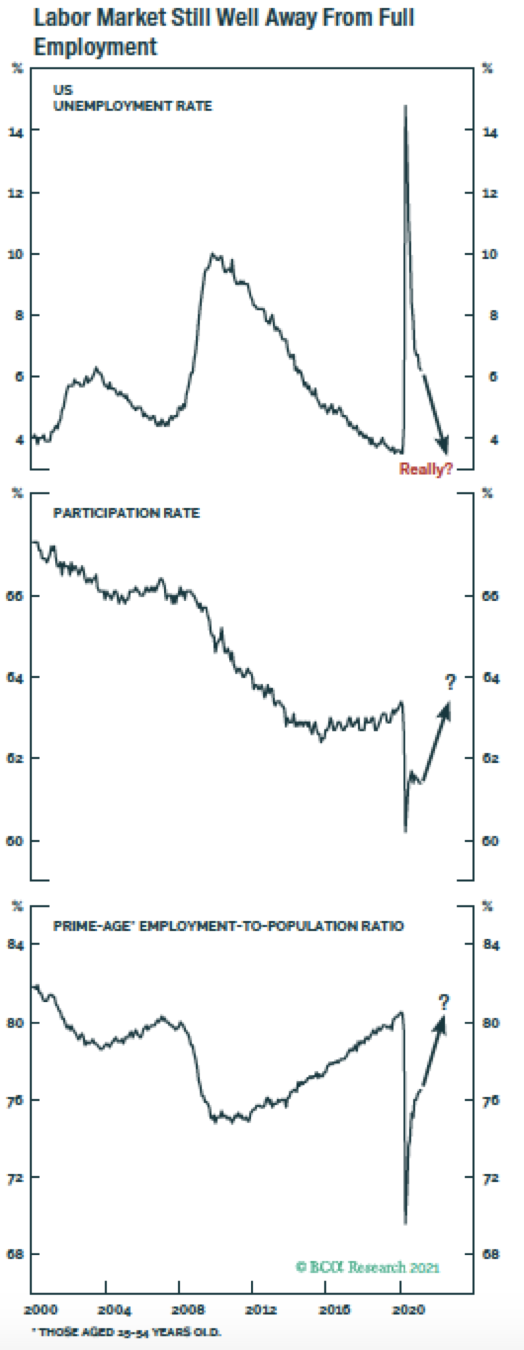

Will a rise in U.S. inflation be transitory or longer-term? The key may be the labor market. For now, the job market and wages remain relatively weak, holding down the kinds of wage pressures that historically have been necessary for inflation to take hold. The nature of the economic shutdown and subsequent reopening may cause labor cost increases to lag other components of the Consumer Price Index, potentially creating a challenge for the Federal Reserve and the economy.

In the past, the Fed typically has tried to fend off rising inflation proactively by raising interest rates. Many economic indicators are in the territory where policymakers historically would start tightening and increasing rates. But after central banks around the world have spent more than a decade struggling to fight off deflation, they have decided to let economies run hot. They appear to be taking the position that the best way to address the world’s enormous debt may be to inflate our way out of it, reducing its real future cost.

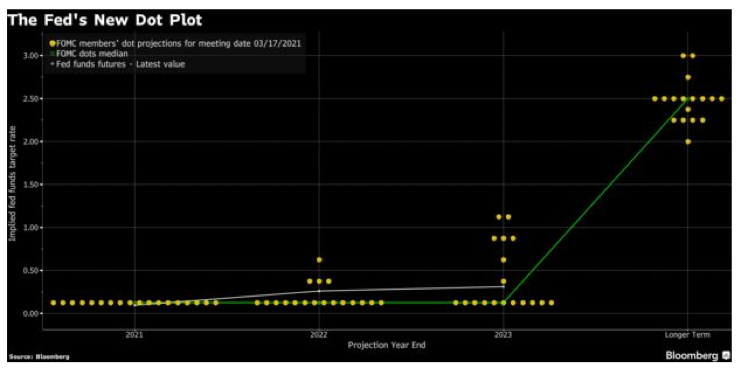

Chair Jerome Powell has made it abundantly clear that the Fed will not increase interest rates until the United States reaches maximum employment and inflation reaches 2% and looks likely to stay there for some time.7 That probably won’t happen until 2023 at the earliest. That said, not all Federal Open Market Committee (FOMC) members agree. The Fed’s New Dot Plot shows that four FOMC members expect a rate hike in 2022, with seven projecting the first increase in 2023.

Many economists are comparing the current environment to the early 1970s. We think it also makes sense to compare today’s environment to the post- World War II era. Like WWII, COVID-19 affected the entire world, and today’s policy and monetary stimulus are similar in size to that post-war stimulus.

Post-WWII policy combined with the release of pent-up demand to produce a subsequent economic boom. During the 1950s, dubbed capitalism’s golden period, GDP grew at an annual rate of more than 6%, interest rates stayed between 3% and 5%, and the S&P 500 produced an annualized total return of 19.3%. The next decade, the index’s annualized return was 7.7%.8 It wasn’t until the 1970s that the Vietnam War, the Middle East Oil Crisis and several policy errors contributed to a shrinking economy, high inflation and weak equity returns.

While history is not always a guide to how the future will unfold, we think it makes sense to understand previous periods that have similarities to today. This perspective tells us that it might be a mistake to assume that transitory post-COVID inflation will necessarily lead to secular inflation that is debilitating to the economy. History suggests that it is unexpected inflationary shocks that are most damaging to financial markets, not the kind of globally synchronized inflationary policies we are seeing now. It’s even possible that the current stimulus could finally move our economy out of secular stagnation.

MARKET OUTLOOK: HIGH VALUATIONS AND ROSY EXPECTATIONS PRESENT RISK

Conditions in the economy look positive for equities and other risk assets. That said, stocks are priced for great news.

In the near term, the big question is whether the robust earnings outlook will be enough to offset the negative impact of higher taxes and interest rates on stocks’ high valuations. Profits are expected to surge, with analysts projecting 25.9% earnings growth this year. If they’re right, 2021 would have the fastest earnings growth since 2010.9

Higher taxes could reduce future profits, however. Rosenberg Research finds that raising the corporate tax rate to 28% from its current 21%, as President Biden proposes, would reduce next year’s S&P 500 earnings estimate by almost 10%. (The reduction would be roughly 5% if lawmakers compromise at a rate of 25%, which is favored by swing-vote Senator Joe Manchin.)

Interest rates are the wild card. Low current rates make debt service inexpensive for governments, corporations and consumers. We don’t expect rates to rise steeply from here, but they might. Higher rates on their own wouldn’t necessarily be bad news for the stock market; in fact, historically, equities have gained ground during periods of rising rates.10 What’s more, long-term Treasury yields well below nominal GDP growth suggest that rates might have to rise quite a bit higher before damaging the economic recovery. Nonetheless, expectations for significant rate increases would weigh on stock valuations, potentially hindering equity market returns.

All that said, we don’t put much stock in short-term projections for interest rates or stock prices. We consider these factors mainly to try to understand the risks built into the markets. The current setup suggests higher volatility.

Investors’ base-case scenario looks very optimistic. The AAII Investor Sentiment Index recently registered about 50% bullish and less than 25% bearish, compared to historical averages of 38% and 30%, respectively.11 Any bad news—on interest rates, inflation, taxes, COVID-19, geopolitics or myriad other factors—could cause investors to question their assumptions and sell.

We urge investors to remember one of the central lessons of 2020: The market is not the economy.12 Stocks often climb when the economy is bleak and fall when the economy is booming. In fact, research by BNY Mellon finds that stock market returns have had almost zero correlation to the current quarter’s GDP growth and only a very slight (0.33) correlation to GDP growth in the following quarter.13 In other words, investing based purely on economic expectations for the next six months has historically been a fool’s errand.

We focus on the long term, which leads us to the following observations:

- Valuations are high. The S&P 500’s P/E ratio looks steep but not extravagant at 23 times projected 2021 earnings.14 But the Shiller P/E ratio, which adjusts for inflation and economic cycles, recently passed 36, reaching its highest level outside of the dot-com boom.15

- Historically, the market has produced lower long-term returns following periods of higher valuations. (See charts below.)

- The S&P 500’s current valuation implies annual returns of around 2% to 3% for the benchmark over the next decade.

Source: FactSet, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management

Source: FactSet, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management

Returns are 12-month and 60-month annualized total returns, measured monthly, beginning February 29, 1996. R² represents the percent of total variation in total returns that can be explained by forward P/E ratios.

Long-term returns don’t move in a straight line, of course. Disciplined rebalancing may help capture relatively low valuations presented during market dips. And the likelihood of subdued returns for the overall market doesn’t mean all stocks will suffer.

Aspects of the current environment seem to rhyme with 2000. That year marked the end of a growth-powered bull market that had caused cap-weighted indices to develop extreme concentrations in relatively few stocks. A subsequent rotation out of growth giants and into small, value and international stocks dragged down returns of broad-market indices and boosted other types of equities. While the Russell 1000 returned -0.46%, annualized, between 2000 and 2005, the small-cap Russell 2000 Value Index gained more than 15%, the energy sector returned above 12% and financials rose more than 7% (all returns annualized).16

It wouldn’t be surprising to see something similar happen this time around. Rosenberg Research observed recently that the pattern of relative returns between the Nasdaq and the Dow looks almost exactly like it did in the winter and spring of 2000. A relative handful of stocks make up more than 40% of the S&P 500, so a rotation out of them has an outsized impact on the rest of the market.

In other words, the market as measured by the S&P 500 not only isn’t the economy—it’s not even really the market. Some types of stocks not well represented by that top-heavy index could thrive, even if the benchmark itself struggles.

What everyone knows often is wrong

The situation we face today is almost the inverse of the one a year ago. The economy looks poised to surge. Prices of stocks and other risk assets have climbed consistently, valuations are high and sentiment is ebullient.

Last year’s economic and human catastrophe didn’t stop the market from rising. Likewise, an economic boom this year might not stop the market from falling.

Economies and markets change, but for the most part human behavior doesn’t. People tend to chase after gains and run away from losses. That’s why today’s markets might be familiar to veterans of the housing bubble, the dot-com bubble or the go-go era of the 1960s. Even sophisticated pros can get FOMO (fear of missing out) in the late stages of a market cycle, as the Archegos episode demonstrates.

Human nature and market history make us skeptical when everyone seems certain of a given outcome. That skepticism informs our take on the ebullience in the equity markets, as explained above. In the words of Howard Marks, “The riskiest thing in the world is the belief there’s no risk. By the same token, the safest (and most rewarding) time to buy usually comes when everyone is convinced there’s no hope.”

Our skepticism of crowdthink also makes us wary of the prevailing belief that bonds are a lost cause. The percentage of traders describing themselves as bulls on Treasuries recently fell to 20%, according to the weekly bond trader survey by market research firm Consensus. That’s lower than in 98% of the survey’s readings over the past 34 years. All that pessimism probably is already baked into interest rates, meaning bonds might post decent performance for the rest of the year. Matt Topley of Lansing Street Advisors points out that more often than not, Treasury bond prices have tended to rebound just when trader sentiment reaches its low point.

POSITIONING: ACTIVE IS ESSENTIAL

This perspective leads us to approach the equity market judiciously and to prefer active management over passive indexed exposure. Earnings are in a trough. We believe that to understand stock values, investors need to understand how individual companies’ earnings may respond in the coming recovery. We began to view active management favorably last year, compared to passive vehicles, in parts of the market including international, small cap, growth stocks and bonds. Currently, we particularly favor:

- Global managers with broad mandates who we believe understand companies’ supply chains and sources of revenue.

- Managers who look to take advantage of inefficiencies in small- to mid-capitalization stocks.

- Active managers in other areas that require skill to determine which companies are likely to win and which could lose market share during the recovery.

We believe such expertise will be invaluable to capture investment returns and manage risk in the months and years to come.

We also are of the opinion that opportunities exist in parts of the credit markets not being reached by Fed intervention. For example, we believe there are opportunities related to middle-market lenders, as well as certain distressed segments of the debt markets.

Volatility is likely to be severe at times. We strive to ensure that our portfolios are not overweight in parts of the market that we believe present outsized risks. We continue to look for opportunities presented by sell-offs as we seek to establish long-term positions at attractive valuations. In addition, we work to keep our portfolios’ defensive allocations safe and liquid, both for protection and to position ourselves to try to capitalize when opportunities emerge.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was ranked No. 5 on the Forbes/SHOOK 2021 Top Women Wealth Advisors list. According to Forbes, the 1,000 women advisors ranked on the list “have offered exemplary service and prospered in a year of unprecedented challenges.”

View the Top Women Wealth Advisors list here >

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was named to the Rochester Business Journal’s inaugural Power 100 list. The Power 100 represents power players and leaders in the Rochester community hand-selected by the publication.

Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, has been ranked #2 on the Forbes 2021 Best-In-State Wealth Advisors list for New York. Forbes received more than 32,000 nominations for the ranking and conducted research and thorough interviews to highlight top advisors across the country. This is the fourth annual ranking by Forbes/SHOOK. Last year, Lori ranked #3 in New York.

View the full rankings list here >

Click here for important disclosures regarding these awards.

Staying Current

On March 25, 2021, Lori Van Dusen, CIMA, CEO and Founder of LVW Advisors, was featured on the panel session “Inside the Deal: Analyzing Acquisitions,” as part of the Barron’s Independent Summit.

In the session, Lori focused on the importance of evaluating mergers and acquisitions based on culture and not just the projected financial benefits. She shared her experience merging with Joseph Zappia, CIMA, noting that his business complemented LVW and his team was a strong cultural fit. She also shared her perspective related to a previous merger that did not survive due to cultural conflict.

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog posts below.

[LVW Whitepaper] A Primer: Convertible Bonds and Convertible Bond Arbitrage >

Roaring ’20s revival? How pent-up demand could fuel recovery >

RMDs are Back in 2021 – What it Means for Clients >

Newsletter Citations:

1 BCA Research.

2 https://fred.stlouisfed.org/series/T5YIE.

3 Reuters.

4 BCA Research.

5 https://www.macrotrends.net/countries/USA/united-states/gdp-growth-rate.

6 Wolfe Research, “Downside Risks are Intensifying,” 3/29/21.

7 https://tradingeconomics.com/united-states/business-confidence.

8 The New York Times.

9 Bloomberg.

10 https://seekingalpha.com/article/4417829-s-and-p-500-21q1-earnings-preview-expectations-continue-to-rise.

11 BCA Research.

12 AAII.

13 BNY Mellon Asset Management, “Stock Markets vs GDP Growth: A Complicated Mixture,” July 2012.

14 https://www.wsj.com/market-data/stocks/peyields.

15 https://www.multpl.com/shiller-pe.

16 Russell, Inc., Bloomberg.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.