Table of Contents

FOURTH QUARTER MARKET SUMMARY

MARKET OUTLOOK

WHY CURRENT EVENTS SHOULDN’T DRIVE INVESTMENT DECISIONS

LVW NEWS

In this issue of The Serious Investor, we reflect on 2020 and the extreme challenges it posed to all aspects of life. And we look ahead in hope to a better year—one in which we put the pandemic behind us. Thank you for your faith during these difficult times; we look forward to serving you and continuing to earn your trust in brighter days to come.

Quick Take:

-

Accelerating vaccine distribution should reduce COVID-19 infections dramatically in the months ahead.

-

The economy is likely to struggle near-term before strengthening later in the year—but healing will take years.

-

Equity prices could pull back from recent heights, but accommodative monetary and fiscal policy should support the market longer-term.

-

Cyclicals and non-dollar assets could take the lead if the Fed succeeds at boosting inflation.

-

We believe active management will be key to capturing opportunities and managing risk.

-

Among income investments, equity dividends and real estate look more appealing than bonds.

FOURTH QUARTER MARKET SUMMARY

As 2021 dawns, we find ourselves reflecting on the human and economic toll of the past year. 2020 was unlike anything any of us have ever experienced; it challenged our health, our emotions, our families, our finances, our daily way of life, our social interactions, our travel, our employment and our trust in government. All of us at LVW Advisors welcome the end of this chapter. As we reflect, we believe the challenges of last year have made us stronger.

The world leaves 2020 facing both tremendous challenges and tremendous opportunities. We are closer to the end of the pandemic than the beginning, and our society has learned valuable lessons about how to navigate a health and economic crisis. Yet large portions of our economy have suffered severe damage, and the healing will be long and difficult.

The fourth quarter of 2020 may go down in history as an inflection point in the healing process. Both the Pfizer-BioNTech and Moderna vaccines demonstrated efficacy rates of around 95%, and each was approved and went into use in December. Vaccines from AstraZeneca, Russia and China also showed promise. Despite problems with the initial rollout, nearly 70% of the professional forecasters enrolled in the Good Judgment Project1 expect enough doses to be available to vaccinate 200 million Americans (about 60% of the U.S. population) by the end of the third quarter of 2021.

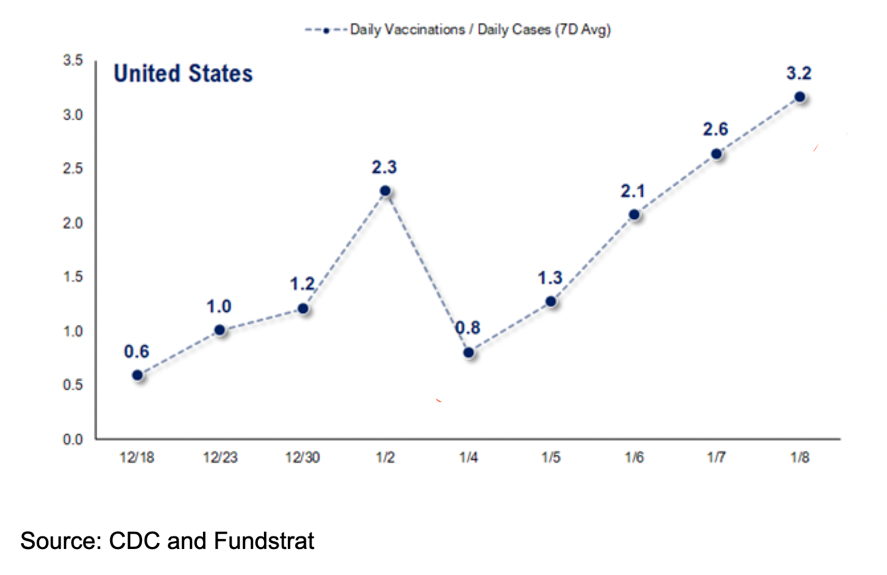

In fact, as of January 8, the vaccination rate in the United States was at three times the rate of new infections and rising (see chart below), meaning we are getting ahead of the curve and should start to see the number of new infections drop dramatically. And the amount of vaccine in inventory far exceeds the amount administered: As former FDA commissioner Dr. Scott Gottlieb points out, 47 million doses of vaccine have been administered and about seven million dosed, leaving inventory of 40 million doses.

Progress on vaccines helped bring the pandemic’s endgame into focus for investors. Joe Biden’s close but decisive victory in the presidential election and the courts’ unambiguous dismissal of President Trump’s challenges also helped dispel a key source of uncertainty. Wins on January 5 in both Georgia Senate runoffs gave Democrats control of both houses of Congress, but by the slimmest of margins. The next day, a violent mob of pro-Trump rioters stormed the Capitol as Congress certified Biden’s victory. Although the events were profoundly disturbing and led to President Trump’s historic second impeachment, they did not alter the outlook for the economy or the markets.

The U.S. economy expanded in the fourth quarter, with the Atlanta Fed’s GDPNow model suggesting GDP growth of better than 11%. But COVID-19 cases surged, with the seven-day average of confirmed new cases in the United States surpassing 200,000. Holiday gatherings are likely to lead to a further surge early in January, and the resulting lockdowns and distancing measures could undermine the economy’s recovery. Congress responded by enacting a second round of fiscal stimulus in late December.

The markets, looking past immediate concerns about the pandemic and the economy, celebrated improved clarity on vaccines and politics. Equities surged, with the S&P 500 gaining 14% in the fourth quarter alone. Value, cyclical and small cap stocks led the way and credit spreads tightened, suggesting that investors were positioning themselves for a post-COVID recovery. The Federal Reserve’s enormously accommodative monetary policy helped keep bond yields historically low, while the yield curve steepened slightly.

Looking across the globe, China appeared to end 2020 in the best position of any major economy. It weathered the pandemic better than other large countries and produced strong export growth, manufacturing and service sector numbers in the fourth quarter. Stimulus in China will continue to provide a tailwind to the economy through mid-2021—hopefully in time to pass the baton to a more organic and broad-based recovery in global growth.

By contrast, European economies struggled in the fourth quarter. As COVID-19 infections surged, European governments re-implemented a variety of lockdown measures. Those restrictions helped control the spread of the virus, but at a cost, with fourth-quarter GDP likely contracting in the euro area. In the United Kingdom, the rise of a new, highly contagious strain of the coronavirus and a messy end to Brexit raised concerns about the direction of the country’s economy. Nevertheless, European equity markets gained nearly 12% on the quarter, according to MSCI, while the MSCI All Country Asia Index rose more than 14%, as investors anticipated better days ahead.

MARKET OUTLOOK

We anticipate that the global economy should strengthen in 2021 as the pandemic winds down. But it’s hard to predict the degree or timing of the recovery, or how much more economic pain we can expect until then.

The new stimulus, which includes extended unemployment benefits and direct payments to individuals, is likely to help support the economy in the short term. Most of its elements are scheduled to expire months before the pandemic is likely to end, but Democratic control of Congress makes additional stimulus more likely.

The employment picture faces particularly acute challenges in the coming years. The accelerated adoption of technology has turbo-charged productivity, which in the second quarter of 2020 rose at its fastest rate in almost 50 years.2 Productivity gains boost profits, but they have a downside: Companies may hold back on hiring after learning they can do more with less. The World Economic Forum’s “Future of Jobs” report estimates that 85 million jobs may be displaced by machines by 2025, while 97 million new tech-focused roles may emerge. David Rosenberg of Rosenberg Research takes issue with the latter estimate. He writes:

This finding is predicated on the assumption that a large share of workers can quickly (as in, within a few months) re-skill to gain entry into new fields like artificial intelligence, cloud computing and engineering … If it were so easy, we wouldn’t be seeing 4 million workers unemployed for more than 27 weeks in the last U.S. employment survey; discouraged workers surging 127% YoY, or the number of workers “marginally attached” to the workforce soaring 69%.

The result, Rosenberg writes, is that many millions of less-skilled workers in service jobs such as retail, hospitality, data entry and administration will not be brought back to work in the post-pandemic economy, holding back the recovery.

That backdrop informs our asset class outlook:

Equities: More than ever, a time for active management

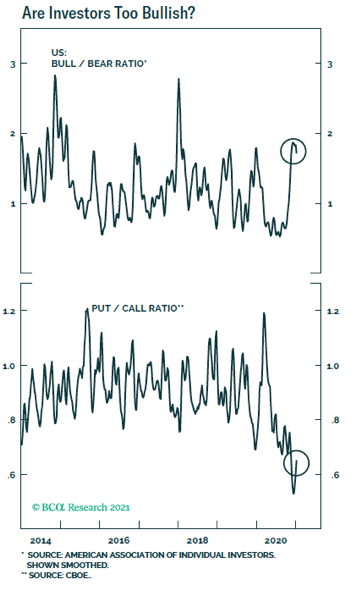

Stocks look overbought, so we expect a short-term correction. The current environment smacks of speculative fervor. During the last two months of 2020, equity funds had their biggest inflows in at least 20 years. Bullish sentiment has surged in the American Association of Individual Investors weekly bull-bear poll, while the put-to-call ratio has fallen to multiyear lows (see chart below).

With much good news priced into the equity market, we’re anticipating a pullback. But investors lack better options, and accommodative monetary policy should support higher prices over the intermediate and longer term. As long as liquidity exceeds assets available to buy, equities are likely to benefit.

Low bond yields present little competition for investors’ capital. The global equity risk premium is near historical highs, and equity dividend yields are higher than bond yields in major markets.3 As we noted in the last issue of this newsletter, even if you were to (very pessimistically) assume that dividend payments didn’t rise at all for the next 10 years, real cumulative equity prices would have to fall 24% for U.S. stocks to underperform U.S. bonds—32% in the euro zone.4 In other words, it would take a catastrophe for stocks not to outperform bonds over the next 10 years.

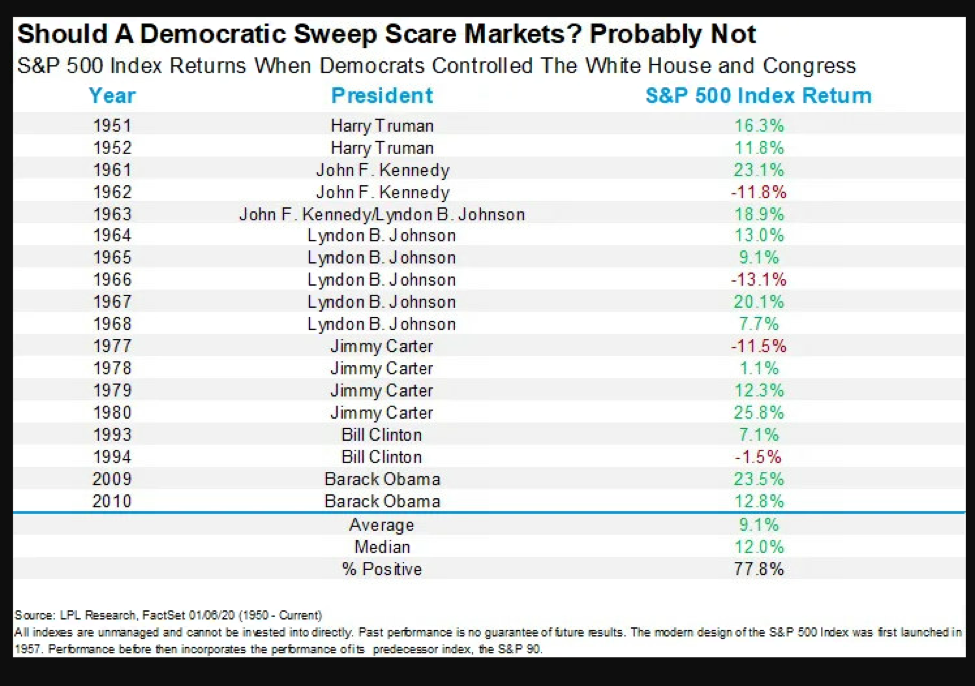

Many investors are concerned that Democratic control of Washington could lead to tax increases that would weigh on the stock market. We encourage clients not to jump to conclusions. Taxes may increase somewhat—and if they do there may be implications for investors in taxable accounts—but ambitious tax hikes are unlikely given the razor-thin majority in Congress. And historically, equity returns under united Democratic control of Washington have been 9.1% (see table below), about the same as long-term historical averages.

Given this environment, we have a neutral view regarding equity allocations and continue to look for investment opportunities, if market downdrafts present, in our view, more attractive entry points. And we view skilled active managers more favorably than passive vehicles.

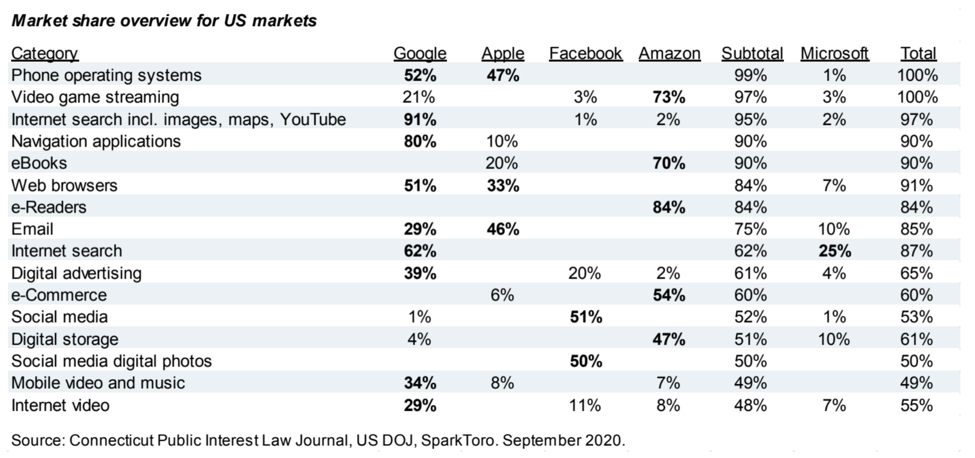

We have noted before that market-cap weighted indices are momentum vehicles—even before Tesla joined the S&P 500. Market benchmarks’ outsized tech weights also heighten passive investors’ exposure to antitrust risk. The “Big 5” technology stocks—Apple, Amazon, Google, Microsoft and Facebook—have extreme market power (see table below), and the U.S. Department of Justice and Congress are in active pursuit.

Knowing what you own is more important than ever:

- Valuation matters. Speculative surges always unwind at some point, and the valuations of the speculators’ darlings fall back to earth, even if they’re excellent businesses. Consider Microsoft, which traded below its peak for 16 years after the late 1990s tech bubble.5

- Big recessions always create winners and losers. Some companies will go belly-up or be bought at bargain-basement prices; others will emerge with dominant market share.

Investing today is not a simple matter of deciding between value or growth, cheap or expensive, old economy or new economy, small or large, foreign or domestic or other dichotomies that are easy to capture passively. We look to all of the above categories in managing client portfolios and employ managers who look company by company within them. In our view, even in today’s unsettled environment, opportunities will continue to be available. Many stocks didn’t participate in market gains over the last few years; we believe that some are shares of businesses with bright futures.

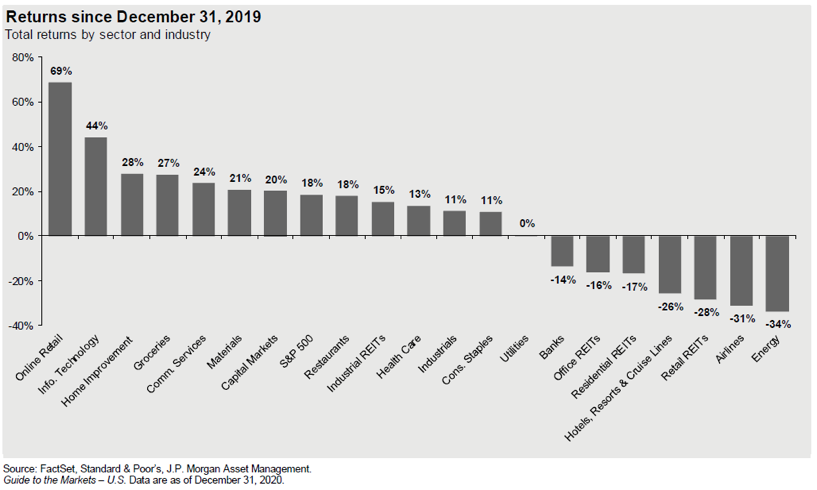

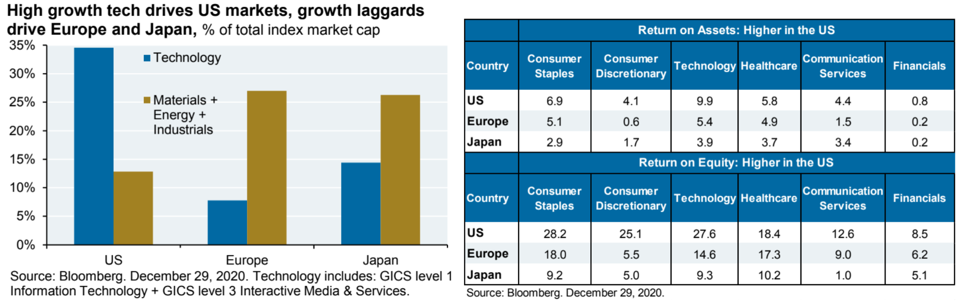

A great many attractive opportunities lie outside the United States, which is why we currently favor managers with global mandates. Select companies in emerging markets offer relatively low valuations and exposure to macroeconomic tailwinds, including faster economic and consumption growth and undervalued currencies. There are businesses in Europe and Japan that may provide opportunity, but generally, passive investing does not offer meaningful exposure to them: Market benchmarks are dominated by low-growth sectors, and companies, on average, have lower return on assets and return on equity than they do in the United States. Instead, we use active managers who work to ferret out what they believe to be opportunistic investments.

Source: JPM Eye on the Market 2021 Outlook, 12/31/20

It is our belief that most equity opportunities entering 2021 fall into three main buckets: growth accelerators, COVID-19 recovery plays and post-pandemic share-takers.

Growth accelerators tend to be involved with e-commerce, enterprise software, cloud computing or other industries that benefited as the pandemic catapulted the world headlong into digital ways of communicating and interacting.

The leaders emerging from the first generation of these companies are likely here to stay—for example, Salesforce, which recently replaced ExxonMobil in the Dow Jones Industrial Average. Subsequent generations will produce other emerging companies. Investors should look to experienced managers who work to understand both the established leaders and the up-and-comers, and who manage position sizes carefully and nimbly.

COVID-harmed companies in banking, energy, travel and hospitality and elsewhere stand to benefit as investors anticipate a normalizing economy. We believe we are at the beginning of a new business cycle which should benefit value and cyclical stocks.

Investors need managers who understand which companies have the balance sheet strength, competitive positions and other characteristics necessary to benefit from the recovery, and who work to interpret stock valuations as earnings rebound. Many companies in decimated industries look expensive now because of weak near-term earnings forecasts—but the current stock prices of these companies could look like bargains in a couple of years.

Post-pandemic share-takers will exit the COVID-19 era in a stronger competitive position than they entered it. In major recessions, weak competitors tend to fall away, allowing market leaders to strengthen their standing. The World Economic Forum6 polled global business leaders about shifts caused by the pandemic; those in advanced economies named reduced competition in professional services, network services and retail as one of the biggest changes.

Moreover, the COVID-19 recession is changing behavior to a degree not seen since the Great Depression. Identifying the firms most likely to benefit requires a deep understanding of individual firms’ industries, financial health and strategic plans.

Fixed income: Better to be a borrower than a lender

In the past, investors could rely on the fixed-income portion of their portfolio to generate income, provide liquidity and hedge against equity bear markets. High-quality bonds continue to offer liquidity and low correlation to stocks. But they yield no better than the rate of inflation—the Bloomberg Barclays U.S. Aggregate Bond Index (AGG) recently yielded 1.2%, matching the annual inflation rate through November—so investors can’t count on core fixed-income allocations to contribute much, if anything, to their portfolios’ returns.

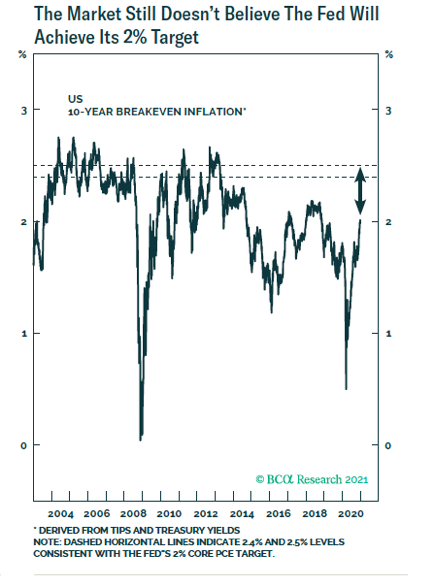

Meanwhile, bonds face significant risks. The duration of the AGG has increased by about a third7 in the last 12 years, leaving many core bond portfolios more exposed to losses from rising interest rates. Inflation is another concern. A near-term jump in inflation looks unlikely, in part because of high unemployment and productivity. But price increases could begin to accelerate later in 2021 due to stimulative monetary and fiscal policy worldwide, the likelihood of a weaker dollar, demand for commodities and the beginning of a new global economic cycle. Some inflation indicators already have picked up, including copper prices, home prices and rents.8 Yet the market is pricing in an inflation rate of only about 2% over the next five years.

Given these conditions, we prefer inflation-protected securities over nominal fixed income. We also are focused on right-sizing defensive holdings by maintaining bond allocations as an equity hedge, while seeking to ensure that investors have enough in liquid assets to ride out and capitalize on market volatility.

At the same time, we are considering more effective ways to produce returns in excess of bonds, with a reduced sensitivity to equity market risk. In the public markets, Fed policies intended to reflate the economy make it more appealing to be a borrower than a lender.

Credit spreads have fallen to near pre-COVID-19 lows, so lending to lower-quality companies—that is, buying their bonds—offers little compensation for the risk involved. By contrast, many companies pay higher yields on their stocks than on their bonds. Equities come with greater volatility. But volatility may not be a problem for investors who have enough liquidity to permit them not to sell when the stock price is depressed. Select real estate investments also may offer a more attractive balance of risk and reward than bonds, while some sectors of real estate should be avoided as more pain is likely to come.

Alternative currencies: Worth consideration

Many clients have asked for our thoughts on Bitcoin, which has outperformed all major asset classes over the past one, three, five and 10 years. As the dollar continues to weaken and central banks around the world aggressively print money, there is a place in portfolios for alternative stores of value. Legendary investor Bill Miller may have summed it up best:

The Fed is pursuing a policy whose objective is to have investments in cash lose money in real terms for the foreseeable future … Bitcoin at this stage is best thought of as digital gold yet has many advantages over the yellow metal. If inflation picks up, or even if it doesn’t, and more companies decide to diversify some small portion of their cash balances into bitcoin instead of cash [as Mass Mutual, Square and others have done], then the current relative trickle into bitcoin would become a torrent.9

Given these considerations, we are continuing to review the pros and cons of Bitcoin as an investment alternative.

WHY CURRENT EVENTS SHOULDN’T DRIVE INVESTMENT DECISIONS

COVID-19, an economic shutdown, millions unemployed, civil unrest, Zoom life, record home sales, a presidential election like no other, the worst bear market for stocks since 2008, the fastest bull market recovery ever—wow, what a crazy year! Yet despite all the craziness, stock markets around the world grinded higher and spent most of the year near all-time highs.

2020 will be the poster child for the disconnect between financial markets and the rest of the world around us. At the end of 2019, no one could have predicted the events of 2020—and if they did, they certainly wouldn’t have forecast a huge year for stocks.

There is an important and potentially life-changing lesson here. We believe investors should not make investment decisions based on current events. Markets do not make it that easy. They hate the unexpected. They discount the future. They can overdo it to both the upside and the downside. Quite simply, they are impossible to predict in the short term. In 2021, it is possible the pandemic will subside, the economy will recover and life will start to return to normal—and markets don’t respond as expected.

We are all learning to adapt to this new world. Many things will change permanently, and many things will revert to the way they were. Regardless, our commitment to providing you with sage, steady and fiduciary-based guidance will remain the same. Cheers to a better, brighter and healthier new year!

LVW NEWS

Awards and Accolades

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, was interviewed by Rochester news anchor Adam Chodak as part of Junior Achievement’s 2020 Rochester Business Hall of Fame induction ceremony.

In the interview, Lori, who was inducted into the Rochester Business Hall of Fame in 2019, spoke about the current market landscape, running a business during a pandemic and entrepreneurship.

Staying Current

Lori Van Dusen, CIMA, Founder and CEO of LVW Advisors, participated in the Forbes/Shook Wealth Management Summit on the breakout session, “Top Teams Share Their Plans for the Future.”

During the session, Lori shared how the LVW Advisors team works together on business development, how to build a business for the next generation and how LVW has evolved as a company during these unprecedented times.

In November 2020, LVW hosted a webinar focused on the world of cybersecurity and what to do in the event of a cyber or fraud attack.

The webinar includes information on the following:

- How to spot malicious emails, text messages and more

- Password best practices

- What to do in the event of a cyberattack or fraud attack

- LVW’s protocols to prevent cyberattacks

- The benefits of LVW’s client portals and how to use them

View the “Cybersecurity: Threats and Best Practices” webinar >

On the LVW Advisors Blog …

Enjoy reading the latest LVW blog post below.

Joe Zappia, CIMA, CCO/Co-CIO, outlines President Joe Biden’s proposed tax plan and reviews how it may affect taxation on capital gains, investment income, estate planning and the potential tax changes for corporations and small businesses.

Read “How the Proposed Biden Tax Plan Can Impact You” >

Employee News

Chris Van Buren, CFP, CPWA, and his wife, Monica, welcomed their daughter, Noelle Marie, into the world on November 30, 2020.

The LVW Advisors team is thrilled for Chris, Monica and their families.

Congratulations!

Newsletter Citations:

1 Good Judgment https://goodjudgment.io/economist.

2 CNBC.

3 BCA Research.

4 BCA Research.

5 Google Finance.

6 Visual Capitalist https://www.visualcapitalist.com/economic-impact-covid-19.

7 Schwab.

8 The New York Times.

9 Miller Value Partners 4Q 2020 Market Letter.

Disclaimer: This report is provided by LVW Advisors for general informational and educational purposes only based on publicly available information from sources believed to be reliable. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, as there can be no assurance that the views and opinions expressed herein will come to pass. No portion of this commentary is to be construed as a solicitation to effect a transaction in securities, or the provision of personalized tax or investment advice. Certain of the information contained in this report is derived from sources that LVW Advisors, LLC (“LVW” or the “Firm”) believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

LVW is an SEC-registered investment advisor that maintains a principal office in the state of New York. This registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The Firm may transact business only in those states in which it has filed notice or qualifies for a corresponding exception from applicable notice filing requirements. Additional information about LVW is contained in the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov.