Download a copy of this newsletter

Welcome to the summer issue of The Serious Investor. In this issue we address the growing likelihood of recession and what it means for our portfolio positioning. We also cover the ways today’s economic and market environment differs from the conditions that have prevailed over most of the last 40 years, and the implications the new climate has for managing risks and pursuing long-term growth.

Quick take:

- Higher-than-expected inflation led the Federal Reserve to tighten monetary policy more aggressively in the second quarter.

- Both stocks and bonds fell as a result, presenting difficult conditions for investors.

- The economy softened, and recession looks increasingly likely.

- We are taking a more cautious view regarding equities.

- That said, we believe the market’s turbulence presents opportunities for active managers in a variety of asset classes.

SECOND QUARTER MARKET REVIEW: HEADWINDS RISE AND THE MARKET FALLS

Persistent strong inflation during the second quarter forced policymakers and investors to recalibrate their expectations for the economy and interest rates. Both stocks and bonds fell as the odds of recession increased.

Inflation rose more than most observers expected, with the Consumer Price Index jumping 8.6% for the 12 months through May. Russia’s invasion of Ukraine and the world’s response to it caused spikes in energy and food supplies. Meanwhile, COVID-19 continued to disrupt supply chains, and labor shortages in the United States contributed to fast-rising wages.

The Federal Reserve became much more aggressive in its fight against inflation. Policymakers followed up their 25 basis point March interest-rate hike with increases of 50 bps in May and 75 bps in June. At the June announcement, Fed Chair Jerome Powell signaled another hike of 50 or 75 bps at the committee’s July meeting, and he said the federal funds rate was likely to reach 3.4% by the end of the year.

Powell described the battle against inflation as “unconditional,” suggesting the Fed will keep tightening even if unemployment rises significantly—an outcome that appears likely if the Fed maintains its official 2% inflation target. When Powell was asked during Senate testimony whether the Fed would consider raising the target, he responded, “That’s just not something we would do.”1

Employment remained strong during the quarter: Unemployment fell to 3.6% in June, and there were nearly two job openings for every unemployed person.2 But the economy showed clear signs of a slowdown. Jobless claims ended the period near a five-month high,3 and leading indicators as a whole fell to levels that suggest economic contraction.

Housing, which is especially sensitive to higher interest rates, weakened dramatically. Mortgage rates jumped to 5.8%, their highest level since 2007, before declining in July. Housing starts fell 14% year over year, new mortgage applications fell in June to a 22-year low,4 and pending home sales dropped 9.1%. Realty firms Redfin and Compass laid off 8% and 10% of their workforce, respectively, as the typical new mortgage payment increased 52% in six months, according to real estate research firm Zonda.5

High inflation began to eat into consumers’ discretionary spending as real (inflation-adjusted) incomes fell. Walmart and Target badly missed first- quarter earnings estimates,6 in part because consumers had changed their spending patterns in response to higher inflation. Retail sales decreased 0.3% month on month in May, much more in real terms.

Manufacturing weakened as well, in the U.S. and in Europe.

As of the end of June, the Atlanta Fed’s GDPNow model predicted that U.S. gross domestic product (GDP) declined 1% in the second quarter following a 1.6% drop in the first quarter. If accurate, the two consecutive negative quarters would fit the technical definition of recession.

Bond yields rose dramatically through June, then generally slid back as the yield curve flattened amid signs of a weakening economy. Yields on both the 2- and 10-year Treasury notes began the quarter near 2.4%, rose to almost 3.5%, then fell back to around 2.9% to end the quarter.

The S&P 500 dropped more than 17% in the quarter for a first-half loss

of 20.6%, marking the index’s worst first half of a year since 1970. Value outperformed growth as investors fled large tech stocks like Tesla (-38%), Amazon (-35%), Facebook (-27%), Google/Alphabet (-22%) and Apple (-22%).

OUTLOOK: THE 40-YEAR CONTEXT

The ongoing correction in financial markets presents challenges unlike those most investors have seen in four decades. We believe a sea change is happening, and the tactics that work in the years to come will likely be different than those that have worked for the last 40.

Declining inflation made it possible for interest rates to fall steadily since the early 1980s, helping push up values in the broad stock and bond markets. As long as inflation wasn’t a problem, the Federal Reserve could deal with rough patches in the economy and financial markets by lowering short-term interest rates (and since the Great Recession, purchasing massive quantities of bonds).

These conditions especially rewarded three investment approaches:

• The passive 60/40 portfolio, as broadly rising, negatively correlated stock and bond markets made it hard to beat the indices.

• Buy and hold, capitalizing on the general upward trajectory of stocks and other financial assets.

• Buy the dip, taking advantage of the “Fed put”—the Federal Reserve’s ability to prevent financial market distress by goosing liquidity.

The sudden paradigm shift from low inflation to high inflation has upended these dynamics. Today, the Fed’s hands are tied. It has to tighten monetary policy to bring down inflation, so it will not inject liquidity to support struggling markets and a flagging economy. With the Fed’s ability to buoy the markets a thing of the past, we think the passive 60/40 portfolio, buy and hold and buy the dip may be relics as well, and we believe different approaches are needed.

Economic outlook: The Fed has no margin for error

Policies after the global financial crisis offered a case study in fighting deflation. Then the government responded to COVID by printing massive amounts of money and dropping it into the hands of American consumers and businesses. This helicopter money had the desired effect at the time, creating skyrocketing demand for goods. But that demand ran headlong into a global economy in which COVID and geopolitical crises kinked and constrained supply chains. In addition, longstanding underinvestment in energy production capacity made energy markets vulnerable to the supply shock caused by Russia’s invasion of Ukraine and the Western world’s response.

The Fed, while acknowledging it responded too slowly to the inflation threat, now is on the warpath against it. The idea that the economy will avoid economic contraction altogether seems increasingly far-fetched, given the confounding conditions policymakers face, the limited tools at their disposal and central bankers’ generally poor track record when trying to slow the economy without causing recession. In the rare times they succeeded, their efforts typically were aided by beneficial exogenous factors—as in 1994, when demographics and rising globalization following the fall of the Soviet Union served as tailwinds to disinflation and growth. In other words, soft landings take luck.

In fact, the economy may be in recession already. That said, recessions take many different forms, with distinct causes, degrees of severity and durations. We think the best-case scenario from here is a mild recession that nudges up unemployment enough to loosen the labor market and bring down demand, with minimal pain to households and continued improvement in supply chains reducing inflation pressures. In that event, inflation might decline enough that the Fed would feel comfortable moderating its tightening campaign by fall.

This scenario may come to pass. The economy has a good-sized cushion: Employment has remained healthy so far, consumers had more than $18.5 trillion in cash as of the first quarter, corporations have $4 trillion in cash on their balance sheets, corporate profits have been exceptionally high at 18% of sales over the past year, and states are sitting on enormous surpluses. These pluses may help the economy bend without breaking, but the Fed has zero margin for error.

Equities and fixed income: No need to hurry

We believe equity declines have created bargains among certain stocks, but there are many reasons to believe broad, market-cap weighted benchmarks could struggle. Years of easy liquidity made it possible for shares of many companies with little to no free cash flow to fund operations and growth with money from new investors. Greg Jensen, co-chief investment officer at Bridgewater Associates LLC, estimates that roughly 40% of the U.S. equity market comprises companies that do not generate cash flow—near a historic high. He points out that these companies can survive only to the extent that new buyers enter the market. With liquidity tighter and the cost of capital higher, they look likely to struggle. And given the stocks’ disproportionate weighting in market-weighted indices, broad-market benchmarks could struggle as well. With the Fed put a thing of the past, the downturn could last a while.

The S&P 500 has fallen more than 20% from its high. Historically, the median recessionary decline in the S&P 500 has been 24%. In other words, the market is almost pricing in a recession. Recessionary bear markets tend to last much longer than non-recessionary bear markets.

Another reason the downturn might continue: The outcomes priced into the financial markets may still be too optimistic. Bond markets currently are priced for a large slowdown in inflation over the next five years (to an annual rate of 2.8%) and the five years after that (2.4%). If inflation continues to surprise to the upside, the Fed may feel the need to accelerate its tightening campaign. In that case, yields would increase accordingly, leading to further bond losses.

Likewise, current valuations in the stock market are based on earnings estimates that have barely budged since the beginning of the year, even as interest rates have jumped. The economy has slowed and recession looks increasingly likely. With recession looking probable, we expect earnings forecasts to come down, pinching price-to-earnings ratios and contributing to further stock declines.

Corporate profits have fallen in every recession. The degree of the decline has ranged from -24% in the 1990 recession to -57% in the late 2000s. The S&P 500’s P/E, currently around 17, typically falls to between 13 and 15.7 If valuations drop to that range, we will consider changing our stance from below neutral on equities to equal weight or overweight, but we see no need to hurry.

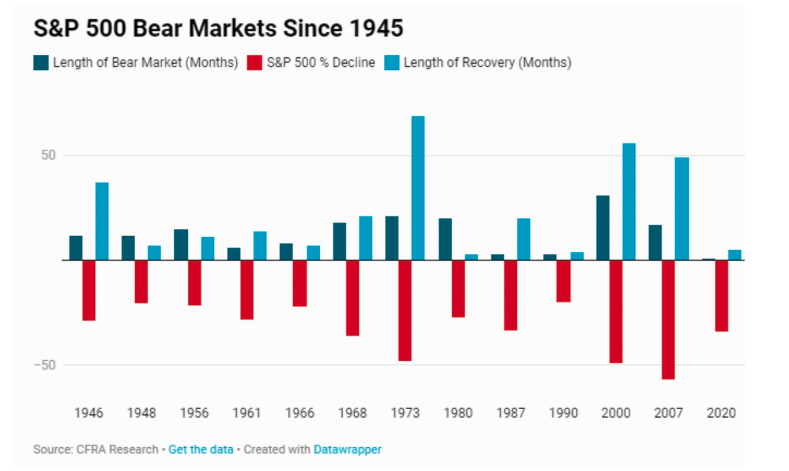

During the 14 bear markets since 1945, the S&P 500 fell an average of 32%. The downturn lasted an average of 12 months, and the market fully recouped its losses in an average of 23 months, according to CFRA data.

We believe this environment heightens the importance of investing in companies that produce strong free cash flow. These enterprises can self- finance rather than depend on liquidity from the markets and, in many cases, can pay shareholders steadily growing dividends that can help offset the impact of inflation.

Today’s dislocations present challenges for passive investors, but we believe they produce many opportunities for selective active investors. Sell-offs in certain parts of the market may create attractive entry points for long-term buyers. For example, small caps look cheap.8 The Russell 2000 small-cap benchmark had its worst first half on record, by far, falling 25% this year and more than 30% since its November high. Its worst first half prior to this was in 2020, a loss of 13%. The index’s P/E ratio on forward earnings has fallen more than 10 points since November, compared to the six-point drop in the S&P 500’s P/E. The small-cap benchmark now trades at roughly the same earnings multiple as the S&P 500, well below its average historical five-point premium, but its 2023 earnings growth estimates are more than double the S&P 500’s.

Similar stories exist in many pockets of the stock market. Goldman Sachs and Wells Fargo are trading below book value. Enterprise software stocks— many of them shares of strong, cash-flow-producing companies—have been pummeled along with the rest of the tech sector. Shares in Europe trade

at historically low valuations, after stock funds there suffered 19 straight weeks of outflows.9 Meanwhile, companies and countries are reshuffling and regionalizing supply chains to prioritize resilience and security, potentially creating opportunities in certain emerging markets.

We believe employing active managers will be key to capitalizing on the opportunities presented by the changes occurring in the world today. In our view, managers who understand their companies, industries and regions intimately will be better positioned in seeking to identify tomorrow’s likely winners and take advantage of today’s mispricings.

POSITIONING: A FOCUS ON CASH FLOW

We pride ourselves on the diligence we do on potential investments. We have decades of experience stress-testing institutional portfolios and considering the potential impacts a wide variety of scenarios could have on investment and portfolios—including high inflation and rising rates. For many years, liquidity and momentum overwhelmed all other factors. In the environment we face now, the diligence we perform has become more important than ever.

We are approaching this environment cautiously and opportunistically. We don’t know how long the bear market will last. But with the Fed put off the table, we have prepared portfolios for the possibility of an extended downturn, favoring cash and taking a cautious approach to equities.

In fixed income, we favor high-quality, short-duration bonds. These securities offer higher yields than they have in many years, and their short maturities provide a degree of protection against rising rates since their principal can be reinvested relatively quickly.

In equities, we may become more cautious in the event of a bear market rally if the underlying economic data does not improve. We favor value—which historically tends to outperform during periods of rising interest rates—and emphasizing strategies that focus on companies with strong free cash flow. Dividend-growth companies may help produce income and hedge inflation.

We continue to seek to generate income from assets other than bonds. In real estate, we have a particular focus on opportunities in resilient sectors with high levels of tenant occupancy—for example, industrial properties outside of the United States, where penetration rates are lower and the demand for new warehouses remains strong.

We believe waning liquidity and slowing consumer demand should create an environment with greater stock-performance differentiation based on business fundamentals. We believe investors who focus on fundamentals in less-efficient market segments should continue to be rewarded.

We expect higher rates and reduced liquidity to create stress in credit markets. Such conditions can create opportunities, and we may pursue them if we start to see rising defaults and other signs of weakness in credit.

We would like to take this opportunity to remind readers that downturns

are intrinsic to investing. Managing them prudently—by monitoring liquidity and risks, maintaining true diversification and rebalancing as appropriate—is essential for growing wealth over the long term. Please reach out to us if you have any questions about how we are managing your assets through today’s challenging conditions.

LVW NEWS Community Events

LVW recently hosted a timely and informative client event titled “How to Navigate Through an Unprecedented Time for Investors“ at Oak Hill Country Club. John Gaines, VP of Blackstone’s Private Wealth Solutions group and co-sponsor of the event, led a very informative discussion about the real estate market and REITs. Additionally, members of the LVW team shared their thoughts about current volatility and market trends, and how to manage portfolios in response. The event was well attended, and we plan to do more of these sessions in the near future. Keep a lookout for an invite, and we always welcome your family members, friends and colleagues!

Awards & Accolades

Barron’s

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, has been recognized on Barron’s 2022 Top 100 Women Financial Advisors list, marking the third consecutive year she’s received this honor. This ranking was established to shine a spotlight on the nation’s best wealth managers and raise the bar

for industry standards. We are thrilled for Lori and our team, as this award is a direct reflection of our exceptional client service and dedication to the wealth management industry.

Click here for important disclosures regarding these awards.

Forbes SHOOK Research

LVW’s Lori Van Dusen was once again ranked No. 1 on the Forbes Best-In- State Wealth Advisors list for 2022 for New York state, excluding New York City.

View the full list of rankings here >

Click here for important disclosures regarding this award.

Lori also was ranked No. 7 in the country on the Forbes 2022 Top Women Wealth Advisors List.

View the full list of rankings here >

Click here for important disclosures regarding this award.

Staying Current

LVW Advisors CEO and Founder Lori Van Dusen, CIMA, joined financial experts on PGIM Investments’ Outspoken series to discuss how inflation, interest rates and global developments are shaping the future of investment.

Recently, LVW’s Christopher Van Buren was interviewed by Financial Advisor. In the article, he discusses annuities and how rising rates can help investors interested in learning more?

Read the full article on annuities here >

At LVW Advisors, we are more than just a wealth management firm; we believe in becoming involved in our communities. As a firm, we strive to remove educational, health and financial barriers. CEO and Founder Lori Van Dusen discusses her own experiences and provides insight to other social entrepreneurs in a recent Impact Boom episode.

Co-Chief Investment Officer Joseph Zappia and Senior Partner Jeff Wagner were featured in Fortune on how to protect investment portfolios from the possibility of a recession occurring this year..

Read the full Fortune article here >

Co-Chief Investment Officer Joseph Zappia spoke with The Wall Street Journal in early June about looking for signs of stabilization. Zappia said he is especially looking for a slowdown of stock sales and for markets to weather bad news from companies without losing value.

Read the full WSJ article here >

On the heels of quarterly earnings from Walmart and Home Depot, Co- Chief Investment Officer Joseph Zappia shared his outlook on consumer spending and home improvement trends with Barron’s. Given the increasing unaffordability of moving, Zappia said home improvement trends may pick up in the coming quarters.

Read the full Barron’s article here >

Employee News

We continue to grow the LVW team! We’ve recently welcomed two new employees.

Nick Mezzoprete, Operations Analyst, joined LVW in mid-June and is supporting advisors with reporting, as well as working closely with LVW’s research team. Nick recently graduated from the University at Buffalo, SUNY with an M.S. in finance, risk management. He is an avid Buffalo sports fan, and when he is not working, he enjoys playing hockey and guitar.

Ashley Sullivan, originally from Rochester, moved back from San Diego with her family and joined LVW on July 11 as a Private Wealth Advisor. Most recently a financial consultant at Charles Schwab, Ashley has been part of the financial industry for more than 10 years and has a strong investment and financial planning background. Ashley enjoys traveling and spending time outdoors with her family.

Welcome to the team, Nick and Ashley!

Blogs

As the markets continue to adjust this year, strategies and tactics that have worked for investors over the last few decades are not as effective. Three mantras—the passive 60/40 portfolio, buy and hold and buy the dip—are being challenged. Co-Chief Investment Officer Joseph Zappia’s recent post reimagines portfolio construction for this new inflation era.