By: Joseph Zappia, CIMA®, Principal, LVW Advisors

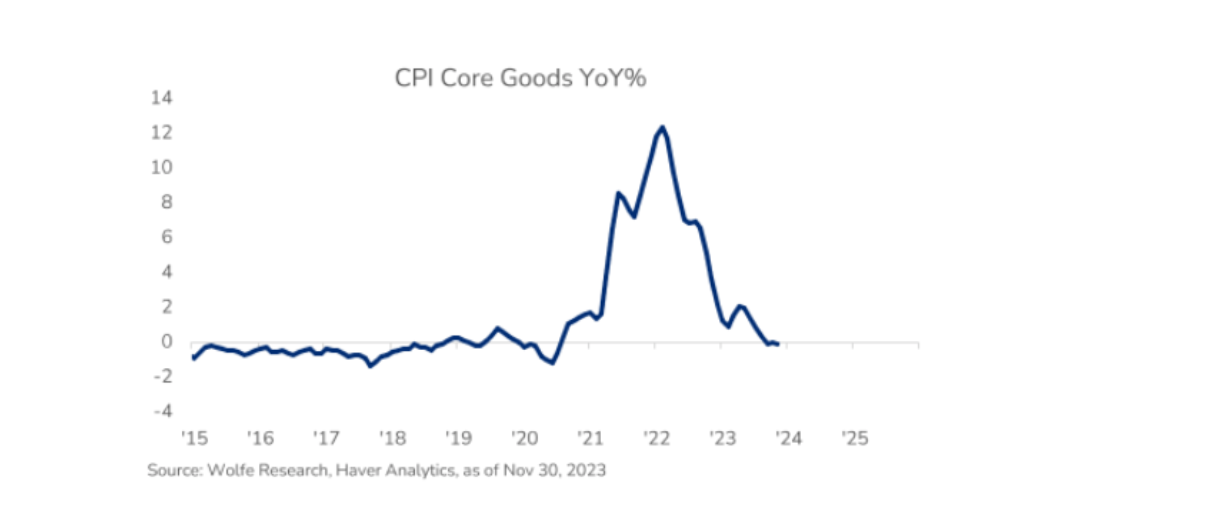

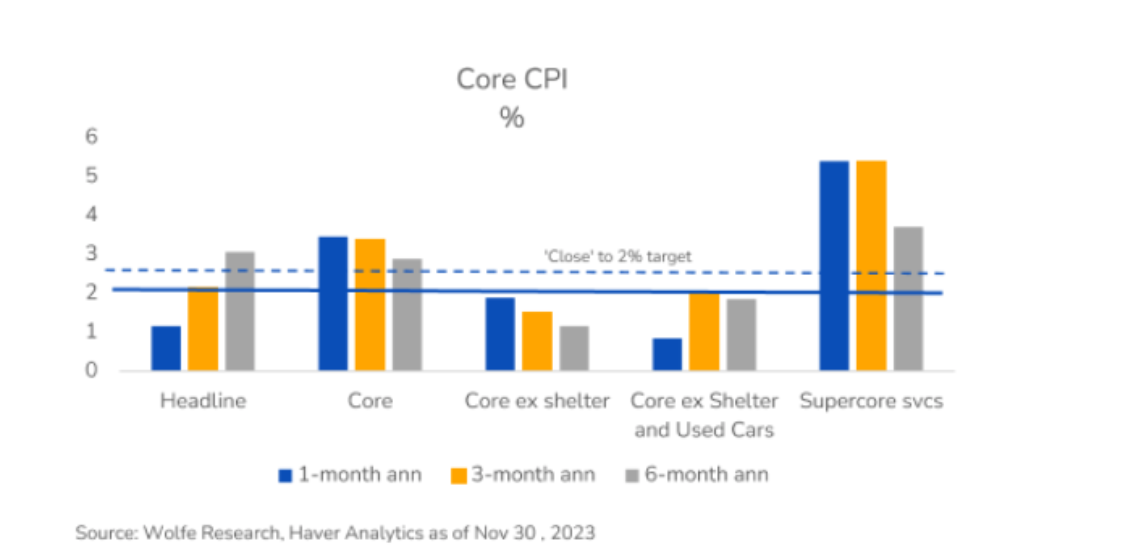

Goods inflation, as measured by the core Consumer Price Index (CPI), has decreased sharply since the peak in 2022, as supply chains have normalized. While goods spending has slowed, it remained solid, hardly explaining this type of goods price deceleration. Improving supply conditions appear to be a large driver of goods price dis-inflating (and recently deflating).

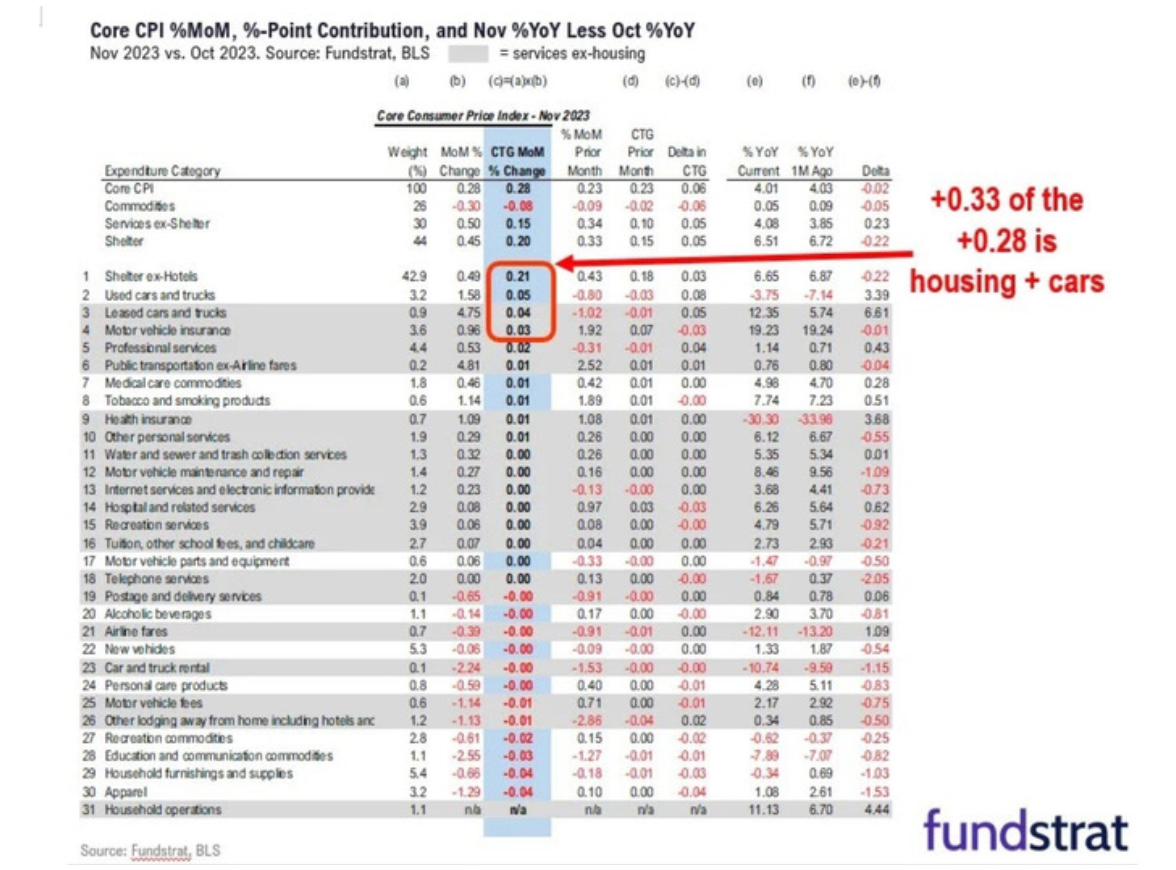

If not for housing and autos, the November core CPI inflation report would have been negative, deflation, month over month.

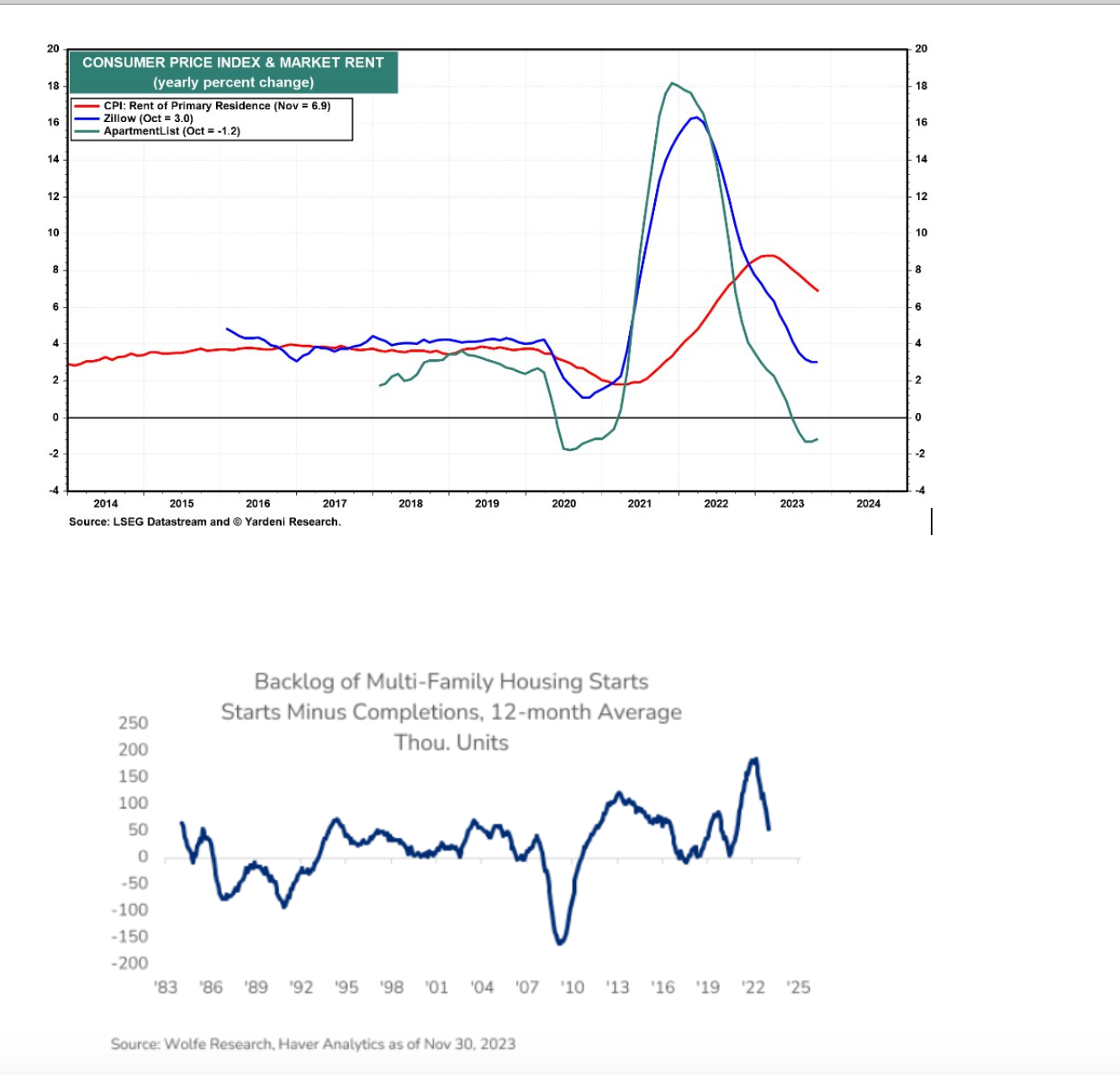

Housing inflation (rents and homes for purchase) surged as COVID motivated people to relocate and search for more space. That’s now over and supply is catching up. Such a massive reshuffling drove up prices in various regions, some more than others. Additionally, with a remaining backlog of multi-family units coming online next year, rent inflation will likely be under pressure.

Shelter costs, which comprise more than 40% of the CPI calculation, lag the actual move in apartment prices due to the effect of the lease rate rollover. This component of the CPI will likely become a massive drag on the index going forward.

Inflation is now very close to target on most measures of the inflation data, helping explain Powell’s pivot. That said, supercore services, i.e., core services ex-housing, is still running hot. With the labor market cooling, it should also slow but this will be key to watch.

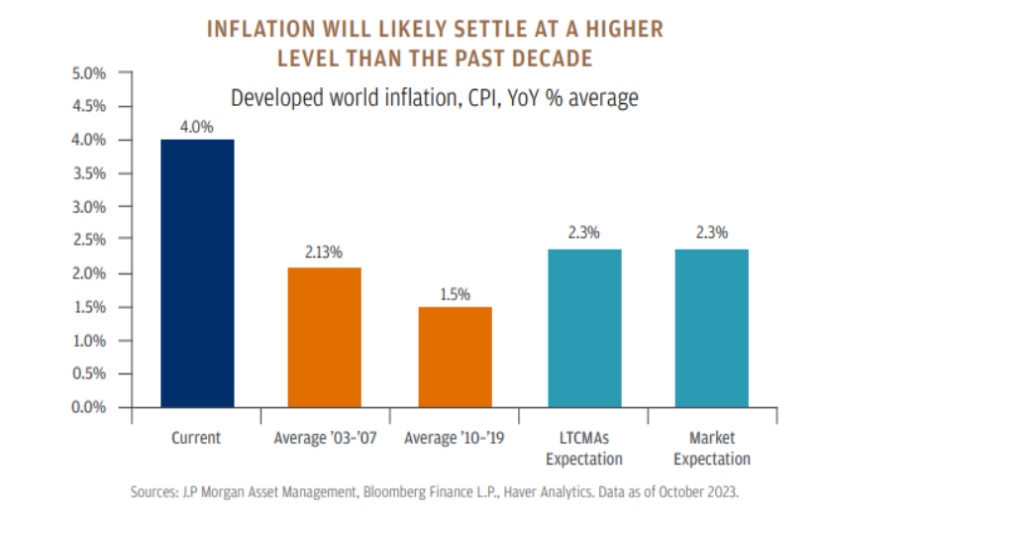

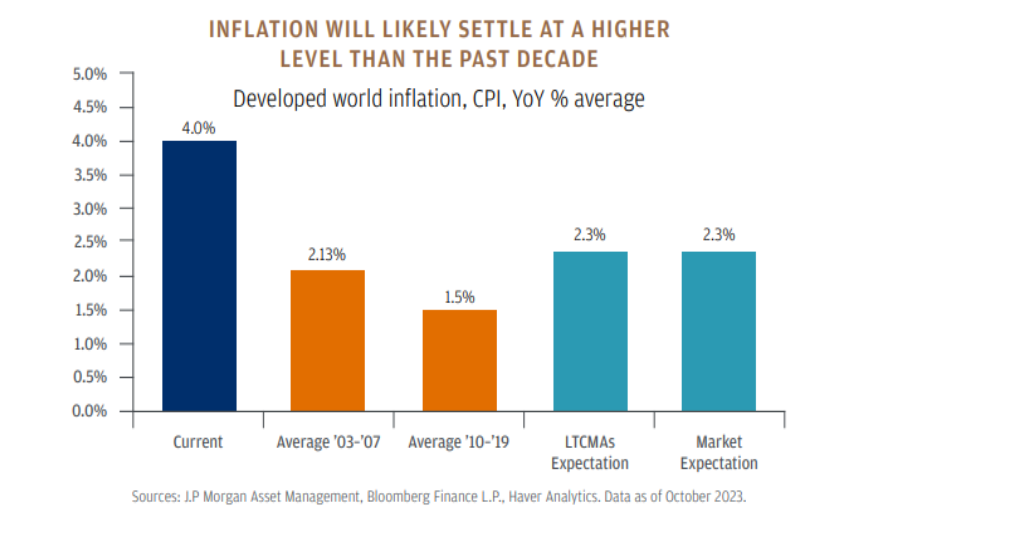

The LVW view is that the Fed’s “2% target” will remain elusive, and inflation will return to a normal level in the coming years, but normal may be defined differently than most people think.

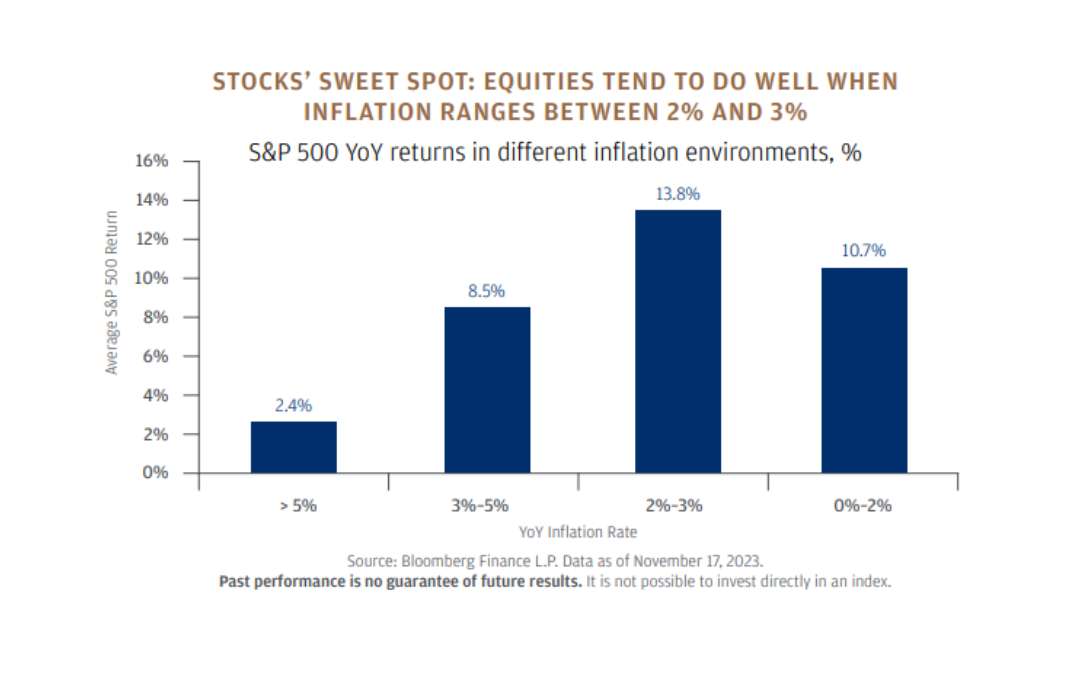

Stocks tend to do well with moderate inflation, which is what we expect.

Stocks tend to do well with moderate inflation, which is what we expect.

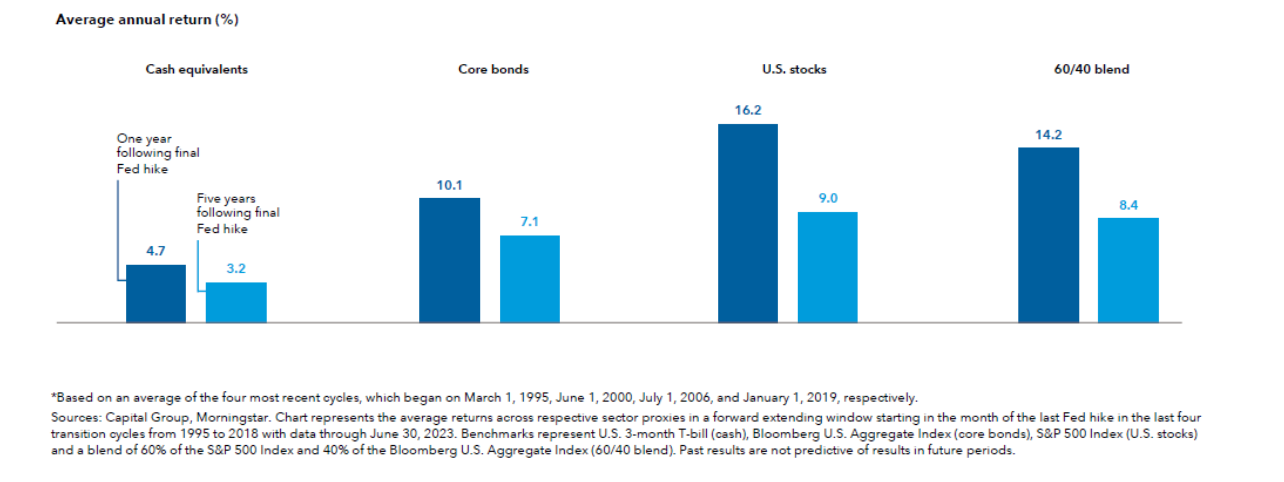

After Fed hikes ended, stocks and bonds have historically outpaced cash.

After nearly two years of flat to negative returns for most stocks and bonds and the most aggressive monetary tightening in 40 years, thus far our economy has avoided recession and the corporate earnings outlook for 2023 is positive. On balance, LVW is more constructive on the stocks and bonds, when compared to cash. Global stock and fixed income markets are evolving quickly, but we believe the current environment presents opportunities for multi-asset investors.

We believe investors who are holding large cash positions should start to consider moving back into these asset classes.

—

Disclosure:

This summary is for informational purposes only and any opinions expressed are current only as of the time made and are subject to change without notice. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Any investment advice provided by LVW Advisors is client specific based on each clients’ risk tolerance and investment objectives. This commentary is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.