Table of Contents

FOURTH QUARTER MARKET SUMMARY

LOOKING AHEAD: THE FOLLY OF FORECASTING

LVW NEWS

Happy New Year! Welcome to the decade’s first issue of The Serious Investor. This installment of our newsletter contrasts the market’s optimism at the end of 2019 with its pessimism a year earlier and offers our perspective on the changes that brought about the shift. It also explains why we think the flurry of market forecasts this time of year is a little silly—and why we manage portfolios not based on what we think will happen, but based on how we can navigate the wide variety of scenarios we think could happen.

Quick take:

- A fourth quarter stock surge made 2019 one of the better years in U.S. equity market history.

- Federal Reserve easing and renewed hopes for profit growth drove the rally.

- Fundamentals improved only modestly, but recession looks unlikely.

- High valuations are likely to weigh on long-term returns.

FOURTH QUARTER MARKET SUMMARY

Liquidity Trumps All

What a difference a year makes! The fourth quarter market environment in 2019 was the polar opposite of the same time period during the previous year.

This time last year, the S&P 500 was coming off bruising losses of -14.0% for the quarter and -4.8% for the year. Late in 2018 the index fell 19.5%—just shy of the definition of a bear market—between its all-time high in September and its low on Christmas Eve. By contrast, the broad-market benchmark finished 2019 with three- and 12-month gains of 9.1% and 31.5%.

The story was similar overseas: In fourth quarter 2018 the MSCI All Country World ex-U.S. Index lost 11.8%, compared to an 8.5% fourth quarter gain in 2019. In the bond markets, rising yields and a steeper curve in fourth quarter 2019 were a mirror image of falling yields and a flatter curve a year earlier.

Why did 2019 end so differently than 2018? Equities’ 2019 surge was largely a snap-back from last December’s swoon. Even after the past year’s rally, the S&P 500 entered 2020 just 11% higher than it was in September 2018. Investors a year ago had sold stocks out of fears about Fed tightening, potential recession and the trade war with China. Algorithmic and momentum-based trading multiplied the effects on the markets. Equity valuations plummeted below 25-year averages,1 reaching their lowest levels since 2014.2

Just as fears about Fed tightening had triggered the December 2018 sell-off, renewed easing set the stage for a relief rally. The Federal Reserve pivoted from raising to lowering interest rates in early summer, and the European Central Bank and the People’s Bank of China cut rates as well. These liquidity injections calmed fears about recession, but only allowed stocks to recover from their fourth quarter 2018 losses. As Oct 2019 started, stocks had only climbed back to where they were a year earlier.

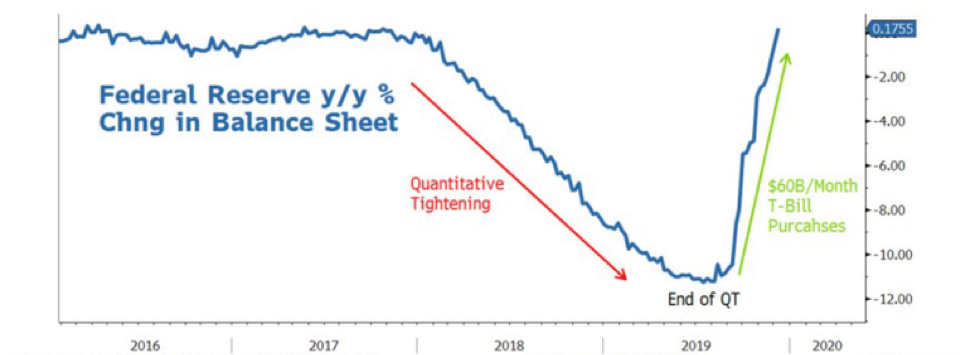

Then three developments in early October—two of them Fed-related—convinced the market that corporate earnings growth could rebound. The U.S. struck a “phase one” trade deal with China; the Fed cut rates for the third time on the year; and it initiated a new kind of quantitative easing to address a cash crunch in the market for repurchase agreements (repos), a key source of liquidity in the financial system. A strong jobs report and better-than-expected corporate earnings added to the positive tone in the markets.

The Return of the QE

Source: Bloomberg, Morgan Stanley

Sentiment improved fast: The percent of “bullish” American Association of Individual Investors members jumped from 20% in mid-October to 44% in late December 2019.3 Momentum followed and helped drive equity markets higher, powered by big gains in the largest stocks.

But while stock prices and sentiment improved dramatically, economic and business fundamentals improved only marginally.

- Profits are forecast to grow 9.5% over the next 12 months,4 but that’s after falling 4% in the third quarter.

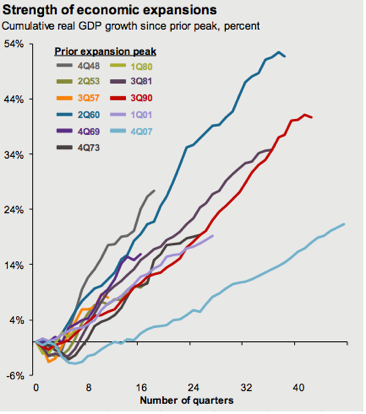

- Recession looks less likely in the near term, but global economic growth remains slow. (See chart below.)

- Corporate debt continues to hover near all-time highs.

Source: JP Morgan

Moreover, valuations look high.

- The S&P 500 came into 2020 with a P/E ratio of 18.2, well above its 20-year average of 15.5.4

- Bonds’ valuations are high, too, with the 10-year Treasury yield lower than the rate of inflation and roughly $12 trillion worth of sovereign bonds globally paying negative yields.4

- Credit spreads are tight: The spread between high-yield bonds and Treasuries finished 2019 more than 25% lower than its historical average.4

Entering 2020, most investors probably feel better about their portfolios than they did a year ago. Ironically, however, the combination of strong returns and only modestly changed fundamentals may have made investing all the more challenging.

LOOKING AHEAD: THE FOLLY OF FORECASTING

Every research provider and financial publication seems to feel obligated to offer a 2020 forecast for the markets. All that prognosticating seems a little ridiculous to us.

What if in this publication a year ago we laid out exactly what would happen in 2019:

- Earnings would fall.

- The yield curve would invert.

- The trade war would escalate.

- Global manufacturing indices would fall into recessionary levels.

- Boeing, the largest U.S. aerospace exporter, would face arguably the worst crisis in its history.

- The U.S. president would be impeached.

- More than $15 trillion in global debts would pay negative yields.

- Shortfalls in the cash markets would cause the U.S. repo market to go haywire.

- Gold and long Treasury bonds would both return about 18%.

- The Fed would pivot abruptly from raising rates to cutting rates to try to fend off recession.

You might have wanted to sell stocks—but if you did, you would have missed one of the better calendar years in market history. In other words, even if you could have known the news in advance, you couldn’t have used that insight very effectively.

The past year is a perfect illustration of the folly of trying to predict the markets and invest accordingly.

- Forecasting any one variable is hard.

- Countless variables affect the markets.

- Even if you could know the news in advance, you couldn’t know how the markets would respond.

- Historically, the stock market rises more often than it falls, and missing gains may undermind your long-term returns.

Still, isn’t the market due for a pause after its big run-up? Not necessarily. After a calendar year with a gain of 20% or more, the S&P 500 has had positive returns in the following year about two-thirds of the time. The same goes after years with a gain of 10% or more. (And the market gained ground 58% of the time the year after losing 10% or more in a calendar year.) Fact is, the market historically has advanced about two-thirds of the time whether the markets were up or down the previous year, the president was Republican or Democrat, or the year number was even or odd.5

The long view

We give no credence to 12-month forecasts. Instead we try to position portfolios for the long term. We can’t predict exactly what will happen in the long term either, but we can form some useful hypotheses based on observations about historical patterns in the markets. One key observation: Markets tend to revert to the mean over time. After an asset class has extreme returns, its subsequent returns are likely to be closer to its historical average.

The longer extreme returns persist, the more likely the asset class’s future returns will revert to the mean. For example, the decade that just ended came on the heels of the S&P 500’s “lost decade,” one of only a few 10-year losses in the index’s history. The S&P 500 advanced in nine of the next 10 years and never fell into a bear market (though it came close twice).

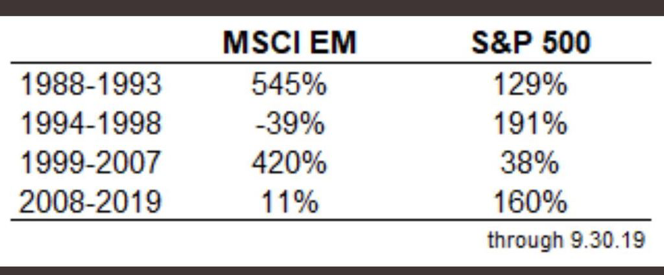

For another example of mean reversion, consider in the following chart the way the S&P 500 and the MSCI Emerging Markets Index have traded leadership positions since the 1980s.

Source: Ned Davis Research

The likelihood of an eventual reversion to the mean doesn’t call for selling U.S. stocks, however. No one knows how long an expensive asset can keep gaining, so the opportunity cost of jumping out of stocks can be enormous. As we noted in this newsletter a year ago, the final phase of a bull market has often been the most explosive—markets sometimes “melt higher” for no obvious reason.

Another key observation: Historically, long-term investors have fared best when they entered at valuations below long-term averages, and they’ve had the weakest long-term returns when they entered at prices above historical averages. We used the following chart in our last newsletter; we’re reprinting it here because it makes this point perfectly. As you can see, long-term returns have been much higher during periods that followed big declines and much lower during periods that followed big gains.

From a long-term perspective, this doesn’t look like a great entry point for the U.S. stock and bond markets as a whole. Consider the following key metrics today compared with 1982, at the dawn of the great bull market.

Source: BCA

Given these conditions, in the next five or 10 years it will be hard for investors in the broad markets to generate the returns they’ve had in the last 30. After crunching the numbers, one of our research providers estimates that over the next decade a diversified stock and bond portfolio might produce 3.8% average annual returns.6

We don’t know if they’ll be right. Even if they are, no one can say when in those 10 years the markets will be strong and when they’ll be weak, so we generally favor the maintenance of a neutral exposure to equities. In addition, in seeking to capitalize on the market’s tendency to revert to the mean, we also favor rebalancing into these assets when market downturns push their valuations well below historical averages.

And while this looks like an unappealing entry point for the broad markets, we believe certain pockets remain attractive. They include developed international equities, which we view as being earlier in the business cycle and less expensive than shares of U.S. companies, and certain technology companies with the potential to disrupt large markets. We may seek to invest in these market segments and others through external managers who may be positioned to act opportunistically to capitalize when dislocations occur.

The headwinds facing conventional asset classes also lead us to favor diversifying portfolios with a combination of skill-based strategies. For example, such opportunities seek to provide enduring sources of return, with performance that relies less on favorable conditions in the overall markets. We view these skill-based strategies as valuable tools in seeking to reduce portfolio volatility and to improve return potential.

Skill-based strategies include cash flow-producing real estate investments, specifically those with exposures that historically have been counter-cyclical. In what we believe to be relatively inefficient segments of the capital markets, we value skill-based long/short managers that we believe have the ability to add value over time by differentiating between potential winners and losers. We believe an increase in volatility to more historically normal levels (or higher) will create fertile ground for these managers.

The private equity investments that we tend to favor focus on small to mid-sized firms. In our opinion, the smaller end of the market offers a much greater opportunity set than the larger end, with more attractive valuations and leverage levels. A focus on small to midsized firms may also increase the risk of loss.

Accounting for risk

While we don’t try to predict the future, we do monitor risks. One of the greatest risks we see is the profound uncertainty facing companies and investors as they decide how to allocate capital. Today global politics, macroeconomics and technological developments have all entered new eras.

Political, economic and technological risks abound:

- The U.S. military’s recent killing of Iranian general Qassem Soleimani has intensified tensions in the Middle East and could lead to greater risk of both physical and cyber attacks.

- Impeachment is likely a non-event for the markets, since the Senate seems sure to acquit, but uncertainty about who will occupy the White House and Congress next January may drive volatility at times.

- The deal with China may not prove as meaningful as the market seems to think; it’s likely a pause in a trade conflict that will last years and possibly decades.

- The world order is changing; to quote one of our investment managers, “You would be hard-pressed today to find a developed economy with politically centrist leadership or one that is not driven by extremist currents.”

- Global economies are increasingly dependent on monetary policies that are as aggressive as they are untested.

- Post-financial crisis regulations have changed the dynamics in the financial system in ways that the world is just beginning to appreciate; the Fed’s attempt to stabilize the repo market may just be one round in an ongoing game of financial system Whack-a-Mole.

- In the stock market, the proliferation of passive investment strategies and algorithmic trading increases the speed and severity of market moves.

- At the same time, technological developments such as artificial intelligence, real-time analytics and virtual reality, and their convergence with social media, are evolving more quickly than we can understand their impacts, much less effectively manage them through regulation.

We present these sources of uncertainty not to be alarmist or pessimistic, but to note that the world faces an unusual degree of change. That change is playing out as the equity markets trade at historically high valuations. The result could be periodic bouts of severe volatility, likely exacerbated by computerized, momentum-based trading.

We work to understand risks as we seek to build truly diversified portfolios. Our appreciation for risk is one reason why we’re stress-testing clients’ portfolios, talking through a variety of potential scenarios and discussing the ways we might respond.

That kind of forethought and preparation is intended to keep clients’ portfolios aligned with their goals throughout changes in the markets. Forget forecasts. We’ll be focused on the factors that really matter to your ability to reach your investment goals—like trying to make equities’ long-term growth potential work for you over time and maintaining appropriate levels of liquidity and safety.

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO, was named to Barron’s Hall of Fame. Members of the Hall of Fame have appeared in 10 or more of Barron’s annual Top 100 Advisor rankings, and their enduring commitment to excellence is seen as a positive example for the industry to emulate. Barron’s puts into perspective what it means to appear on this list: About 300,000 identify specifically as financial advisors, and Barron’s estimates that about 120,000 approach financial advice as a full-time vocation. The 145 Hall of Fame advisors represent a tiny fraction of the best 1% of all advisors in the industry.

In recognition of her involvement in the Rochester community, Lori Van Dusen, CIMA, Founder and CEO, was inducted into the 2019 Rochester Business Hall of Fame, joining a prestigious list of Rochester’s outstanding business leaders.

RIA Intel, an Institutional Investor publication, featured Lori Van Dusen, CIMA, Founder and CEO, in the article, “She Went Running With Jamie Dimon. When She Said This, He Stopped.” She discussed investing, women in finance and the importance of kids taking risks. Read the full article on the LVW website.

Employee News

JP Woo joined LVW Advisors as a Research Support Analyst. JP is a recent graduate of University of Rochester where he majored in financial economics and mathematics, with a minor in Chinese.

JP enjoys traveling the world and has a passion for photography. He also volunteers with Hugs Foundation, a not-for-profit charity that sends volunteer medical missions to conduct free surgeries on children with congenital facial deformities.

Welcome, JP!

Rick Van Kuren, CFA, Senior Partner, presented as part of a panel on “Measuring and Managing Portfolio Risk” at the 2019 Opal Endowment and Foundation Forum in Boston on November 7 and 8. The conference, put on by the Opal Group, caters to top executives and decision-makers in a variety of industries.

Conner Boillat, Private Wealth Advisor and Research Associate, presented at McQuaid’s Career Forum where he talked to students about working in the finance industry. Conner is also a member of McQuaid’s Young Alumni Board.

Staying Current

SECURE Act and What It Means for You

Summarized by Chris Van Buren, Private Wealth Advisor

The Setting Every Community Up for Retirement Enhancement (SECURE) Act has been signed into law and went into effect January 1. This act may affect your retirement and we’ve highlighted the key changes you need to know.

No more age restriction on traditional IRA contributions

For tax years beginning in 2020, individuals can make contributions to a traditional IRA after reaching age 70½. Before the SECURE Act, you could not make contributions beginning in the year you turned 70½.

SECURE eliminates “stretch” IRAs

If an individual inherits a qualified retirement account from someone other than their spouse after December 31, 2019, they must fully withdraw from the account within 10 years. This change affects all qualified plans, including 401(k), 403(b), 457(b), 401(a), ESOPs, cash balance plans, lump sums from defined benefit plans and IRAs. If an individual inherited a retirement account prior to December 31, 2019, they are grandfathered into being able to use the “stretch” IRA strategy.

RMD age pushed to 72

Before the SECURE Act, most individuals were required to take minimum distributions (RMDs) from retirement accounts once they reached age 70½. The SECURE Act now delays this requirement to age 72. This applies to individuals who turn 70½ after December 31, 2019.

Penalty-free 529 & IRA withdrawals

Under the SECURE Act, up to $10,000 of 529 plan money can be used to pay off student debt. The $10k is a lifetime amount—not an annual limit. Any student loan interest paid for with tax-free 529 plan earnings is not eligible for the student loan interest deduction.

Parents can now take up to a $5,000 penalty-free distribution from their retirement accounts within a year of the birth or adoption of a child. Income taxes must be paid on the withdrawal but the 10% penalty, if younger than 59½ years old, will be avoided.

The intention of the SECURE Act is to aid Americans’ ability to save for retirement. To discuss how this act may impact you, please reach out to your financial advisor.

Cryptocurrency 101

Conner Boillat, Private Wealth Advisor and Research Associate, interviewed Kevin Kelly, co-founder of Delphi Digital, an independent research and consulting firm focused on the digital asset market. Kevin’s passion for the crypto space has afforded him the opportunity to bridge the gap between traditional market analysis and blockchain-specific applications.

CB: Alright Kevin, how about we start with the basics: What is a cryptocurrency?

KK: A cryptocurrency is essentially a blockchain-based digital asset designed to facilitate peer-to-peer transactions without the need for a third-party intermediary. However, we tend to use the term “crypto asset” (which can also be broken down further into various sub-categories) because at this point there aren’t many coins or tokens being used purely as currencies or MoEs (medium of exchange).

CB: It seems that whenever the media speaks about anything to do with cryptocurrency, they only focus on Bitcoin. Why is Bitcoin a leader, or at the very least so well known, when it comes to the cryptocurrency space?

KK: Bitcoin was the first cryptocurrency to be developed over 10 years ago, so naturally it has a bit of a first-mover advantage. It is also the most secure computing network in the world, which has played a significant role in its rise to fame. More recently, the narrative that Bitcoin could one day serve as an alternative to physical gold has grown among investors and crypto enthusiasts alike, which has helped propel its +120% gain year-to-date (as of 9/30/19).

CB: When the average person thinks about Bitcoin, or really any cryptocurrency, they have some strong preconceived notions because of the media narrative and high level of misinformation. What are the biggest misconceptions about cryptocurrency, the ones that are most important for you to debunk?

KK: There are several large misconceptions about crypto, arguably the most notable being that these assets are only used to facilitate transactions for illicit activities (e.g., buying drugs, money laundering, dark web transactions, etc.). While there are certainly examples of Bitcoin and other crypto assets being used for illegal activities, to say it is their primary use case is a gross exaggeration. Another common misconception is that everything is competing to be the next Bitcoin. The reality is there are dozens of crypto assets with unique properties and use cases that share little overlap with Bitcoin. Smart contract platforms like Ethereum are one of the largest sectors, but there’s also decentralized finance (DeFi), exchanges, data storage, gaming; the list goes on and on. That’s not to say Bitcoin doesn’t have any competitors; there are several prominent crypto assets with similar monetary properties to Bitcoin (fixed supply, predictable issuance rate, proof-of-work consensus algorithm), but none come close to the security or general acceptance that Bitcoin boasts today.

CB: A lot of people get excited about the prospect of investing in crypto because they have seen the incredible returns that early adopters have made by investing in digital assets; influencer Dan Conway and his recent book, Confessions of a Crypto Millionaire, comes to mind. However, I think that everyday investors have done little in the way of formal research and are simply chasing a quick profit instead of focusing on why they should be investing in cryptocurrency, over what time period, how it fits in their portfolio and the associated risks. Why should someone consider having Bitcoin/crypto as a part of their asset allocation, and how does this differ for individual investors versus institutions?

KK: I’ve never been one for fear mongering, but I think it’s important for investors, both individuals and institutions, to understand that the probability the next 10 years mimic the last decade is relatively low. Does that mean the markets are going to crash tomorrow? No. But many analysts and strategists (myself included) are forecasting lower real returns going forward for many of the biggest winners this cycle (U.S. large cap stocks, high-yield debt, etc.). Most investors have significant exposure to these asset classes and for good reason. I believe the asymmetric upside of Bitcoin (and crypto at large) is compelling enough to warrant a small allocation within a multi-asset portfolio because if it achieves what many of us believe it can, it would require Bitcoin to be worth magnitudes more than its current value.

CB: You mentioned this earlier, but there has been a lot of buzz lately surrounding Bitcoin being a “safe haven” asset during times of equity market volatility, akin to gold. Is this a viable use case for Bitcoin?

KK: It’s far too early to label Bitcoin as a “safe haven” asset, especially given its historical volatility relative to comparable “risk-off” assets like U.S. Treasuries or gold. It’s more apt to call it a non-sovereign, uncorrelated asset seeing as it has periods where it trades more in line with gold (like we saw earlier summer 2019) and other times when it trades more closely with risk assets. For example, in Q4 2018 we saw a sizable sell-off in both the crypto and equity markets as investors dumped risk assets. We’ve found Bitcoin actually performs better when equity market volatility is trending lower, which supports the notion investors still view it as a riskier asset rather than a “digital gold” alternative.

CB: When I was at the WealthStack conference, I listened to many professional Bitcoin/crypto allocators, investors and experts; they certainly make it seem like the future is bright for digital assets. More and more institutions (prominent endowments such as Harvard, Stanford, MIT and the like) are now allocating to crypto, and more and more institutions and advisors are warming up to the idea, especially given the recently increased stability of the infrastructure and security around crypto investment platforms. Where do you see cryptocurrencies developing to in the next five to 10 years, and what has you most excited/intrigued about the applications for the future?

KK: I’d be amiss not to start with Bitcoin since I truly believe it’s as big of a monetary breakthrough as it is technological. A provably scarce, censorship-resistant, non-sovereign asset is something we’ve simply never seen before. Aside from that, I’m excited to see how the market for tokenized assets develops as this is another interesting sector that’s starting to sprout up. An easy example is tokenizing real estate or individual properties to allow fractional ownership of assets most investors don’t have access or the means to acquire. While that’s one of the simpler use cases, we’re already starting to see companies express interest in tokenizing various revenue streams or capital-intensive projects. Eventually, we may find ourselves in a world filled with decentralized autonomous organizations (or DAOs as they are often called) where stakeholders contribute to a common cause or goal through various incentive mechanisms designed into the underlying protocols. It sounds a bit too sci-fi for some, but years from now I think we’ll be surprised at how many different opportunities crypto and blockchain technology create.

CB: We all know that, despite the many exciting opportunities, with every new technology or investment comes risks. What are the biggest threats to the widespread adoption of crypto?

KK: Currently, the biggest threats to widespread adoption are increased regulatory scrutiny or outright criminalization of crypto assets. I think the probability of that happening is slim, and decreasing by the day, but nonetheless it is a risk.

CB: What is the number one thing that you want people to know about crypto?

KK: That it’s not all anarchists or drug dealers advocating for these things. There’s certainly your fair share of extremists (on both sides of the proverbial aisle), but for every one of them there are 10 others building incredibly innovative products to service this new digital economy. The best part is this movement is just getting started.

CB: Last question: What is the easiest, most secure way for the average person to start investing in cryptocurrency today?

KK: There are several secure ways for the average investor to get exposure to crypto, but it’s important to note this space is still nascent. One of the easiest ways is to create an account on Coinbase (one of the largest crypto exchanges), which will allow to you buy, sell and hold a variety of crypto assets, including Bitcoin. That being said, I never tell anyone to put in anything they can’t afford to lose because this space is still risky, so before you take any action I highly recommend reading up on the best practices for storing crypto assets as well since it’s quite different from holding traditional investments.

Read the full interview and write up on Conner’s blog >

Newsletter Citations:

1 “S&P 500 Forward P/E Ratio,” Barry Ritholtz, https://ritholtz.com/2019/01/sp-500-index-forward-p-e-ratio/

2 Multpl.com, https://www.multpl.com/s-p-500-pe-ratio/table/by-month

3 Ycharts.com, https://ycharts.com/indicators/us_investor_sentiment_bullish

4 JP Morgan

5 “What Will the Stock Market Return in 2020?” Forbes, December 27, 2019

6 BCA report, “The Next 10 Years: What Lies Ahead?”

Disclaimer: This report is provided for informational purposes only. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.

Barron’s Advisor Hall of Fame

Advisors appearing in our rankings have answered 100-plus questions about their practices in our annual survey. The questionnaire addresses a wide range of data points, including the assets the advisors oversee, the revenue they collect on those assets, the industry designations they possess, their regulatory records, the length of time they’ve been in the industry, their charitable and philanthropic work, the investment vehicles they use to allocate assets, the sizes and shapes of their teams, and more.

Rochester Business Hall of Fame 2019 Class of honorees

The Rochester Business Hall of Fame is presented by Junior Achievement of Rochester New York Area Inc., the Rochester Business Journal and Rochester Museum & Science Center. The Hall of Fame Committee, advised by an independent group of past inductees, selects each year’s honorees. Members of the Hall of Fame are selected on the basis of their business contributions to the Rochester New York area.

Awards and recognitions by unaffiliated publications should not be construed by a client or prospective client as a guarantee that the client will experience a certain level of results; nor should they be construed as a current or past endorsement of the investment adviser or its representatives. Rankings published by magazines and others are generally based on information prepared and/or submitted by the recognized adviser.