By Jonathan Thomas, CFP, Private Wealth Advisor

Year-end tax planning is more important than ever this year. Between new legislation affecting 2020 taxes and the Biden-Harris win, there are strategies you can take advantage of now to save later. Below, we explore the key tax saving strategies to consider before the end of the year.

Retirement Contributions:

- Maximize contributions to 401(k)s. For 2020, the contribution limit for employees who participate in a 401(k) plan was increased to $19,500. Employees age 50 or older can take advantage of the catch-up provision by contributing an additional $6,500, totaling $26,000.

- Maximize the deductible contribution to your IRA or maximize the contribution to a Roth IRA. For 2020, the maximum contribution is $6,000, with an additional $1,000 permitted for those age 50 or over, totaling $7,000.

- Maximize contributions to Health Savings Accounts (HSAs).Maximum contribution is $3,550 for individuals, with an additional $1,000 for those over age 55, and $7,100 for families.

- HSAs are only available only to those who are in a High Deductible Health Plan (HDHP). Look into your health plan to see if an HSA is available.

- Set up a Roth IRA for your children or grandchildren who may meet the income limits. Rather than gifting your grandchild $1,000 for Christmas, why not open and fund a Roth IRA for them with $1,000?

- Set up a retirement plan as a business owner or self-employed. Depending on the number of employees and how your business is structured, there are several different retirement plans available. Speak with your CPA about what plan is best for you.

Gifting:

- Gift individuals: You are permitted to gift $15,000 per individual, tax-free, under the annual gift tax exclusion.

- Contribute to 529 Plans for a state tax deduction: Changes to 529 plans now permit funds to be used for K-12 private education, trade and vocational schools, as well as college and graduate schools.

- Consider paying college tuition: Pay for a beneficiary’s college tuition costs directly to the school, without any gifting limit being imposed.

- Make direct payments for healthcare or medical costs: Pay for a beneficiary’s healthcare or medical costs directly to the hospital, again without any gifting limit

Investing:

- Tax-Loss Harvest: It’s a good idea to sift through any unrealized losses in your investment portfolio to take advantage of tax-loss harvesting at year-end. Realized losses in a portfolio can offset realized gains. Up to $3,000 can be used to offset any ordinary income in a year and the remaining can be used in later years.

- Long-term gains > Short-term gains: If raising cash for year-end distributions, give preference to selling securities with long-term gains (held for longer than one year) as opposed to short-term gains (held less than one year). Long-term gains are generally taxed at 15% for most individuals, where short-term gains are taxed at your ordinary income tax rate, which is generally higher.

- Consider taking long-term gains if taxable income is less than $40,000 for individuals or less than $80,000 married filing jointly: Capital gains are taxed at 0% if you fall in this category.

Charitable Contributions:

- Above the line deduction on cash contributions (up to $300) for all taxpayers even if you don’t itemize: There are often better options available than gifting cash to charities. However, this year is different under the CARES Act. Gift the first $300 in cash to maximize this special deduction in 2020 and proceed with other strategies beyond that.

- Gift appreciated stock to charity: Low basis stock can be gifted directly to charity, eliminating any tax liability for you and the charity.

- Qualified Charitable Distributions (QCDs) from IRAs if over age 70.5: This is a tax-free way to gift to charity directly from your IRA. Earlier, we wrote a longer piece on QCDs as part of the LVW blog. (read here)

- Bunching gifts: Gift multiple years’ contributions to charity into one year, permitting the itemization of deductions. This is beneficial if you are expecting a high-income year.

- Donor-Advised Fund: Place appreciated stock in a separate charitable fund that you can gift directly from, such as a Donor Advised Fund.

Other Planning Strategies:

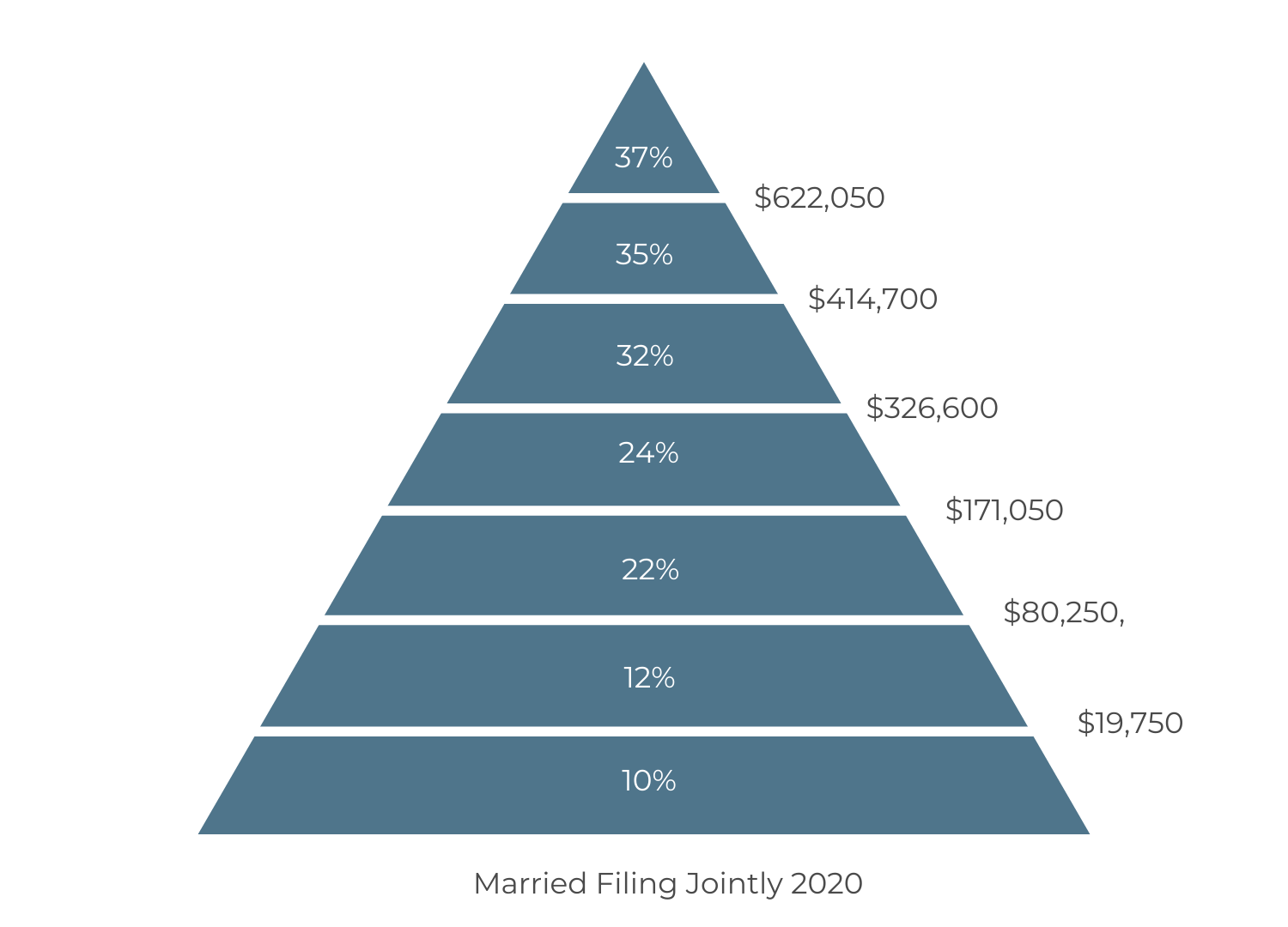

Roth Conversions to fill up Tax Bracket: Once you have an idea of your taxable income for the year, consider making small Roth Conversions to fill up your tax bracket. For example, if you are married filing jointly with income of $250,000, consider a Roth conversion of $76,000 to reach the top of the 24% marginal tax bracket, staying under the (much larger) 32% bracket.

Return redeemed 529 Plan Assets: If you are a 529 plan owner and your beneficiary has been reimbursed for college tuition in 2020 due to COVID-19, you must return the assets to the 529 or there will be a tax and penalty due.

The information contained in this summary is for informational purposes only and any opinions expressed are current only as of the time made and are subject to change without notice. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Any investment advice provided by LVW Advisors is client specific based on each clients’ risk tolerance and investment objectives. This commentary is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.