Table of Contents

SECOND QUARTER MARKET SUMMARY

WINNERS AND LOSERS

LVW NEWS

Welcome to the summer issue of The Serious Investor. This issue offers our perspective on the equity market’s surprising second quarter recovery and explains how we’re investing for a future that’s likely to look very different from the past.

Quick Take

-

A massive infusion of liquidity from the federal government propped up the economy.

-

The flood of liquidity lifted almost all asset classes, particularly equities.

-

Government intervention kept financial markets functioning and threw the economy a lifeline.

-

Yet the economy remains severely damaged and will take years to recover.

-

The pace of recovery will depend largely on society’s ability to control the spread of COVID-19.

-

We are approaching this environment cautiously, employing active management to seek opportunities—especially in segments of the markets not buoyed by government intervention.

SECOND QUARTER MARKET SUMMARY

The Great Disconnect

The second quarter might go down in history as the Great Disconnect. After a first quarter with the quickest-ever bear market, equity indices from late March through June posted their strongest rally on record, including their best calendar quarter since 1987.

On the surface, this surge may be among the most surprising of all time, coming despite historically bad economic data, a lack of progress slowing the COVID-19 pandemic, racial strife and political dysfunction. But in the short term, markets rarely trade based on obvious, known information. They anticipate the future—and during the second quarter, the news for the markets generally got better, not worse.

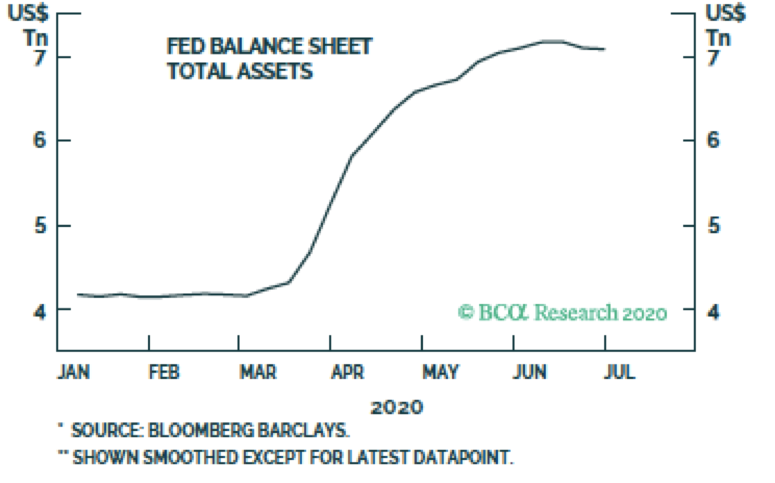

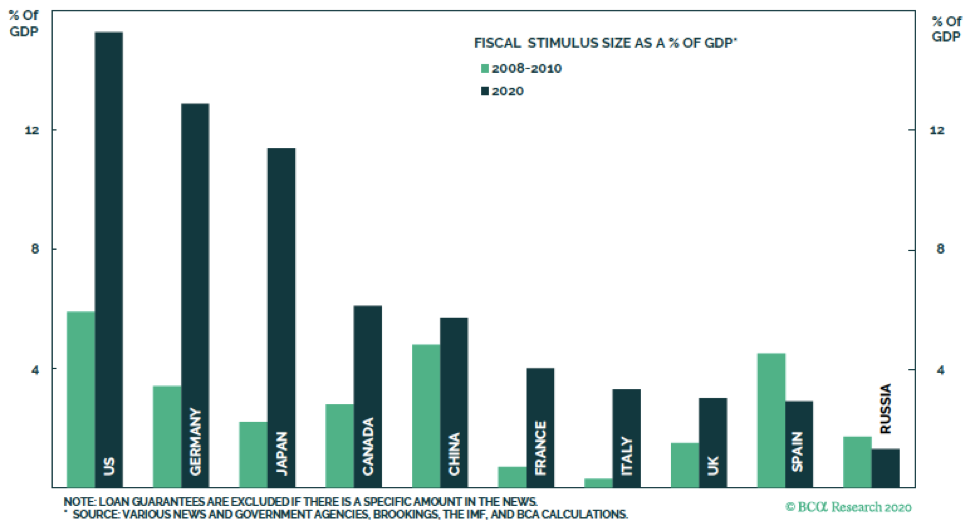

Although it might seem counterintuitive, the short-term jump in broad-market indices like the S&P 500 isn’t hard to explain. It’s the product of monumental liquidity provided by the Federal Reserve and fiscal stimulus by Congress. In writing this letter, we struggled to find the appropriate adjective to describe the level of intervention. Words like unprecedented, titanic and colossal fail to do justice to the scale of the government’s actions. As our CEO Lori Van Dusen said in our March webinar, “It would be a mistake to bet against the balance sheet of the United States.” No one expected the best quarter for U.S. stocks since 1987.

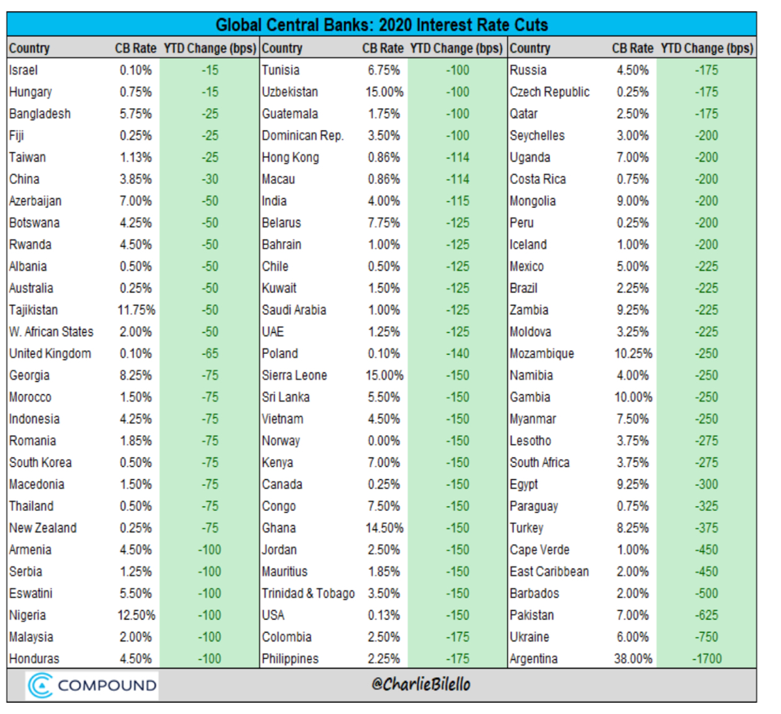

Government intervention happened on a global scale. So far 84 central banks have cut rates in 2020.

Signs that the economy may have bottomed also contributed to equity market gains, as did the fact that market benchmarks happen to be concentrated in the very stocks most likely to benefit from lockdowns. But the economy and the markets aren’t out of the woods, and this new era of crisis and government intervention means the longer-term outlook is less clear than ever—making this a time for caution.

A stress test for policymakers

When it became clear in February that the United States would have to shut down major portions of its economy to try to contain the COVID-19 pandemic, the Federal Reserve, the Treasury and elected officials applied the lessons they learned during the Great Financial Crisis of 2008 to keep financial markets functioning and the economy afloat.

The Fed quickly dropped interest rates to zero and created one lending facility after another, including arrangements to support corporate credit, commercial paper, small business loans, mortgages, money market funds, municipal bonds and other components of the financial system.1 The intent was to prevent the kind of credit freeze that hamstrung the economy 12 years ago, and it worked. Buoyed by the Fed’s assurances that it would buy corporate bonds, investment-grade credit issuance hit its highest level ever in the first quarter2 and continued setting records in April and May.3 These actions by the Fed also aided a sharp recovery in the prices of non-investment grade debt. As of late May, corporations had raised more than $1 trillion in bonds for the year, more than $700 billion of it coming after the Fed announced on March 23 that it would support the corporate bond market.4

Access to credit could serve as a bridge across the recession for many companies. For example, Boeing in early April looked headed for bankruptcy and insolvency. The Fed’s support for the corporate bond market increased investors’ confidence, to the point that Boeing was able to raise $25 billion in a public bond offering, enabling it to forgo direct government assistance. That liquidity serves as a lifeline but nothing more: The company was floundering with the 737 Max crisis before COVID-19, and its airline customers remain years from profitability. Time will tell whether Boeing and other struggling companies can recover, and how fully.

Congress and the Treasury also acted quickly, enacting $2 trillion in stimulus spending including direct payments to individuals, expanded unemployment benefits and forgivable loans to small businesses. It succeeded at blunting the economic pain inflicted by the economic shutdown; remarkably, the poverty rate may have dropped even as the economy endured a depression-like downturn.5 In some states, the combination of regular unemployment and the additional Treasury incentive totals to $50,000 in annualized unemployment benefits.

Although policymakers have largely succeeded at blunting the worst of the recession to this point, absolute economic conditions remain dismal. As of late June, roughly one in eight workers were newly unemployed since March 1,6 and real GDP was projected to have shrunk 40%in the second quarter.7 Meanwhile, COVID-19 cases were climbing throughout the South and the West, calling into question the durability of any economic recovery, and the United States was enduring its most widespread racial strife since the civil rights era.

A rising tide of liquidity

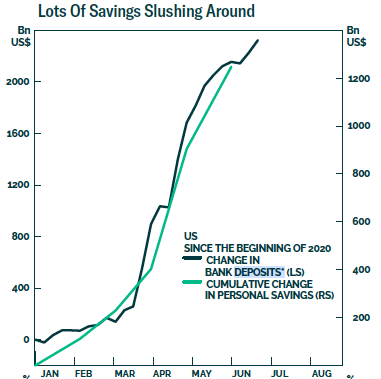

There are record levels of cash on the sidelines. The personal savings rate spiked to 32% in April—almost double the previous high of 17%, set in 1975—and sat at 23% in May.8 Much of corporate America’s trillion-dollar borrowing spree went into cash intended to help companies weather the COVID-19 recession. These conditions contribute to a better outlook for consumer spending and corporate profits than existed in March.

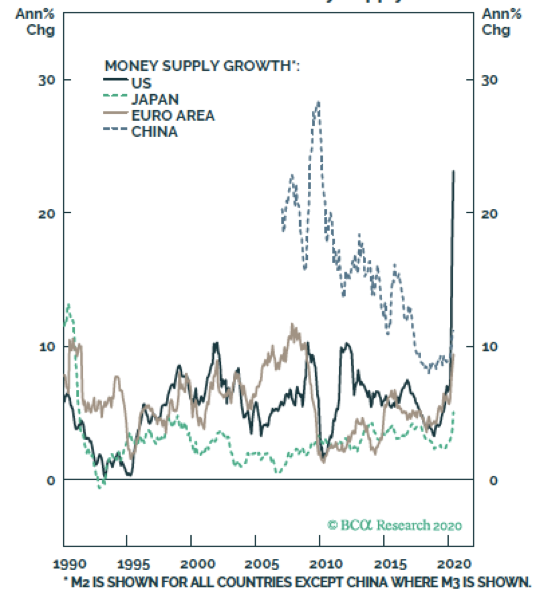

The chart below shows the impact of the Fed’s actions on the money supply as measured by M2, which includes bank deposits, money market securities and mutual funds.

Some recent indicators have pointed to a stabilization in economic activity, with a modest rebound in some areas. Eased restrictions on mobility and commerce and the extension of federal loans and grants have made it possible for some businesses to open, while stimulus checks and unemployment benefits have supported household incomes and spending. These developments helped employment move higher in May and June: The economy added 7.3 million jobs in those two months, far higher than analysts’ forecasts.9

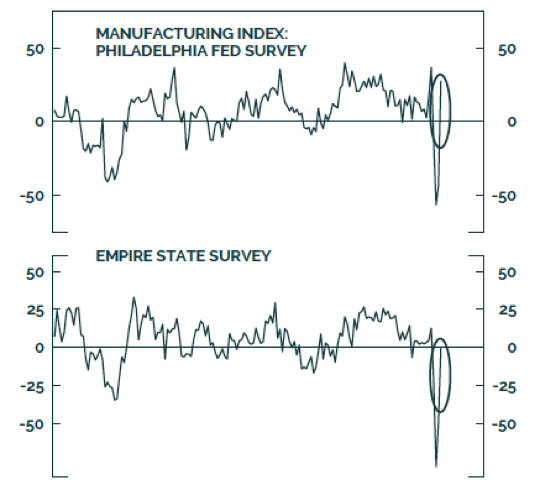

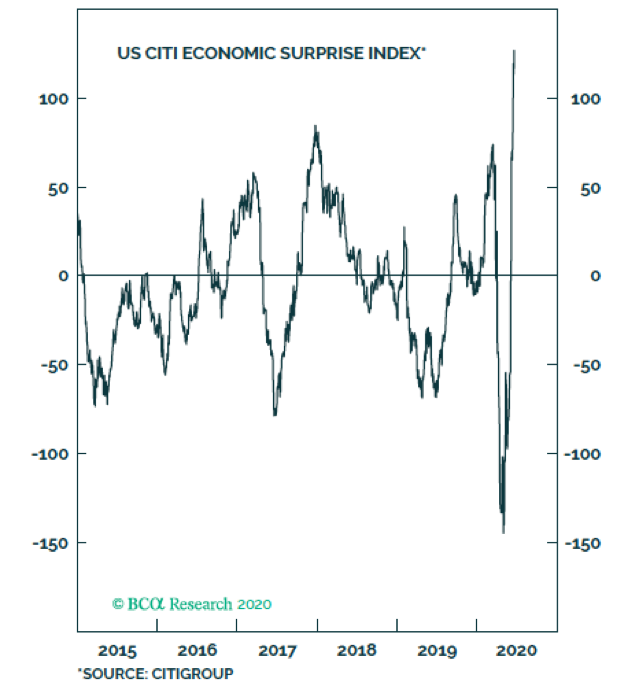

Strong showings in June from the Philadelphia Fed manufacturing survey and the Empire State survey offered more evidence of an economic rebound. Results like these helped the U.S. Citi Economic Surprise Index hit an all-time high in mid-June.

Economic indicators picking up10

Good surprises11

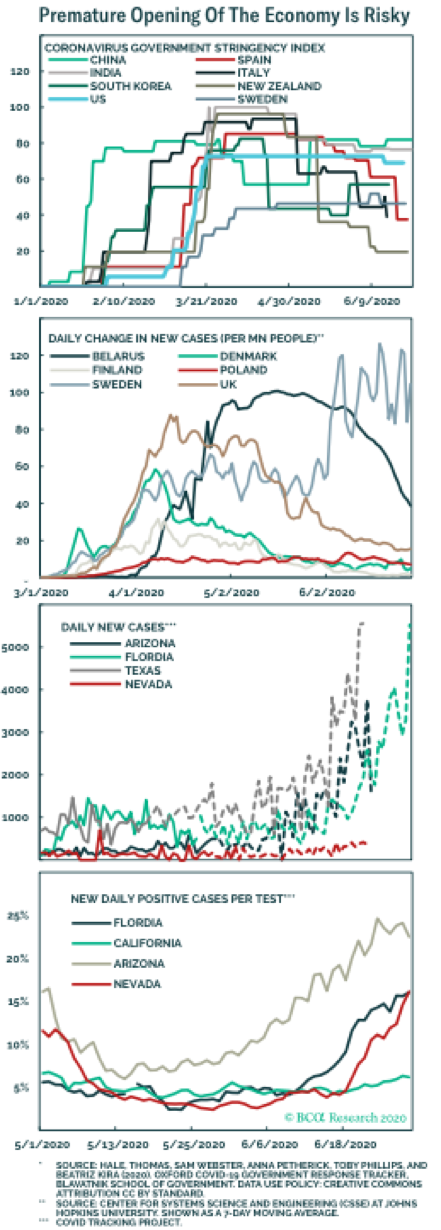

That said, output and employment remain far below their pre-pandemic levels, and the timing and strength of the recovery remain uncertain. Much of the lack of clarity in the economic outlook comes from uncertainty about the path of the disease and the impact of measures to contain it. A full recovery is unlikely until the public is confident that the disease is contained.

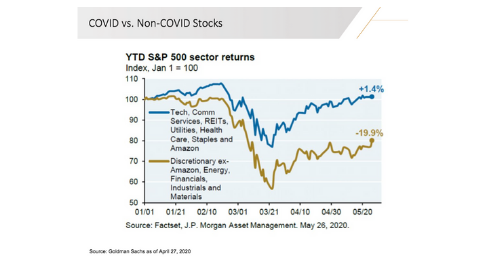

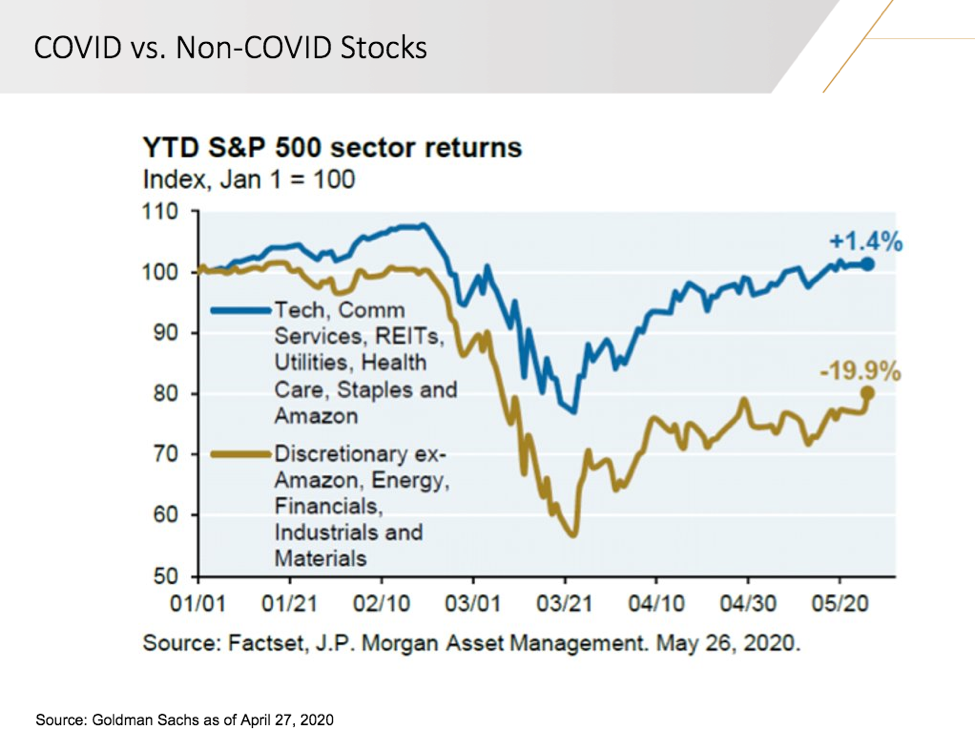

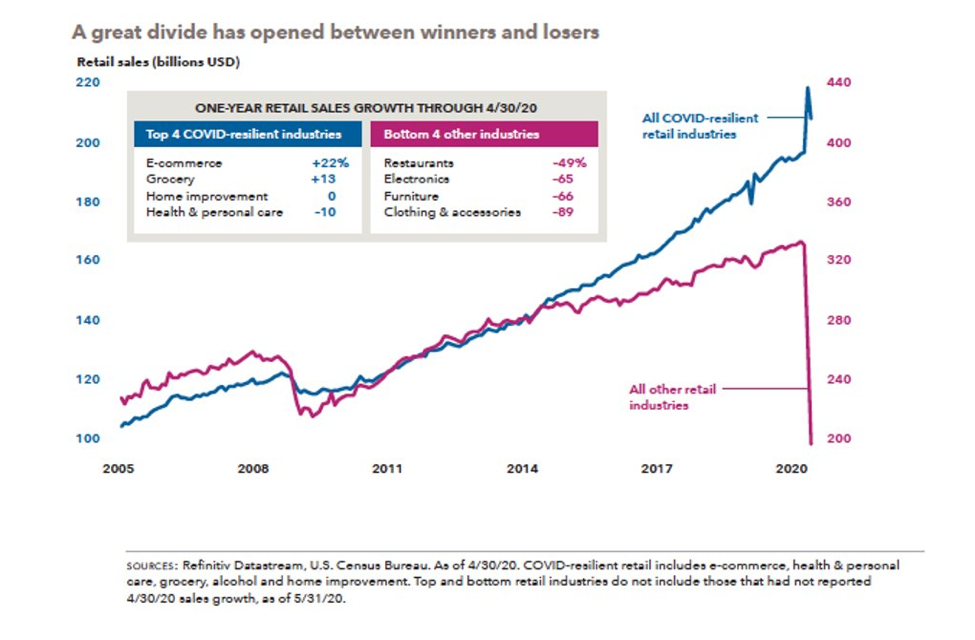

WINNERS AND LOSERS

Stocks’ gains serve as a reminder that in the equity market, the direction of changes often trumps the absolute level of economic conditions. Another reason for the rally in the Dow and the S&P 500: Both indices are dominated by shares of companies that benefit from the current environment, such as Microsoft and Amazon. The average stock remains mired in deep correction territory, with the Invesco S&P 500 Equal Weight ETF down more than 15% between February 19 and the end of June, with huge gaps between COVID-19 winners and losers.

Don’t count on a V-shaped recovery

Although policymakers’ efforts to prop up the economy and the financial markets largely have succeeded to this point, there’s no guarantee the rebound will continue. Many signs suggest that the recovery started to backtrack even before new COVID-19 cases ballooned in June. The New York Times reported on July 2 that:12

- New job postings on ZipRecruiter fell in June after a big gain in May.

- Small business employment and openings, which jumped in May, leveled off in June and weakened at month’s end.

- Retail foot traffic fell in late June in large cities across the South.

- Credit and debit card spending declined starting in late May after increasing in previous weeks.

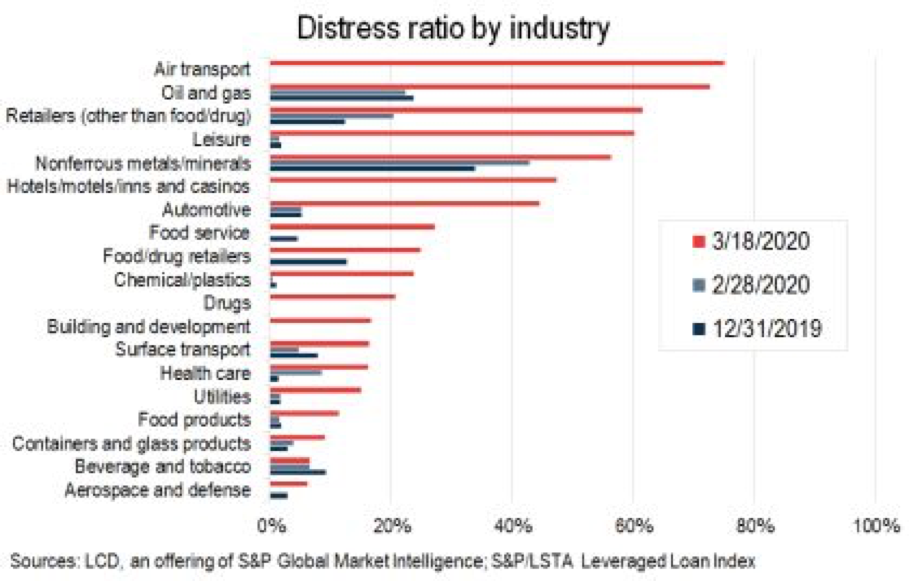

Markets have been willing to look past the economic trough and anticipate better times ahead. Yet these recent trends highlight that the trough could be wider than many people seem to think. The collapse in economic activity has done considerable damage. Spreads on high-yield bonds are increasing again, suggesting that credit investors have become less confident in the economic recovery. Bankruptcies are rising, and with activity still down 20% in consumer-facing sectors, pressure on companies’ business models won’t ease soon—especially given evidence that banks are tightening their lending conditions.

The small and mid-sized businesses that employ more than half of American workers are particularly vulnerable; damage to them may cut short improvements in employment and the spending bump from the stimulus. The resurgence of COVID-19 cases will slow and reverse many reopening efforts. Problems with municipal budgets, real estate and other sectors also could hold back the recovery.

There is no easy way to revive the economy before containing the spread of the virus. Reopening prematurely is risky. Four in 10 Americans have seen the state they live in either pause or reverse efforts to reopen.

Furthermore, no one knows what the economy will look like on the other side of the trough. Longer-term, we have to expect that the government’s massive intervention will have some negative repercussions for economic growth, corporate profits and financial markets. The mood of the country seems to have shifted to the left, and a Biden victory appears more likely. We wouldn’t be surprised to see a rollback of the corporate tax cuts, a higher estate tax and capital gains taxed at a level closer to income tax rates, along with more aggressive regulation.

Earnings expectations seem to anticipate a future that looks a lot like the past. We think they may be overly optimistic. Higher taxes alone could reduce earnings at S&P 500 companies by 15%, making it even harder to justify the S&P 500’s recent lofty valuation of 24 times forward fourth quarter earnings.

Of course, the trajectory of the pandemic and our institutions’ response to it are likely to be the most important factors affecting the economy and markets. New York Times columnist David Leonhardt reports that many scientists think the baseline scenario is that a vaccine will arrive sometime in 2021. “Until then,” he writes, “the world will endure waves of sickness, death and uncertainty.”13

There are an infinite number of potential outcomes around that baseline scenario. Broadly speaking, the possibilities are binary: Things either will get worse or get better.

Bad outcome: COVID-19 lingers, as efforts to produce a vaccine or effective treatment fall short. The economy shuts down again, and lawmakers are unable to agree to additional stimulus measures. Equity markets correct while bonds and real assets such as gold rally.

Good outcome: The novel coronavirus began spreading earlier than previously thought, so we reach herd immunity more quickly than anticipated. Researchers develop an effective vaccine. The federal government passes a second stimulus package, while the Fed continues to do “whatever it takes” to keep financial markets functioning. The influx of cash buoys risk assets, inflation creeps up and boosts real assets, and bonds suffer.

This health and economic situation is complex, dynamic and uncharted, and no one knows how it will play out.

Fed Chair Jerome Powell has made it clear that interest rates will remain low for a long time. Meanwhile, policymakers will have to address the spectacular $3 trillion increase in the federal debt. In our view, the Fed’s best path is to create inflation that effectively negates the debt in real terms. “Helicopter money”—direct payments to the private sector—would be the last resort of quantitative easing and possibly the most effective, since it puts cash directly in consumers’ hands. These are the conditions on the playing field, and the game plan must adjust accordingly—regardless of potential moral hazard.

It’s conceivable that higher inflation would have devastating consequences for the financial markets. Alternatively, the massive injection of money into households may drive spending that fuels relatively benign inflationary growth, similar to the post-WWII era. Wharton professor Jeremy Siegel estimates that an inflation rate of approximately 15% would effectively wipe out the additional debt the U.S. government has taken on.14 This scenario likely would benefit risk assets, real assets and gold. Bond holders would be left holding the bag.

We live in a time of extreme uncertainty. We have to expect unpredictable developments, both positive and negative. The lack of clarity and the range of potential outcomes make this a time for caution.

Positioning

For a year or more leading up to the COVID-19 crisis, we were concerned about heightened risks late in the economic cycle. Valuations were high and so was corporate debt—much of which was opaque, given the rise of the shadow banking system and leverage used by large private equity firms through leveraged buyouts. These concerns led to our relatively cautious positioning to start the year.

In March, we reevaluated our portfolios’ holdings to try to determine which investments would be best able to hold up through the crisis. We presently are evaluating the risks again, and in particular looking at opportunities that may have been created in the parts of the market that the Fed can’t rescue. We have worked directly and through our network of distressed managers to try to identify opportunities to invest in good companies with bad balance sheets, and to seek companies with enough cash to shore up their finances and seize or retain leadership positions.

It is our view that equity markets are priced for full recovery. We can’t predict how long stock prices will stay elevated, but the data suggest that the risk-reward equation does not favor broad-market equity investors, particularly in the United States. Yet bond valuations look even richer, and monetary and

fiscal support could continue to buoy stocks. This environment leads us to a neutral position in equities overall.

We currently favor actively managed strategies to take advantage of what we expect to be an environment in which correlations between stocks are low and the winners’ performance far outstrips the losers’. Goldman Sachs reported in mid-June that the valuation spread between the highest- and lowest-multiple stocks registered in the 93rd percentile of market history, and recently was the widest on record outside of the late 1990s tech bubble.15 We believe that such valuation disparities present opportunities for skilled long-only and long-short managers to add value.

The U.S. stock market has led the world since before the Great Financial Crisis. However, active managers may be able to find more appealing values elsewhere. And while every economy around the world (including the economy of each U.S. state) is trying to get back to pre-pandemic levels without triggering an increase in COVID-19 cases, Germany, France and Japan are the closest to narrowing that gap. We are favoring managers with global mandates. Meanwhile, we are emphasizing our portfolios’ exposure to international equities via an active manager that focuses on international growth opportunities, including those with meaningful revenue exposure to emerging markets such as China.

This environment also leads us to look for other ways to earn returns for clients. We think corporate credit offers interesting opportunities, and we are evaluating specialists, with flexible mandates, who we believe have the skills, experience and access to seek them out.

We also are exploring opportunities in distressed credit. Our economy is in the early stages of a long distressed-debt cycle. Huge volumes of public sector debts, mortgage forbearance, unpaid rents, private-sector debts and other liabilities will need to be rectified or renegotiated. Investors who are in a position to offer liquidity into this market may be rewarded. For example, yields on CCC-rated bonds—which are not distorted by Fed intervention—currently are about 300 basis points higher than they were before the COVID-19 crisis.16 We are examining experienced distressed credit managers who will seek to take advantage of opportunities like these in the coming months and years. While past performance is not always indicative of future results, distressed credit presented opportunities coming out of the last recession and may provide opportunities again today.

The past several months have served as a real-life stress test. We at LVW Advisors are using it to evaluate our systems and discipline for managing portfolios. We encourage investors to do something similar: to consider what you can learn from the challenges that 2020 has presented and how those lessons can inform your actions in the present and the future.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was interviewed for an article in Barron’s published May 22 titled, “It’s a Weird Market. Time To Go Active.”

The Barron’s article depicts how some financial advisors—even those previously skeptical of active management—believe the market is acting irrational enough that select managers may be able to beat index returns.

In the article, Lori discusses navigating what she considers could be potential landmines and significant opportunities in this volatile market.

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, and Joe Zappia, CIMA, CCO/Co-CIO and Principal, were featured on Schwab’s “How I Became an Independent RIA” podcast series in the episode, “Stronger Together.”

On the podcast episode, Joe shares his story of leaving a large wirehouse based in New York City to partner with Lori’s established RIA firm, LVW Advisors. Joe sought to go to an independent model that put the client first and by joining LVW, that vision continues to guide both Lori and Joe as they lead LVW today.

On June 9, Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, joined her colleague and friend, Dr. Vikram Mansharamani, on a webinar for clients and partners titled, “Navigating Uncertainty.”

Dr. Mansharamani is a renowned author, economist and professor. His work is dedicated to exploring how we got to the current world of protectionism, nationalism and populism, and how the combination of political, social, technological, demographic and economic pressures will impact future trends.

On the webinar, Lori and Dr. Mansharamani discuss their viewpoints on relevant topics such as the changing landscape of education and urbanization, the current health pandemic and resulting government intervention, passive investing and U.S.-China relations.

Watch the “Navigating Uncertainty” webinar >

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was interviewed by Barron’s Editor-At-Large Jack Otter on April 13 as part of Barron’s “The Way Forward” series. This series features wealth management professionals and how they are navigating the challenges and current market volatility presented by COVID-19.

Listen to the full interview on Barron’s >

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was ranked in the top 10 for the third consecutive year on the Forbes Top Women Wealth Advisors list. She ranked No. 5 on both the 2020 and 2019 lists.

The Forbes ranking of America’s Top Women Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative data, such as telephone and in-person interviews, a review of best practices, service and investing models, and compliance records, as well as quantitative data, like revenue trends and assets under management. Awards and recognition by unaffiliated rating services, companies and/or publications should not be construed by a client or prospective client as a guarantee that they will experience a certain level of results if LVW Advisors is engaged, or continues to be engaged, to provide investment advisory services, nor should such awards and recognition be construed as a current or past endorsement of LVW Advisors or its representatives by any of its clients.

Staying Current

In a new financial planning video series, Joe Zappia, CIMA, CCO/Co-CIO and Principal of LVW Advisors, and Jonathan Thomas, CFP, Private Wealth Advisor, cover topics we think should be top of mind for our clients.

The first video focuses on the key features of the SECURE and CARES Acts. In the video, Joe and Jonathan cover how the two pieces of legislation impact IRAs and what potential tax implications could be, and answer some frequently asked questions from clients. Watch the video here >

The second video focuses on why we are deeming 2020 “The Year of the Roth IRA.” In the video, Joe and Jonathan answer client questions surrounding IRAs and Roth IRA conversions. Watch the video here >

On May 1, Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, and Joe Zappia, CIMA, CCO/Co-CIO and Principal, held a webinar for clients and partners titled “The Great Reset: What a Recovery Could Look Like.”

On the webinar, Lori and Joe provide a market recap and discussed the implications to health, the economy and the market with respect to what a recovery could look like. Additionally, Lori and Joe answer numerous client-submitted questions.

Watch the “The Great Reset: What a Recovery Could Look Like” webinar >

Newsletter Citations:

1 National Law Review: https://www.natlawreview.com/article/summary-federal-reserve-credit-facilities-announced-march-17-23-2020.

2 Fitch Ratings: https://www.fitchratings.com/research/corporate-finance/us-investment-grade-issuance-hits-record-245b-volume-for-1q20-29-04-2020.

3 CNBC: https://www.cnbc.com/2020/05/11/the-fed-thawed-debt-market-and-big-companies-built-a-500-billion-war-chest-to-fight-the-virus.html.

4 CNBC: https://www.cnbc.com/2020/05/29/corporations-raise-1-trillion-in-the-bond-market-after-fed-backstop-double-the-pace-of-last-year.html.

5 University of Chicago’s Harris Public Policy: https://harris.uchicago.edu/news-events/news/new-poverty-measure-confirms-coronavirus-driven-federal-stimulus-measures-were.

6 The New York Times: https://www.nytimes.com/interactive/2020/05/13/upshot/coronavirus-america-job-losses-slowing-tracker.html.

7 Federal Reserve Bank of Atlanta: https://www.frbatlanta.org/cqer/research/gdpnow#:~:text=Latest%20estimate%3A%20%2D39.5%20percent%20%E2%80%94,46.6%20percent%20on%20June%2025.

8 BEA.Gov: https://www.bea.gov/data/income-saving/personal-saving-rate.

9 CNBC: https://www.cnbc.com/2020/06/05/jobs-report-may-2020.html.

10 BCA The Democratization of Equity Investing, 6/22/20, page 7.

11 BCA The Democratization of Equity Investing, 6/22/20, page 8.

12 The New York Times: https://www.nytimes.com/2020/07/01/business/economic-recovery-virus-surge.html?inf_contact_key=5422f2c707f220f6ee06c05be7e50f515f312e841240463012d7d3fa49f1848d.

13 The New York Times: https://www.nytimes.com/2020/07/10/opinion/sunday/coronavirus-economy-two-years.html?referringSource=articleShare

14 Ritholtz Wealth Management: https://ritholtz.com/2020/06/mib-jeremy-siegel-covid-market/.

15 Goldman Sachs US Weekly Kickstart, 6/12/20.

16 FRED, St. Louis Federal Reserve, https://fred.stlouisfed.org/series/BAMLH0A3HYCEY.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.